Answered step by step

Verified Expert Solution

Question

1 Approved Answer

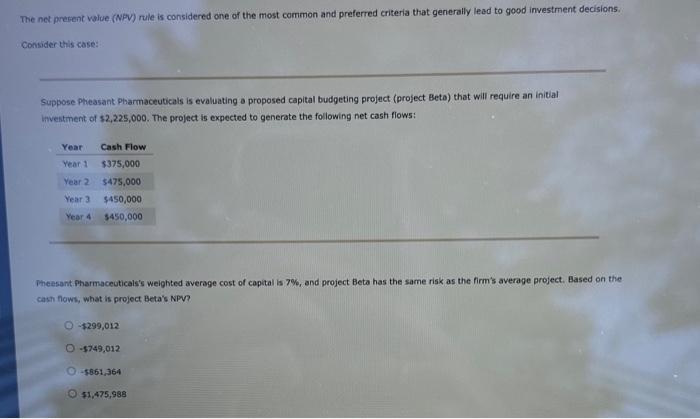

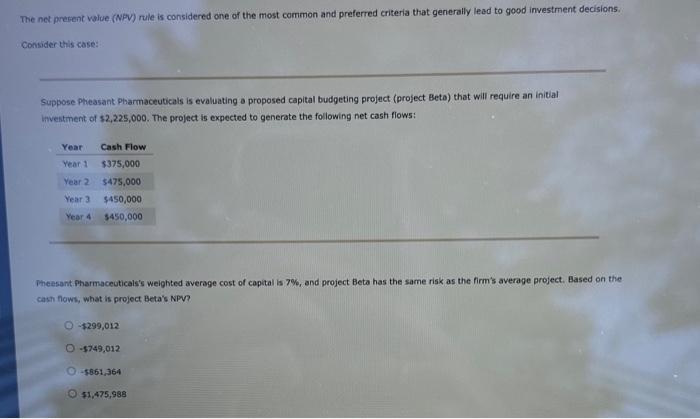

please help! The net present volue. (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions.

please help!

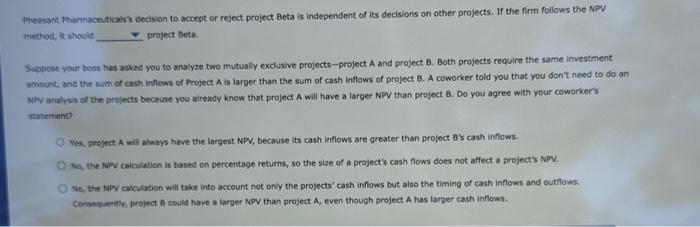

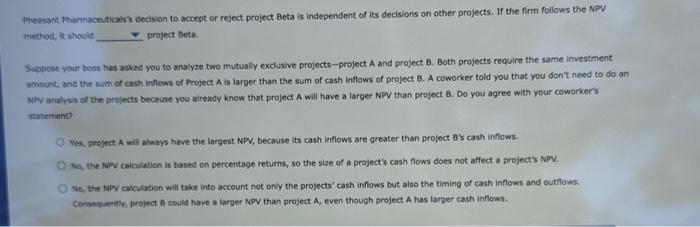

The net present volue. (NPV) rule is considered one of the most common and preferred criteria that generally lead to good investment decisions. Consider this case: Suppose Pheasant pharmactuticals is evaluating a proposed capital budgeting project (project Beto) that will require an initial investment of $2,225,000. The project is expected to generate the following net cash flows: Theesant fharmaceuticals's weighted average cost of capital is 7%, and project Beta has the same risk as the firm's average project. Based on the cash flows, what is project Beta's NPV? $299,0125749,012$661,364$1,475,988 Phessart Peanrmaceuticals's decision to accept or reject project Beta is independent of its decisions on other projects. If the firm follows the NPP method, it should project Beta. Suppose your boss has asked you to analyze two mutually exclusive projects-project A and project B. Both projects require the same investment wenount, and the sum of cash inflows of Project A is larger than the sum of cash intlows of project B. A coworker told you that you don't need to do an NWy arialyais of the projects because you aiready know that project A will have a larger Npy than project B. Do you agree with your coworker's atitertint? Yes, project. A will awways have the largest NPN, because its cash inflows are greater than project B's cash inflows. Na. Whe Niry calcutation is based on percentage returns, so the size of a project's cash flows does not affect a project's NPV. No, the NPN calculation will take into account not only the projects' cash inflows but also the timing of cash inflows and outflows. Comequently, project 8 could have a larger Nop than project A, even though project A has larger cash inflows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started