Answered step by step

Verified Expert Solution

Question

1 Approved Answer

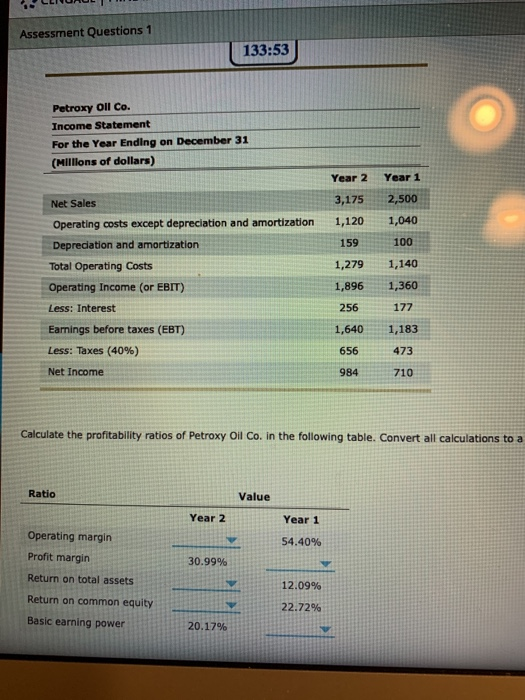

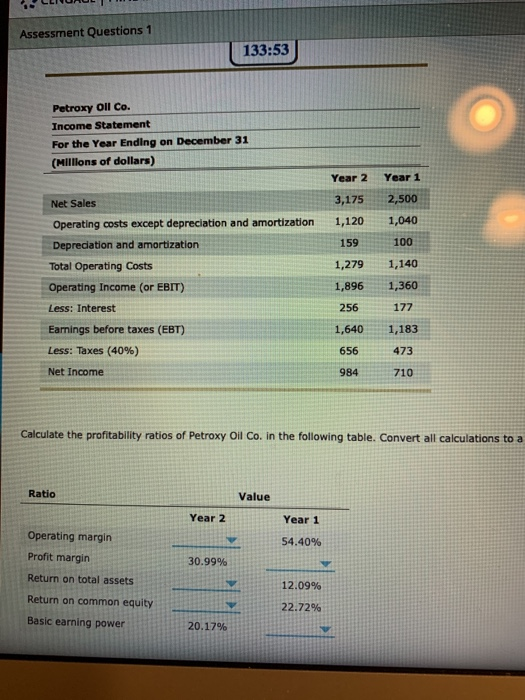

please help this is for final grade LLIURUL Assessment Questions 1 133:53 Petroxy Oll Co. Income Statement For the Year Ending on December 31 (Millions

please help this is for final grade

LLIURUL Assessment Questions 1 133:53 Petroxy Oll Co. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 3,175 1,120 Year 1 2,500 1,040 100 159 1,279 1,140 Net Sales Operating costs except depreciation and amortization Depreciation and amortization Total Operating costs Operating Income (or EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes (40%) Net Income 1,896 1,360 256 177 1,640 1,183 656 473 984 710 Calculate the profitability ratios of Petroxy Oil Co. in the following table. Convert all calculations to a Ratio Value Year 2 Year 1 Operating margin Profit margin 54.40% 30.99% Return on total assets Return on common equity 12.09% 22.72% Basic earning power 20.17% LLIURUL Assessment Questions 1 133:53 Petroxy Oll Co. Income Statement For the Year Ending on December 31 (Millions of dollars) Year 2 3,175 1,120 Year 1 2,500 1,040 100 159 1,279 1,140 Net Sales Operating costs except depreciation and amortization Depreciation and amortization Total Operating costs Operating Income (or EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes (40%) Net Income 1,896 1,360 256 177 1,640 1,183 656 473 984 710 Calculate the profitability ratios of Petroxy Oil Co. in the following table. Convert all calculations to a Ratio Value Year 2 Year 1 Operating margin Profit margin 54.40% 30.99% Return on total assets Return on common equity 12.09% 22.72% Basic earning power 20.17%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started