Please help to get 100% to this my assignment with out of 30points this is for our CHAPTER 9 TOPIC CONTAINS WITH 5 QUESTION. So 1 question per 1 photo out of 9photos.

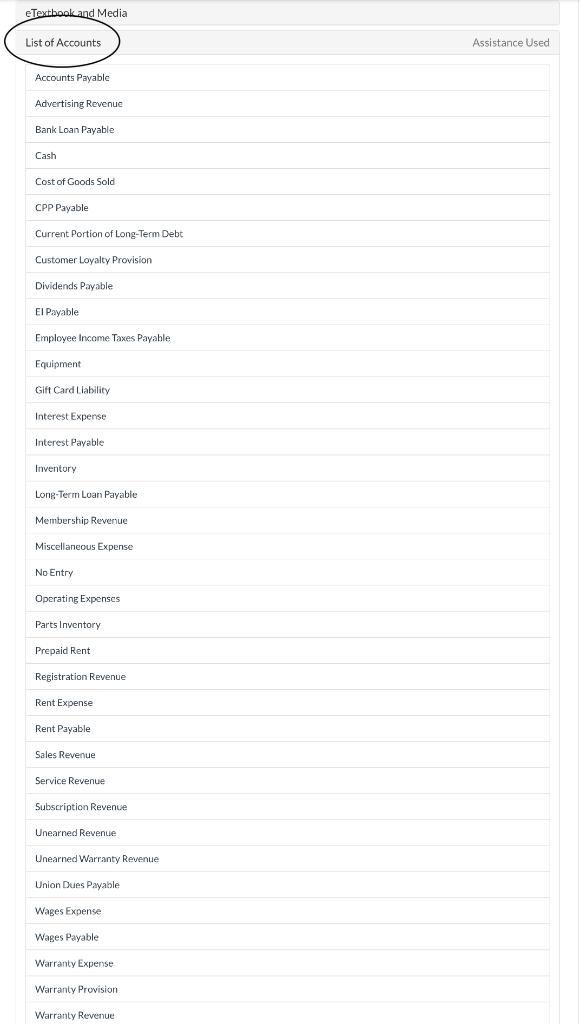

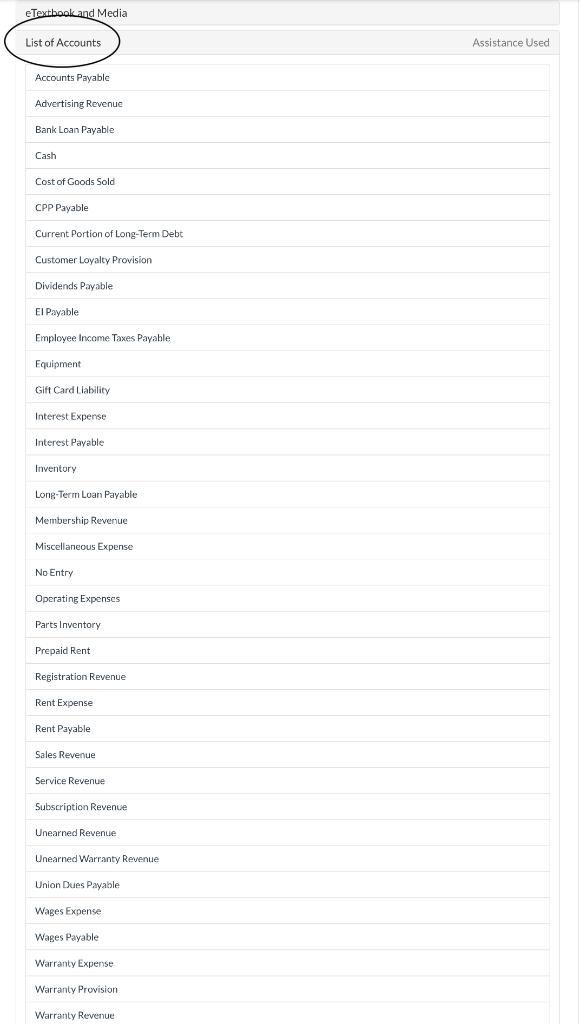

ATTENTION - This are the LIST OF ACCOUNT YOU ARE GOING TO USE FOR THE QUESTION 1 to 5

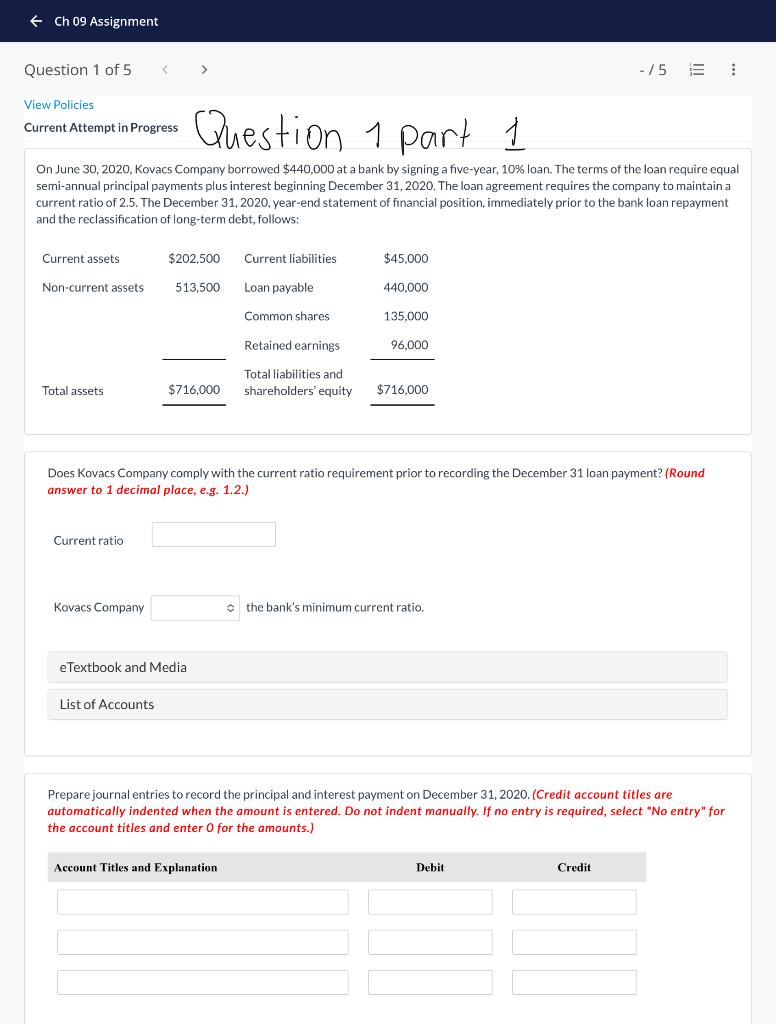

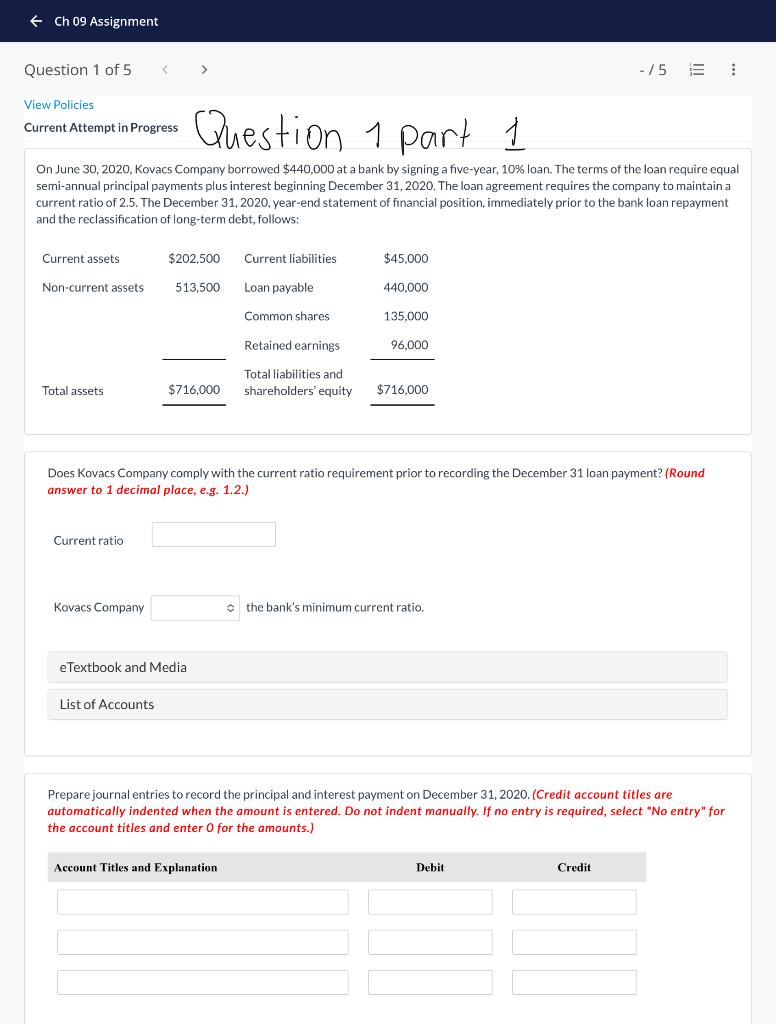

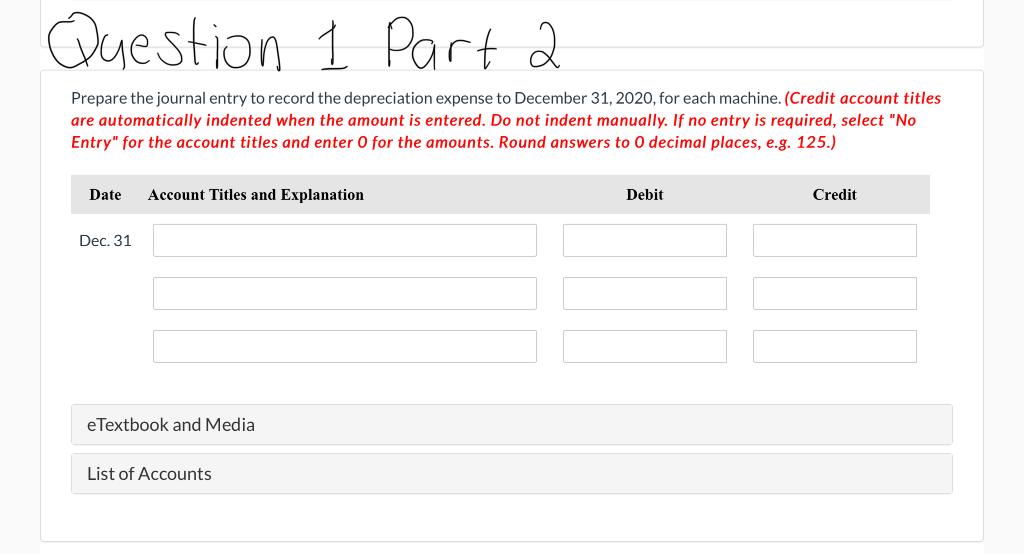

Question 1 - Part 1 and 2

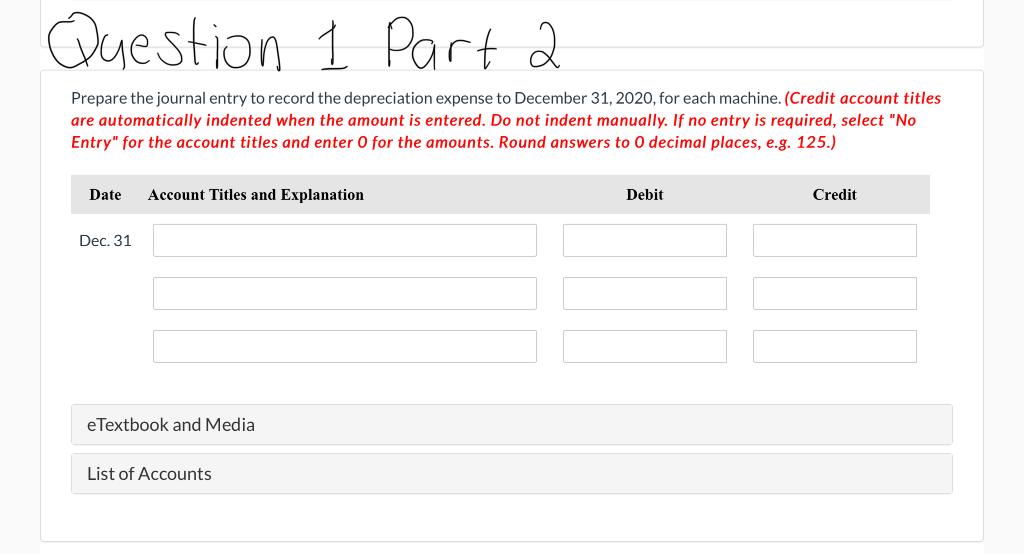

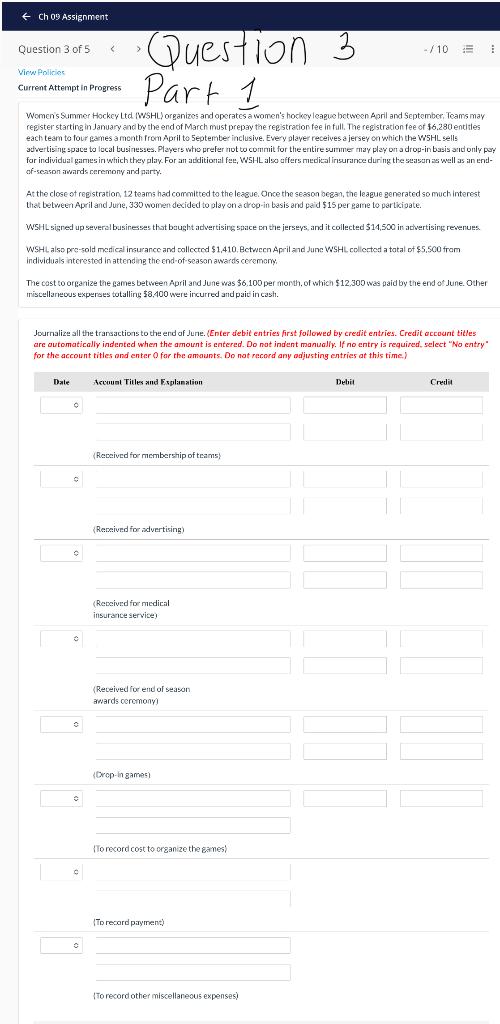

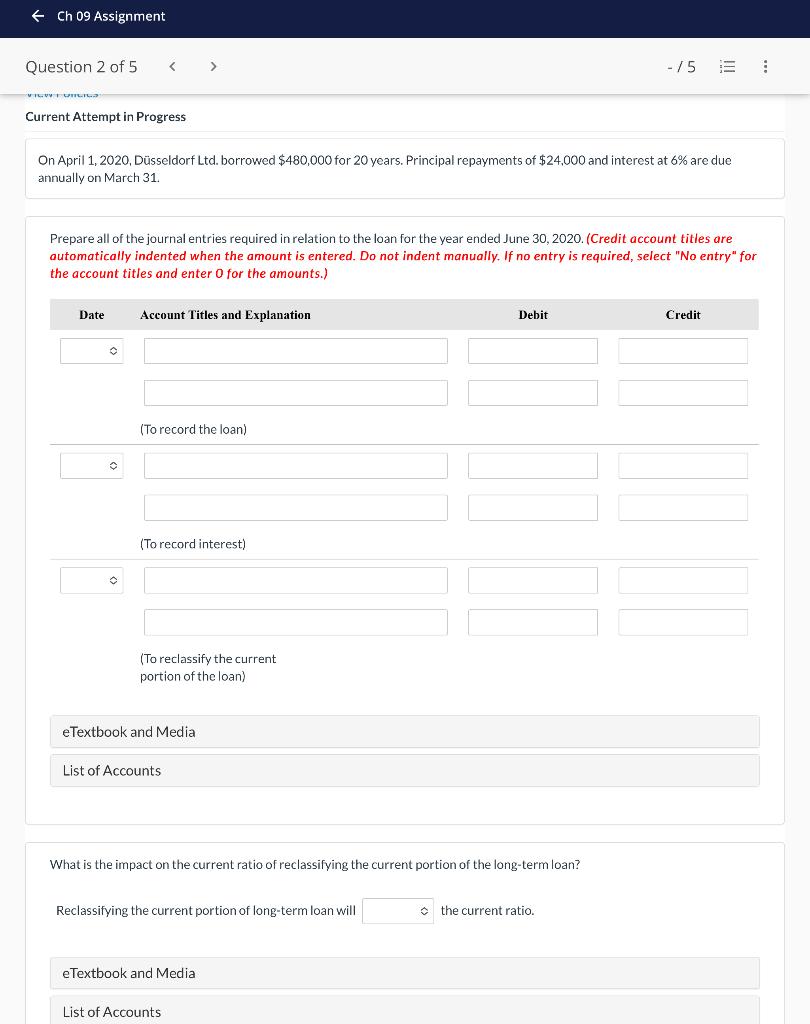

Question 2

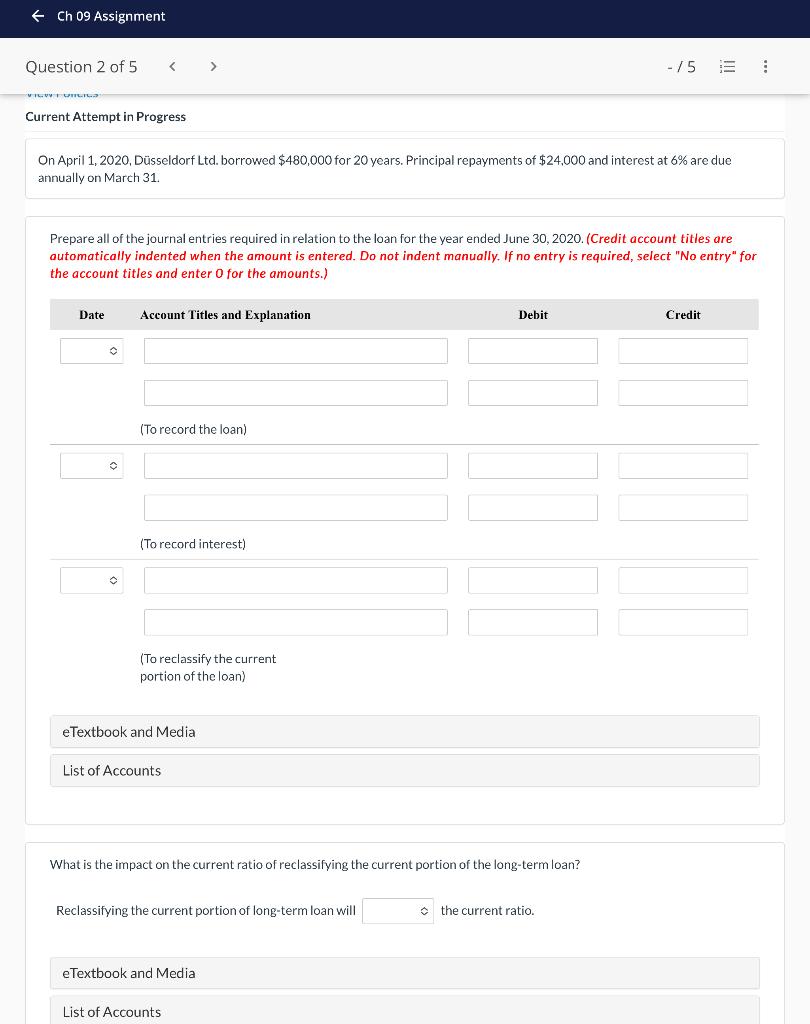

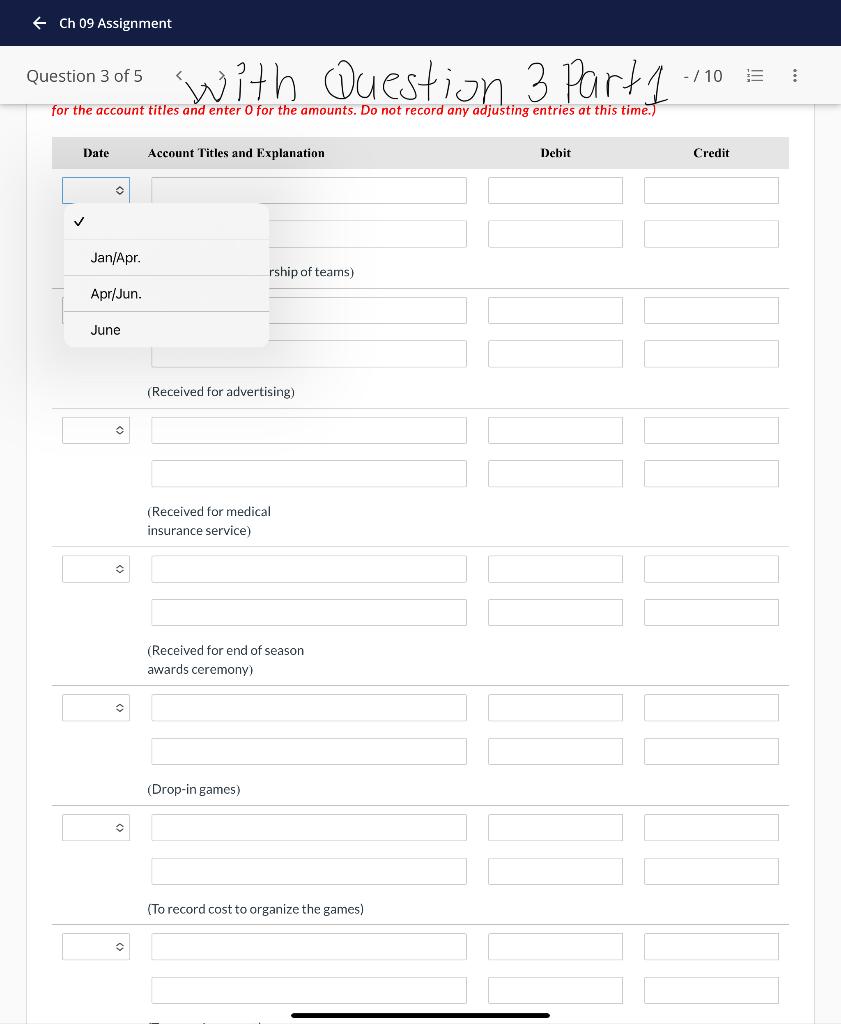

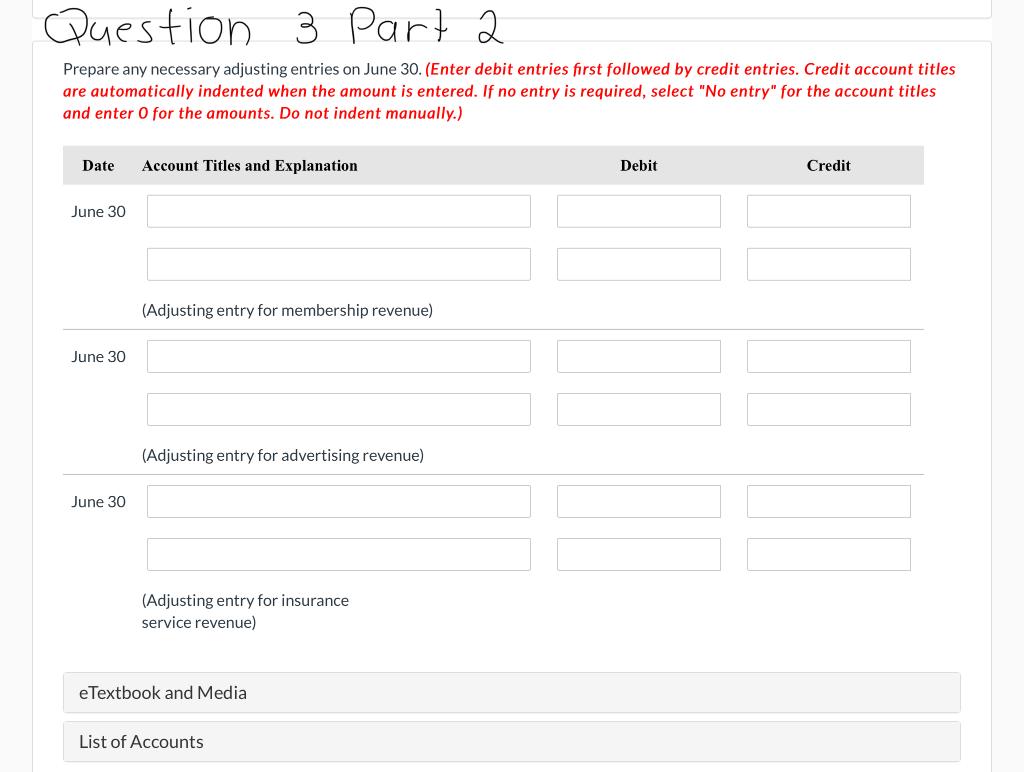

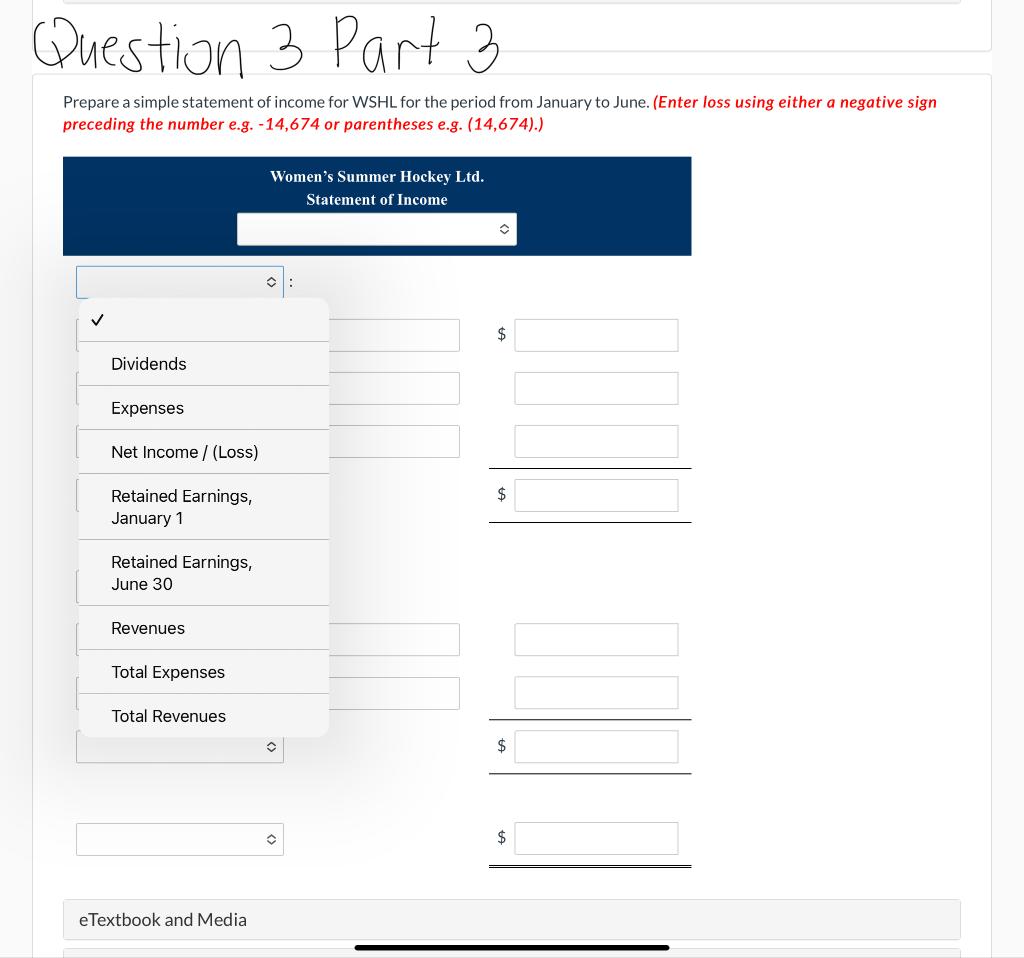

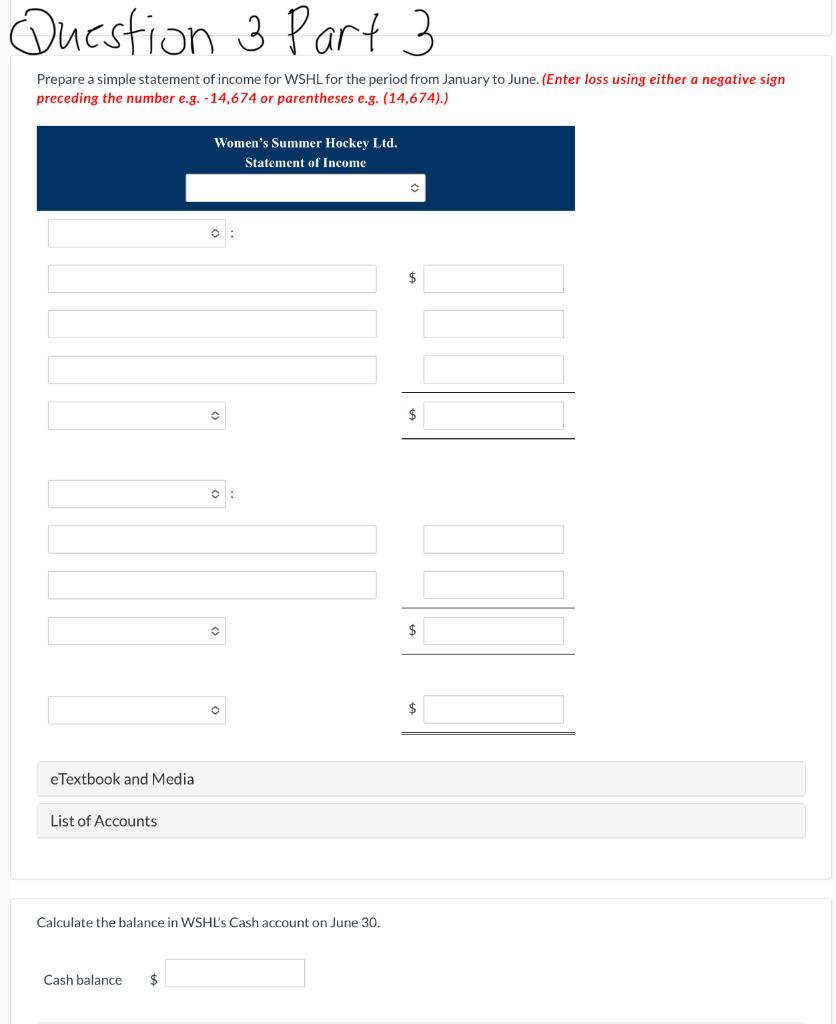

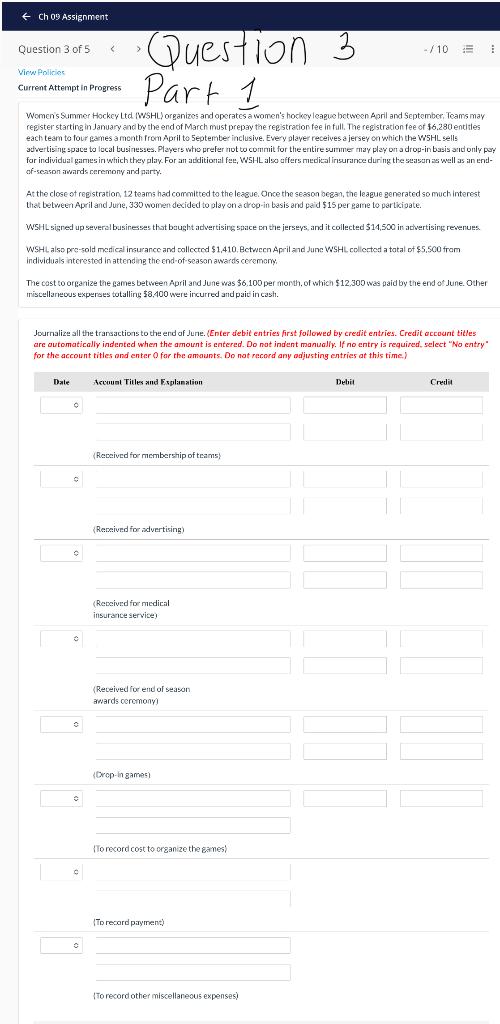

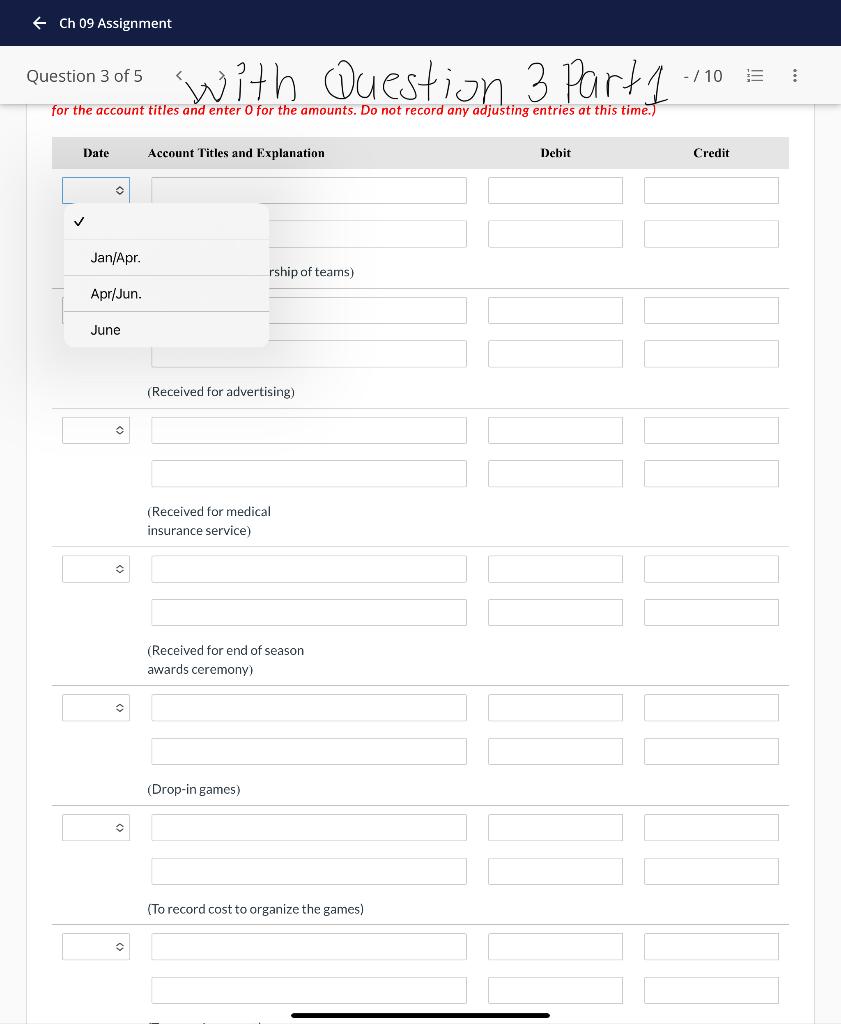

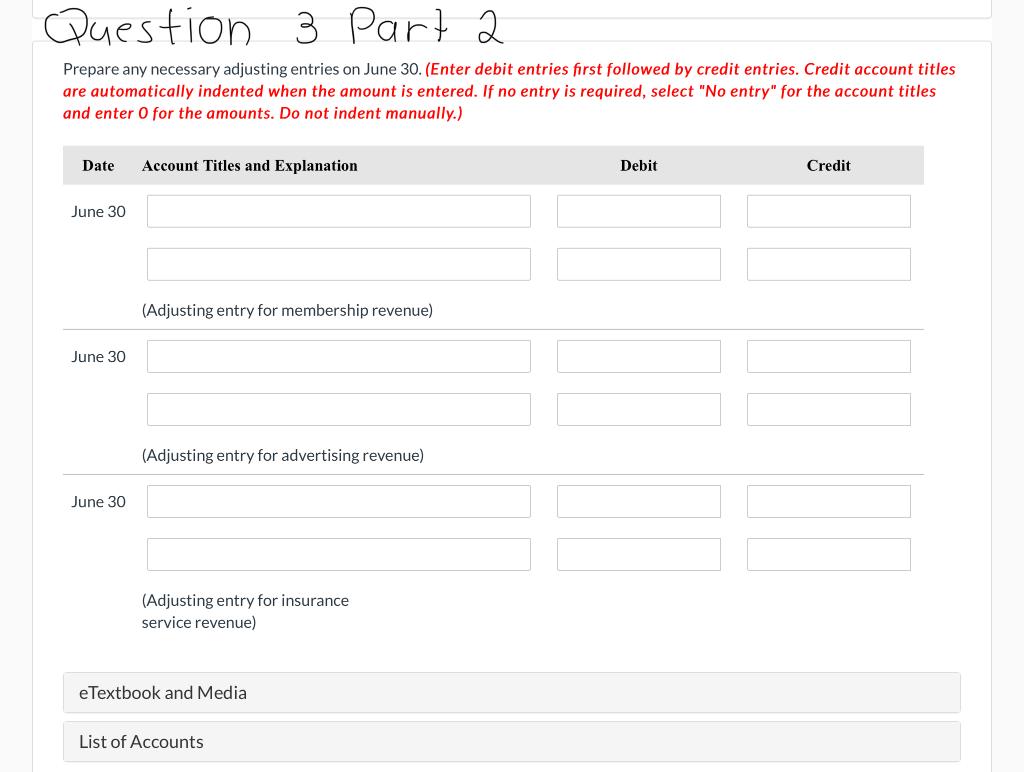

Question 3 - Part 1, 2 and 3

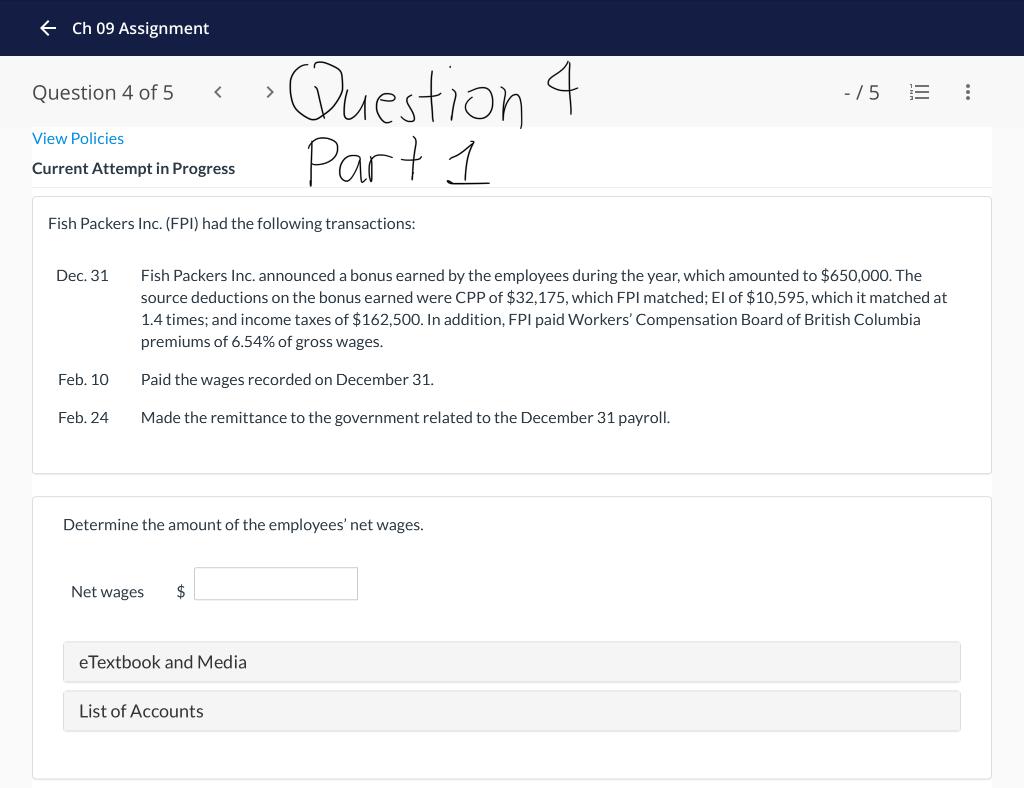

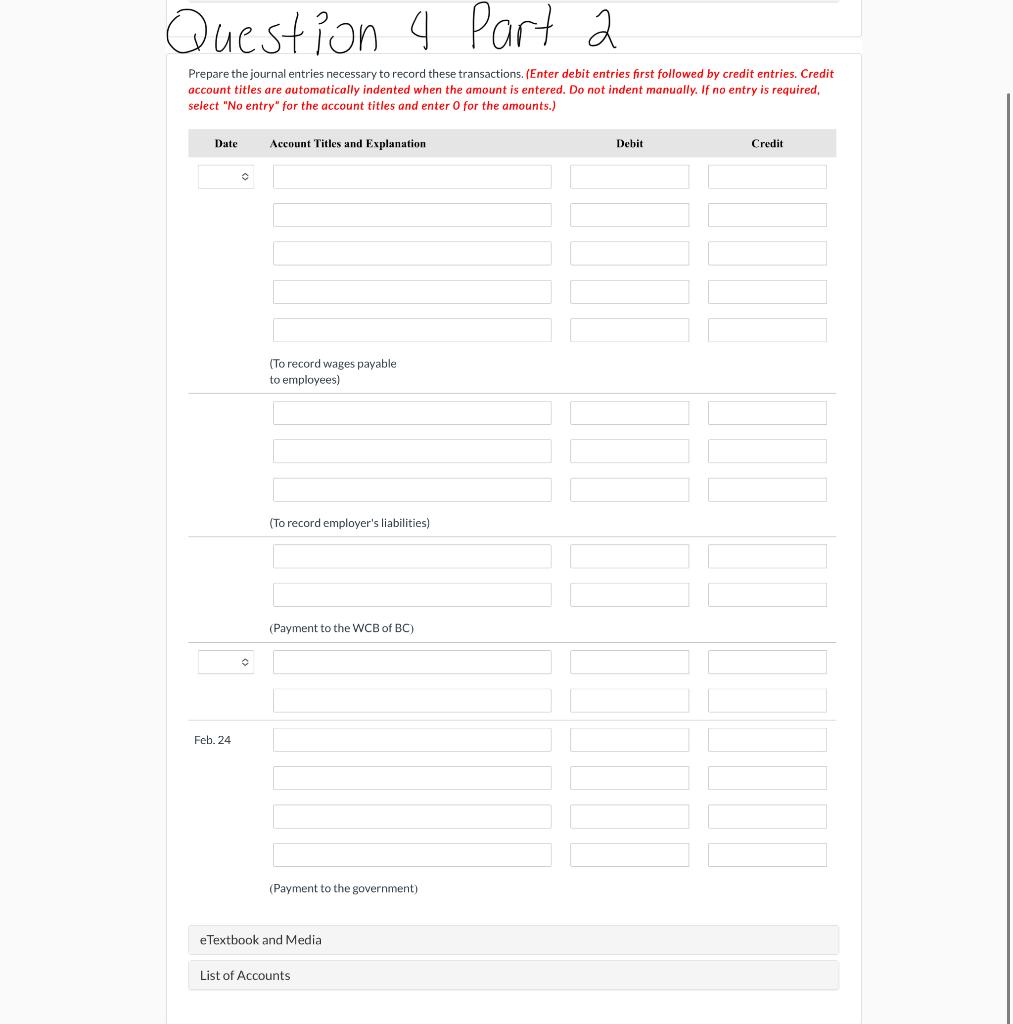

Question 4 - Part 1and2

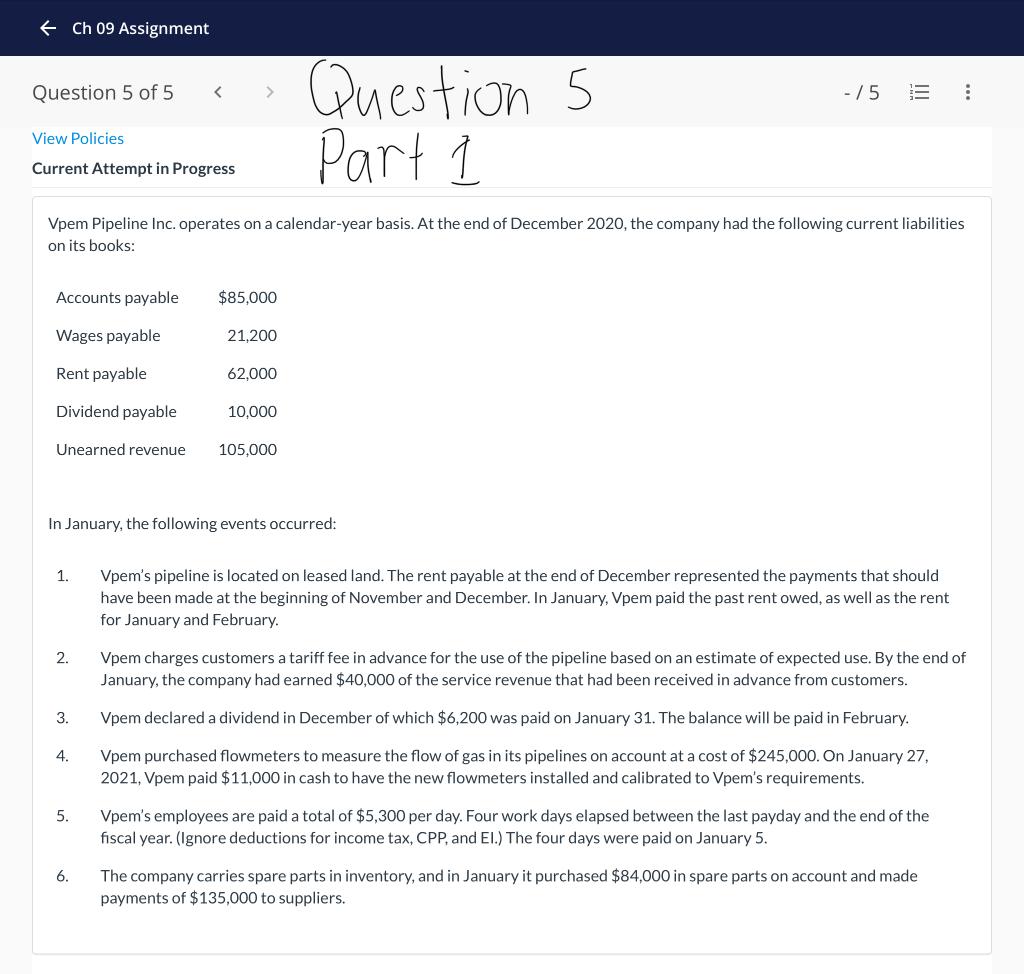

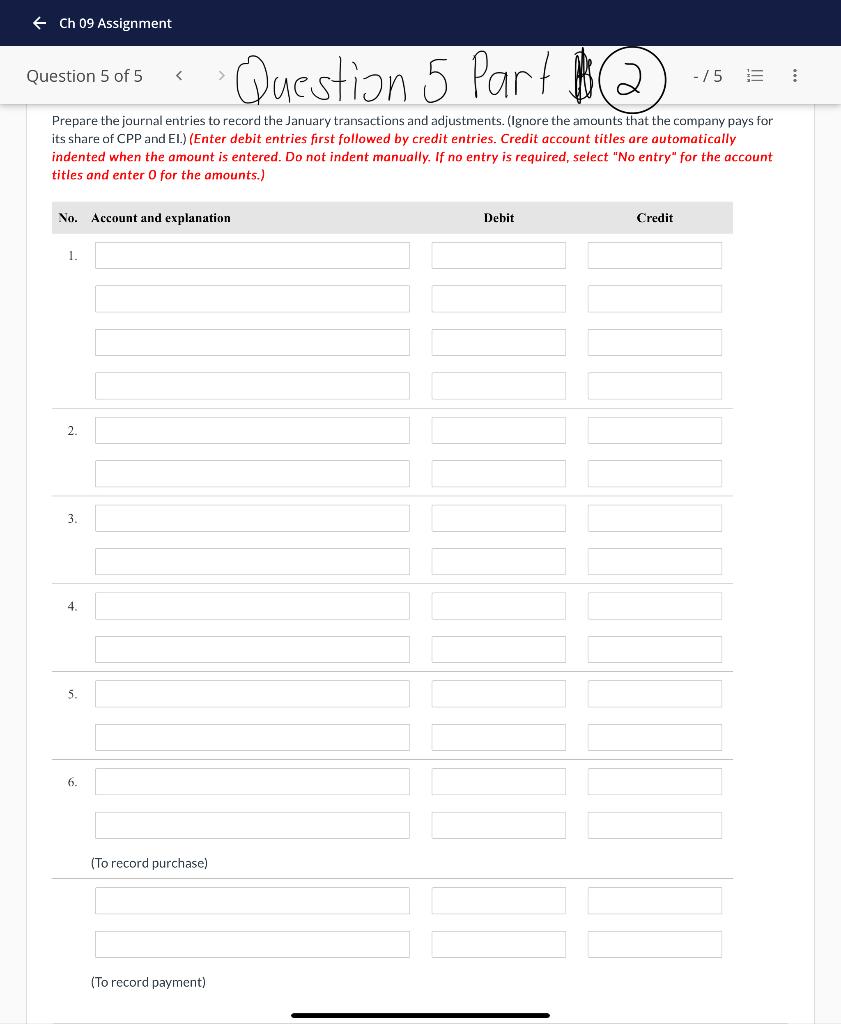

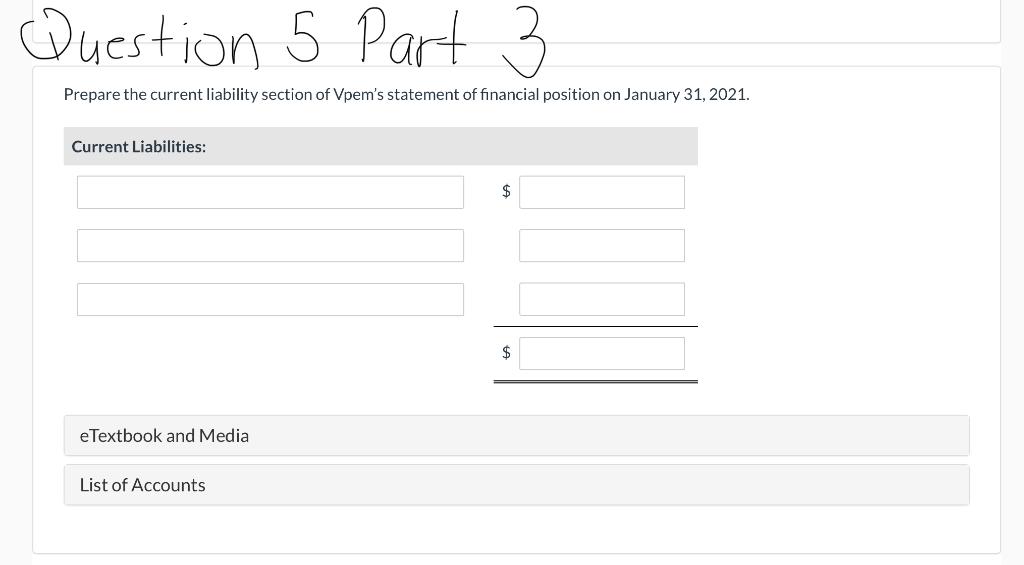

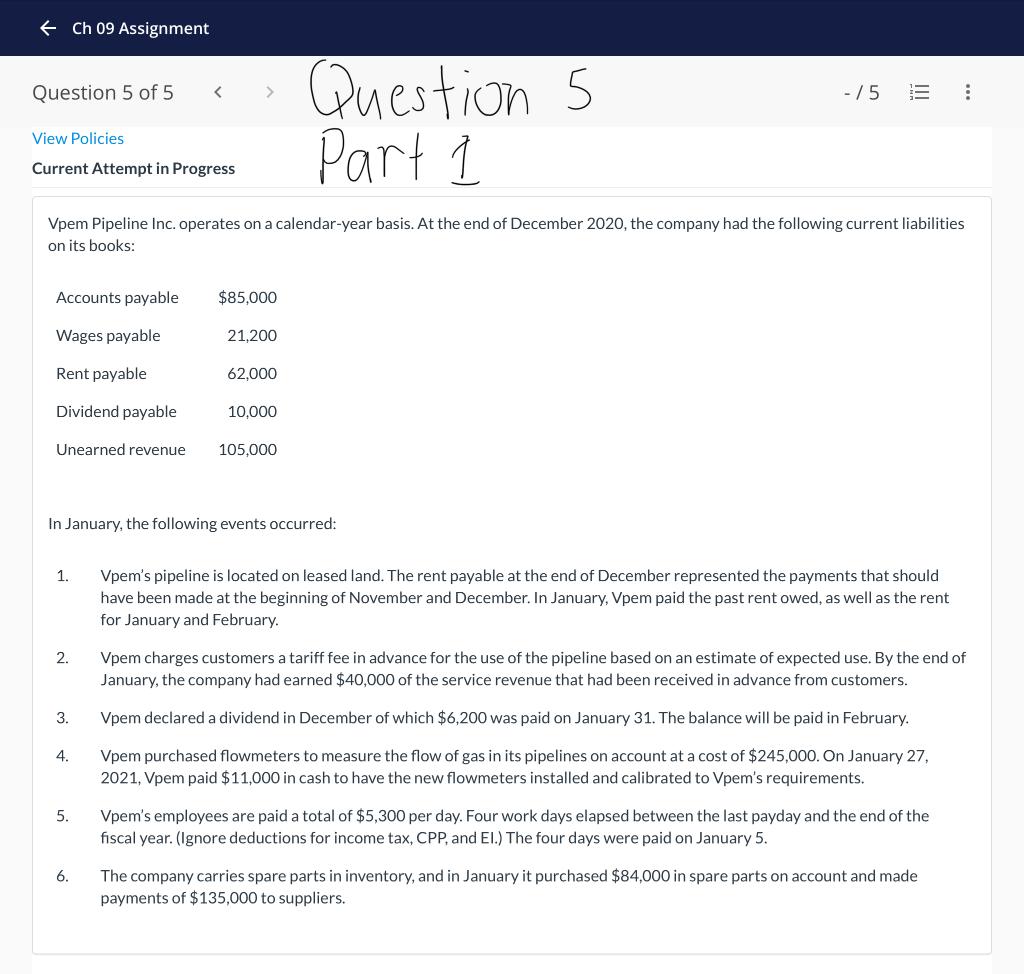

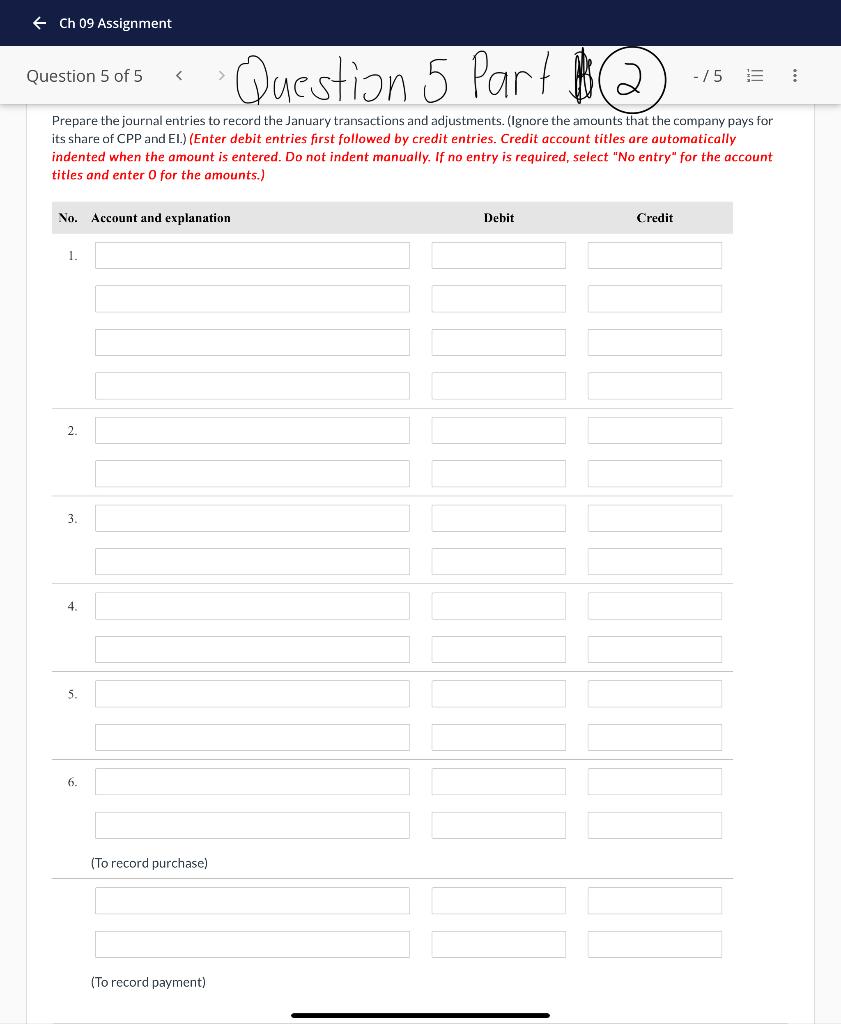

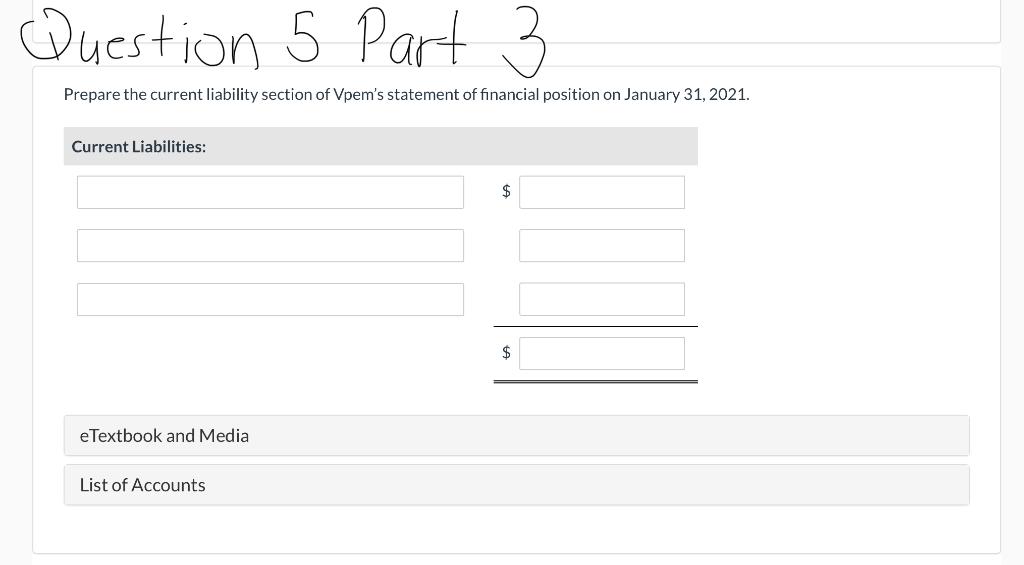

Question 5 - Part 1, 2 and 3

Question 5 - Part 1, 2 and 3

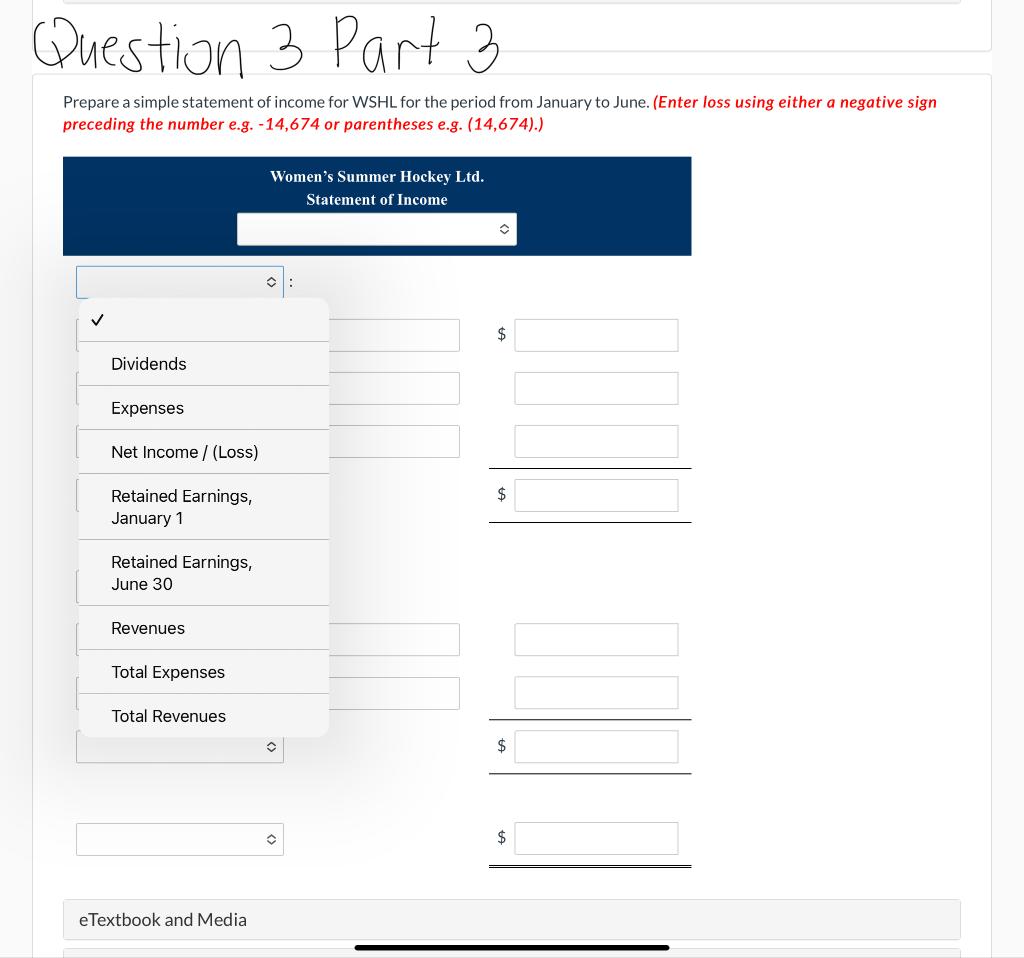

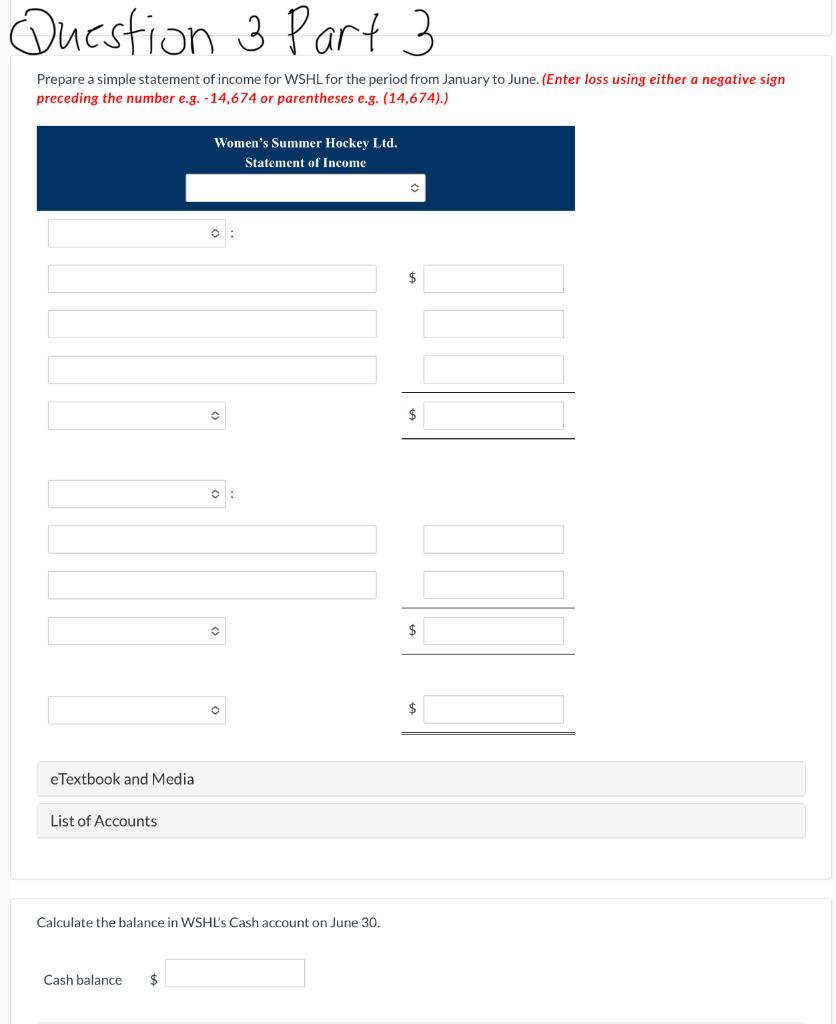

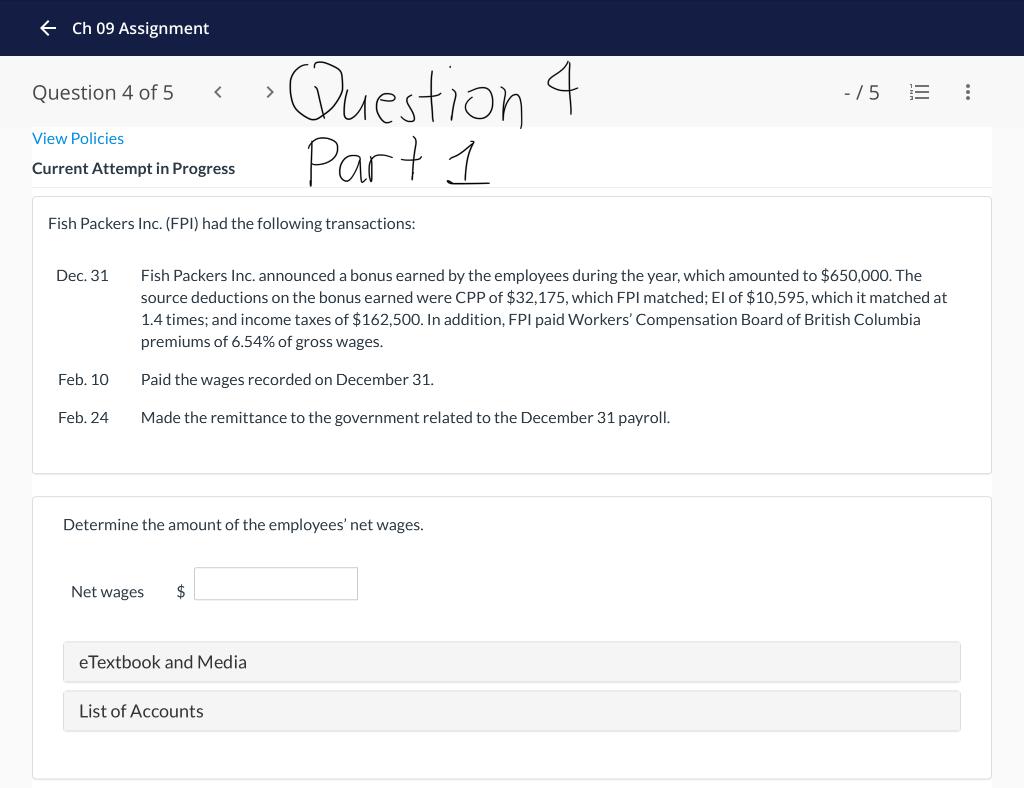

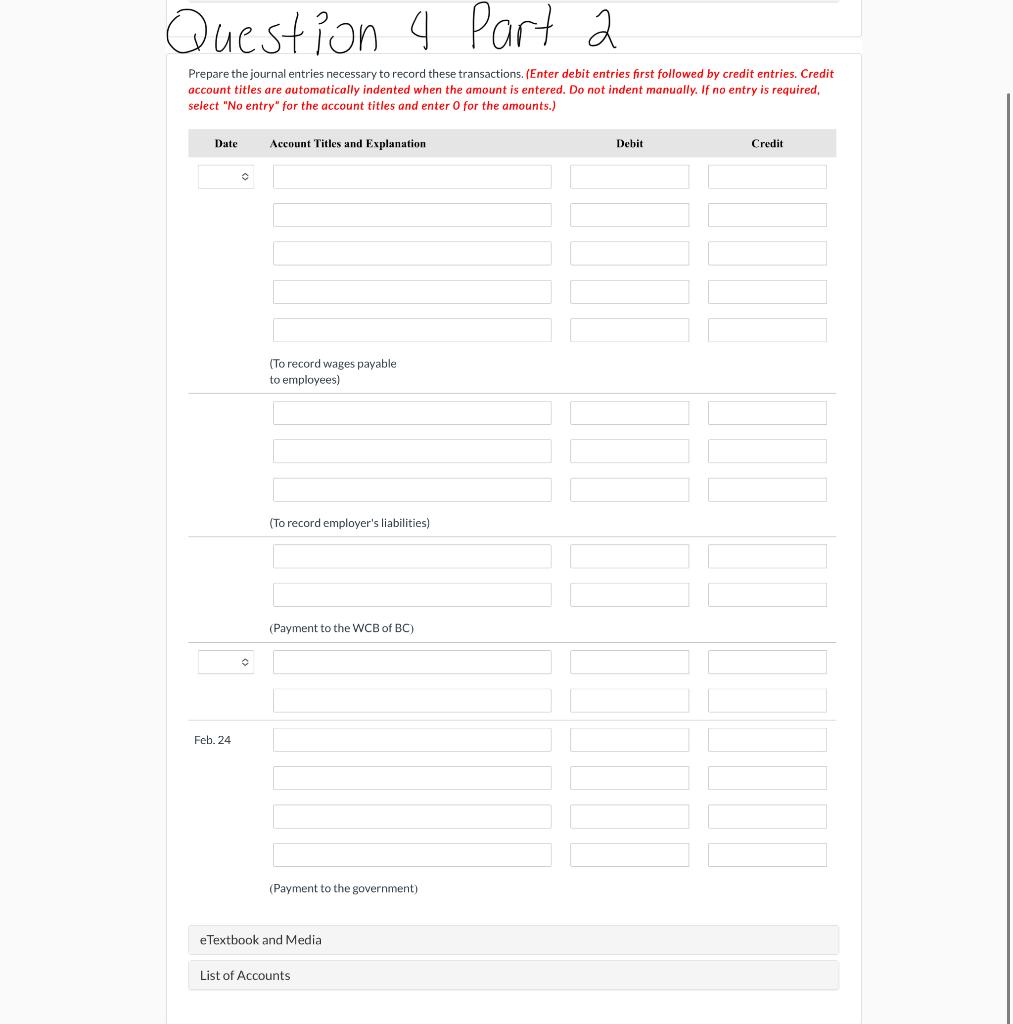

eTextbook and Media List of Accounts Accounts Payable Advertising Revenue Bank Loan Payable Cash Cost of Goods Sold CPP Payable Current Portion of Long-Term Debt Customer Loyalty Provision Dividends Payable El Payable Employee Income Taxes Payable. Equipment Gift Card Liability Interest Expense Interest Payable Inventory. Long-Term Loan Payable Membership Revenue Miscellaneous Expense No Entry Operating Expenses Parts Inventory Prepaid Rent Registration Revenue Rent Expense Rent Payable Sales Revenue Service Revenue Subscription Revenue Unearned Revenue Unearned Warranty Revenue Union Dues Payable Wages Expense Wages Payable Warranty Expense Warranty Provision Warranty Revenue Assistance Used Ch 09 Assignment Question 1 of 5 -/5 E View Policies Current Attempt in Progress Question 1 part 1 On June 30, 2020, Kovacs Company borrowed $440,000 at a bank by signing a five-year, 10% loan. The terms of the loan require equal semi-annual principal payments plus interest beginning December 31, 2020. The loan agreement requires the company to maintain a current ratio of 2.5. The December 31, 2020, year-end statement of financial position, immediately prior to the bank loan repayment and the reclassification of long-term debt, follows: Current assets $202,500 Current liabilities $45.000 Non-current assets 513,500 Loan payable 440,000 Common shares 135,000 Retained earnings 96,000 Total liabilities and. Total assets $716,000 shareholders' equity $716,000 Does Kovacs Company comply with the current ratio requirement prior to recording the December 31 loan payment? (Round answer to 1 decimal place, e.g. 1.2.) Current ratio Kovacs Company the bank's minimum current ratio. eTextbook and Media List of Accounts Prepare journal entries to record the principal and interest payment on December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Question 1 Part 2 Prepare the journal entry to record the depreciation expense to December 31, 2020, for each machine. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 125.) Date Account Titles and Explanation Debit Credit Dec. 31 eTextbook and Media List of Accounts Ch 09 Assignment Question 2 of 5 Ch 09 Assignment Question 3 of 5 -/10 E I View Policies Question 3 Part 1 Current Attempt in Progress Women's Summer Hockey Ltd (WSHL) organizes and operates a women's hockey league between April and September, Teams may register starting in January and by the end of March must prepay the registration fee in full. The registration fee of $6.280 entitles each team to four games a month from April to September inclusive. Every player receives a jersey on which the WSHL sells advertising space to local businesses. Players who prefer not to commit for the entire summer may play on a drop-in basis and only pay for individual games in which they play. For an additional fee, WSHL also offers medical insurance during the season as well as an end- of-season awards ceremony and party. At the close of registration, 12 teams had committed to the league. Once the season began, the league generated so much interest that between April and June, 330 women decided to play on a drop-in basis and paid $15 per game to participate. WSHL signed up several businesses that bought advertising space on the jerseys, and it collected $14,500 in advertising revenues WSHL also pre-sold medical insurance and collected $1,410. Between April and June WSHL collected a total of $5,500 from individuals interested in attending the end-of-season awards ceremony. The cost to organize the games between April and June was $6.100 per month, of which $12,300 was paid by the end of June. Other miscellaneous expenses totalling $8,400 were incurred and paid in cash. Journalize all the transactions to the end of June. (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Do not record any adjusting entries at this time.) Date Account Titles and Explanation Debit Credit (Received for membership of teams) (Received for advertising) (Received for medical insurance service) (Received for end of season awards ceremony) (Drop-in games) To record cost to organize the games) (To record payment) (To record other miscellaneous expenses) 0 0 0 0 C C C Ch 09 Assignment Question 3 of 5 with Question 3 Party for the account titles and enter 0 for the amounts. Do not record any adjusting entries at this time.) Date Account Titles and Explanation Debit Jan/Apr. Apr/Jun. June rship of teams) (Received for advertising) (Received for medical insurance service) (Received for end of season awards ceremony) (Drop-in games) (To record cost to organize the games) - / 10 Credit E Question 3 Part 2 Prepare any necessary adjusting entries on June 30. (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Do not indent manually.) Date Account Titles and Explanation Debit Credit June 30 June 30 June 30 (Adjusting entry for membership revenue) (Adjusting entry for advertising revenue) (Adjusting entry for insurance service revenue) eTextbook and Media List of Accounts Question 3 Part 3 Prepare a simple statement of income for WSHL for the period from January to June. (Enter loss using either a negative sign preceding the number e.g. -14,674 or parentheses e.g. (14,674).) Women's Summer Hockey Ltd. Statement of Income Dividends Expenses Net Income / (Loss) Retained Earnings, January 1 Retained Earnings, June 30 Revenues Total Expenses Total Revenues eTextbook and Medial $ $ $ $ Question 3 Part 3 Prepare a simple statement of income for WSHL for the period from January to June. (Enter loss using either a negative sign preceding the number e.g. -14,674 or parentheses e.g. (14,674).) Women's Summer Hockey Ltd. Statement of Income O eTextbook and Media List of Accounts Calculate the balance in WSHL's Cash account on June 30. Cash balance $ O $ $ $ $ Ch 09 Assignment Question 4 of 5 -/5 Question 4 Part 1 Fish Packers Inc. announced a bonus earned by the employees during the year, which amounted to $650,000. The source deductions on the bonus earned were CPP of $32,175, which FPI matched; El of $10,595, which it matched at 1.4 times; and income taxes of $162,500. In addition, FPI paid Workers' Compensation Board of British Columbia premiums of 6.54% of gross wages. Paid the wages recorded on December 31. Made the remittance to the government related to the December 31 payroll. ||| ... Question 4 Part 2 Prepare the journal entries necessary to record these transactions. (Enter debit entries first followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit (To record wages payable to employees) (To record employer's liabilities) (Payment to the WCB of BC) (Payment to the government) Feb. 24 O eTextbook and Media List of Accounts Ch 09 Assignment Question 5 of 5 Ch 09 Assignment Question 5 of 5

Question 5 - Part 1, 2 and 3

Question 5 - Part 1, 2 and 3