Please help. This question is lengthy so I will be breaking it up into multiple questions and posting them. This is part 4. *EDITED* Please assist with section A.h; Schedule of Cash Receipts and section A.i; Schedule of Cash Payments

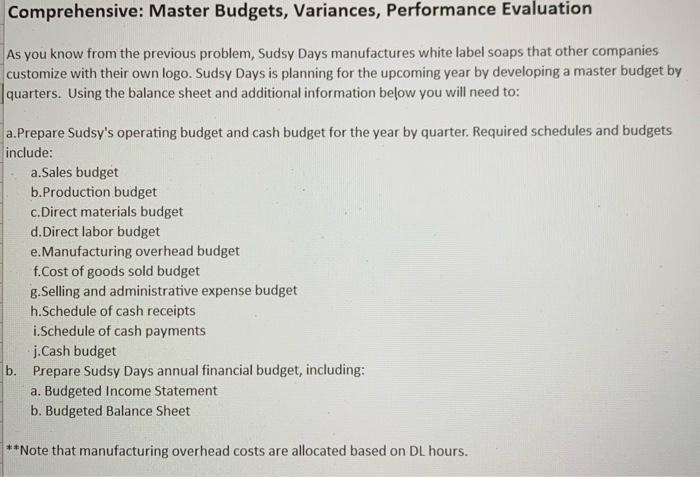

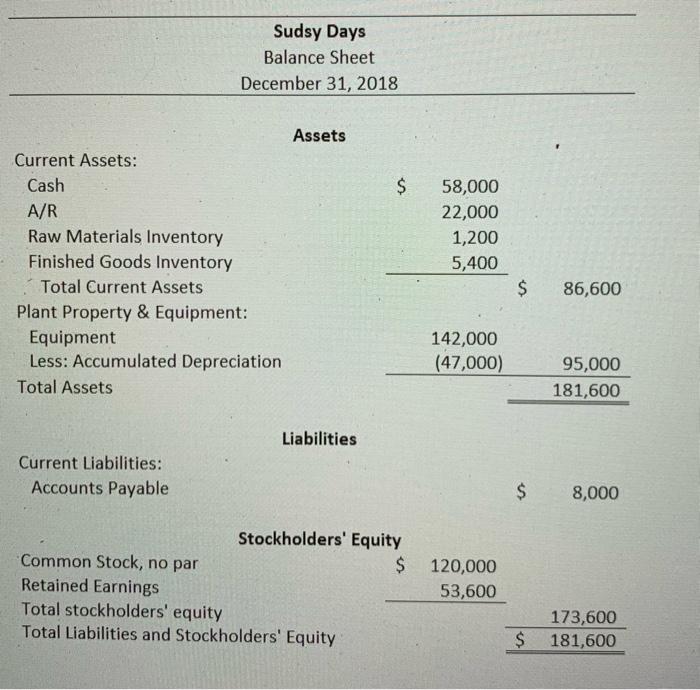

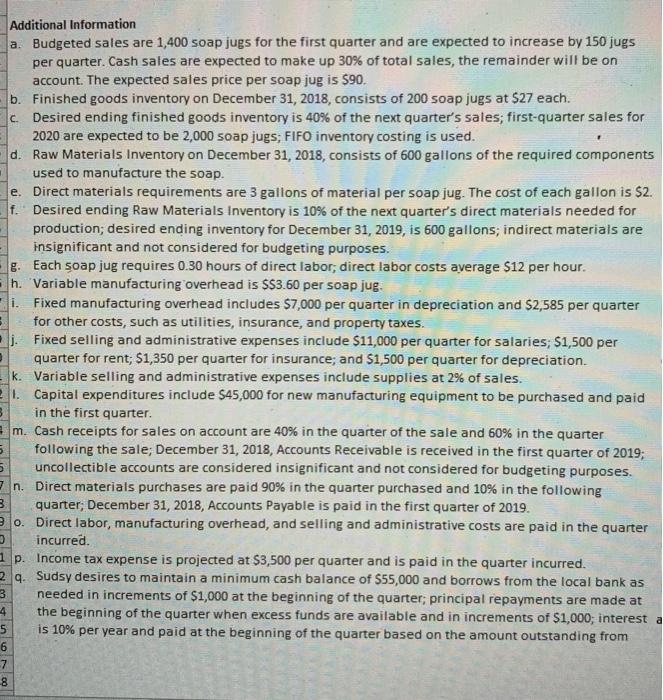

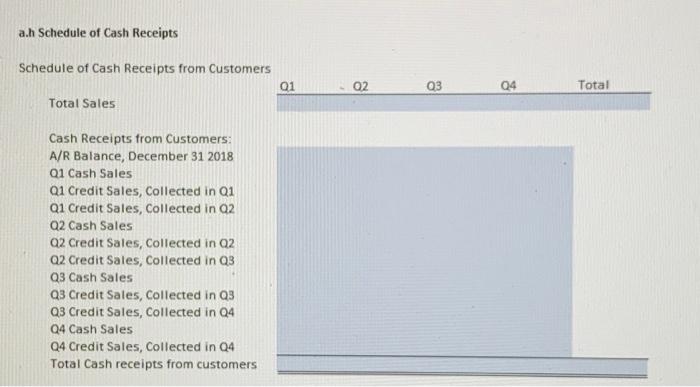

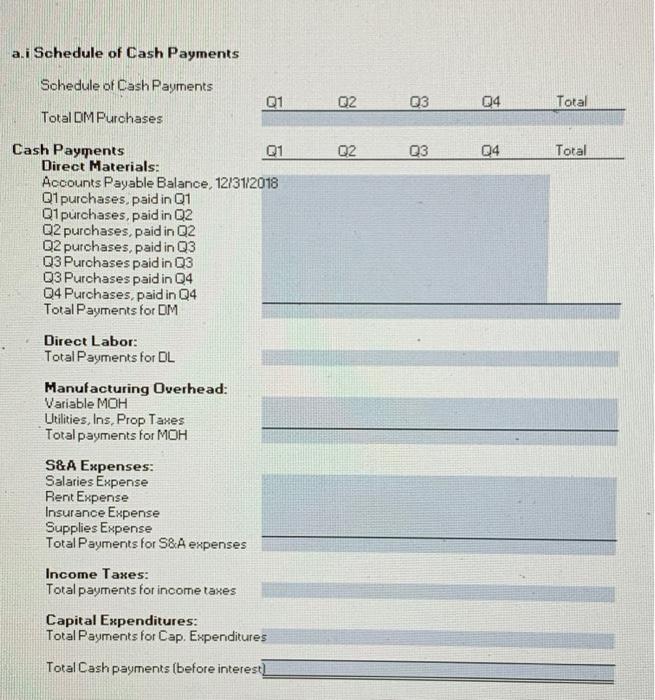

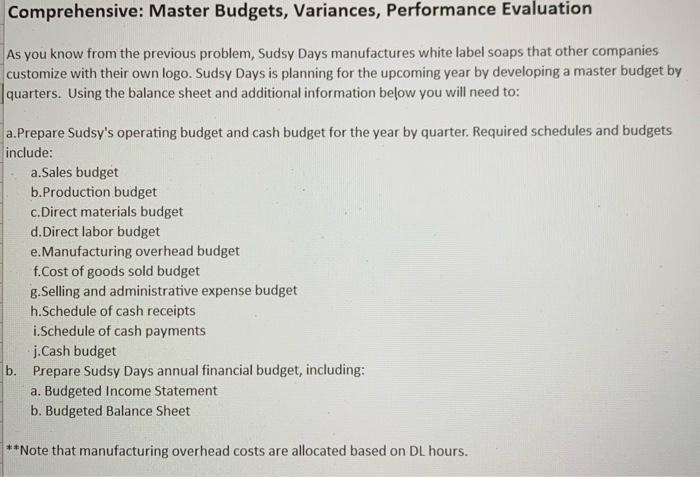

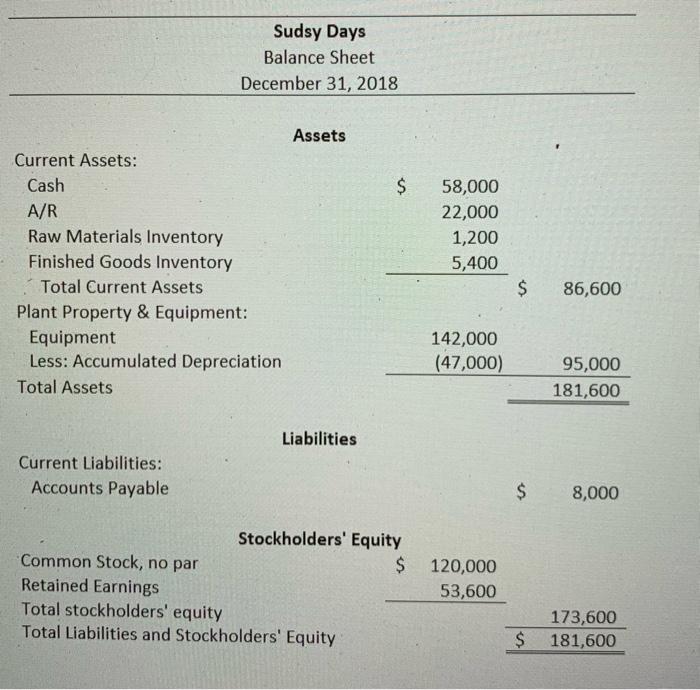

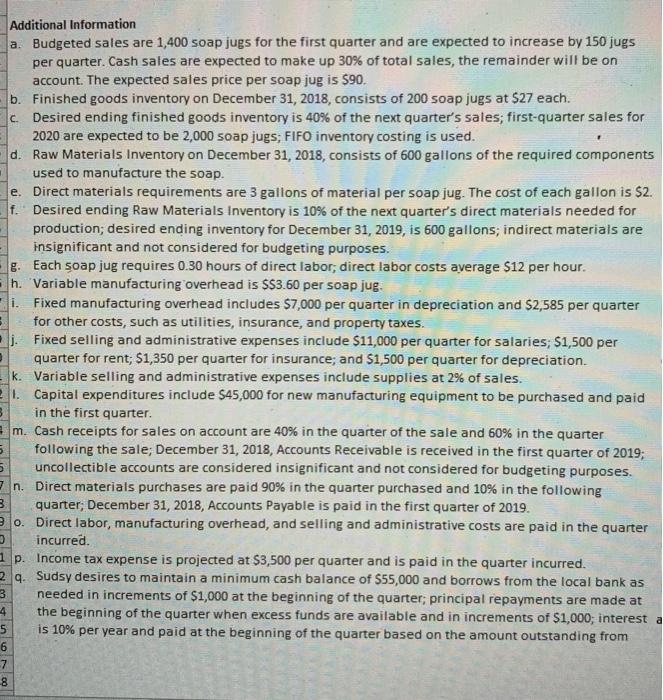

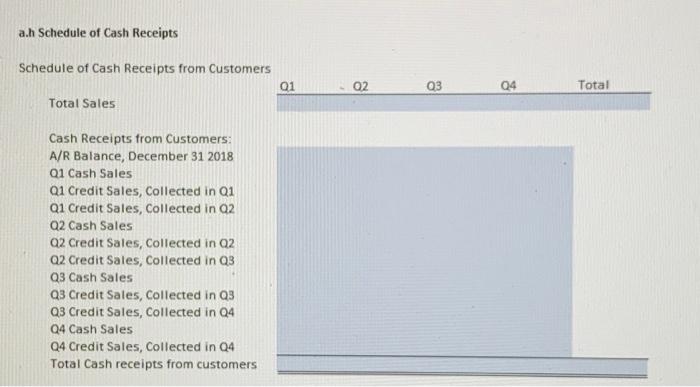

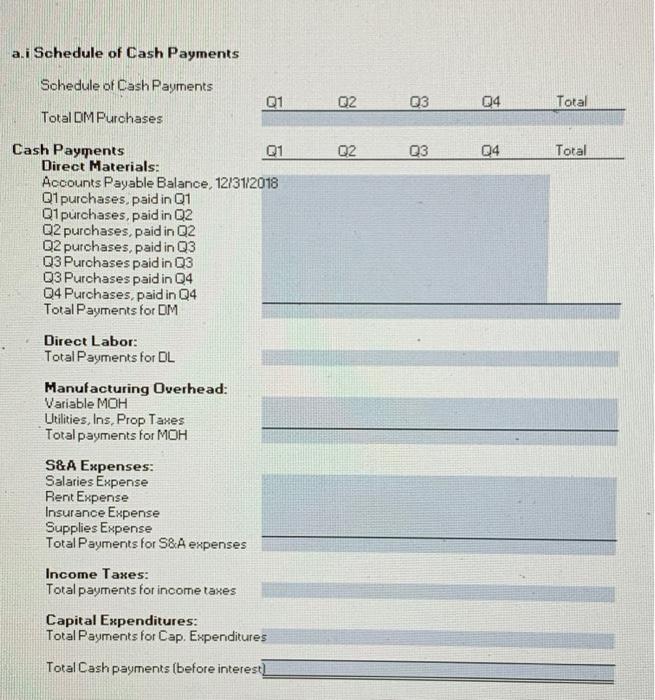

Comprehensive: Master Budgets, Variances, Performance Evaluation As you know from the previous problem, Sudsy Days manufactures white label soaps that other companies customize with their own logo. Sudsy Days is planning for the upcoming year by developing a master budget by quarters. Using the balance sheet and additional information below you will need to: a.Prepare Sudsy's operating budget and cash budget for the year by quarter. Required schedules and budgets include: a.Sales budget b.Production budget c.Direct materials budget d.Direct labor budget e. Manufacturing overhead budget f.Cost of goods sold budget g.Selling and administrative expense budget h.Schedule of cash receipts i.Schedule of cash payments j.Cash budget b. Prepare Sudsy Days annual financial budget, including: a. Budgeted Income Statement b. Budgeted Balance Sheet **Note that manufacturing overhead costs are allocated based on DL hours. Sudsy Days Balance Sheet December 31, 2018 Assets $ 58,000 22,000 1,200 5,400 Current Assets: Cash A/R Raw Materials Inventory Finished Goods Inventory Total Current Assets Plant Property & Equipment: Equipment Less: Accumulated Depreciation Total Assets $ 86,600 142,000 (47,000) 95,000 181,600 Liabilities Current Liabilities: Accounts Payable $ 8,000 Stockholders' Equity Common Stock, no par $ Retained Earnings Total stockholders' equity Total Liabilities and Stockholders' Equity 120,000 53,600 173,600 $ 181,600 C. 3 Additional Information a. Budgeted sales are 1,400 soap jugs for the first quarter and are expected to increase by 150 jugs per quarter. Cash sales are expected to make up 30% of total sales, the remainder will be on account. The expected sales price per soap jug is 590. b. Finished goods inventory on December 31, 2018, consists of 200 soap jugs at $27 each. Desired ending finished goods inventory is 40% of the next quarter's sales; first-quarter sales for 2020 are expected to be 2,000 soap jugs: FIFO inventory costing is used. d. Raw Materials Inventory on December 31, 2018, consists of 600 gallons of the required components used to manufacture the soap. e. Direct materials requirements are 3 gallons of material per soap jug. The cost of each gallon is $2. f. Desired ending Raw Materials Inventory is 10% of the next quarter's direct materials needed for production; desired ending inventory for December 31, 2019, is 500 gallons; indirect materials are insignificant and not considered for budgeting purposes. g. Each soap jug requires 0.30 hours of direct labor, direct labor costs average 512 per hour. h. Variable manufacturing overhead is $$3.60 per soap jug. Fixed manufacturing overhead includes $7,000 per quarter in depreciation and $2,585 per quarter for other costs, such as utilities, insurance, and property taxes. j. Fixed selling and administrative expenses include $11,000 per quarter for salaries; $1,500 per quarter for rent; $1,350 per quarter for insurance; and $1,500 per quarter for depreciation. k. Variable selling and administrative expenses include supplies at 2% of sales. I. Capital expenditures include 545,000 for new manufacturing equipment to be purchased and paid in the first quarter. m. Cash receipts for sales on account are 40% in the quarter of the sale and 60% in the quarter following the sale; December 31, 2018, Accounts Receivable is received in the first quarter of 2019; 5 uncollectible accounts are considered insignificant and not considered for budgeting purposes. n. Direct materials purchases are paid 90% in the quarter purchased and 10% in the following 3 quarter December 31, 2018, Accounts Payable is paid in the first quarter of 2019. 20. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter 3 incurred. 1 p. Income tax expense is projected at $3,500 per quarter and is paid in the quarter incurred. 2 9. Sudsy desires to maintain a minimum cash balance of $55,000 and borrows from the local bank as needed in increments of $1,000 at the beginning of the quarter; principal repayments are made at 4 the beginning of the quarter when excess funds are available and in increments of $1,000; interest a is 10% per year and paid at the beginning of the quarter based on the amount outstanding from 6 7 8 3 5 3 5 a.h Schedule of Cash Receipts Schedule of Cash Receipts from Customers 01 02 03 Q4 Total Total Sales Cash Receipts from Customers: A/R Balance, December 31 2018 01 Cash Sales Q1 Credit Sales, Collected in Q1 Q1 Credit Sales, Collected in Q2 Q2 Cash Sales Q2 Credit Sales, Collected in Q2 Q2 Credit Sales, Collected in Q3 Q3 Cash Sales Q3 Credit Sales, Collected in Q3 Q3 Credit Sales, Collected in 04 Q4 Cash Sales Q4 Credit Sales, Collected in 04 Total Cash receipts from customers ai Schedule of Cash Payments Schedule of Cash Payments Q1 02 03 04 Total Total DM Purchases Q2 Q3 04 Total Cash Payments Q1 Direct Materials: Accounts Payable Balance, 12/31/2018 Q1purchases, paid in 01 Q1 purchases, paid in Q2 Q2 purchases, paid in 02 02 purchases, paid in Q3 03 Purchases paid in Q3 03 Purchases paid in Q4 Q4 Purchases paid in Q4 Total Payments for OM Direct Labor: Total Payments for DL Manufacturing Overhead: Variable MOH Utilities, Ins, Prop Taxes Total payments for MOH S&A Expenses: Salaries Expense Rent Expense Insurance Expense Supplies Expense Total Payments for S&A expenses Income Taxes: Total payments for income taxes Capital Expenditures: Total Payments for Cap. Expenditures Total Cash payments (before interest