please help tutors am stuck with the following economics

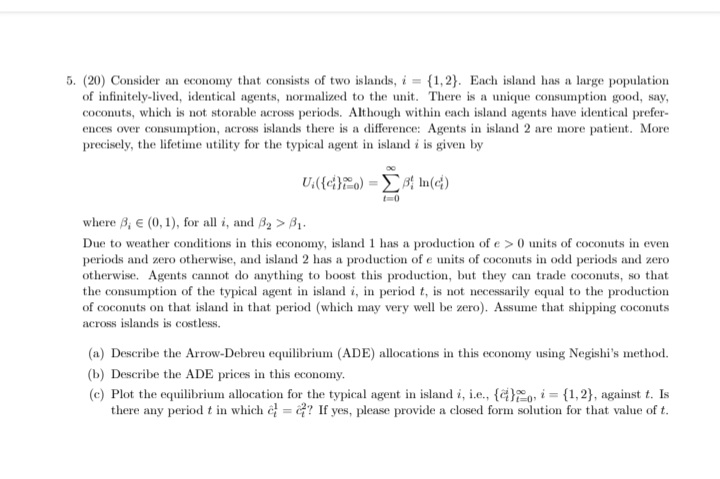

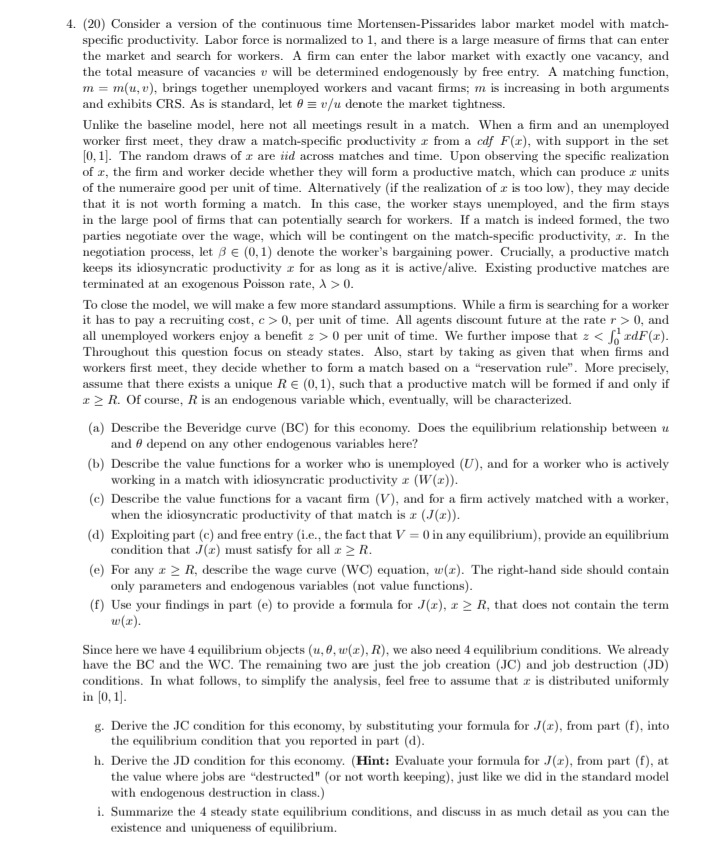

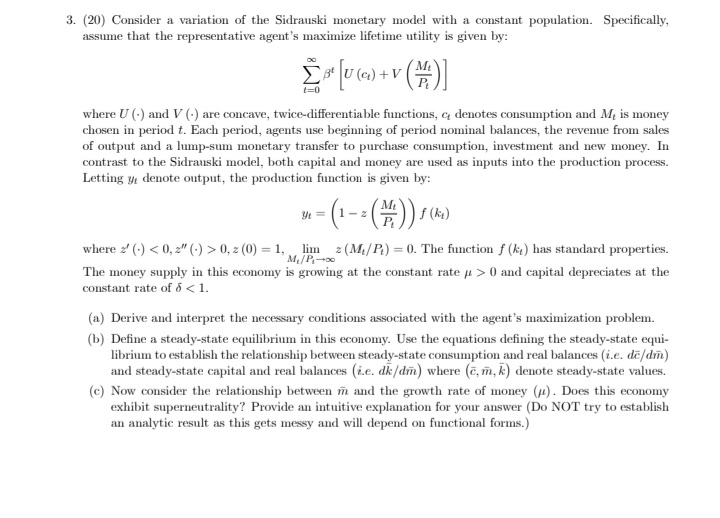

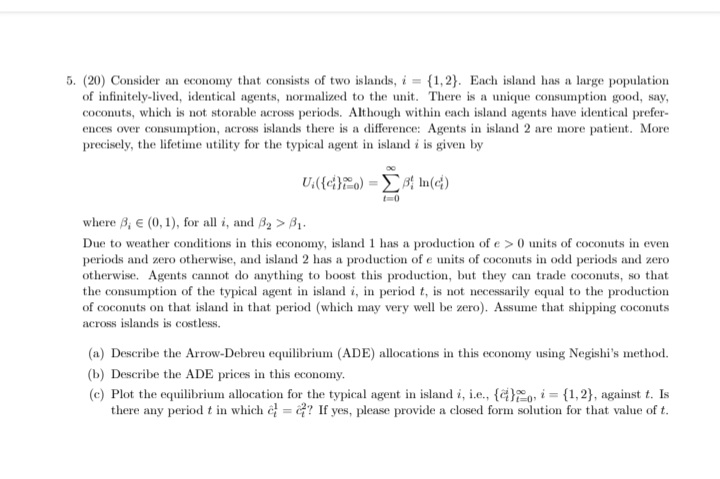

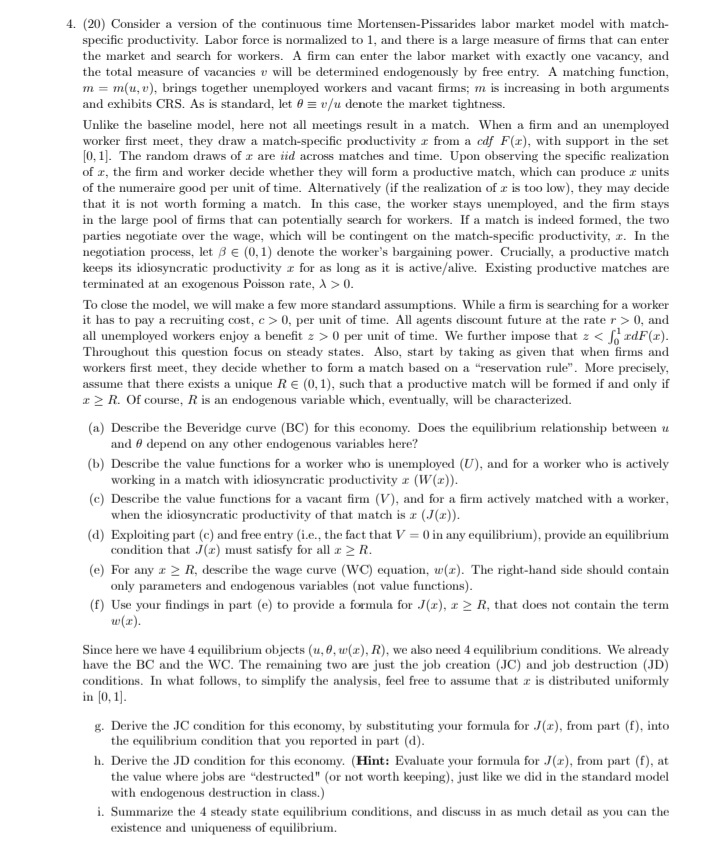

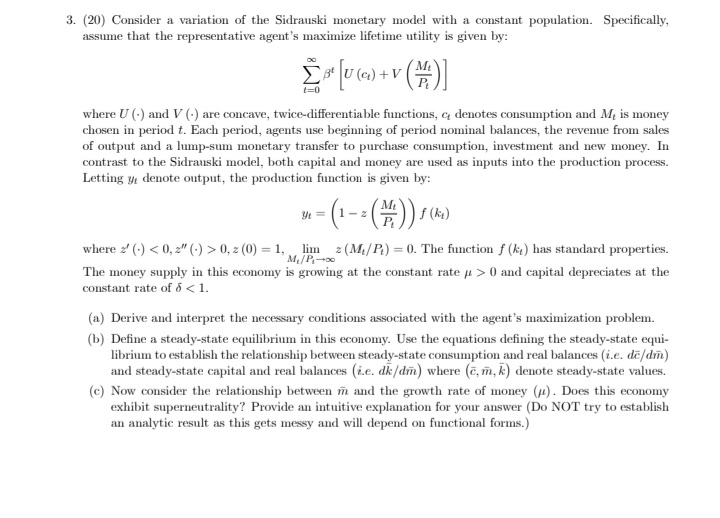

5. (20) Consider an economy that consists of two islands, i = {1, 2}. Each island has a large population of infinitely-lived, identical agents, normalized to the unit. There is a unique consumption good, say, coconuts, which is not storable across periods. Although within each island agents have identical prefer- ences over consumption, across islands there is a difference: Agents in island 2 are more patient. More precisely, the lifetime utility for the typical agent in island i is given by U.(()to) = >B In(c) where S, E (0, 1), for all i, and Be > 1. Due to weather conditions in this economy, island I has a production of e > 0 units of coconuts in even periods and zero otherwise, and island 2 has a production of e units of coconuts in odd periods and zero otherwise. Agents cannot do anything to boost this production, but they can trade coconuts, so that the consumption of the typical agent in island i, in period t, is not necessarily equal to the production of coconuts on that island in that period (which may very well be zero). Assume that shipping coconuts across islands is costless. (a) Describe the Arrow-Debreu equilibrium (ADE) allocations in this economy using Negishi's method. (b) Describe the ADE prices in this economy. (c) Plot the equilibrium allocation for the typical agent in island i, i.e., {G),, i = {1,2}, against t. Is there any period t in which & = @? If yes, please provide a closed form solution for that value of t.4. (20) Consider a version of the continuous time Mortensen-Pissarides labor market model with match- specific productivity. Labor force is normalized to 1, and there is a large measure of firms that can enter the market and search for workers. A firm can enter the labor market with exactly one vacancy, and the total measure of vacancies v will be determined endogenously by free entry. A matching function, m = m(u, "), brings together unemployed workers and vacant firms; m is increasing in both arguments and exhibits CRS. As is standard, let e = v/u denote the market tightness. Unlike the baseline model, here not all meetings result in a match. When a firm and an unemployed worker first meet, they draw a match-specific productivity a from a cdf F(x), with support in the set 0. 1]. The random draws of a are did across matches and time. Upon observing the specific realization of x, the firm and worker decide whether they will form a productive match, which can produce r units of the numeraire good per unit of time. Alternatively (if the realization of a is too low), they may decide that it is not worth forming a match. In this case, the worker stays unemployed, and the firm stays in the large pool of firms that can potentially search for workers. If a match is indeed formed, the two parties negotiate over the wage, which will be contingent on the match-specific productivity, z. In the negotiation process, let B e (0, 1) denote the worker's bargaining power. Crucially, a productive match keeps its idiosyncratic productivity a for as long as it is active/alive. Existing productive matches are terminated at an exogenous Poisson rate, A > 0. To close the model, we will make a few more standard assumptions. While a firm is searching for a worker it has to pay a recruiting cost, c > 0, per unit of time. All agents discount future at the rate r > 0, and all unemployed workers enjoy a benefit z > 0 per unit of time. We further impose that a 0, = (0) = 1, lim = (M/P) =0. The function f (k) has standard properties. The money supply in this economy is growing at the constant rate a > 0 and capital depreciates at the constant rate of 6