PLEASE HELP the experts continue to not answer my question

#2

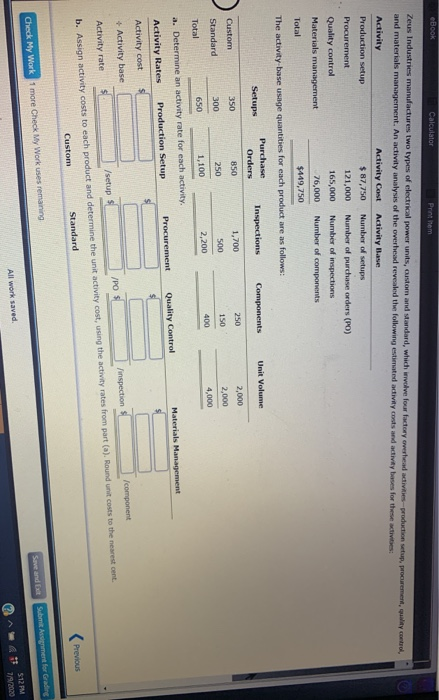

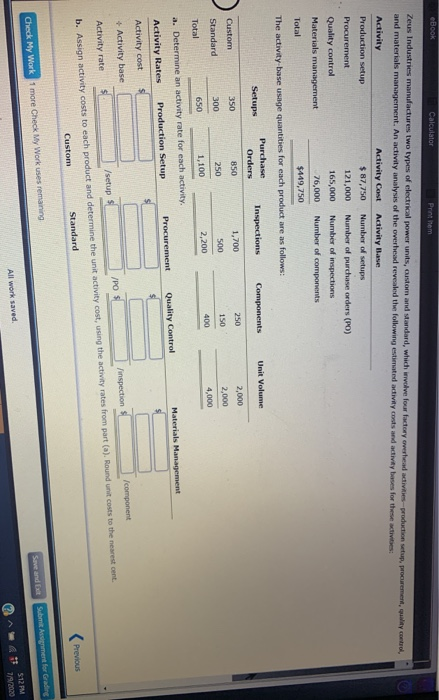

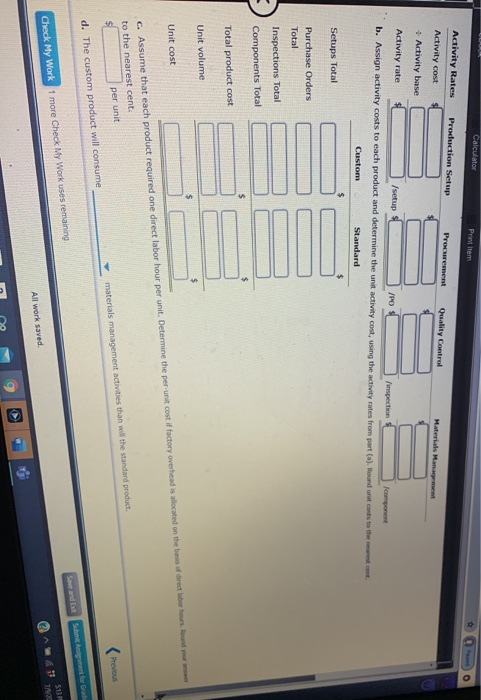

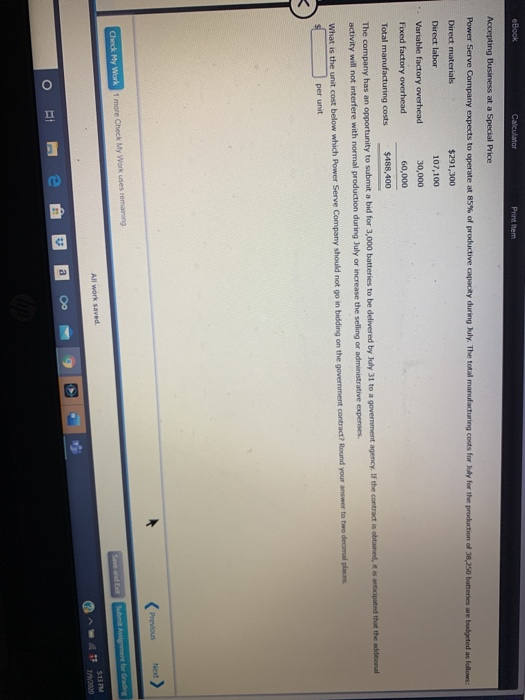

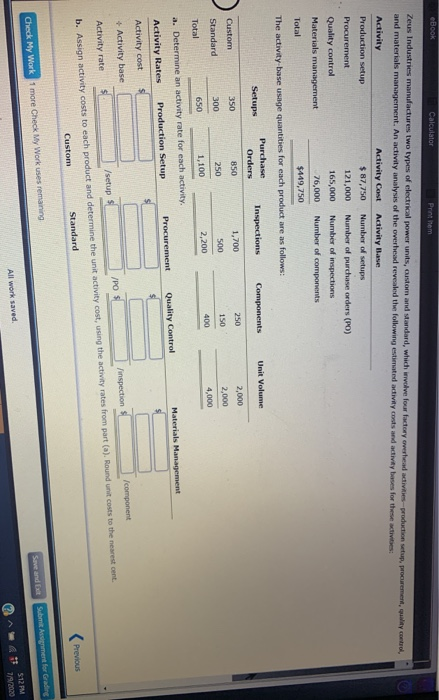

eBook Calculator Printem Zeus Industries manufactures two types of electrical power units, custom and standard, which involve four factory overhead activities-production setup, procurement, quality control, and materials management. An activity analysis of the overhead revealed the following estimated activity costs and activity bases for these activities: Activity Activity Cost Activity Base Production setup $ 87,750 Number of setups Procurement 121,000 Number of purchase orders (PO) Quality control 165,000 Number of inspections Materials management 76,000 Number of components Total $449,750 The activity-base usage quantities for each product are as follows: Purchase Setups Inspections Orders Custom 350 1,700 Components Unit Volume 250 850 500 2,000 2,000 4,000 150 250 Standard 300 400 2,200 1,100 650 Total Materials Management a. Determine an activity rate for each activity, Activity Rates Production Setup Procurement Quality Control Activity cost + Activity base Activity rate /setup /POS inspection component b. Assign activity costs to each product and determine the unit activity cost, using the activity rates from part (a). Round unit costs to the nearest cent. Custom Standard Previous Save and Submit Assignment for Grading Check My Work 1 more Check My Work uses remaining 512 PM All work saved Calculator Print them Activity Rates Production Setup Procurement Activity cost Quality Control Materials Man Activity base Activity rate /setup /PD b. Assign activity costs to each product and determine the unit activity cost, using the activity rates from part (a). Round unit cos to the nearest com Custom Standard Setups Total Purchase Orders Total inue Inspections Total Components Total Total product cost Unit volume $ Unit cost 6. Assume that each product required one direct labor hour per unit. Determine the per-unit cost if factory overhead is allocated on the basis of director hours and you to the nearest cent per unit Previous materials management activities than will the standard product d. The custom product will consume Save and at Submit Auger for Grade 3117 Check My Work 1 more Check My Work uses remaining 3 792 All work saved no eBook Calculator Printem Accepting Business at a Special Price Power Serve Company expects to operate at 85% of productive capacity during July. The total manufacturing costs for July for the production of 38,250 batteries are budgeted as follows: Direct materials $291,300 Direct labor 107,100 Variable factory overhead 30,000 Fixed factory overhead 60,000 Total manufacturing costs $488,400 The company has an opportunity to submit a bid for 3,000 batteries to be delivered by July 31 to a government agency. If the contract is obtained, it is ticipated that the additional activity will not interfere with normal production during July or increase the selling or administrative expenses What is the unit cost below which Power Serve Company should not go in bidding on the government contract? Round your answer to two decimal places per unit Previous Check My Work 1 more Check My Work uses remaining Summert for Grading 513 PM All work saved a 00 II E O