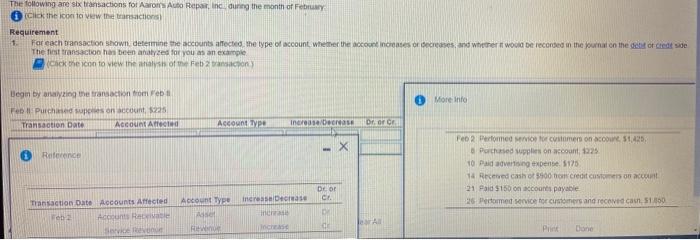

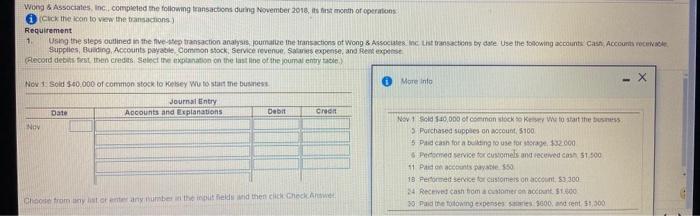

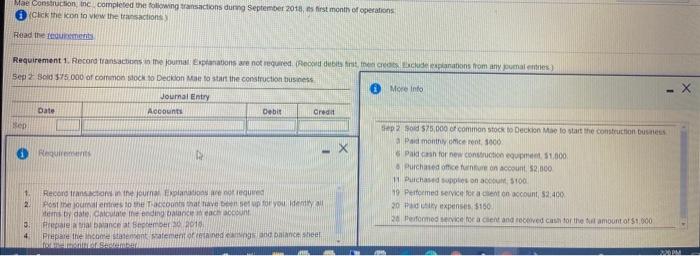

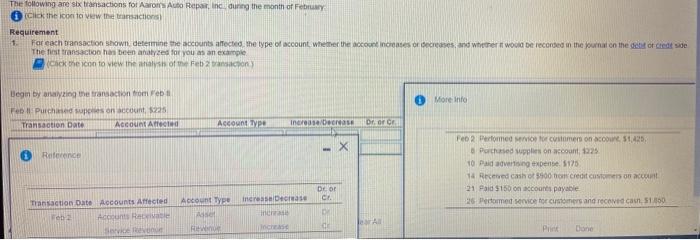

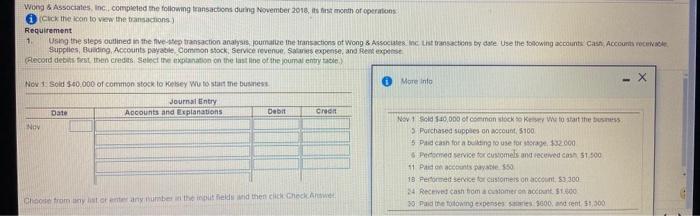

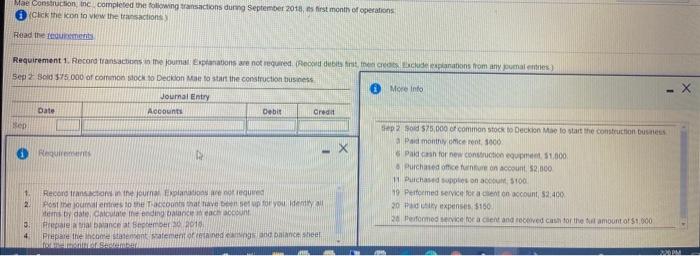

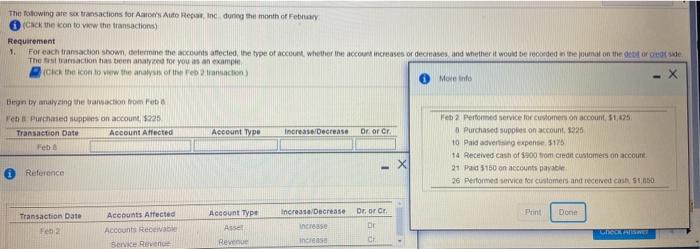

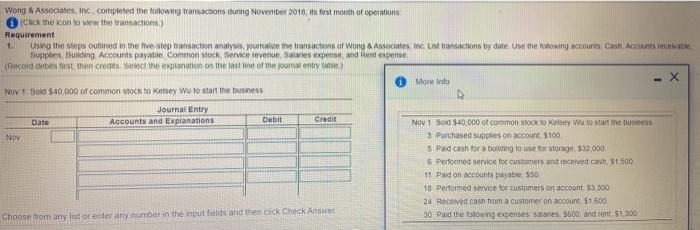

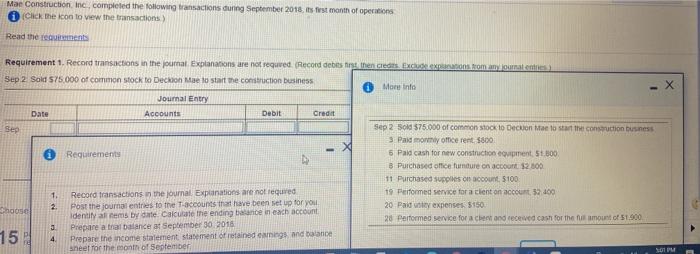

The following are six transactions for Aaron Auto Repar Inc during the month of February Click the icon to the transactions Requirement 1 For each transaction Show determine the accounts affected the type of account whether the account increases or decreases, and whether it would be recorded in the Journal on the door credt side The fest transaction has been analyzed for you an example (ock the icon to view the analysis of the Feb 2 transaction Begin by analyzing the transaction from Feb More info Purchase on count 225 Transaction Date Account Atfeld Account Type incredere Dr. OF C X Reference Feb 2 Performed for customers on account. 51425 Parched suppliers on account 1225 10 paid advertising Expense 175 14 Received cashot S900 tot credit customers on account 21 Paid $150 on accounts payable 26 Performed service for customers and received cann. 51.350 DO increase CA Transaction Date Accounts Affected Account Re ide Account Type TA RE Increase Print Done Wong & Associates, Inc., completed the following transactions during November 2016. its first month of operations Cick the icon to view the transactions) Requirement 1. Using the steps outlined in the five transaction analysis oumate the transactions of Wong & Associates icist transactions by date. Use the following accounts cast Accounts rece Supplies, Buiding, Accounts payable common stock, Service revenge Sales expense, and Rent expense Record de ten credits Select the explanation on the last line ot the journal entry Nov 1 Sold $40.000 of common stock toolsey Wu to start the business More info X Journal Entry Accounts and Explanations Date Debit Credit NOV Novi Sad 10,000 of common stock key to start the bones Purchased suppies on account 5100 5 Pad cash for at bling to use for storage 532.000 Petoned service to customels and received cash $1.00 11 Paid on accounts payable $50 18 Performed service for customers on account. $3300 24 Received cash toma corona 1 30 Pad the Towing expenses 5600and rent $1,500 Choose from any list or any number the tend then click Check Mae Construction in completed the following transactions during September 2018, s first months of operations Click the konto view the transactions Read the fedements Requirement 1. Record transactions in the journal Exponations are not required. Recubit the receptions from any umalis Sep Bold $75.000 of common stock Deckin Mostart the construction business More info Journal Entry Date Accounts Debit Credit Sep 2 od 575,000 of common stock to Deckin Mae to start the construction Business Paid monthly cerent, 1000 Requirements & Pads for new construction equipment 51.000 Purchase office fun on account 52 000 11 Purchased on a 100 1 Record Transit Journal Energed 19 Performed service for a set on account 52.400 2. Poematou o that have for your identity all 20 Pily expenses $100 We by date calculate the ending balance account 20 Performed a cent and received as for the amount of $1.000 e tabance at pembur 2010 4 Prepare the income statement satement of neden od place M The foowing are sa transactions for ' Auto Repar inc dung the month of Fea 1 (Cack the icon to the transactions) Requirement 1 For each transaction show, elmine the counts affected the type of account whether the account increases or decreases and whether it would be recorded the mat on the door de The action has been analyzed for you as an exam cick the icon to view the analysis of the transaction X More info Begin by analyzing the action from Fett Purchased suppies on account, $225 Transaction Date "Account Affected Feb Account Type Increase/Decrease Oror Cr. Feb 2 Performed service for customers on account 51.95 Purchased supplies on account 1225 10 Paid advertir expense 3175 14 Received cash of $300 om credit customers on account 21 Paid 5150 on accounts payable 26 Performed service for customers and received as Sto. X Reference Increase Decrease Done Transaction Date Feb 2 Accounts Affected Accounts Receiva Service Revenge Account Type Asse Revenue Dr. or Cr DE increase ined CE Wong & Associates, Inc. completed the following transactions during November 2010, first month of operation Click the icon to the transactions Requirement Using the steps outlined in the live step transaction analysis, journal the transactions of Wong & Associates, Inc List transactions by date. Use the following accounts Cash Accounts receivable Supplies Buiting Accounts payable common stock Service revenue Stars expertise and Rent experte Records in the credits Select the explanation on the last line of the jouma entry More Indo - X NOV 1S 540,000 of common stock to Kelsey wo to start the finess Journal Entry Date Accounts and explanations bebit Credit NOV 1 So $40,000 of common stock to Kelsey Wu to start the business Now 3 Purchased supplies on account. 5100 5. Pad cash for a bonding to use for storage: 537.000 6 Performed service for customers and received cash 51500 11 Paid on accounts payable $50 18 Performed service for customers on account 53.300 24 Received cash from a customer on account. $1.500 Choose from any leto enter any number in the input fields and then click Check Answer 30 Paid the following expenses sanes. SG00, and rent 51.300 Mae Construction Inc, completed the following transactions during September 2018, its st month of operations (Click the icon lo view the transactions) Read the requirements Requirement 1. Record transactions in the journal Explanations are not requed. Record debits thence consomma Sep 2 Sold 575.000 of common stock to Deckion Mae to start the construction business More info Journal Entry Date Accounts Debit Credit Sep Sep 2 Sold 575.000 of common stock to Dection Mae to start the construction business Paid mormy office rent $800 Requirements 6 Paid cash for new construction equipment 51.000 B Purchased office fundure on account $2809 11 Purchased supplies on account 5100 1. Record transactions in the journal Explanations are not requred 19 Performed service for a client on account 52.400 2 hoose Post the journal entries to the accounts that have been set up for you 20 Paid we expenses $150 Identity alrems by date. Calculate the ending balance in each account 28 Performed service for a chand received cast for the amount of 51.900 3 Prepare a tral balance a September 30, 2016 4 Prepare the income statement statement of retained wings and balance Sheet for the month of September SOM 15