Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help this is due in 30 minutes Coffee Bean, Inc. (CBI), is a processor and distributor of a variety of blends of coffee. The

please help this is due in 30 minutes

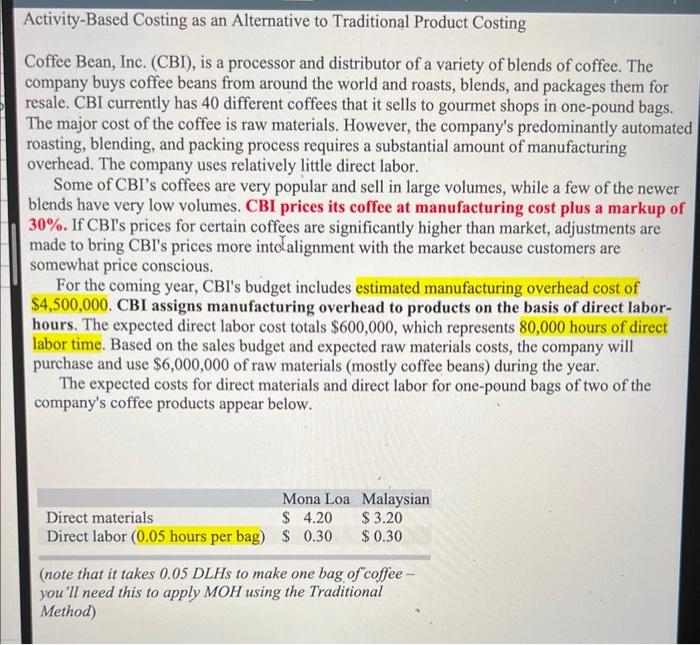

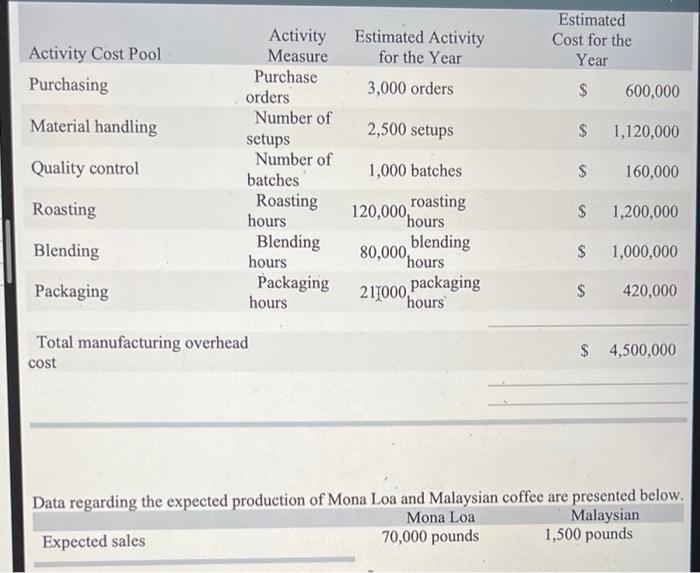

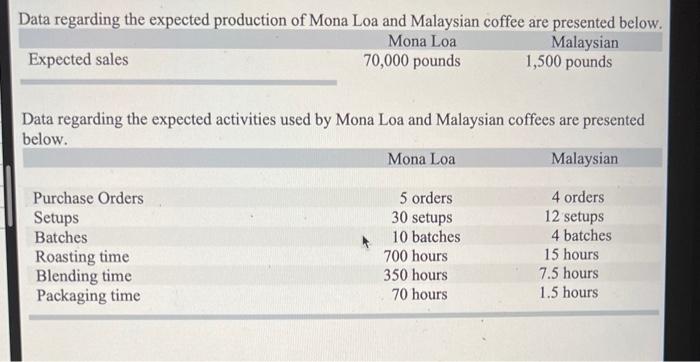

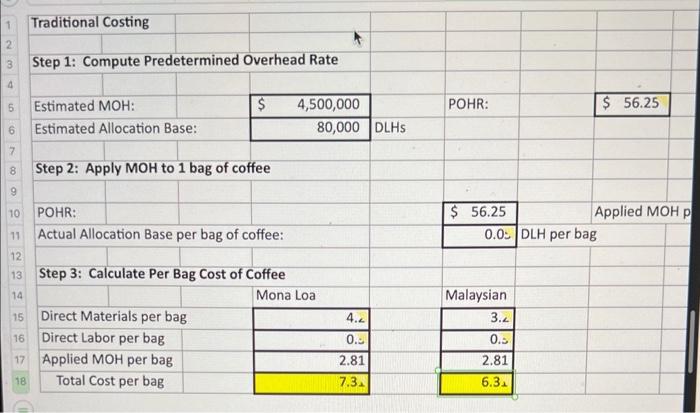

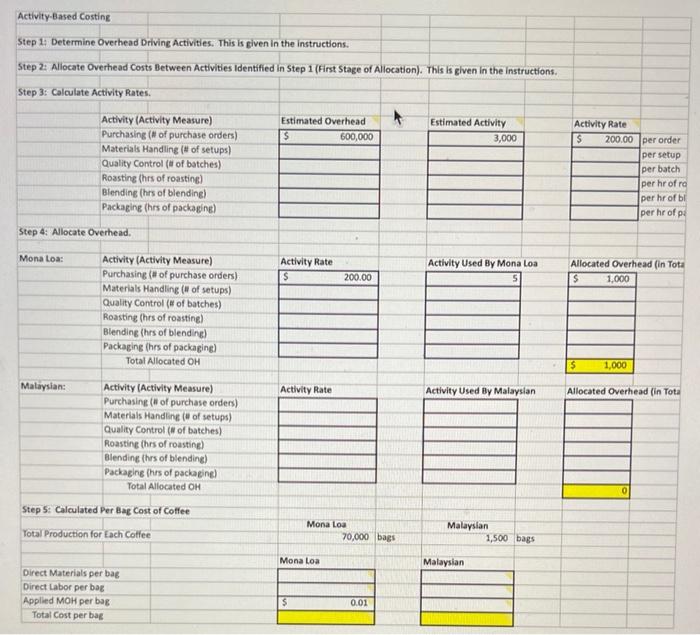

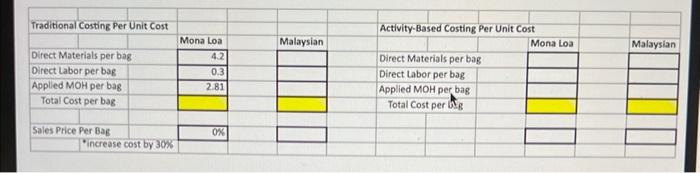

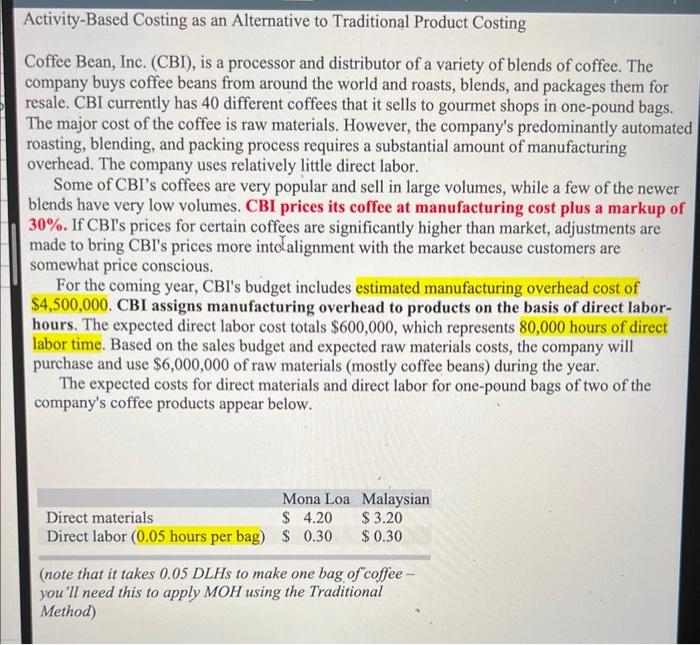

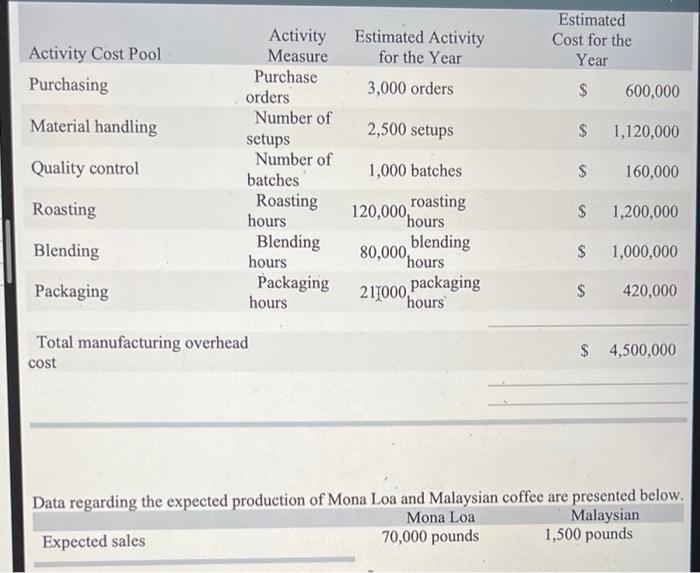

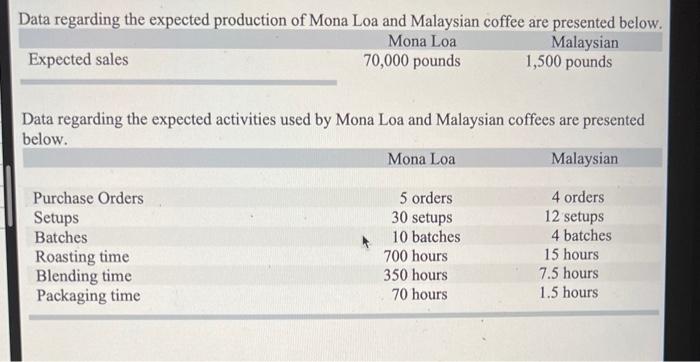

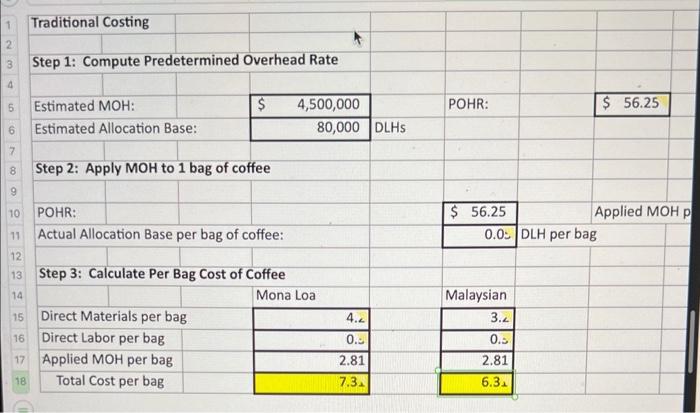

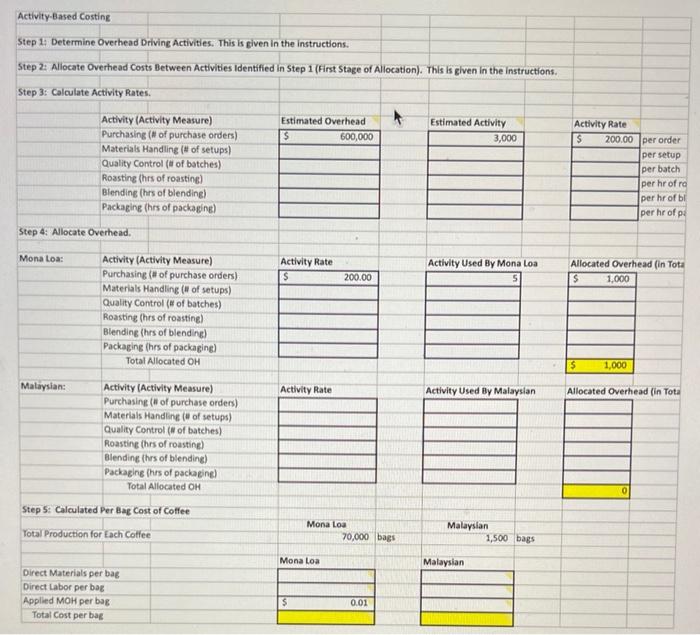

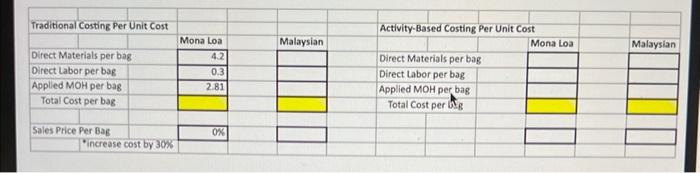

Coffee Bean, Inc. (CBI), is a processor and distributor of a variety of blends of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. CBI currently has 40 different coffees that it sells to gourmet shops in one-pound bags. The major cost of the coffee is raw materials. However, the company's predominantly automatec roasting, blending, and packing process requires a substantial amount of manufacturing overhead. The company uses relatively little direct labor. Some of CBI's coffees are very popular and sell in large volumes, while a few of the newer blends have very low volumes. CBI prices its coffee at manufacturing cost plus a markup of 30%. If CBI's prices for certain coffees are significantly higher than market, adjustments are made to bring CBI's prices more intolalignment with the market because customers are somewhat price conscious. For the coming year, CBI's budget includes estimated manufacturing overhead cost of $4,500,000. CBI assigns manufacturing overhead to products on the basis of direct laborhours. The expected direct labor cost totals $600,000, which represents 80,000 hours of direct labor time. Based on the sales budget and expected raw materials costs, the company will purchase and use $6,000,000 of raw materials (mostly coffee beans) during the year. The expected costs for direct materials and direct labor for one-pound bags of two of the company's coffee products appear below. (note that it takes 0.05DLH to make one bag of coffee you'll need this to apply MOH using the Traditional Method) Data regarding the expected production of Mona Loa and Malaysian coffee are presented below. Data regarding the expected activities used by Mona Loa and Malaysian coffees are presented helow Activity-Based Costing Step 1: Determine Overhead Driving Activities. This is given in the instructions. Step 2: Allocate Overhead Costs Between Activities Identified in Step 1 (First Stage of Allocation). This is given in the instructions. Step 3: Calculate Activity Rates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started