Please help to work out below question with full calculations and explanations:

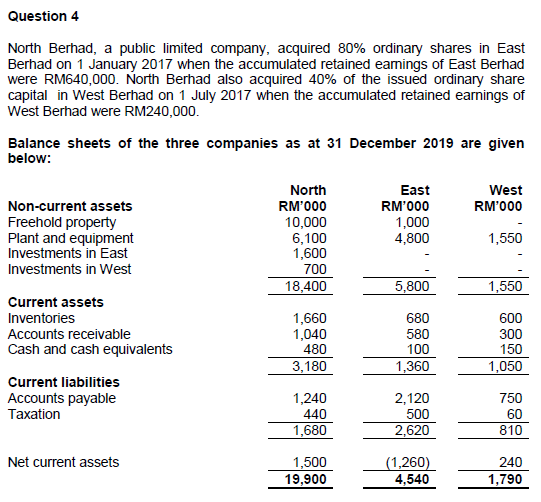

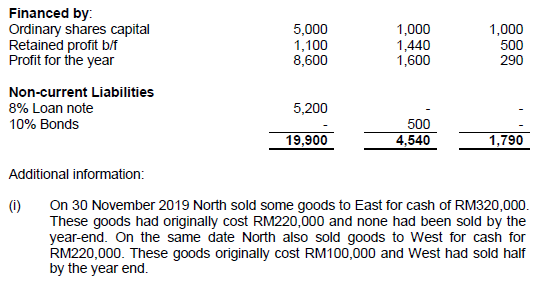

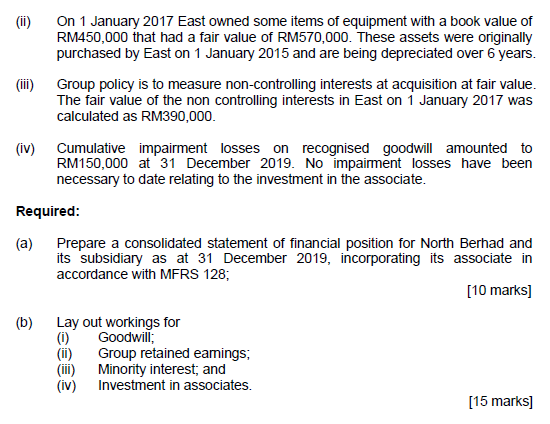

Question 4 North Berhad, a public limited company, acquired 80% ordinary shares in East Berhad on 1 January 2017 when the accumulated retained earnings of East Berhad were RM640,000. North Berhad also acquired 40% of the issued ordinary share capital in West Berhad on 1 July 2017 when the accumulated retained earnings of West Berhad were RM240,000. Balance sheets of the three companies as at 31 December 2019 are given below: North East West Non-current assets RM'000 RM'000 RM'000 Freehold property 10,000 1,000 Plant and equipment 6,100 4,800 1,550 Investments in East 1,600 Investments in West 700 18,400 5,800 1,550 Current assets Inventories 1,660 680 600 Accounts receivable 1,040 580 300 Cash and cash equivalents 480 100 150 3,180 1,360 1,050 Current liabilities Accounts payable 1,240 2,120 750 Taxation 440 500 60 1,680 2,620 810 Net current assets 1,500 (1,260) 240 19,900 4,540 1,790Financed by: Ordinary shares capital 5,000 1,000 1,000 Retained profit b/f 1,100 1.440 500 Profit for the year 8,600 1,600 290 Non-current Liabilities 8% Loan note 5,200 10% Bonds 500 19,900 4.540 1,790 Additional information: (i) On 30 November 2019 North sold some goods to East for cash of RM320,000. These goods had originally cost RM220,000 and none had been sold by the year-end. On the same date North also sold goods to West for cash for RM220,000. These goods originally cost RM100,000 and West had sold half by the year end.(ii) On 1 January 2017 East owned some items of equipment with a book value of RM450,000 that had a fair value of RM570,000. These assets were originally purchased by East on 1 January 2015 and are being depreciated over 6 years. (ii) Group policy is to measure non-controlling interests at acquisition at fair value. The fair value of the non controlling interests in East on 1 January 2017 was calculated as RM390,000. (iv) Cumulative impairment losses on recognised goodwill amounted to RM150,000 at 31 December 2019. No impairment losses have been necessary to date relating to the investment in the associate. Required: (a) Prepare a consolidated statement of financial position for North Berhad and its subsidiary as at 31 December 2019, incorporating its associate in accordance with MFRS 128; [10 marks] (b) Lay out workings for Goodwill; 133 Group retained eamings; Minority interest; and iv) Investment in associates. [15 marks]