Answered step by step

Verified Expert Solution

Question

1 Approved Answer

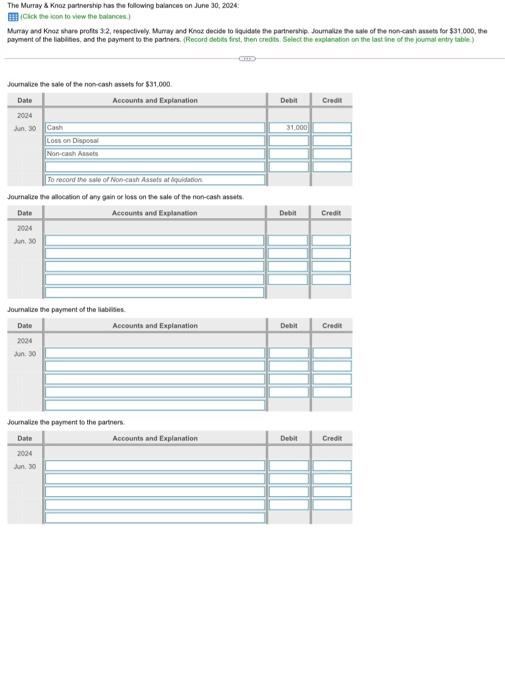

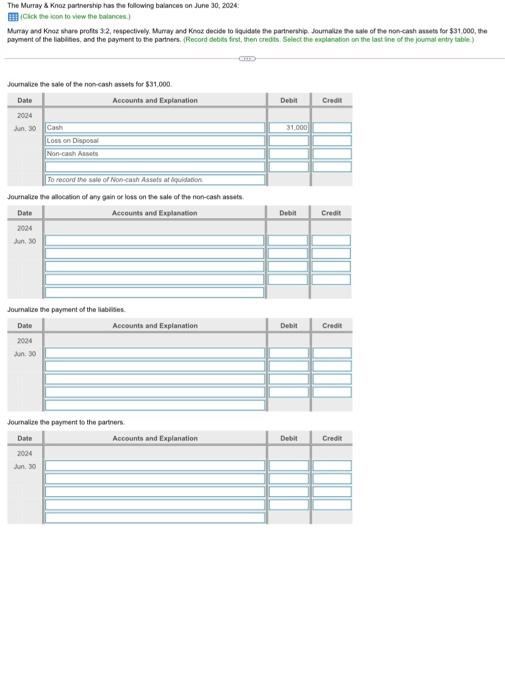

please help! The Murray & Knoz partnership has the following balances on June 30, 2024 Click the icon to view the balances) Murray and Knox

please help!

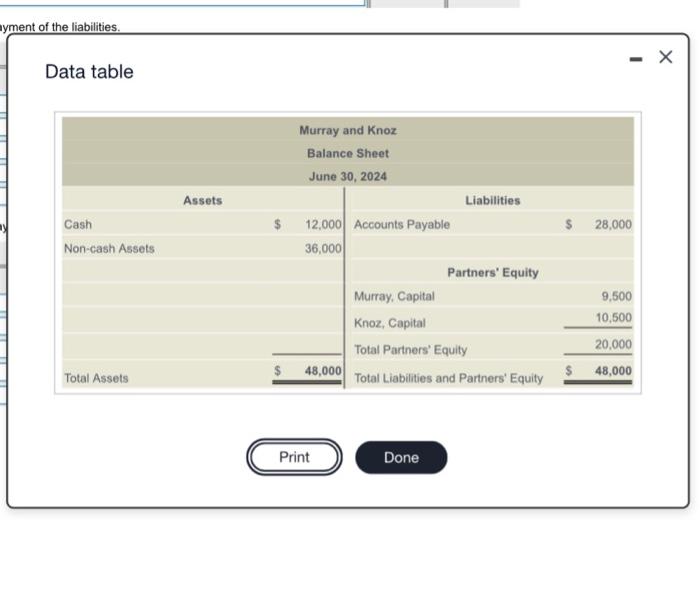

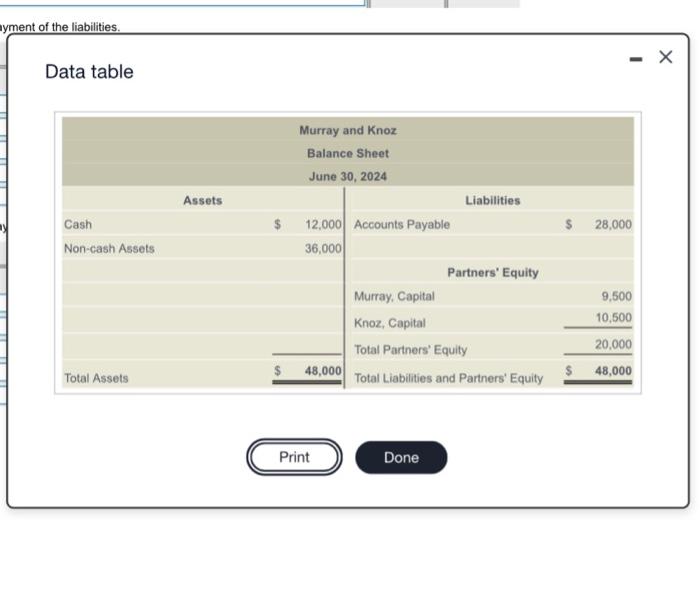

The Murray & Knoz partnership has the following balances on June 30, 2024 Click the icon to view the balances) Murray and Knox share profits 32, respectively Murray and Kroz decide to date the partnership. Journal the sale of the non-cash assets for $31.000, the payment of the liabilities, and the payment to the partners. (Record debts first, then credits Select the explanation on the lastne of the journal entry table Debit Credit Journalize the sale of the non-cash assets for $31.000 Date Accounts and Explanation 2004 30 Cash Lots on Disposa Non-cash Amet 31.000 To record the sale of Non Assels at liquidation Journalize the allocation of any gain or loss on the sale of the non-cash Date Accounts and explanation Debit Credit Jun 30 Debit Credit Journalize the payment of the liabides. Date Accounts and Explanation 2004 An Journalize the payment to the partners Date Accounts and Explanation Debit Credit n. 30 ayment of the liabilities. - Data table Assets 28,000 Cash Non-cash Assets Murray and Knoz Balance Sheet June 30, 2024 Liabilities 12,000 Accounts Payable 36,000 Partners' Equity Murray, Capital Knoz, Capital Total Partners' Equity 48,000 Total Liabilities and Partners' Equity 9,500 10,500 20,000 $ 48,000 Total Assets Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started