please help

this is my data for this problem:

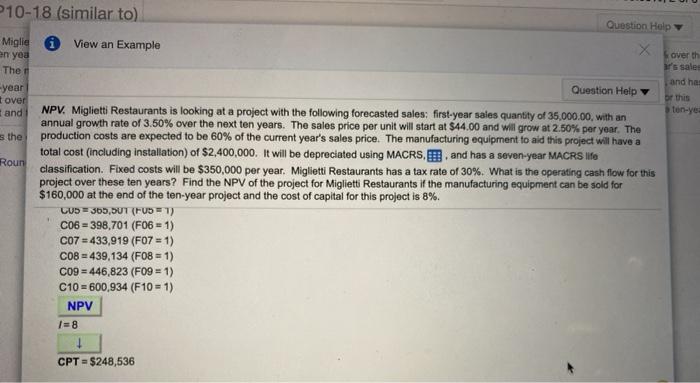

question example: and it shows how to solve

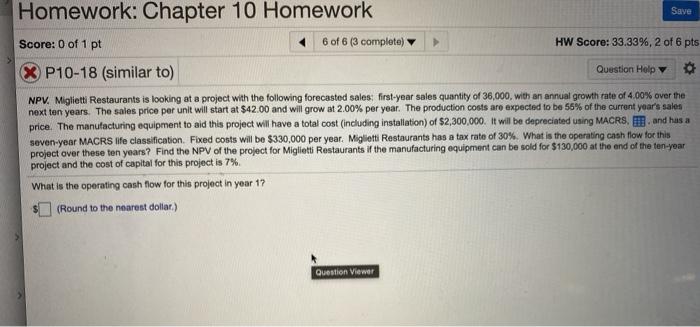

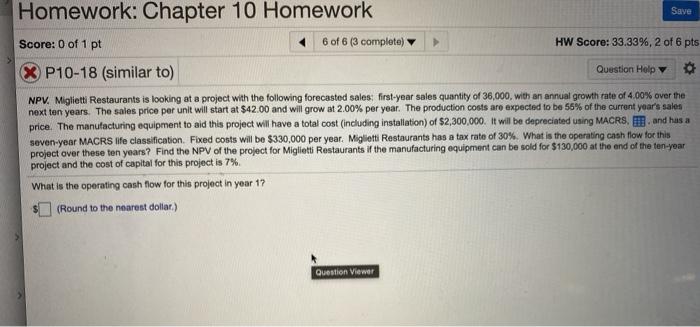

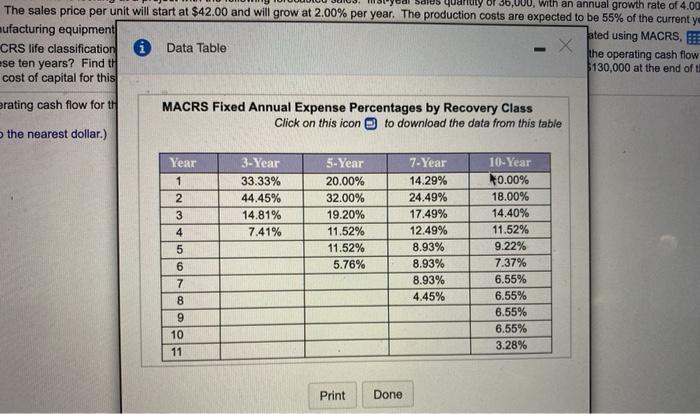

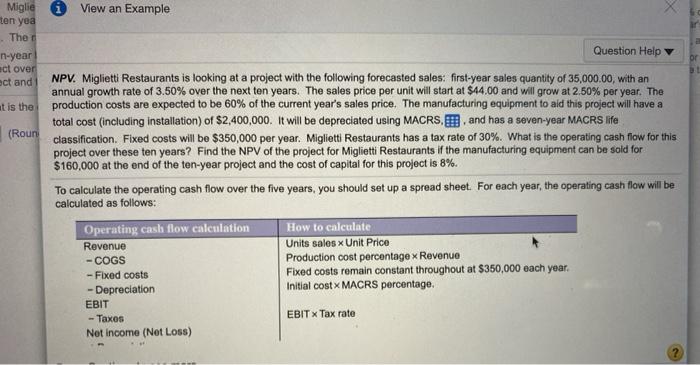

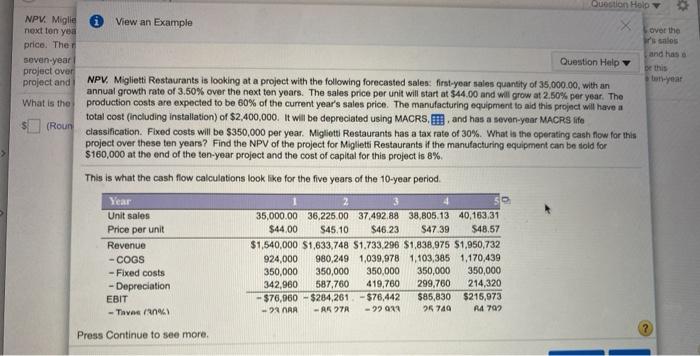

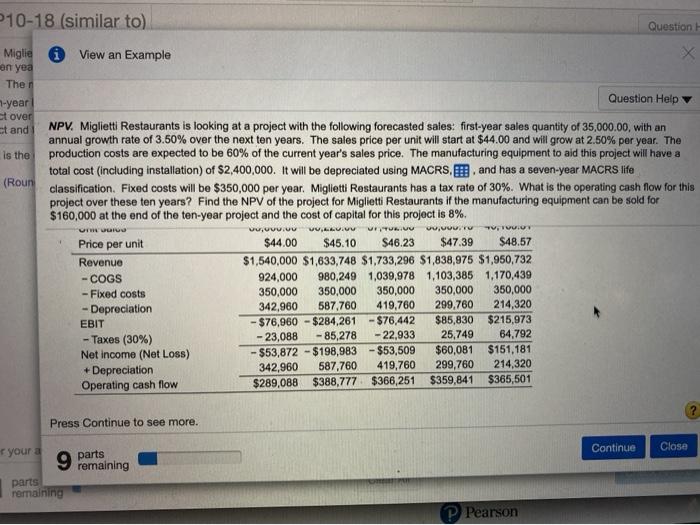

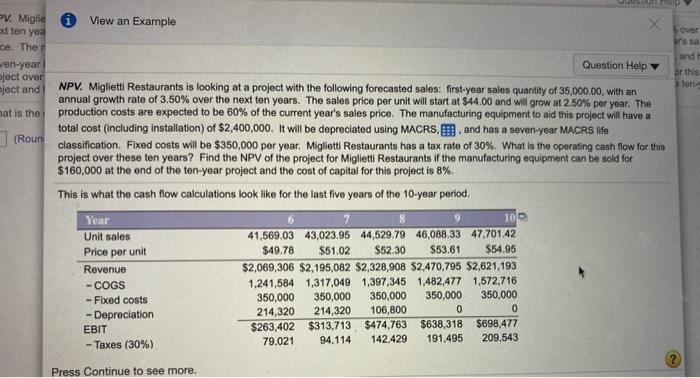

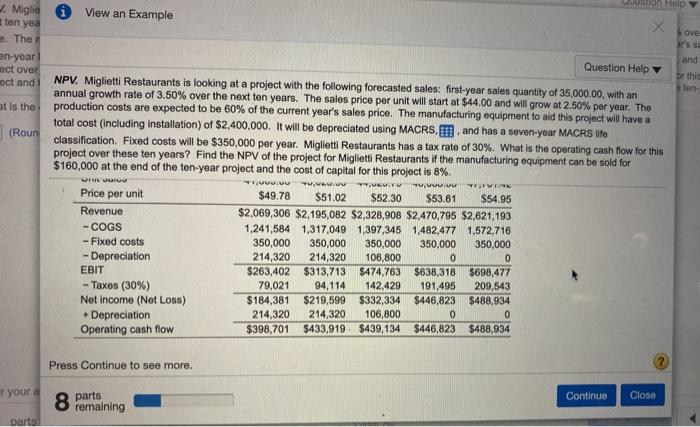

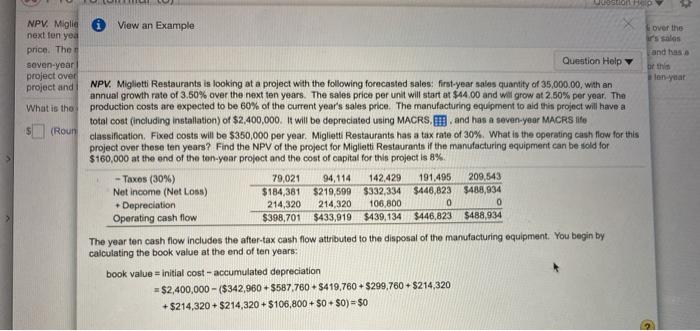

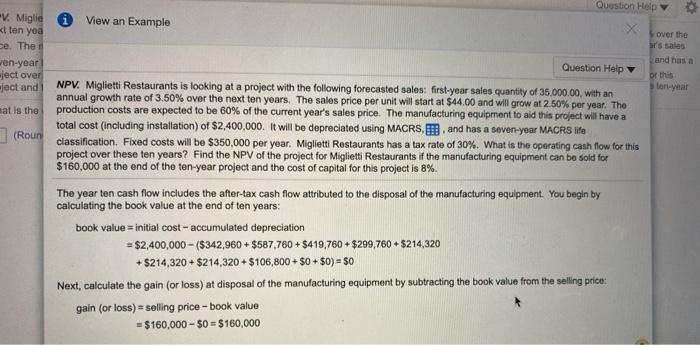

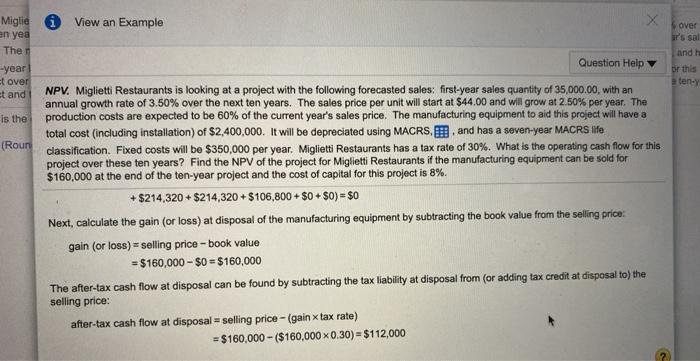

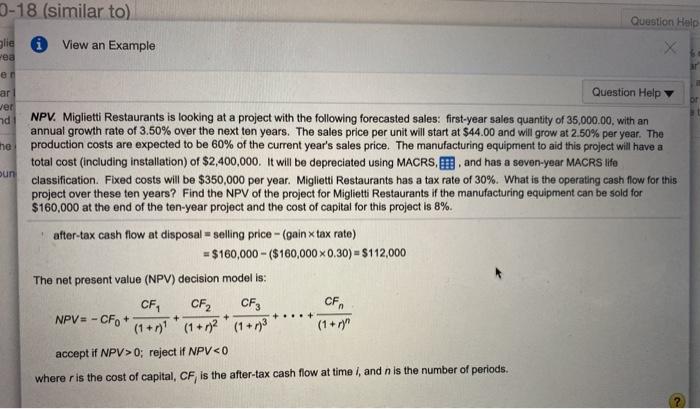

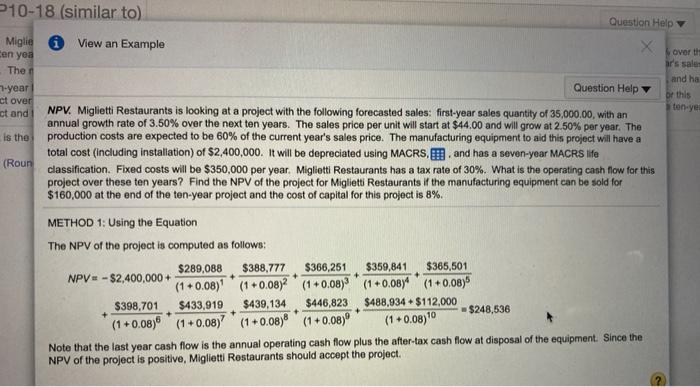

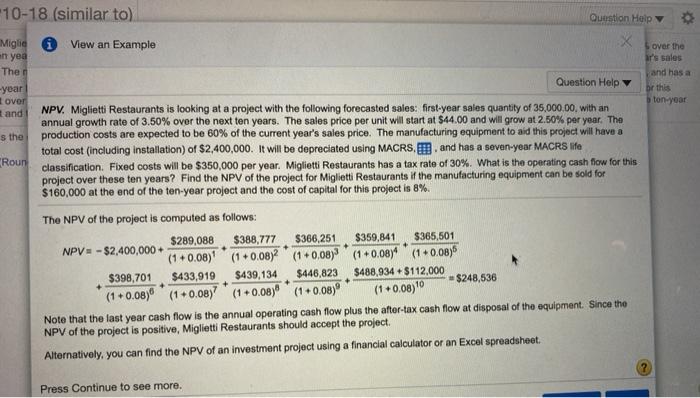

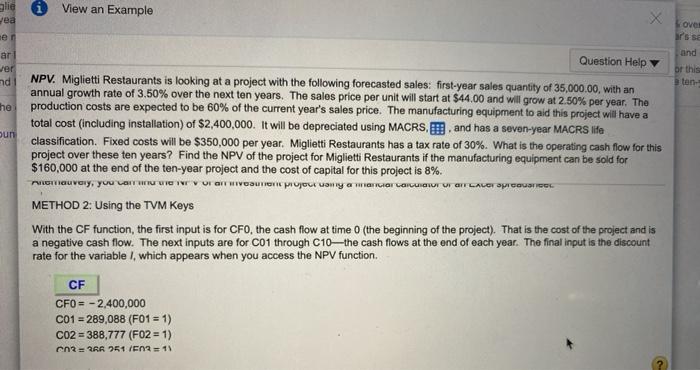

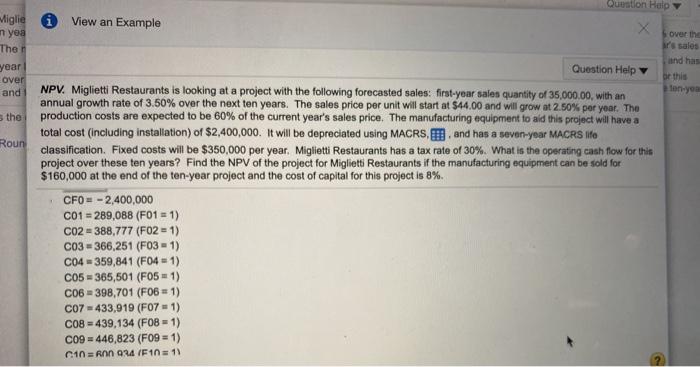

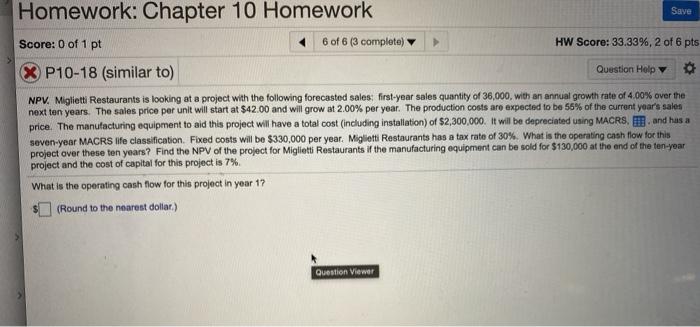

Homework: Chapter 10 Homework Save Score: 0 of 1 pt 6 of 6 (3 completo) HW Score: 33.33%, 2 of 6 pts X P10-18 (similar to) Question Help NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 36,000, with an annual growth rate of 4.00% over the next ten years. The sales price per unit will start at $42.00 and will grow at 2.00% per year. The production costs are expected to be 56% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,300,000. It will be depreciated using MACRS, and has a seven-year MACRS life classification Fixed costs will be $330.000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $130,000 at the end of the ten-year project and the cost of capital for this project is 7% What is the operating cash flow for this project in year 1? (Round to the nearest dollar) Question Viewer quantity of 30,000, with an annual growth rate of 4.00 The sales price per unit will start at $42.00 and will grow at 2.00% per year. The production costs are expected to be 55% of the current y ufacturing equipment ated using MACRS, DE CRS life classification X Data Table the operating cash flow ese ten years? Find th $130,000 at the end oft cost of capital for this erating cash flow for th MACRS Fixed Annual Expense Percentages by Recovery Class Click on this icon to download the data from this table the nearest dollar.) 3-Year 33.33% 44.45% 14.81% 7.4 Year 1 2 3 4 5 6 7 8 9 10 11 5-Year 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7-Year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% 10-Year 0.00% 18.00% 14.40% 11.52% 9.22% 7.37% 6.55% 6.55% 6.55% 6.55% 3.28% Print Done Miglie i View an Example ten yea or The n-year Question Help act over act and NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000.00, with an annual growth rate of 3.50% over the next ten years. The sales price per unit will start at $44.00 and will grow at 2.50% per year. The It is the production costs are expected to be 60% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, and has a seven-year MACRS life (Roun classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $160,000 at the end of the ten-year project and the cost of capital for this project is 8%. To calculate the operating cash flow over the five years, you should set up a spread sheet. For each year, the operating cash flow will be calculated as follows: Operating cash flow calculation How to calculate Revenue Units sales x Unit Price - COGS Production cost percentage x Revenue - Fixed costs Fixed costs remain constant throughout at $350,000 each year. -Depreciation Initial cost X MACRS percentage. EBIT - Taxos EBIT X Tax rate Not Income (Net Loss) Question Holy View an Example NPV. Miglie next ten yea price. The seven-year project over project and over the s salos and has a De this la- Question Help What is the (Roun NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000.00, with an annual growth rate of 3.50% over the next ten years. The sales price per unit will start at $44.00 and will grow at 2.50% per year. The production costs are expected to be 60% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, and has a seven-year MACRS life classification. Fixed costs will be $350,000 per year. Migliotti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $160,000 at the end of the ten-year project and the cost of capital for this project is 8% This is what the cash flow calculations look like for the five years of the 10-year period. Year Unit sales Price per unit Revenue -COGS - Fixed costs - Depreciation EBIT Tavas 3 35,000.00 36,225,00 37.492.88 38,805.13 40,163,31 $44,00 $45.10 $46.23 $4739 $48,57 $1,540,000 $1,633,748 $1,733,296 $1,838,975 $1,950,732 924,000 980,249 1,039,978 1,103,385 1,170,439 350,000 350,000 350,000 350,000 350,000 342,960 587,760 419,760 299,760 214,320 - $76,960 - $284,261 - $76,442 $85,830 $215,973 - NRA -ASTA -2011 25 749 14792 Press Continue to see more. 10-18 (similar to) Question Miglie View an Example en yea Then 7-year Question Help et over ct and NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000.00, with an annual growth rate of 3.50% over the next ten years. The sales price per unit will start at $44.00 and will grow at 2.50% per year. The is the production costs are expected to be 60% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, E. and has a seven-year MACRS life (Roun classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $160,000 at the end of the ten-year project and the cost of capital for this project is 8%. Price per unit $44.00 $45.10 $46.23 $47.39 $48.57 Revenue $1,540,000 $1,633,748 $1,733,296 $1,838,975 $1,950,732 - COGS 924,000 980,249 1,039,978 1,103,385 1,170,439 - Fixed costs 350,000 350,000 350,000 350,000 350,000 -Depreciation 342,960 587,760 419,760 299,760 214,320 EBIT - $76,960 - $284,261 - $76,442 $85,830 $215,973 - Taxes (30%) -23,088 -85,278 - 22,933 25,749 64.792 Net income (Net Loss) - $53,872 - $198,983 - $53,509 $60,081 $151,181 +Depreciation 342,960 587,760 419,760 299,760 214,320 $289,088 $388,777 Operating cash flow $366,251 $359,841 $365,501 vu,uvuvy VUUUU UUUU JU,VITU TV, Vio Press Continue to see more. Continue Close your a 9 parts remaining parts remaining P Pearson View an Example PV. Miglie od ten yea ce. The Over are sa wen-year bject over Dject and and or this fen mat is the (Roun Question Help NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000.00, with an annual growth rate of 3.50% over the next ten years. The sales price per unit will start at $44.00 and will grow at 2.50% per year. The production costs are expected to be 60% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, ... and has a seven-year MACRS life classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $160,000 at the end of the ten-year project and the cost of capital for this project is 8%. This is what the cash flow calculations look like for the last five years of the 10-year period. Year 8 9 100 Unit sales 41,569.03 43,023.95 44,529.79 46,088.33 47.701.42 Price per unit $49.78 $51.02 $52.30 $53.61 $54.95 Revenue $2,069,306 $2,195,082 $2,328,908 $2.470,795 $2,621,193 - COGS 1,241,584 1,317,049 1,397,345 1,482,477 1,572,716 - Fixed costs 350,000 350,000 350,000 350,000 350,000 -Depreciation 214,320 214,320 106,800 0 0 EBIT $263,402 $313.713 $474,763 $638,318 $698.477 - Taxes (30%) 79.021 94.114 142.429 191.495 209.543 Press Continue to see more. on Help View an Example Miglie ten yea e. The en-year act over ect and ove a's se and or this at is the ] (Roun Uuro Tvivu TUVUU Y .. Tu,www.vu TUTTE Question Help NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000.00, with an annual growth rate of 3.50% over the next ten years. The sales price per unit will start at $44.00 and will grow at 2.50% per year. The production costs are expected to be 60% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, and has a seven-year MACRS ilfe classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $160,000 at the end of the ten-year project and the cost of capital for this project is 8%. Price per unit $49.78 $51.02 $52.30 $53.61 $54.95 Revenue $2,069,306 $2,195,082 $2,328,908 $2,470,795 $2,621,193 - COGS 1,241,584 1,317,049 1,397,345 1,482,477 1,572,716 - Fixed costs 350,000 350,000 350,000 350.000 350,000 - Depreciation 214,320 214,320 106,800 0 0 EBIT $263,402 $313,713 $474.763 $638,318 $698,477 - Taxes (30%) 79,021 94,114 142,429 191,495 209,543 Net income (Net Loss) $184,381 $219,599 $332,334 $446,823 $488,934 + Depreciation 214,320 214,320 106,800 0 0 Operating cash flow $398,701 $433,919 $439,134 $446,823 $488,934 Press Continue to see more. your a Continue Close 8 Pemaining Darts over the ir's salos and has lon-year NPV. Miglie View an Example next ten yea price. The seven-year Question Help project over project and NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000.00, with an annual growth rate of 3.50% over the next ten years. The sales price per unit will start at $44.00 and will grow at 2,50% per year. The What is the production costs are expected to be 60% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, I. and has a seven-year MACRS life $ (Roun classification Fixed costs will be $350.000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $160,000 at the end of the ten-year project and the cost of capital for this project is 8% - Taxes (30%) 79,021 94,114 142,429 191,495 209,543 Net income (Net Loss) $184,381 $219,599 $332,334 $446,823 $488,934 Depreciation 214,320 214,320 106,800 0 0 Operating cash flow $398,701 $433,919 $439,134 $446,823 $488,934 The year ten cash flow includes the after-tax cash flow attributed to the disposal of the manufacturing equipment. You begin by calculating the book value at the end of ten years: book value initial cost-accumulated depreciation = $2,400,000 -($342,960 $587,760+ $419,760 +$299,760 + $214,320 +$214,320 - $214,320 + $ 106,800 + $0 $0)= $0 Question Help View an Example X over the V. Miglie et ten yea se. The wen-year ject over and has a or this tor-year ject and at is the (Roun Question Help NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000.00, with an annual growth rate of 3.50% over the next ten years. The sales price per unit will start at $44.00 and will grow at 2.50% per year. The production costs are expected to be 60% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, E, and has a seven-year MACRS life classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $160,000 at the end of the ten-year project and the cost of capital for this project is 8% The year ten cash flow includes the after-tax cash flow attributed to the disposal of the manufacturing equipment. You begin by calculating the book value at the end of ten years: book value = initial cost-accumulated depreciation = $2,400,000 - ($342,960 + $587,760 + $419,760 + $299,760 + $214,320 +$214,320 + $ 214,320 + $ 106,800 + $0 + $0) - $0 Next, calculate the gain (or loss) at disposal of the manufacturing equipment by subtracting the book value from the selling price: gain (or loss) = selling price -book value = $160,000 - $0 = $160,000 View an Example over assal And Miglia en yea The -year et over t and or this ten-Y is the (Roun Question Help NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000.00, with an annual growth rate of 3.50% over the next ten years. The sales price per unit will start at $44.00 and will grow at 2.50% per year. The production costs are expected to be 60% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, and has a seven-year MACRS life classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $160,000 at the end of the ten-year project and the cost of capital for this project is 8%. +$214,320 + $214,320 + $106,800 + $0 + $0) = $0 Next, calculate the gain (or loss) at disposal of the manufacturing equipment by subtracting the book value from the selling price: gain (or loss) = selling price - book value = $160,000 - $0 = $160,000 The after-tax cash flow at disposal can be found by subtracting the tax liability at disposal from (or adding tax credit at disposal to) the selling price: after-tax cash flow at disposal = selling price -(gain x tax rate) = $160,000 - ($160,000 x 0.30) = $112,000 3-18 (similar to) Question Help glie Hea View an Example ar Jet nd he pun Question Help NPV. Miglietti Restaurants is looking at a project with the following forecasted sales: first-year sales quantity of 35,000.00, with an annual growth rate of 3.50% over the next ten years. The sales price per unit will start at $44.00 and will grow at 2.50% per year. The production costs are expected to be 60% of the current year's sales price. The manufacturing equipment to aid this project will have a total cost (including installation) of $2,400,000. It will be depreciated using MACRS, ... and has a seven-year MACRS life classification. Fixed costs will be $350,000 per year. Miglietti Restaurants has a tax rate of 30%. What is the operating cash flow for this project over these ten years? Find the NPV of the project for Miglietti Restaurants if the manufacturing equipment can be sold for $160,000 at the end of the ten-year project and the cost of capital for this project is 8%. after-tax cash flow at disposal - selling price -(gain x tax rate) = $160,000 - ($160,000 0.30) = $112,000 The net present value (NPV) decision model is: CF + + ... + CF CF CF3 NPV=- CF(1+71* (1 ++)2 (1+me accept if NPV>0; reject if NPV