Please help! This is all one question.

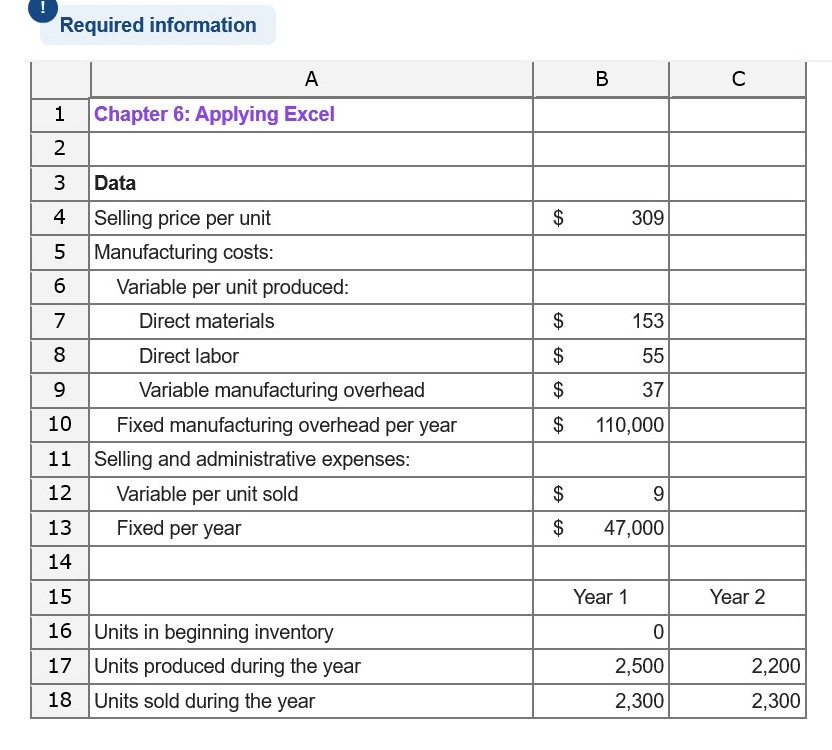

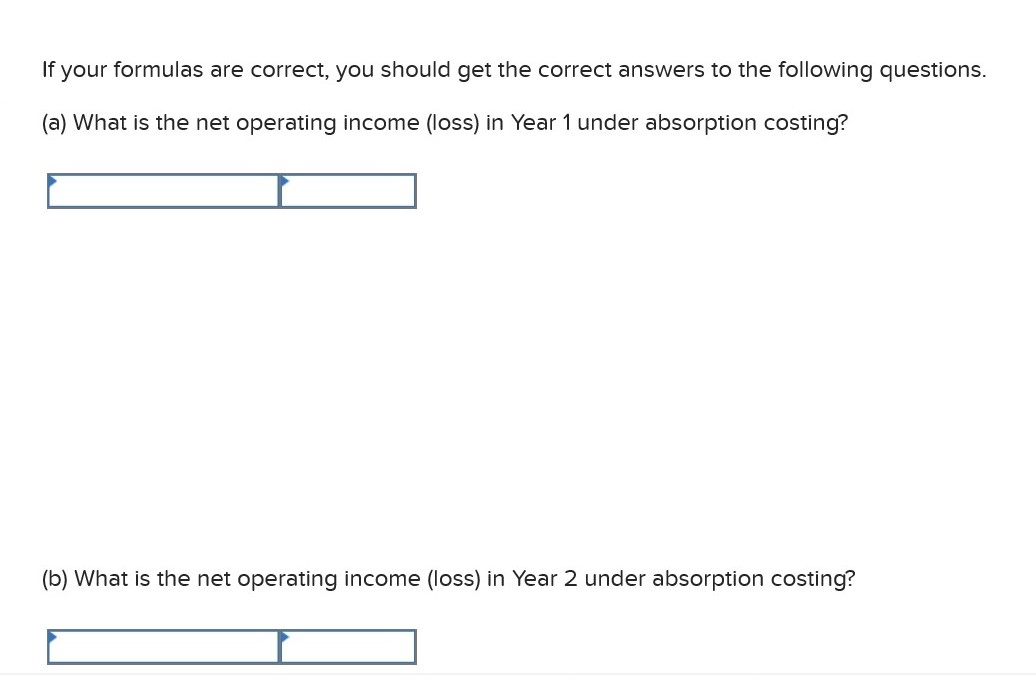

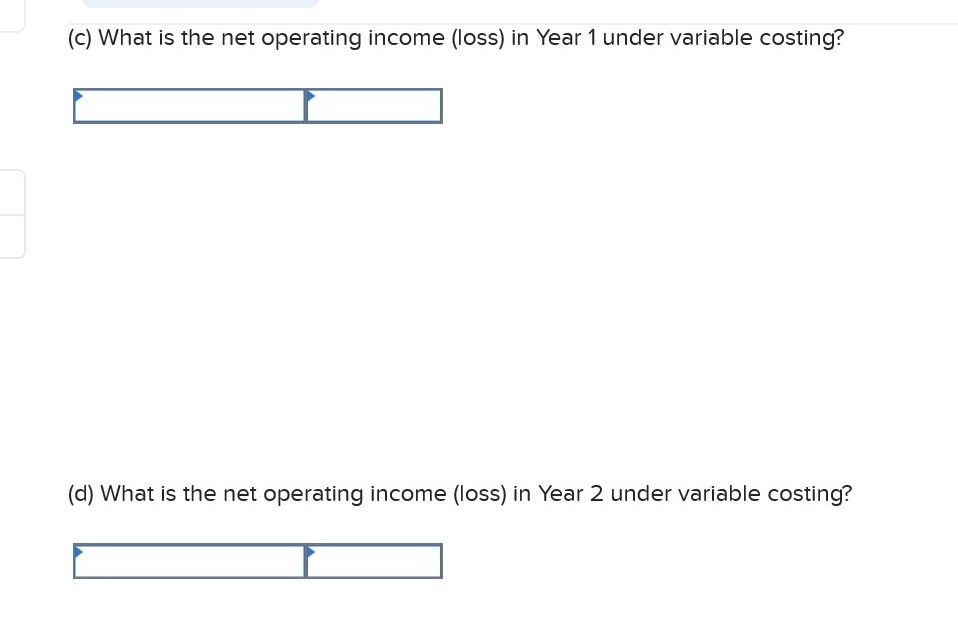

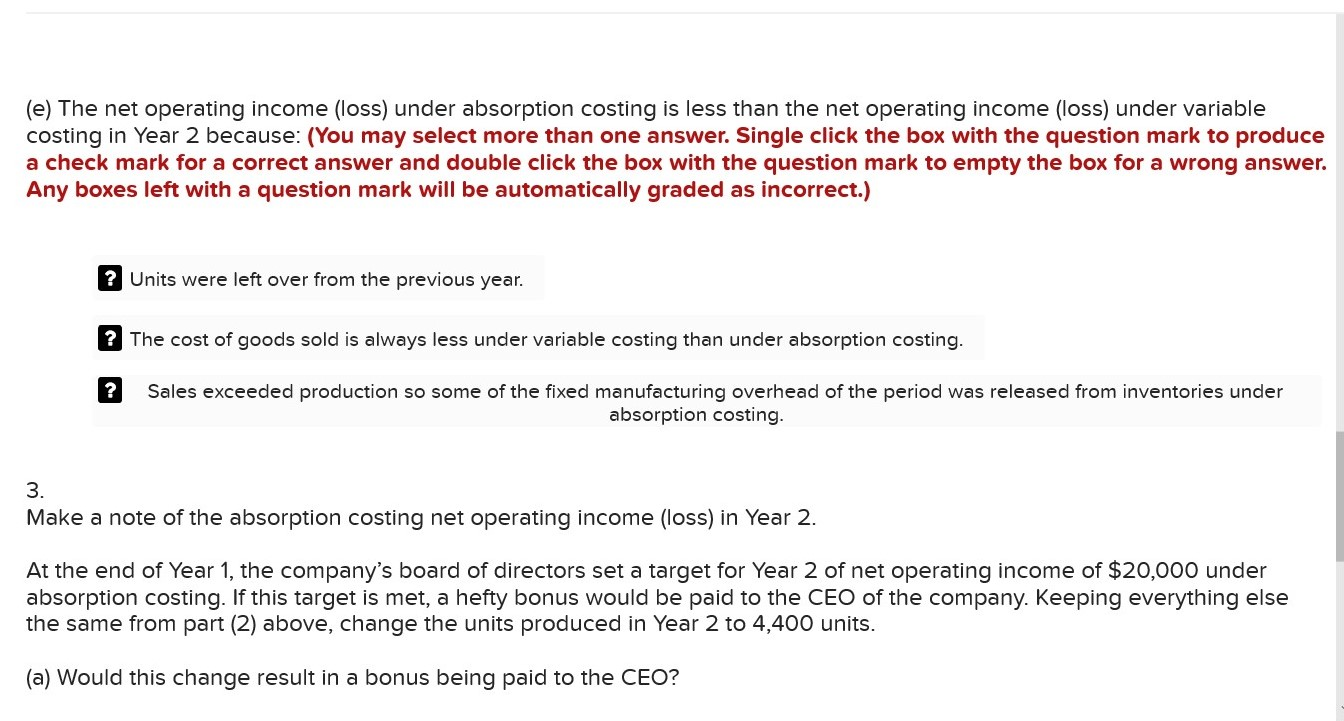

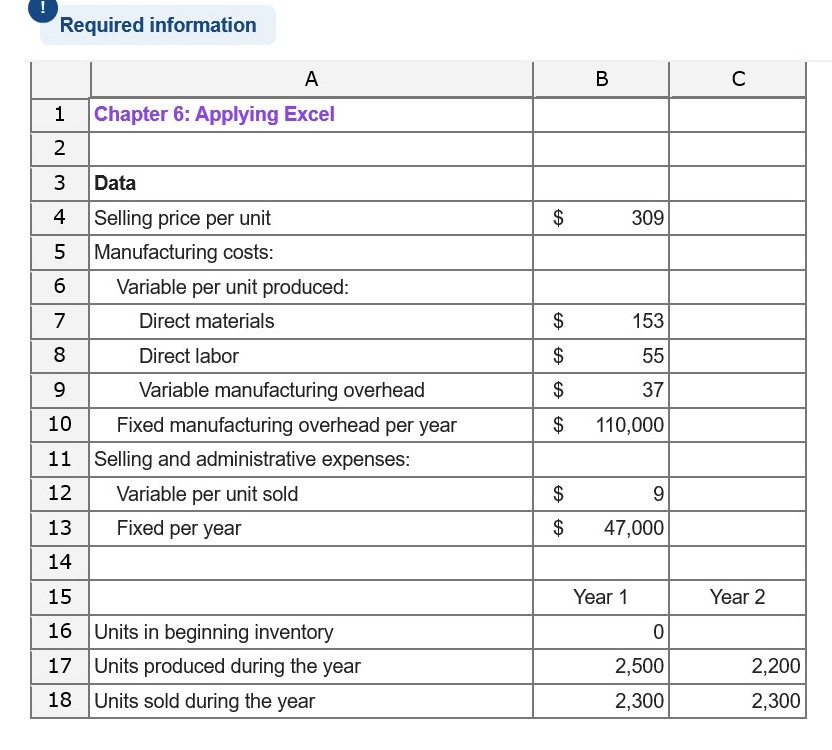

Required information B A Chapter 6: Applying Excel 1 2 $ 309 $ 153 $ 55 3 Data 4 Selling price per unit 5 Manufacturing costs: 6 Variable per unit produced: 7 Direct materials 8 Direct labor 9 Variable manufacturing overhead 10 Fixed manufacturing overhead per year 11 Selling and administrative expenses: 12 Variable per unit sold 13 Fixed per year 14 $ 37 $ 110,000 $ 9 $ 47,000 15 Year 1 Year 2 16 Units in beginning inventory 17 Units produced during the year 18 Units sold during the year 0 2,500 2,300 2,200 2,300 If your formulas are correct, you should get the correct answers to the following questions. (a) What is the net operating income (loss) in Year 1 under absorption costing? (b) What is the net operating income (loss) in Year 2 under absorption costing? (c) What is the net operating income (loss) in Year 1 under variable costing? (d) What is the net operating income (loss) in Year 2 under variable costing? (e) The net operating income (loss) under absorption costing is less than the net operating income (loss) under variable costing in Year 2 because: (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) ? Units were left over from the previous year. ? The cost of goods sold is always less under variable costing than under absorption costing. ? Sales exceeded production so some of the fixed manufacturing overhead of the period was released from inventories under absorption costing. 3. Make a note of the absorption costing net operating income (loss) in Year 2. At the end of Year 1, the company's board of directors set a target for Year 2 of net operating income of $20,000 under absorption costing. If this target is met, a hefty bonus would be paid to the CEO of the company. Keeping everything else the same from part (2) above, change the units produced in Year 2 to 4,400 units. (a) Would this change result in a bonus being paid to the CEO? O Yes (b) What is the net operating income (loss) in Year 2 under absorption costing? (c) Would this doubling of production in Year 2 be in the best interests of the company if sales are expected to continue to be 2,300 units per year? O Yes O No