Answered step by step

Verified Expert Solution

Question

1 Approved Answer

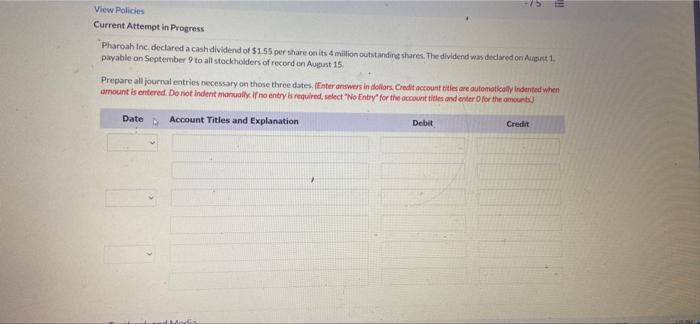

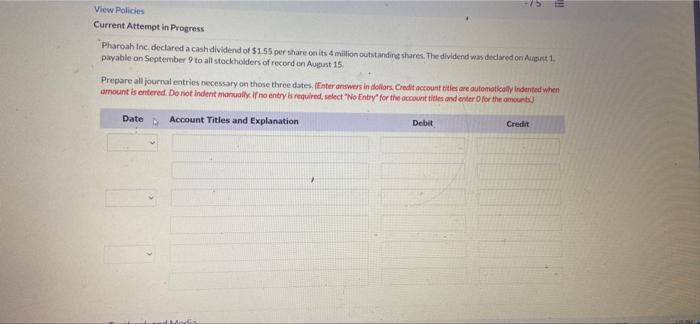

please help, urgent needed 11 View Policies Current Attempt in Progress Pharoah Inc, declared a cash dividend of $155 per share on its 4 million

please help, urgent needed

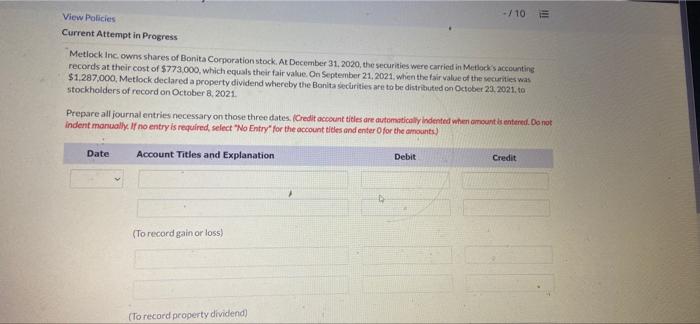

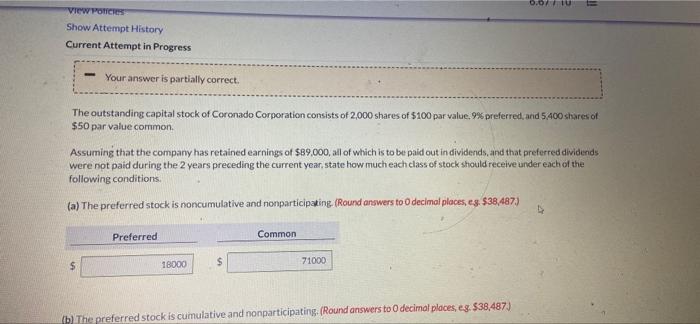

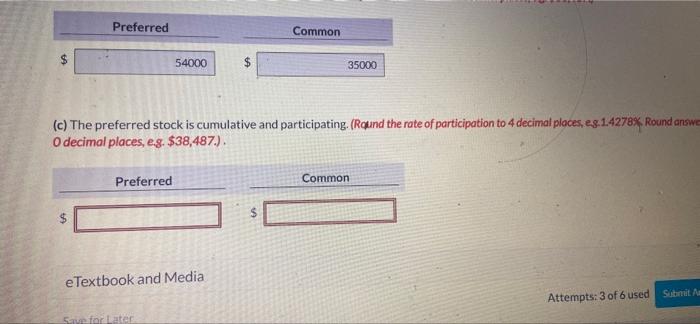

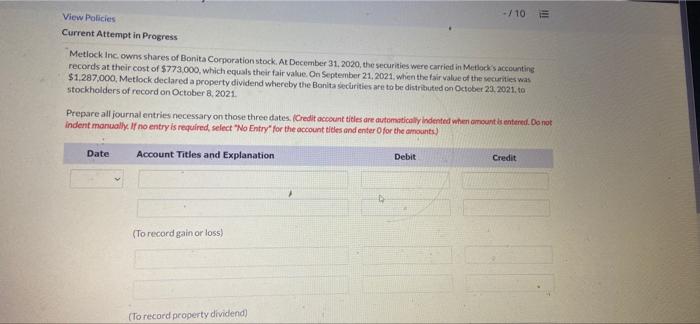

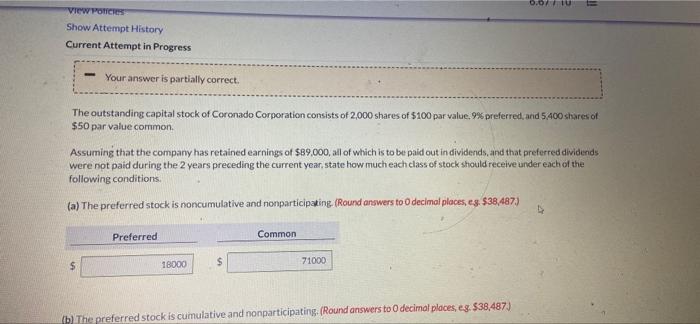

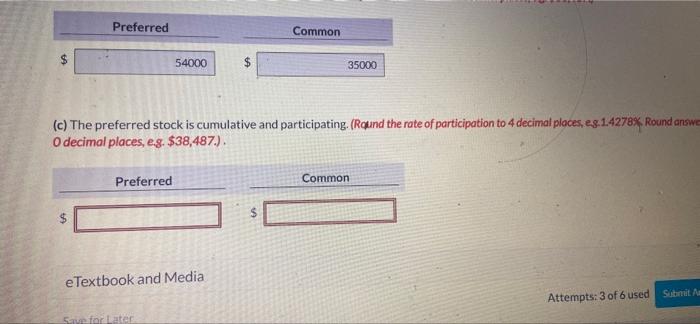

11 View Policies Current Attempt in Progress Pharoah Inc, declared a cash dividend of $155 per share on its 4 million outstanding shares. The dividend was declared on August 1 payable on September 9 to all stockholders of record on August 15 Prepare all journal entries necessary on those three dates. (Enter answers in dollars. Creditoccountries are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account title and enter for the mount] Date Account Titles and Explanation Debit Credit -710 THI View Policies Current Attempt in Progress Metlock Inc owns shares of Bonita Corporation stock At December 31, 2020, the securities were carried in Methods accounting records at their cost of $773.000, which equals their fair value. On September 21, 2021, when the fair value of the securities was $1.287,000, Metlock declared a property dividend whereby the Bonita securities are to be distributed on October 23.2021. to stockholders of record on October 8, 2021 Prepare all journal entries necessary on those three dates. (Credit account titles are automatically indented when amounts entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts) Date Account Titles and Explanation Debit Credit (To record gain or loss) (To record property dividend) 0.01 VIEW POTCH Show Attempt History Current Attempt in Progress - Your answer is partially correct. The outstanding capital stock of Coronado Corporation consists of 2,000 shares of $100 par value. 9% preferred, and 5,400 shares of $50 par value common Assuming that the company has retained earnings of $89,000, all of which is to be paid out in dividends, and that preferred dividends were not paid during the 2 years preceding the current year, state how much each class of stock should receive under each of the following conditions (a) The preferred stock is noncumulative and nonparticipating (Round answers to decimal places, es $38,487) 10 Preferred Common 18000 $ 71000 (h) The preferred stock is cumulative and nonparticipating: (Round answers to decimal places, es $38,487) Preferred Common 54000 35000 (c) The preferred stock is cumulative and participating (Round the rate of participation to 4 decimal places, eg.14278%, Round answer O decimal places, e.g. $38,487.). Preferred Common e Textbook and Media Attempts: 3 of 6 used Sabinuit Aa Sarlater

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started