Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help The Parent Company purchased common stock of Sub Company in a series of open-market purchases in 2020 and 2022. January 1, 2020 purchased

please help

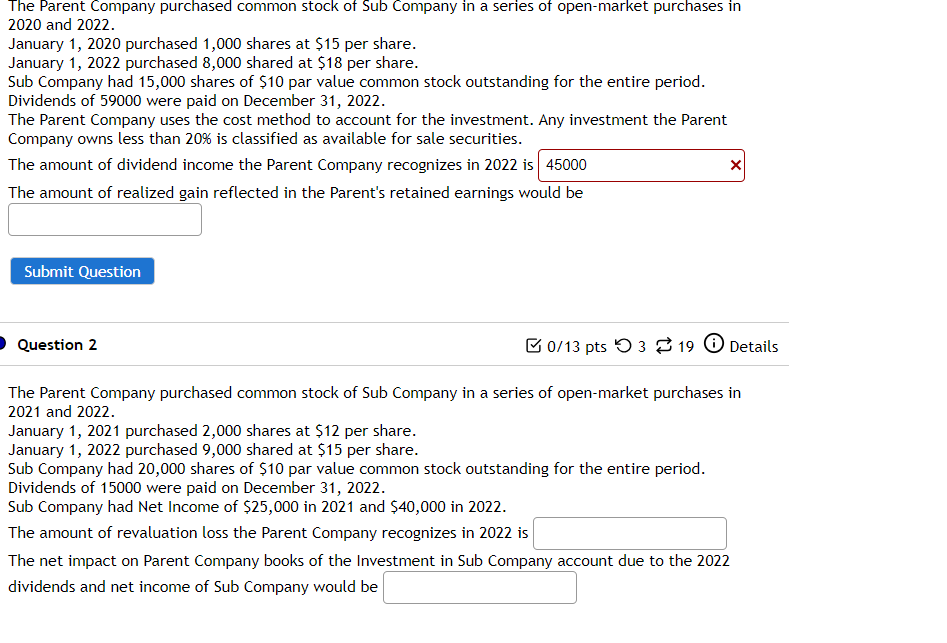

The Parent Company purchased common stock of Sub Company in a series of open-market purchases in 2020 and 2022. January 1, 2020 purchased 1,000 shares at $15 per share. January 1, 2022 purchased 8,000 shared at $18 per share. Sub Company had 15,000 shares of $10 par value common stock outstanding for the entire period. Dividends of 59000 were paid on December 31, 2022. The Parent Company uses the cost method to account for the investment. Any investment the Parent Company owns less than 20% is classified as available for sale securities. The amount of dividend income the Parent Company recognizes in 2022 is The amount of realized gain reflected in the Parent's retained earnings would be Question 2 0/13 pts 319 (i) Detail The Parent Company purchased common stock of Sub Company in a series of open-market purchases in 2021 and 2022. January 1, 2021 purchased 2,000 shares at $12 per share. January 1, 2022 purchased 9,000 shared at $15 per share. Sub Company had 20,000 shares of $10 par value common stock outstanding for the entire period. Dividends of 15000 were paid on December 31,2022. Sub Company had Net Income of $25,000 in 2021 and $40,000 in 2022. The amount of revaluation loss the Parent Company recognizes in 2022 is The net impact on Parent Company books of the Investment in Sub Company account due to the 2022 dividends and net income of Sub Company would beStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started