Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help!!! the other answers to this question are incorrect, please try to give a new answer!!! Thanks!! this is all the information given The

Please help!!! the other answers to this question are incorrect, please try to give a new answer!!!

Thanks!!

this is all the information given

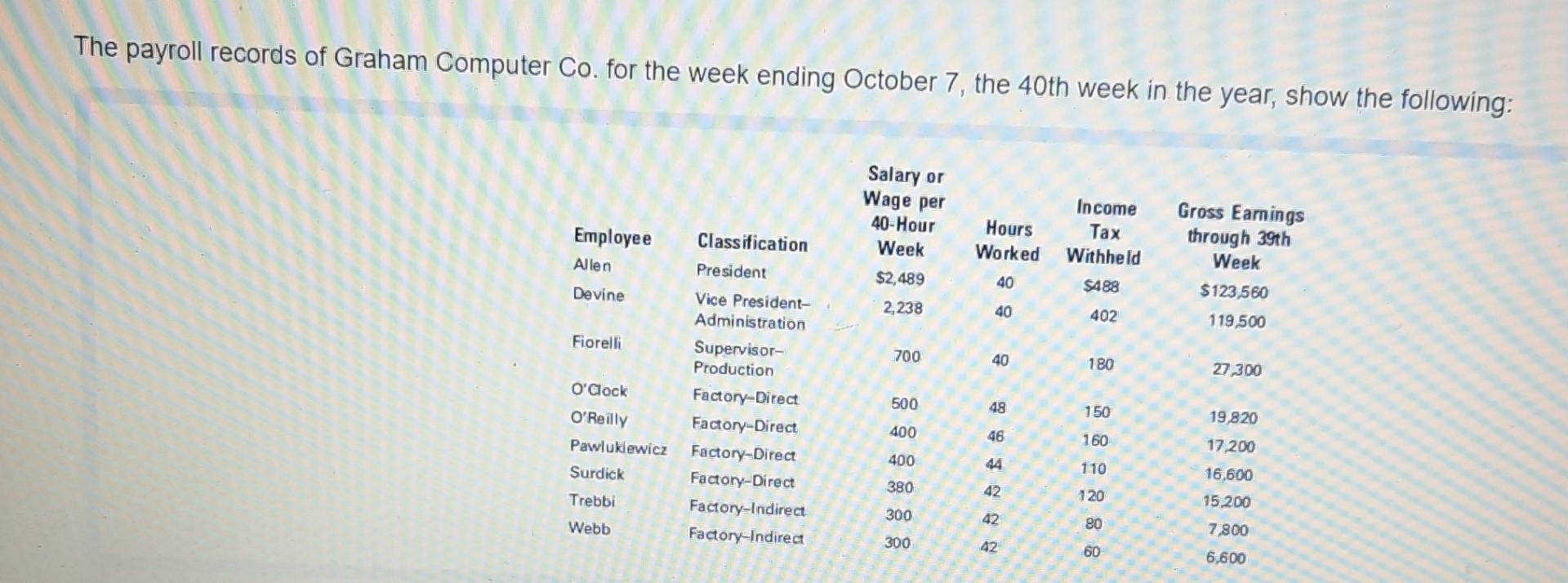

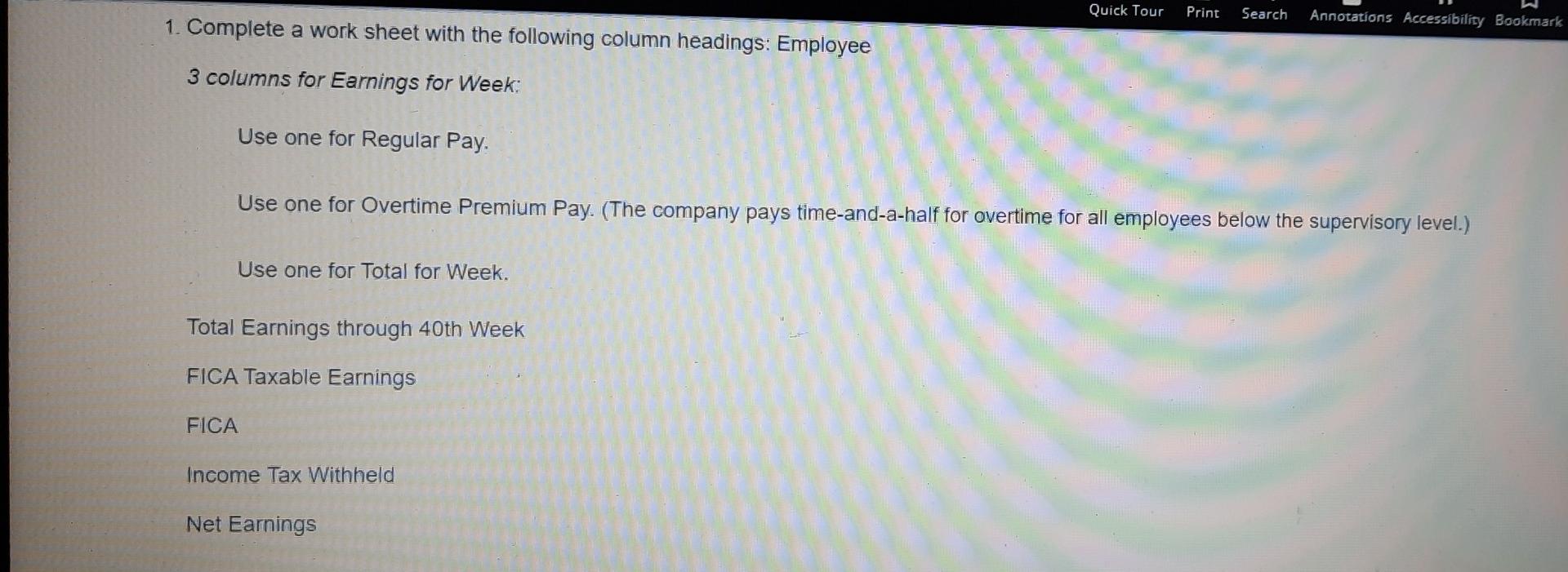

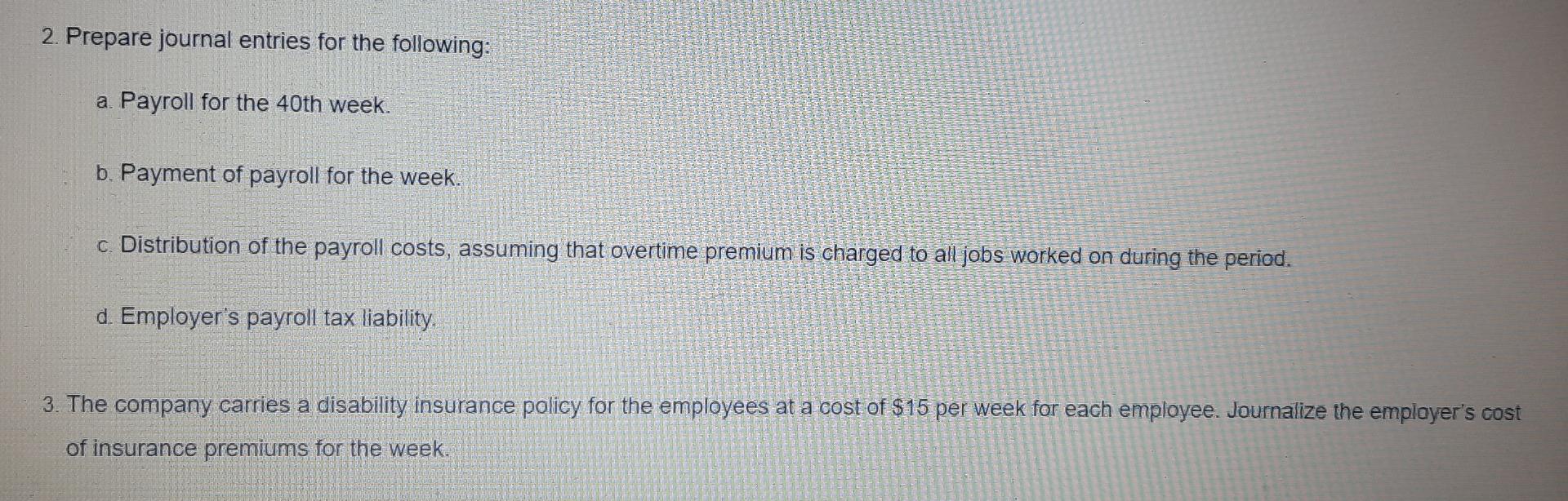

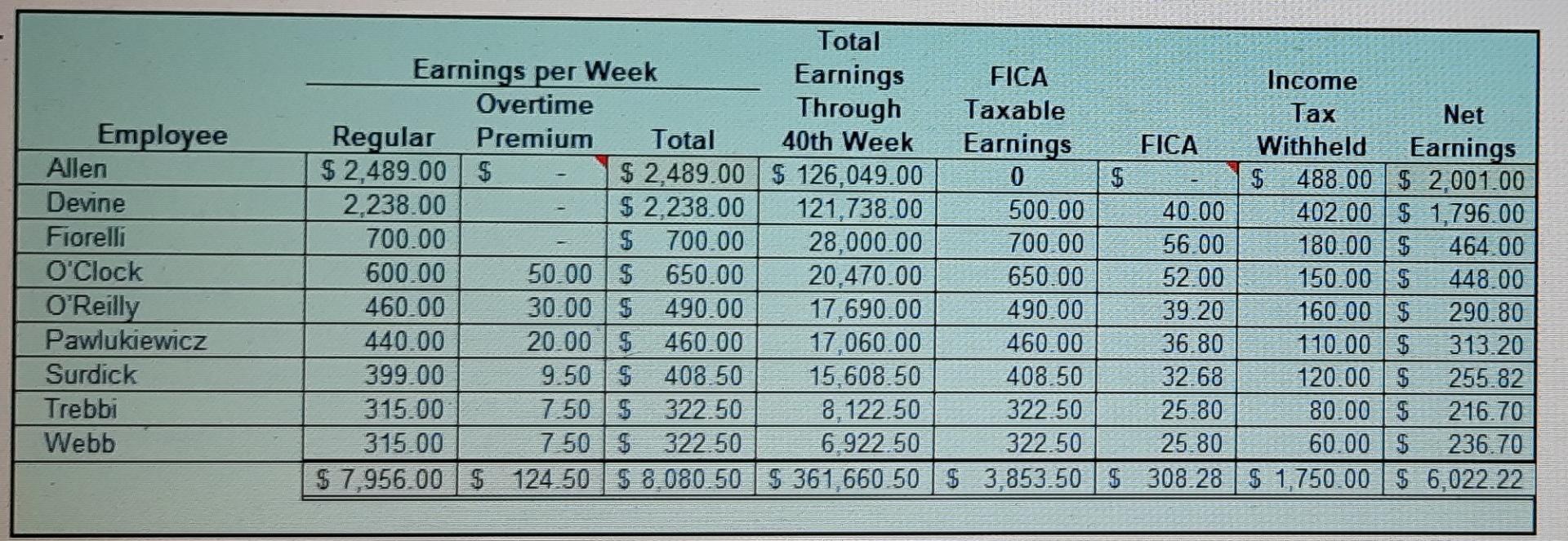

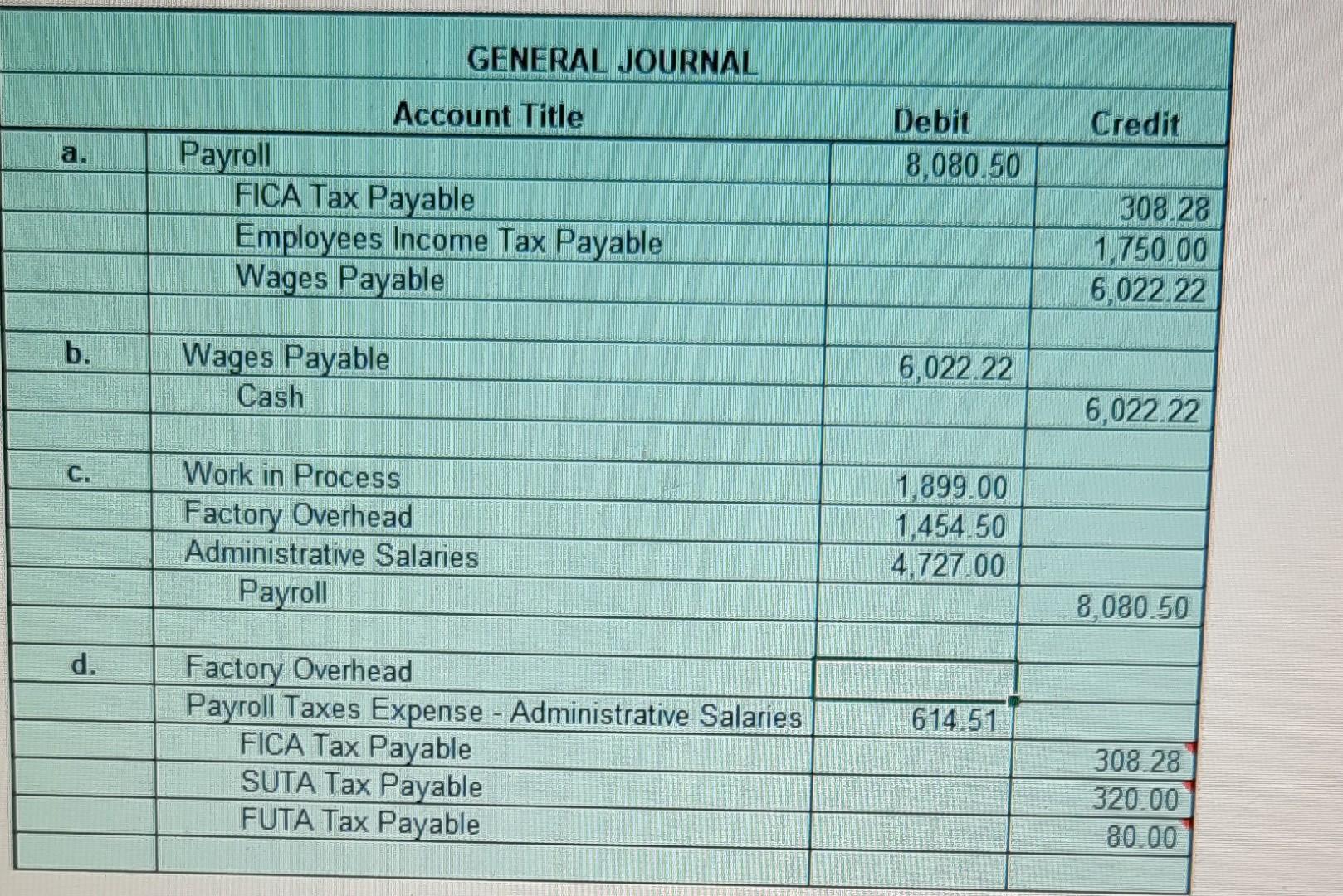

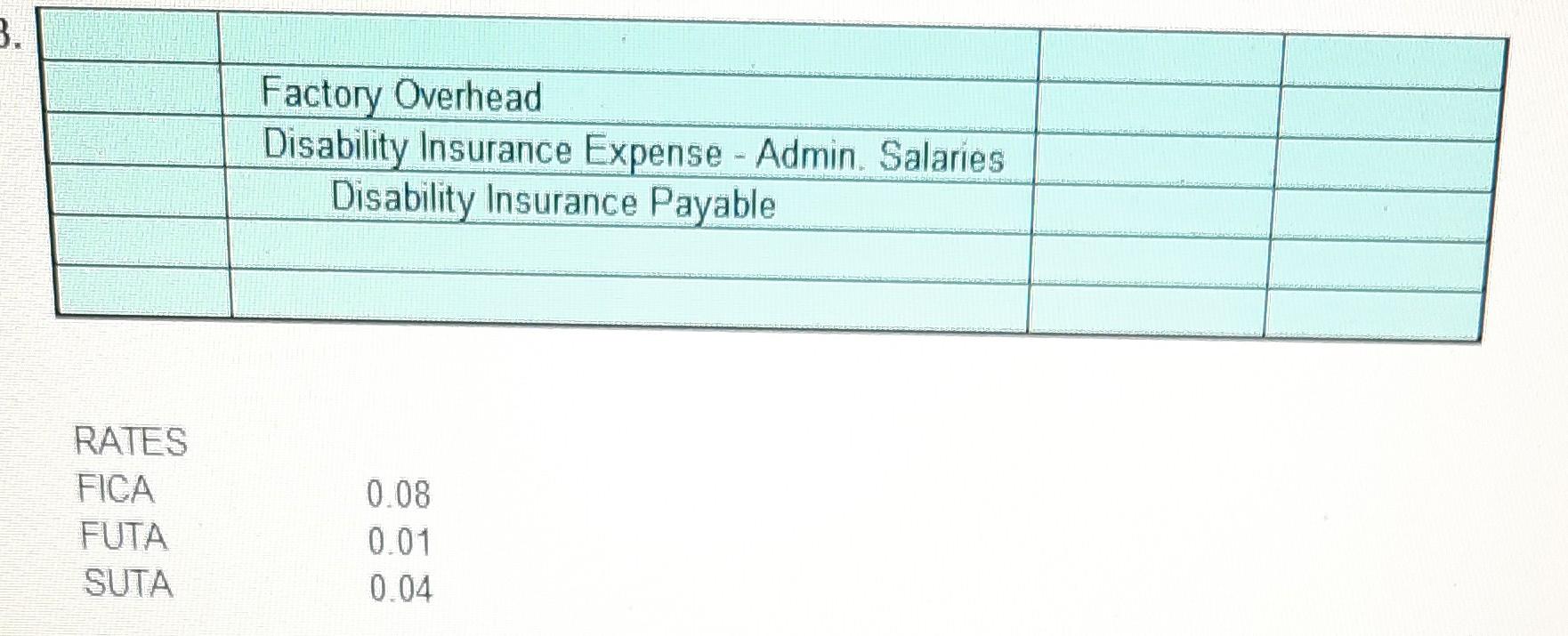

The payroll records of Graham Computer Co. for the week ending October 7, the 40th week in the year, show the following: Employee Allen Salary or Wage per 40-Hour Week $2,489 2,238 Hours Worked Income Tax Withheld Gross Earnings through 39th Week $123,560 119,500 40 5488 Devine 40 402 Fiorelli 700 40 180 27 300 Classification President Vice President- Administration Supervisor- Production Factory Direct Factory-Direct Factory-Direct Factory-Direct Factory-Indirect Factory-Indirect 500 48 O'Clock O'Reilly Pawlukiewicz Surdick 150 400 46 160 400 44 19,820 17 200 16,600 15,200 110 380 42 Trebbi 120 300 42 Webb 80 7,800 300 42 60 6.600 Quick Tour Print Search 1. Complete a work sheet with the following column headings: Employee Annotations Accessibility Bookmark 3 columns for Earnings for Week: Use one for Regular Pay. Use one for Overtime Premium Pay. (The company pays time-and-a-half for overtime for all employees below the supervisory level.) Use one for Total for Week. Total Earnings through 40th Week FICA Taxable Earnings FICA Income Tax Withheld Net Earnings 2. Prepare journal entries for the following: a Payroll for the 40th week. b. Payment of payroll for the week. c. Distribution of the payroll costs, assuming that overtime premium is charged to all jobs worked on during the period. d. Employer's payroll tax liability. 3. The company carries a disability insurance policy for the employees at a cost of $15 per week for each employee. Journalize the employer's cost of insurance premiums for the week. Employee Allen Devine Fiorelli O'Clock O'Reilly Pawlukiewicz Surdick Trebbi Webb Total Earnings per Week Earnings FICA Income Overtime Through Taxable Tax Net Regular Premium Total 40th Week Earnings FICA Withheld Earnings $ 2,489.00 $ $ 2,489.00 $ 126,049.00 0 $ $ 488.00 $ 2,001.00 2,238.00 $ 2,238.00 121,738,00 500.00 40.00 402.00 $ 1,796.00 700.00 $ 700.00 28,000.00 700.00 56.00 180.00 $ 464.00 600.00 50.00 $ 650.00 20,470.00 650.00 52.00 150.00 S 448.00 460.00 30.00 $ 490.00 17,690.00 490.00 39.20 160.00 $ 290.80 440.00 20.00 $ 460.00 17,060.00 460.00 36.80 110.00 $ 313.20 399.00 9.50 $ 408.50 15,608,50 408.50 32.68 120.00 $ 255.82 315.00 7.50 $ 322.50 8,122.50 322.50 25.80 80.00 $ 216.70 315.00 7.50 $ 322.50 6.922.50 322.50 25.80 60.00 $ 236.70 $ 7,956.00 $ 124.50 $ 8.080.50 $ 361,660.50 $ 3,853.50 $ 308.28 $ 1,750.00 $ 6,022.22 GENERAL JOURNAL Credit Debit 8,080.50 Account Title Payroll FICA Tax Payable Employees Income Tax Payable Wages Payable 308.28 1,750.00 6,022.22 b. Wages Payable Cash 6,022 22 6,022.22 C. Work in Process Factory Overhead Administrative Salaries Payroll 1,899.00 1.454.50 4.727.00 8,080.50 d. 614.51 Factory Overhead Payroll Taxes Expense - Administrative Salaries FICA Tax Payable SUTA Tax Payable FUTA Tax Payable 308.28 320.00 80.00 3. Factory Overhead Disability Insurance Expense - Admin. Salaries Disability Insurance Payable RATES FICA FUTA SUTA 0.08 0.01 0.04Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started