Answered step by step

Verified Expert Solution

Question

1 Approved Answer

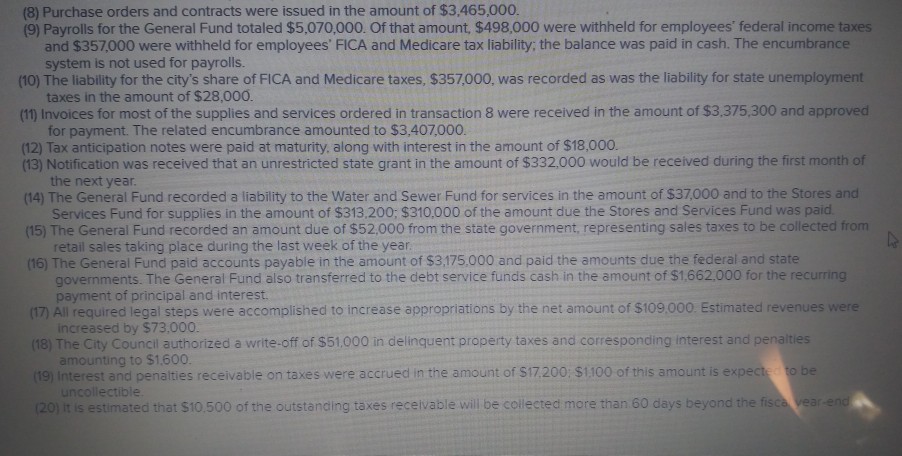

please, help to record transactions. thank you (8) Purchase orders and contracts were issued in the amount of $3,465,000 (9) Payrolls for the General Fund

please, help to record transactions. thank you

(8) Purchase orders and contracts were issued in the amount of $3,465,000 (9) Payrolls for the General Fund totaled $5,070,000. Of that amount, $498,000 were withheld for employees' federal income taxes and $357000 were withheld for employees' FICA and Medicare tax liability, the balance was paid in cash. The encumbrance (10) The liability for the city's share of FICA and Medicare taxes, $357,000, was recorded as was the liability for state unemployment (11) Invoices for most of the supplies and services ordered in transaction 8 were received in the amount of $3.375,300 and approved (12) Tax anticipation notes were paid at maturity, along with interest in the amount of $18,000 system is not used for payrolls. taxes in the amount of $28,000. for payment. The related encumbrance amounted to $3,407,000. (13) Notification was received that an unrestricted state grant in the amount of $332,000 would be received during the first month of the next year (14) The General Fund recorded a liability to the Water and Sewer Fund for services in the amount of $37,000 and to the Stores and (15) The General Fund recorded an amount due of $52,000 from the state government, representing sales taxes to be collected frorm (16) The General Fund paid accounts payable in the amount of $3,175,000 and paid the amounts due the federal and state Services Fund for supplies in the amount of $313,200; $310,000 of the amount due the Stores and Services Fund was paid retail sales taking place during the last week of the year governm ents. The General Fund also transferred to the debt service funds cash in the amount of $1,662,000 for the recurring (17) All required legal steps were accomplished to increase appropriations by the net amount of $109 000 Estimated revenues were (18) The City Council authorized a write-off of $51,000 in delinquent property taxes and corresponding interest and penalties (19) Interest and penalties receivable on taxes were accrued in the amount of $17.200: $1100 of this amount is exp payment of principal and interest increased by $73,000. amounting to $1,600 ectible estimated that $10.500 of the outstanding taxes receivable will be collected more than 60 days beyond the fisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started