Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help to answer this question Happy Giraffe has preferred stock that payn a dividend of $9.00 par share and sells for $100 per share.

please help to answer this question

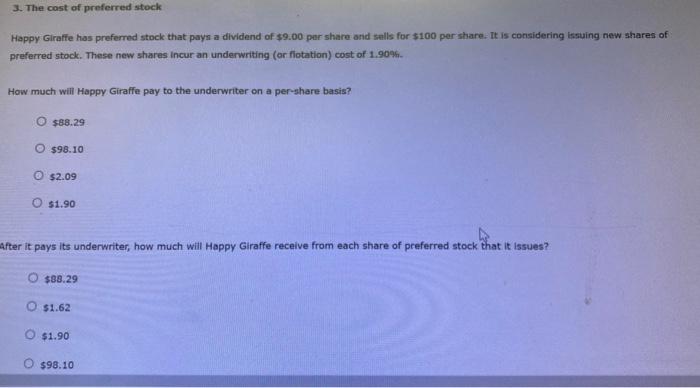

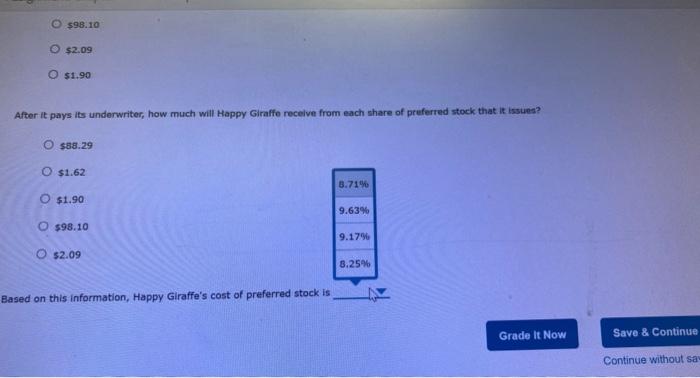

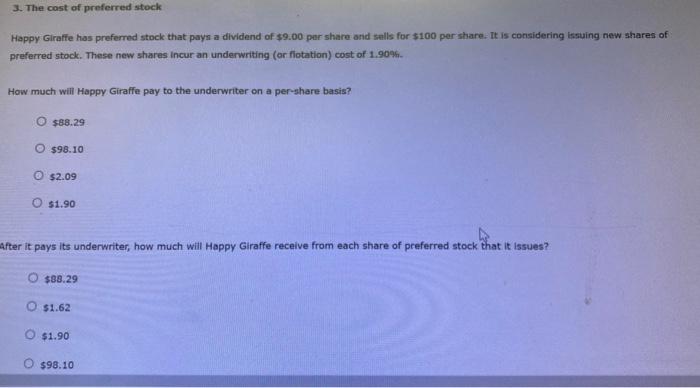

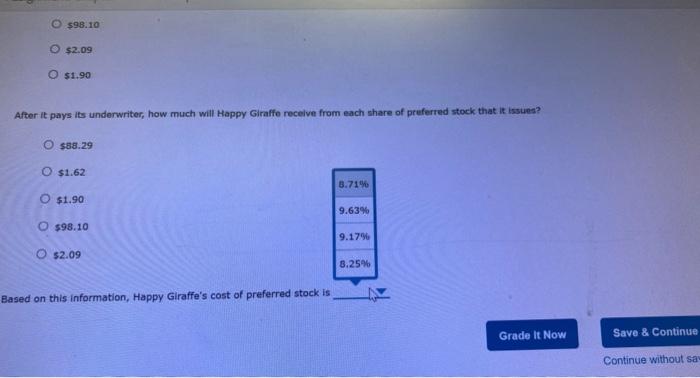

Happy Giraffe has preferred stock that payn a dividend of $9.00 par share and sells for $100 per share. It is considering issuing new shares of preferred stock. These new shares incur an underwriting (or flotation) cost of 1.90%. How much will Happy Giraffe pay to the underwriter on a per-share basis? $88.29 $98.10 $2.09 $1.90 After it pays its underwriter, how much will Happy Giraffe recelve from each share of preferred stock that it issues? $38.29 $1.62 $1.90 $98.10 $98.10 $2.09 $1.90 After it pays its underwriter, how much will Happy Giraffe recelve from each share of pruferred stock that it issues? $88.29 $1.62 $1.90 598.10 $2.09 \begin{tabular}{|l|} \hline 8.71% \\ \hline 9.63% \\ 9.17% \\ \hline 8.25% \\ \hline \end{tabular} Based on this information, Happy Giraffe's cost of preferred stock is Continue without sa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started