Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help The following information was extracted on 31 December 2021 from the records of Koekashop (Pty) Ltd, after the gross profit was determined for

Please help

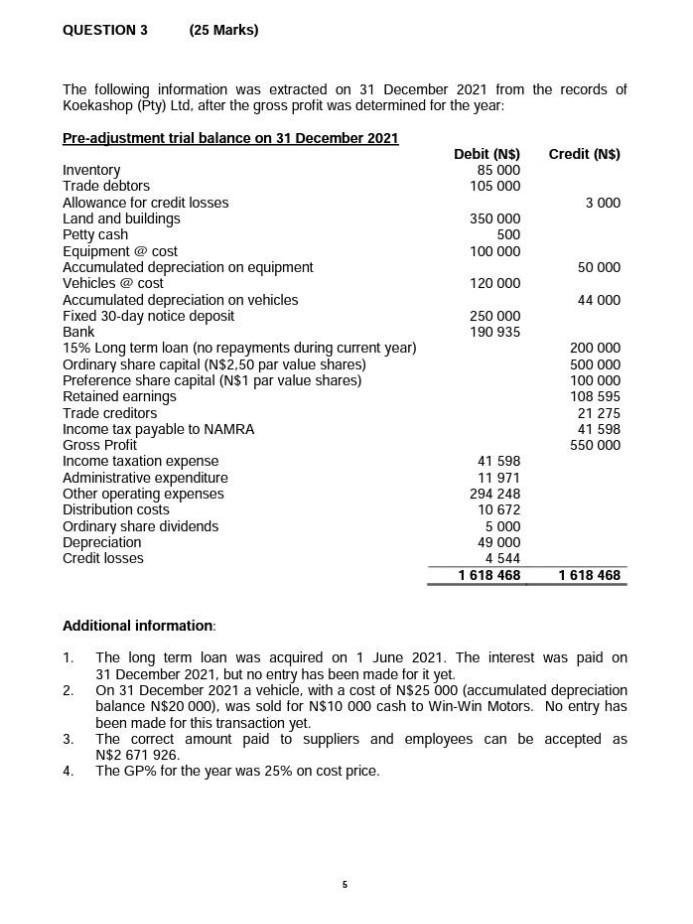

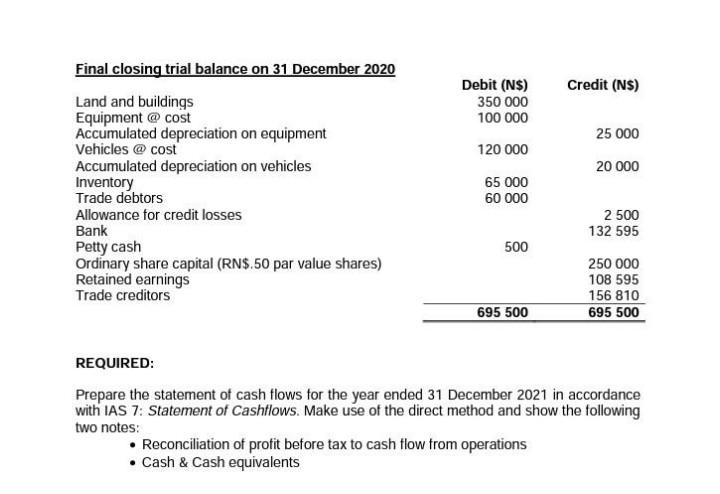

The following information was extracted on 31 December 2021 from the records of Koekashop (Pty) Ltd, after the gross profit was determined for the year: Additional information: 1. The long term loan was acquired on 1 June 2021. The interest was paid on 31 December 2021, but no entry has been made for it yet. 2. On 31 December 2021 a vehicle, with a cost of N$25000 (accumulated depreciation balance N$20000 ), was sold for N\$10 000 cash to Win-Win Motors. No entry has been made for this transaction yet. 3. The correct amount paid to suppliers and employees can be accepted as N $2671926. 4. The GP\% for the year was 25% on cost price. REQUIRED: Prepare the statement of cash flows for the year ended 31 December 2021 in accordance with IAS 7: Statement of Cashflows. Make use of the direct method and show the following two notes: - Reconciliation of profit before tax to cash flow from operations - Cash \& Cash equivalentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started