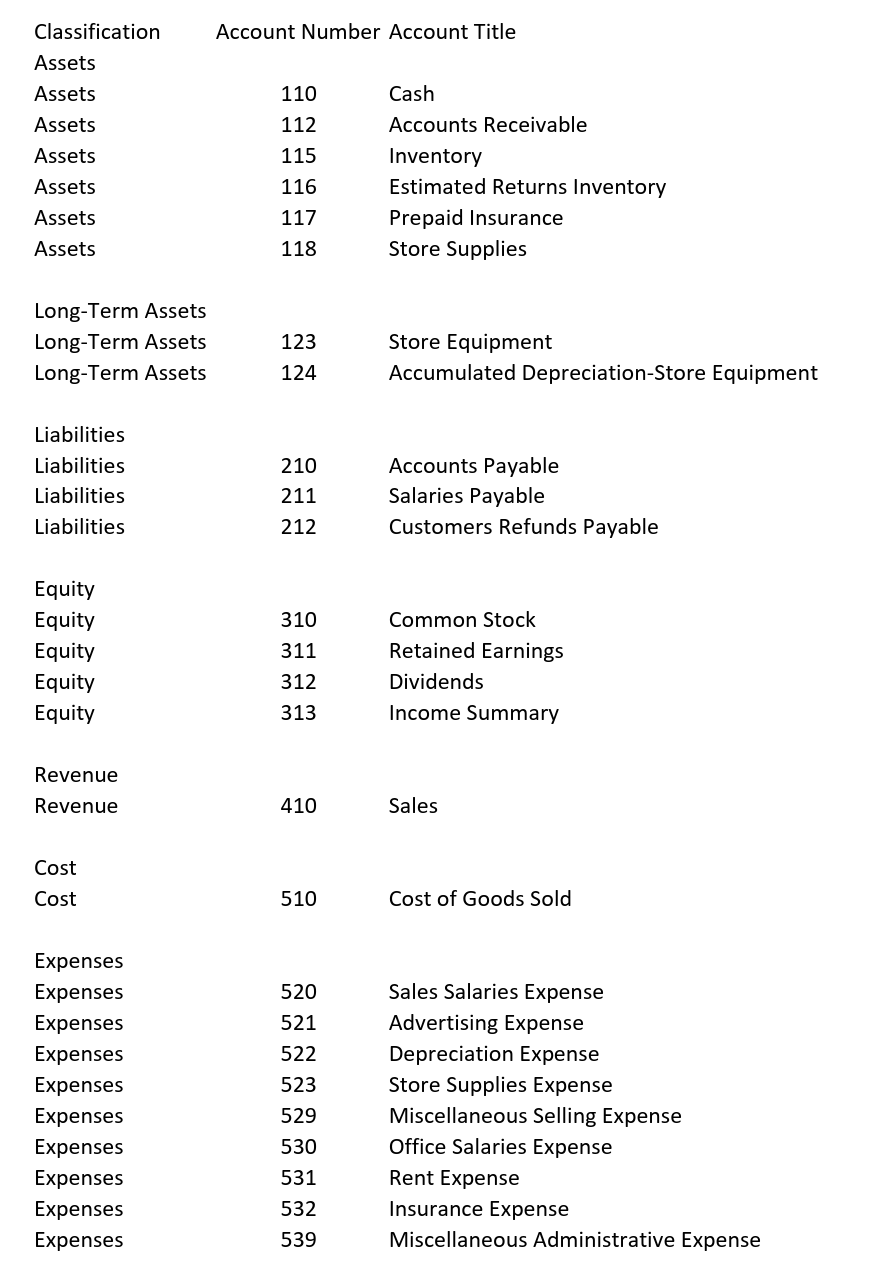

Please help to journalize each transaction below for an unadjusted trial balance as of may 31. Please use the chart of accounts below. thank you

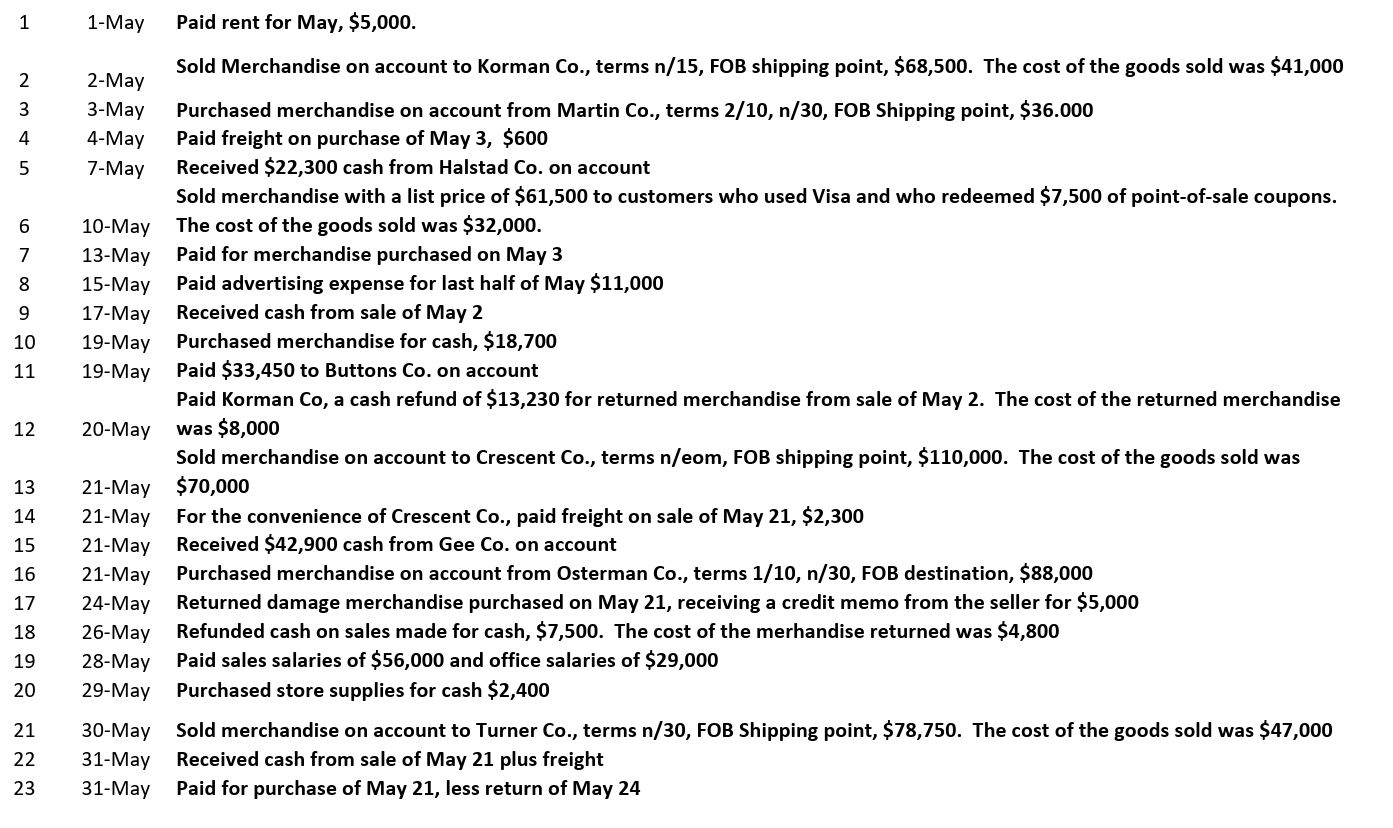

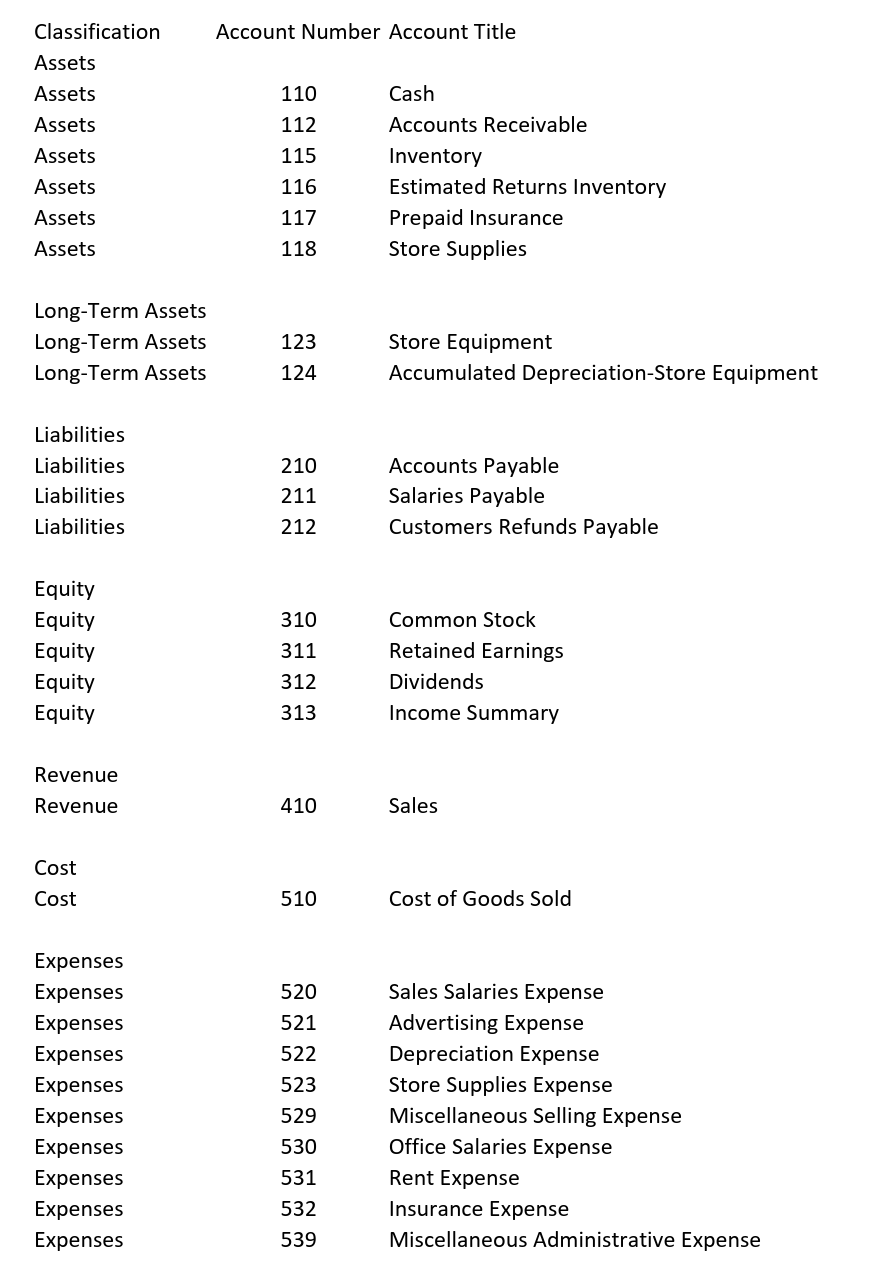

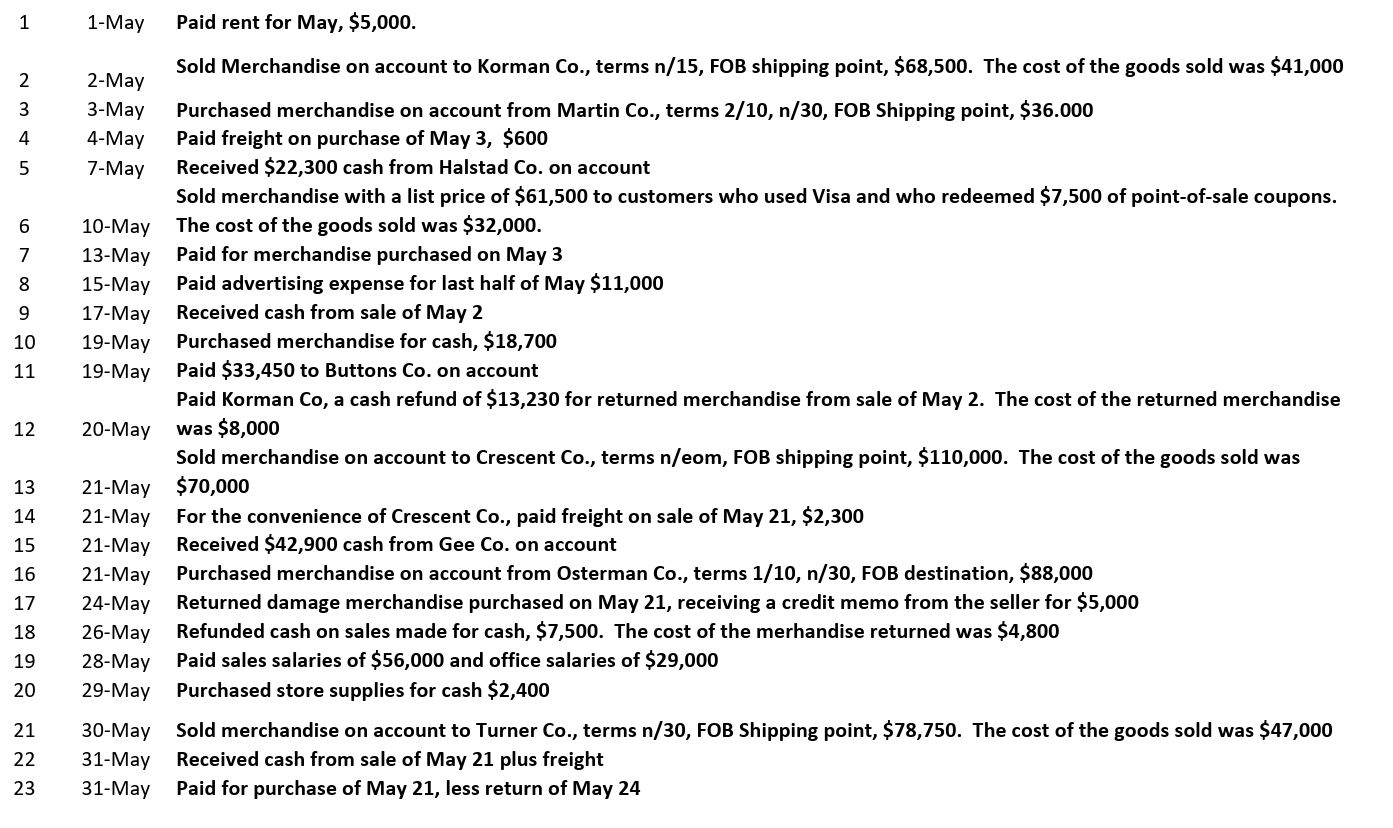

\begin{tabular}{|c|c|c|} \hline 1 & 1-May & Paid rent for May, $5,000. \\ \hline 2 & 2-May & Sold Merchandise on account to Korman Co., terms n/15, FOB shipping point, $68,500. The cost of the goods sold was $41,000 \\ \hline 3 & 3-May & Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB Shipping point, $36.000 \\ \hline 4 & 4-May & Paid freight on purchase of May 3, \$600 \\ \hline 5 & 7-May & Received \$22,300 cash from Halstad Co. on account \\ \hline & & Sold merchandise with a list price of $61,500 to customers who used Visa and who redeemed $7,500 of point-of-sale coupons. \\ \hline 6 & 10-May & The cost of the goods sold was $32,000. \\ \hline 7 & 13-May & Paid for merchandise purchased on May 3 \\ \hline 8 & 15-May & Paid advertising expense for last half of May $11,000 \\ \hline 9 & 17-May & Received cash from sale of May 2 \\ \hline 10 & 19-May & Purchased merchandise for cash, $18,700 \\ \hline 11 & 19-May & Paid $33,450 to Buttons Co. on account \\ \hline 12 & 20-May & \begin{tabular}{l} Paid Korman Co, a cash refund of $13,230 for returned merchandise from sale of May 2 . The cost of the returned merchandise \\ was $8,000 \end{tabular} \\ \hline 13 & 21-May & $70,000 \\ \hline 14 & 21-May & For the convenience of Crescent Co., paid freight on sale of May 21,$2,300 \\ \hline 15 & 21-May & Received $42,900 cash from Gee Co. on account \\ \hline 16 & 21-May & Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, $88,000 \\ \hline 17 & 24-May & Returned damage merchandise purchased on May 21, receiving a credit memo from the seller for $5,000 \\ \hline 18 & 26-May & Refunded cash on sales made for cash, $7,500. The cost of the merhandise returned was $4,800 \\ \hline 19 & 28-May & Paid sales salaries of $56,000 and office salaries of $29,000 \\ \hline 20 & 29-May & Purchased store supplies for cash $2,400 \\ \hline 21 & 30-May & Sold merchandise on account to Turner Co., terms n/30, FOB Shipping point, $78,750. The cost of the goods sold was $47,000 \\ \hline 22 & 31-May & Received cash from sale of May 21 plus freight \\ \hline 23 & 31-May & Paid for purchase of May 21, less return of May 24 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Classification & Account Number & Account Title \\ \hline Assets & & \\ \hline Assets & 110 & Cash \\ \hline Assets & 112 & Accounts Receivable \\ \hline Assets & 115 & Inventory \\ \hline Assets & 116 & Estimated Returns Inventory \\ \hline Assets & 117 & Prepaid Insurance \\ \hline Assets & 118 & Store Supplies \\ \hline \multicolumn{3}{|l|}{ Long-Term Assets } \\ \hline Long-Term Assets & 123 & Store Equipment \\ \hline Long-Term Assets & 124 & Accumulated Depreciation-Store Equipment \\ \hline \multicolumn{3}{|l|}{ Liabilities } \\ \hline Liabilities & 210 & Accounts Payable \\ \hline Liabilities & 211 & Salaries Payable \\ \hline Liabilities & 212 & Customers Refunds Payable \\ \hline \multicolumn{3}{|l|}{ Equity } \\ \hline Equity & 310 & Common Stock \\ \hline Equity & 311 & Retained Earnings \\ \hline Equity & 312 & Dividends \\ \hline Equity & 313 & Income Summary \\ \hline \multicolumn{3}{|l|}{ Revenue } \\ \hline Revenue & 410 & Sales \\ \hline \multicolumn{3}{|l|}{ Cost } \\ \hline Cost & 510 & Cost of Goods Sold \\ \hline \multicolumn{3}{|l|}{ Expenses } \\ \hline Expenses & 520 & Sales Salaries Expense \\ \hline Expenses & 521 & Advertising Expense \\ \hline Expenses & 522 & Depreciation Expense \\ \hline Expenses & 523 & Store Supplies Expense \\ \hline Expenses & 529 & Miscellaneous Selling Expense \\ \hline Expenses & 530 & Office Salaries Expense \\ \hline Expenses & 531 & Rent Expense \\ \hline Expenses & 532 & Insurance Expense \\ \hline Expenses & 539 & Miscellaneous Administrative Expense \\ \hline \end{tabular}