Please help to find ratio analysis and interpretation

Below is the formula that we studied:

| | Formula |

| 1)Current ratio | Current asset/ Current liabilities |

| 2)Acid test ratio | Cash + short-term investment+ account receivable(net) / Current liabilities |

| 3)Account receivable turnover | Net credit sales/ Average net account receivable |

| 4)Inventory turnover | Cost of goods sold/Average inventory |

| 5)Profit margin | Net income/Net sales |

| 6)Asset turnover | Net sales/Average total asset |

| 7)Return on asset | Net income/ Average total asset |

| 8)Return on common stockholders equity | Net income/Average common stockholder equity |

| 9)Earning per share | Net income Dividend/ Weighted -average common share outstanding |

| 10)Price earnings ratio | Market price per share of stock/ Earning per share |

| 11)Pay-out ratio | Cash dividend/Net income |

| 12)Debt to asset ratio | Total debt/ Total asset |

| 13)Times interest earned | Income before taxes and interest expense/Interest expense |

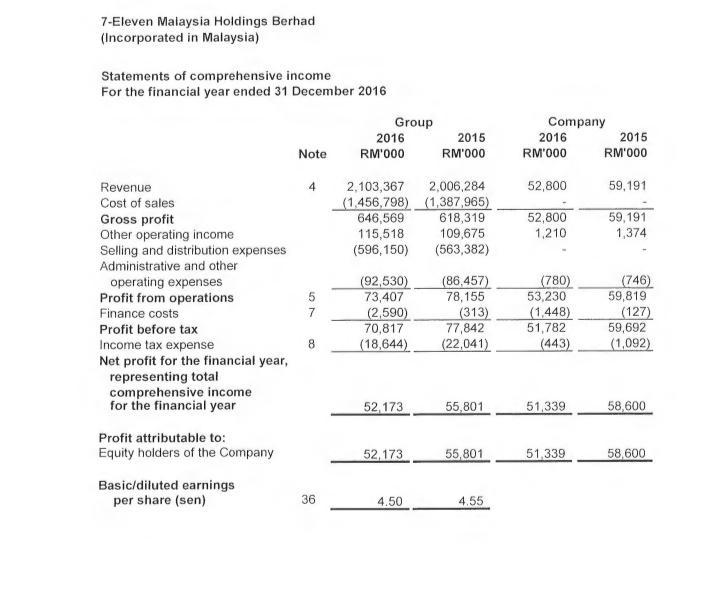

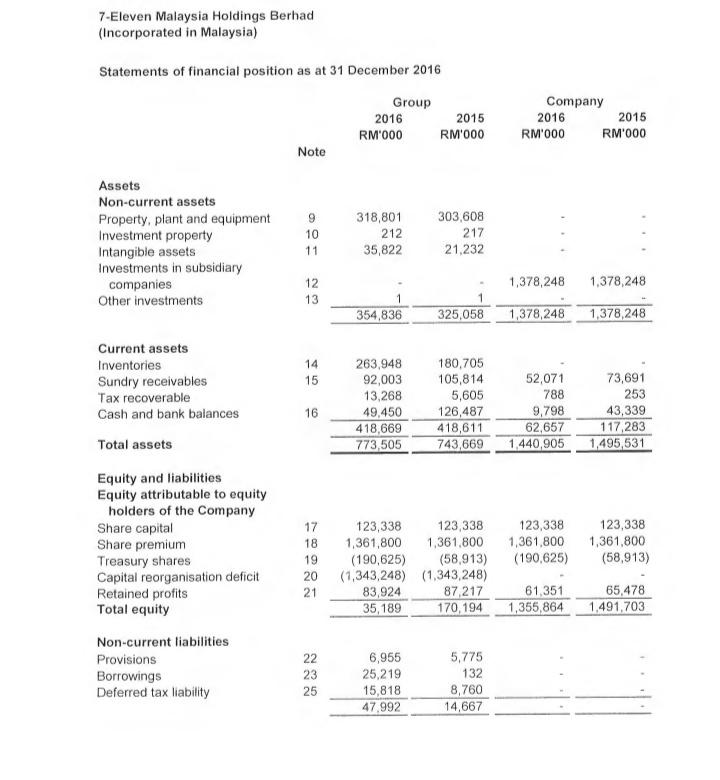

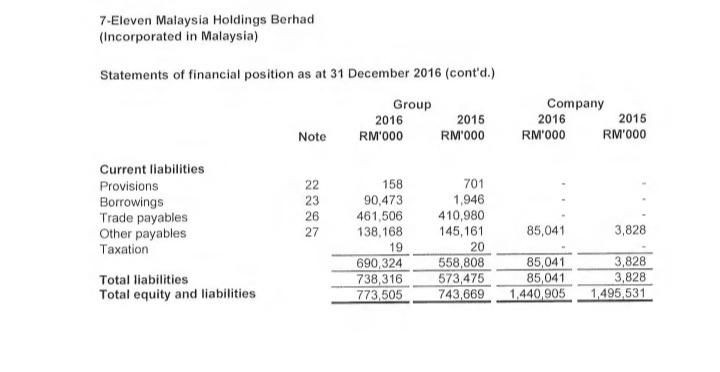

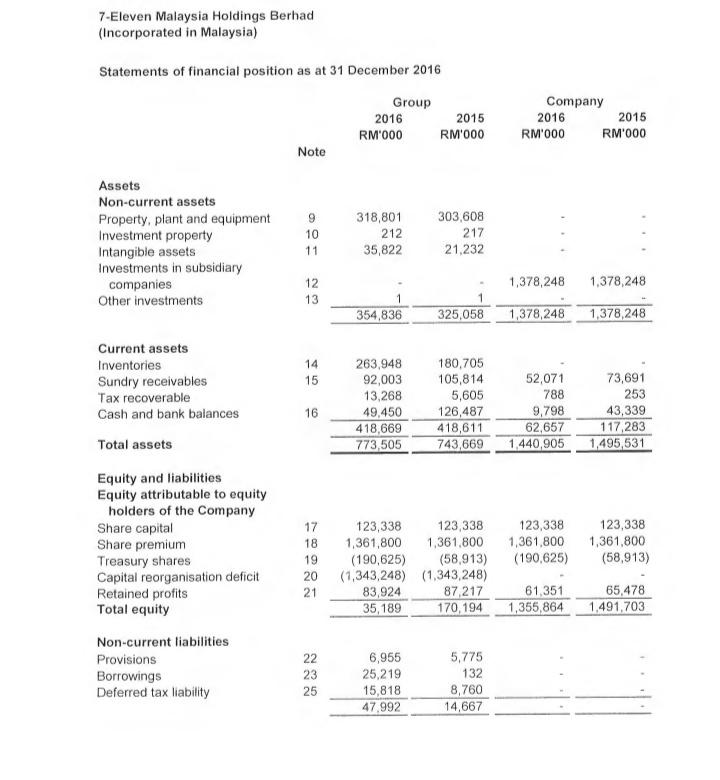

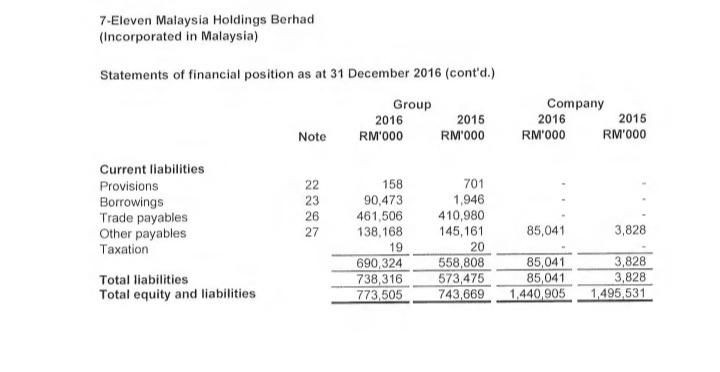

7-Eleven Malaysia Holdings Berhad (Incorporated in Malaysia) Statements of comprehensive income For the financial year ended 31 December 2016 Group 2016 RM'000 2015 RM1000 Company 2016 2015 RM'000 RM'000 Note 4 52,800 59,191 2,103,367 2,006,284 (1,456,798) (1,387,965) 646,569 618,319 115,518 109,675 (596,150) (563,382) 52,800 1.210 59,191 1,374 Revenue Cost of sales Gross profit Other operating income Selling and distribution expenses Administrative and other operating expenses Profit from operations Finance costs Profit before tax Income tax expense Net profit for the financial year, representing total comprehensive income for the financial year 5 7 (92,530) 73,407 (2,590) 70,817 (18,644) (86,457) 78,155 (313) 77,842 (22,041) (780) 53,230 (1,448) 51,782 (443) (746) 59,819 (127) 59,692 (1,092) 8 52 173 55,801 51,339 58,600 Profit attributable to: Equity holders of the Company 52,173 55,801 51 339 58,600 Basic/diluted earnings per share (sen) 36 4.50 4.55 7-Eleven Malaysia Holdings Berhad (Incorporated in Malaysia) Statements of financial position as at 31 December 2016 Group 2016 RM'000 2015 RM'000 Company 2016 2015 RM'OOO RM'000 Note Assets Non-current assets Property, plant and equipment Investment property Intangible assets Investments in subsidiary companies Other investments 9 10 11 318,801 212 35,822 303,608 217 21.232 1,378,248 1,378,248 12 13 1 325,058 354,836 1,378,248 1,378,248 14 15 Current assets Inventories Sundry receivables Tax recoverable Cash and bank balances Total assets 263,948 92,003 13,268 49,450 418,669 773,505 180,705 105,814 5,605 126,487 418,611 743,669 16 52,071 788 9,798 62,657 1.440,905 73,691 253 43,339 117,283 1.495,531 Equity and liabilities Equity attributable to equity holders of the Company Share capital Share premium Treasury shares Capital reorganisation deficit Retained profits Total equity 17 18 19 20 21 123,338 1,361,800 (190,625) 123,338 1,361,800 (58,913) 123,338 123,338 1,361,800 1,361,800 (190,625) (58,913) (1,343,248) (1.343,248) 83,924 87,217 35,189 170,194 61,351 1,355,864 65,478 1.491.703 Non-current liabilities Provisions Borrowings Deferred tax liability 22 23 25 6,955 25,219 15,818 47,992 5,775 132 8,760 14,667 7-Eleven Malaysia Holdings Berhad (Incorporated in Malaysia) Statements of financial position as at 31 December 2016 (cont'd.) Group 2016 RM'000 2015 RM'000 Company 2016 2015 RM'000 RM'000 Note Current liabilities Provisions Borrowings Trade payables Other payables Taxation Total liabilities Total equity and liabilities 22 23 26 27 701 1,946 410,980 145,161 85,041 158 90,473 461,506 138,168 19 690,324 738,316 773,505 3,828 20 558,808 573,475 743,669 85,041 85,041 1.440.905 3,828 3,828 1,495,531