Answered step by step

Verified Expert Solution

Question

1 Approved Answer

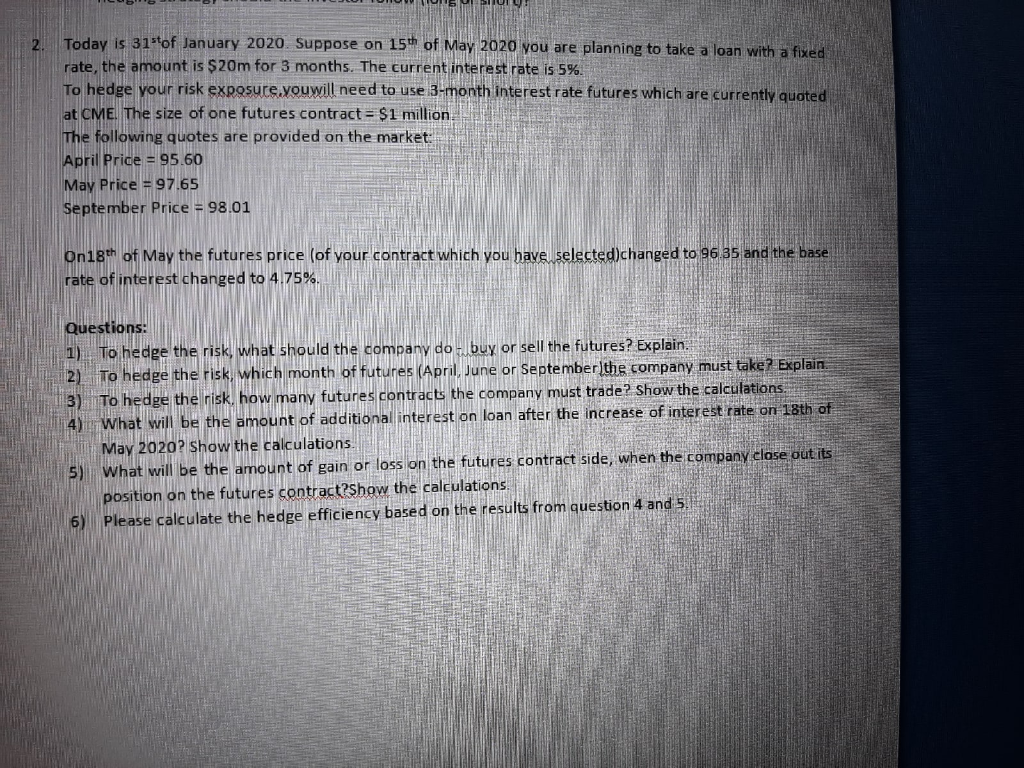

PLEASE HELP TO SOLVE THE SECOND PROBLEM. IT IS DERIVATIVE COURSES 55 COLONUSURULU Today is 31 of January 2020. Suppose on 15th of May 2020

PLEASE HELP TO SOLVE THE SECOND PROBLEM. IT IS DERIVATIVE COURSES

55 COLONUSURULU Today is 31 of January 2020. Suppose on 15th of May 2020 you are planning to take a loan with a fixed rate, the amount is $20m for 3 months. The current interest rate is 5%. To hedge your risk exposure youwill need to use 3-month interest rate futures which are currently quoted at CME. The size of one futures contract = $1 million The following quotes are provided on the market April Price = 95.60 May Price = 97.65 September Price = 98.01 Onigth of May the futures price (of your contract which you have selected changed to 96.35 and the base rate of interest changed to 4.75%. Questions: 1). To hedge the risk, what should the company do - buy or sell the futures? Explain. 2) To hedge the risk, which month of futures (April, June or September the company must take? Explain. 3) To hedge the risk, how many futures contracts the company must trade? Show the calculations. 4) What will be the amount of additional interest on loan after the increase of interest rate on 18th of May 2020? Show the calculations. 5) What will be the amount of gain or loss on the futures contract side, when the company close out its position on the futures contract?show the calculations Please calculate the hedge efficiency based on the results from question 4 and 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started