Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help to slove these 3 questions and show your all working clearly. ( mangerial accounting) Q1) Lunar Pte Ltd (Lunar) is considering Project Aura,

Please help to slove these 3 questions and show your all working clearly. ( mangerial accounting)

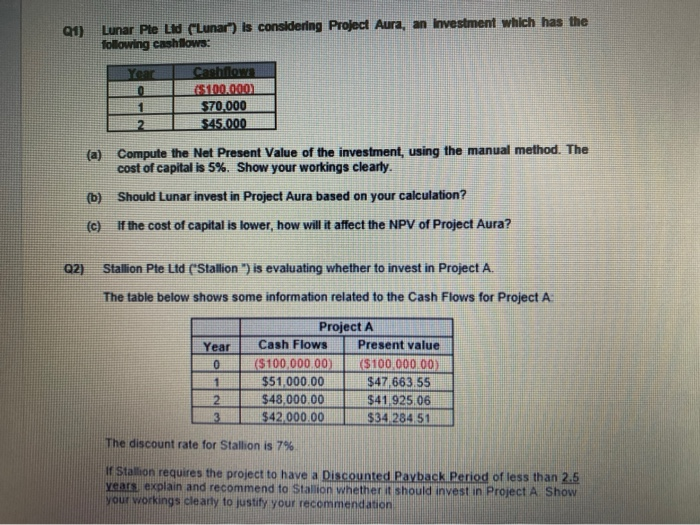

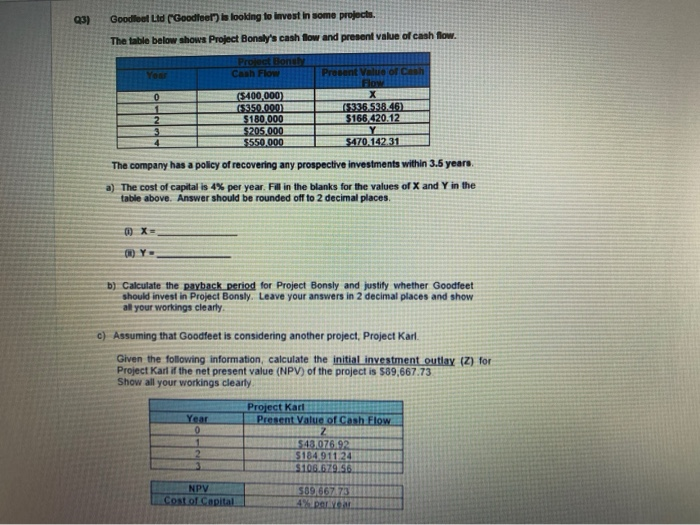

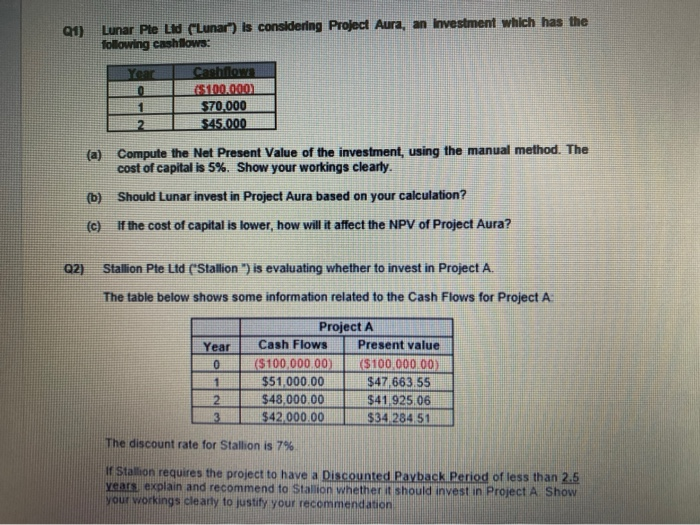

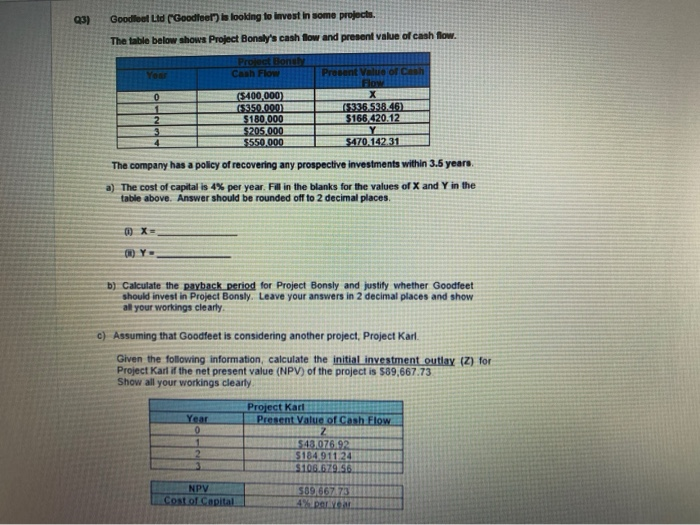

Q1) Lunar Pte Ltd (Lunar") is considering Project Aura, an Investment which has the following cashllows: Cashflows 15.100.000 $70,000 $45.000 (a) Compute the Net Present Value of the investment, using the manual method. The cost of capital is 5%. Show your workings clearly. (b) Should Lunar invest in Project Aura based on your calculation? (C) If the cost of capital is lower, how will it affect the NPV of Project Aura? Q2) Stallion Pte Ltd ("Stallion ") is evaluating whether to invest in Project A. The table below shows some information related to the Cash Flows for Project A Year 0 1 2 3 Project A Cash Flows Present value ($100.000,00) ($100.000.00) $51,000.00 $47 663.55 $48,000.00 $41 925.06 $42.000.00 $34 284 51 The discount rate for Stallion is 7% if Stallion requires the project to have a Discounted Payback period of less than 2.5 years explain and recommend to Stallion whether it should invest in Project A Show your workings clearly to justify your recommendation 03) Goodfeel Ltd ("Goodfeer is looking to invest in some projects. The table below shows Project Bonsly's cash flow and present value of cash flow. Project Bone Cash Flow Present Value of Cash 0 (5400,000 X ($350.000 19335.538.46) 2 $180,000 $166.420.12 3 $205.000 4 5550.000 $470.142 31 The company has a policy of recovering any prospective investments within 3.5 years a) The cost of capital is 4% per year. Fill in the blanks for the values of X and Y in the table above. Answer should be rounded off to 2 decimal places. b) Calculate the payback period for Project Bonsly and justify whether Goodfeet should invest in Project Bonsly. Leave your answers in 2 decimal places and show al your workings clearly c) Assuming that Goodfeet is considering another project, Project Karl. Given the following information, calculate the initial investment outlay (Z) for Project Karl if the net present value (NPV) of the project is $89,667.73 Show all your workings clearly Year 9 Project Kari Present Value of Cash Flow Z $43.076.92 5184 911 24 $106.679.56 1 2 NPV Costo Capital 56966773 4% DARYO

Q1) Lunar Pte Ltd (Lunar") is considering Project Aura, an Investment which has the following cashllows: Cashflows 15.100.000 $70,000 $45.000 (a) Compute the Net Present Value of the investment, using the manual method. The cost of capital is 5%. Show your workings clearly. (b) Should Lunar invest in Project Aura based on your calculation? (C) If the cost of capital is lower, how will it affect the NPV of Project Aura? Q2) Stallion Pte Ltd ("Stallion ") is evaluating whether to invest in Project A. The table below shows some information related to the Cash Flows for Project A Year 0 1 2 3 Project A Cash Flows Present value ($100.000,00) ($100.000.00) $51,000.00 $47 663.55 $48,000.00 $41 925.06 $42.000.00 $34 284 51 The discount rate for Stallion is 7% if Stallion requires the project to have a Discounted Payback period of less than 2.5 years explain and recommend to Stallion whether it should invest in Project A Show your workings clearly to justify your recommendation 03) Goodfeel Ltd ("Goodfeer is looking to invest in some projects. The table below shows Project Bonsly's cash flow and present value of cash flow. Project Bone Cash Flow Present Value of Cash 0 (5400,000 X ($350.000 19335.538.46) 2 $180,000 $166.420.12 3 $205.000 4 5550.000 $470.142 31 The company has a policy of recovering any prospective investments within 3.5 years a) The cost of capital is 4% per year. Fill in the blanks for the values of X and Y in the table above. Answer should be rounded off to 2 decimal places. b) Calculate the payback period for Project Bonsly and justify whether Goodfeet should invest in Project Bonsly. Leave your answers in 2 decimal places and show al your workings clearly c) Assuming that Goodfeet is considering another project, Project Karl. Given the following information, calculate the initial investment outlay (Z) for Project Karl if the net present value (NPV) of the project is $89,667.73 Show all your workings clearly Year 9 Project Kari Present Value of Cash Flow Z $43.076.92 5184 911 24 $106.679.56 1 2 NPV Costo Capital 56966773 4% DARYO

Please help to slove these 3 questions and show your all working clearly. ( mangerial accounting)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started