Answered step by step

Verified Expert Solution

Question

1 Approved Answer

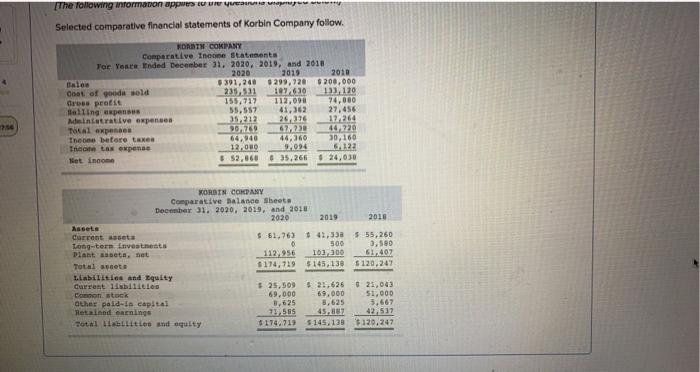

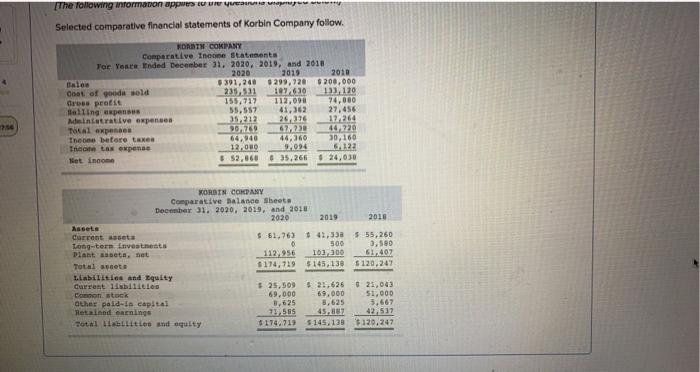

please help The following informamon appers to you Selected comparative financial statements of Korbin Company follow. ORAIN COMPANY Comparative Income statements Yar Year Ended December

please help

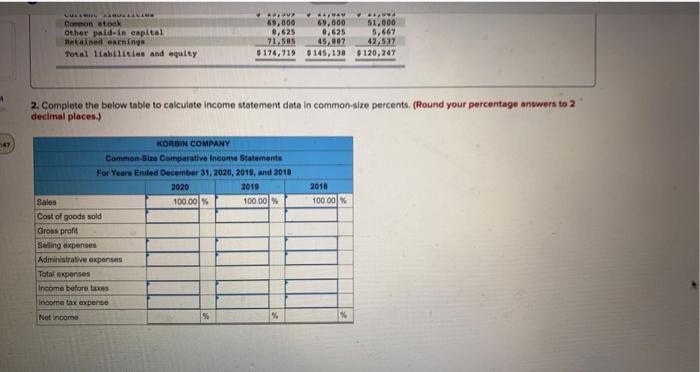

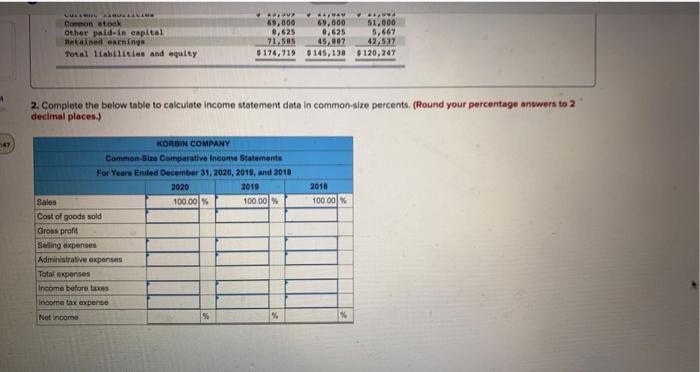

The following informamon appers to you Selected comparative financial statements of Korbin Company follow. ORAIN COMPANY Comparative Income statements Yar Year Ended December 31, 2020, 2019, and 2018 2020 2019 2010 late $391,240 $299,720 8200,000 Onet of goods sold 235, 531 102.630 133,120 Gross profit 155,715 112,098 74,080 Halling expenses 55,557 41.362 27,456 Ministrative expenses 35,212 26.2016 17264 To al expenses 90769 67220 44,220 Theone before taxes 64,940 44,60 30,160 Income tax expense 12.0HD 9.094 6122 Net Income $ 52,868 35,266 $ 24,00 KORSTN CORDAN Comparative Balance Sheets December 31, 2020, 2019, and 2018 2020 2019 2018 Assets Current Assets $ 61,76) 43,338 $ 55,260 Long-tern Investments 0 500 3.580 Diant sets, bet 112,956 103,300 61,407 Total set $174,719 $145,138 $120,247 Liabilities and Equity Current llibilities 25,509 21.626 21,043 Cannon stock 69,000 69,000 51,000 Other paid-in capital 3,625 8,625 3,667 Retained earnings 21585 45,887 42,537 Total llities and equity $174,719 $145,139 $120,247 LULL Common stock Other paid-in capital Metained earning Total liabilities and equity 4. 69,000 69,000 51.000 8,625 0,625 5,667 91.585 45,007 42,537 $174,719 145,138 $120,247 4 2. Complete the below table to calculate income statement data in common-size percents. (Round your percentage answers to 2 decimal places.) 47 2018 10000 KORDIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2020, 2010, and 2018 2020 2010 Sales 100.00% 100.00% Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started