Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help, urgent needed please help please help - === POLAR but the end. When they They www. mw000 W The Goddess of the they

please help, urgent needed

please help

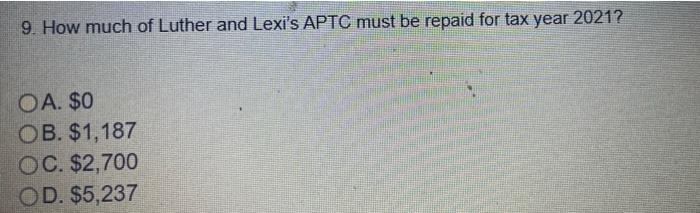

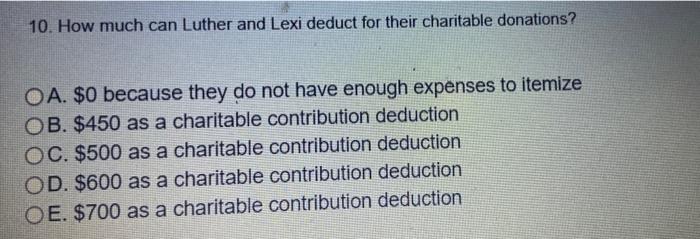

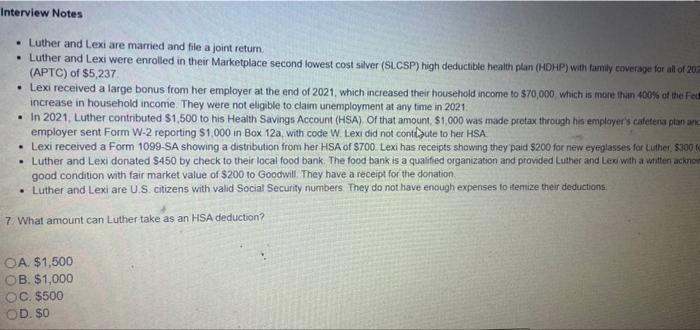

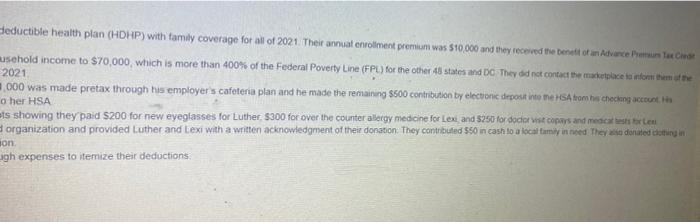

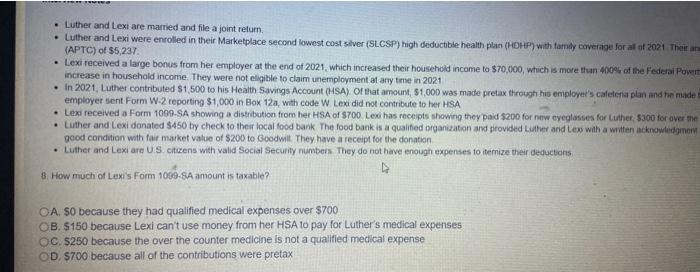

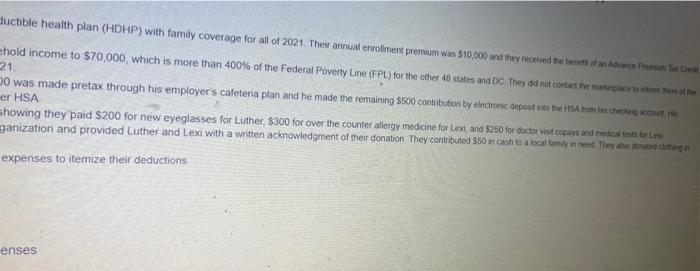

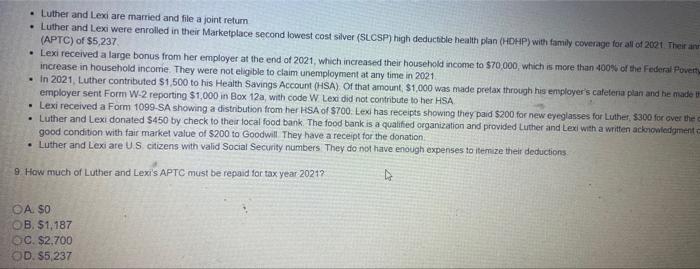

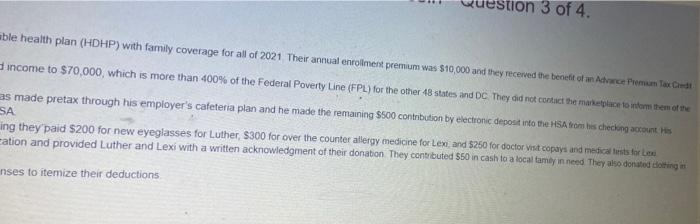

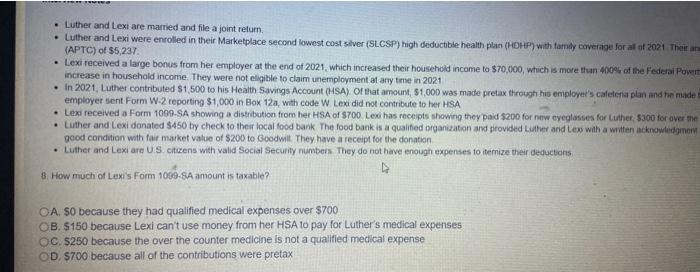

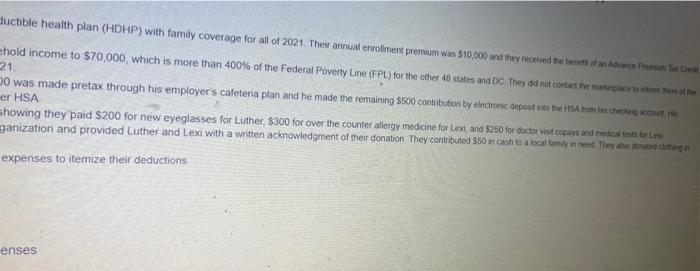

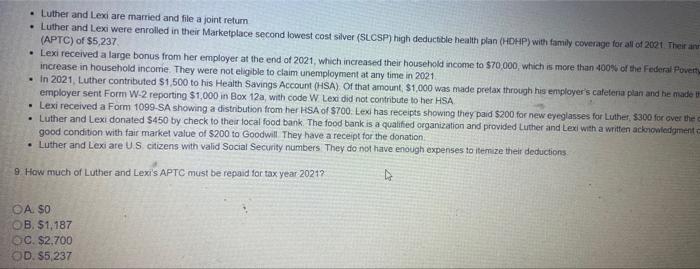

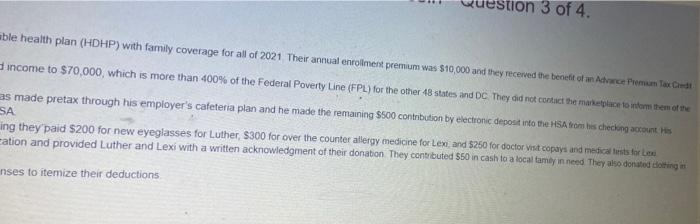

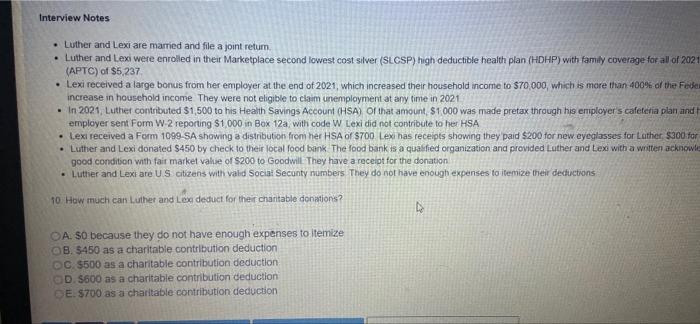

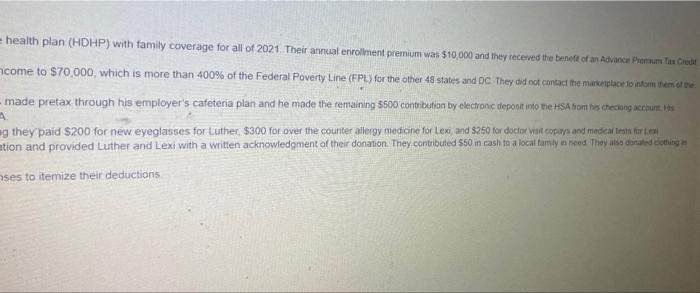

please help

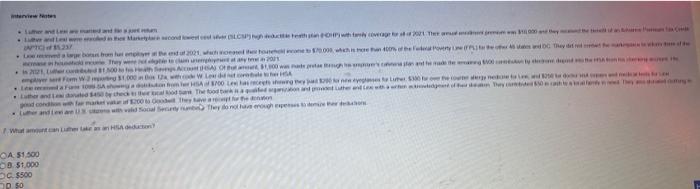

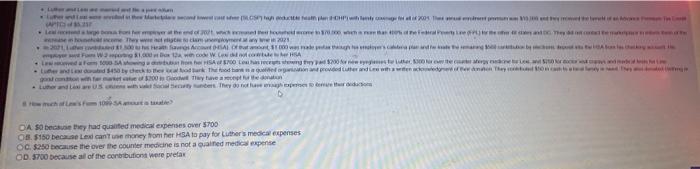

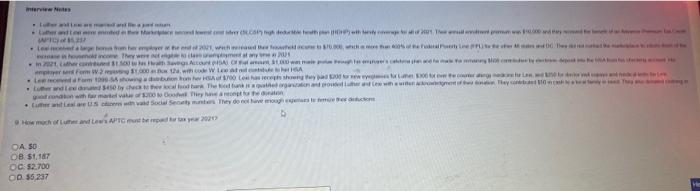

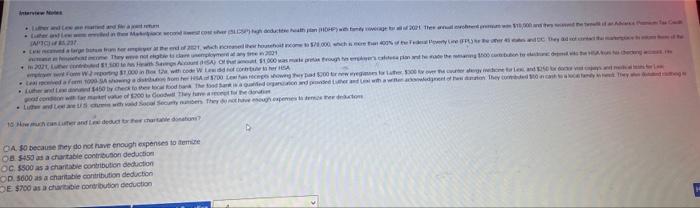

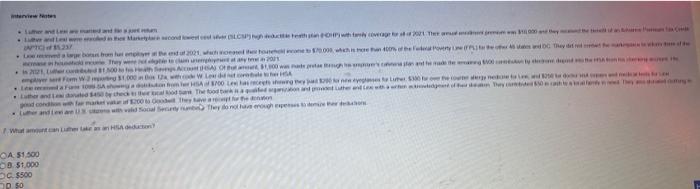

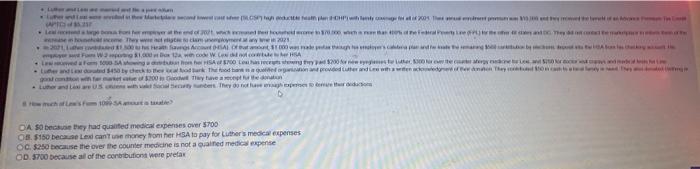

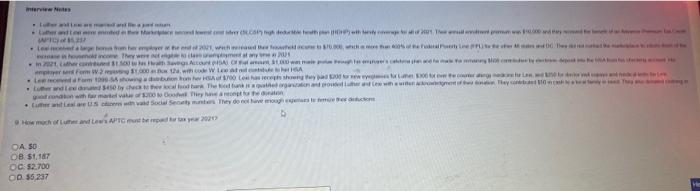

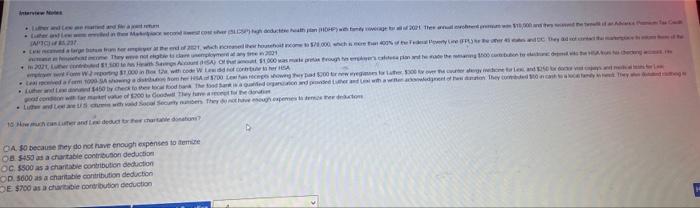

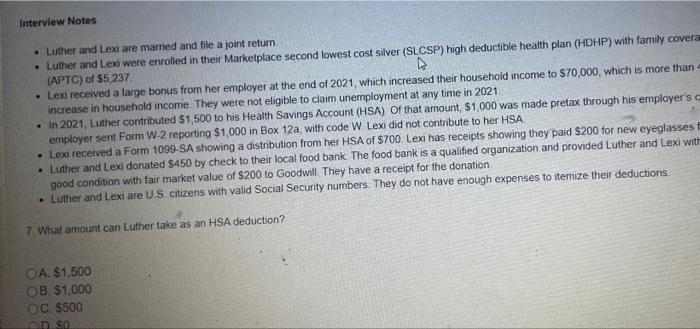

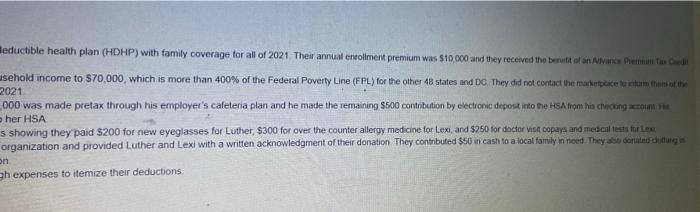

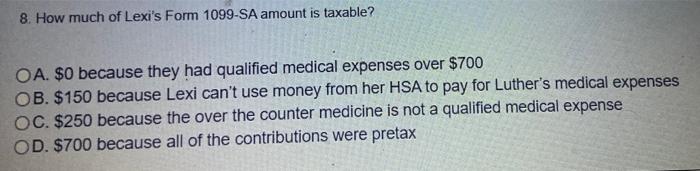

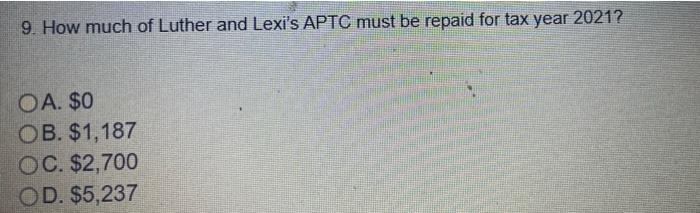

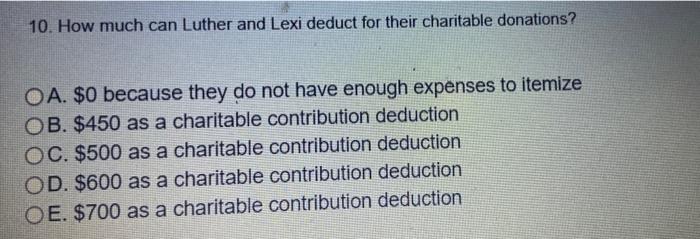

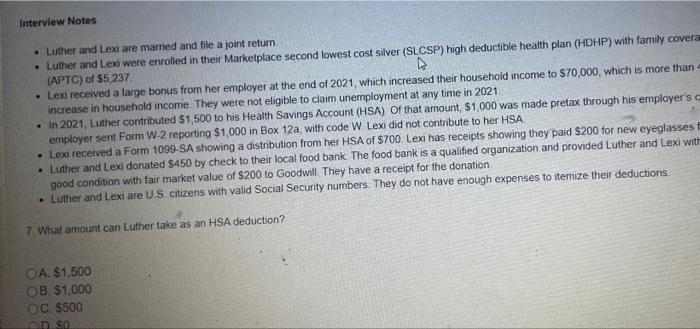

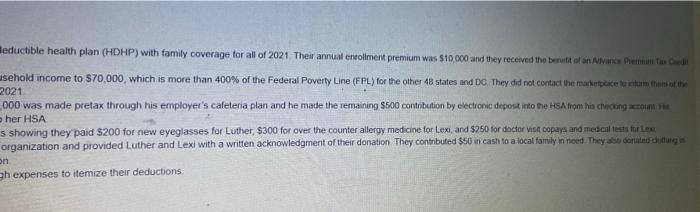

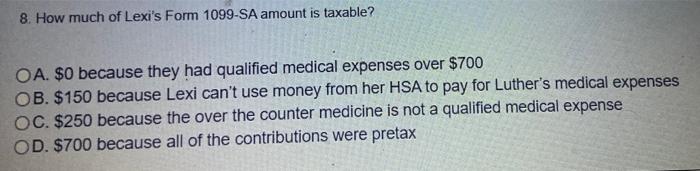

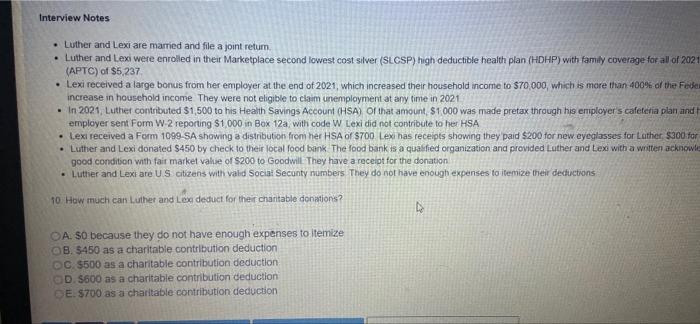

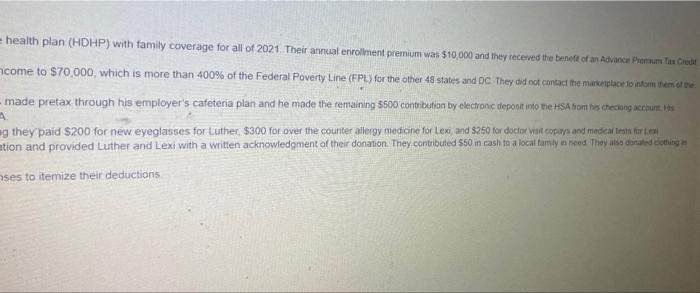

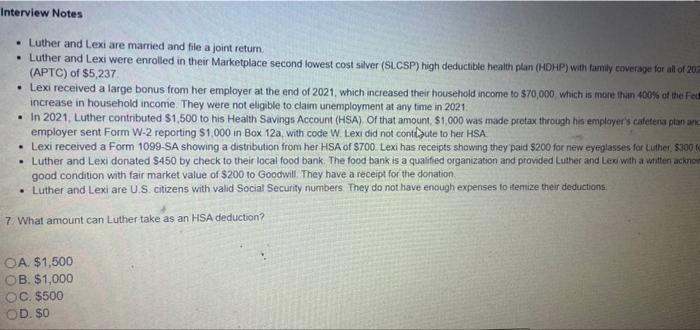

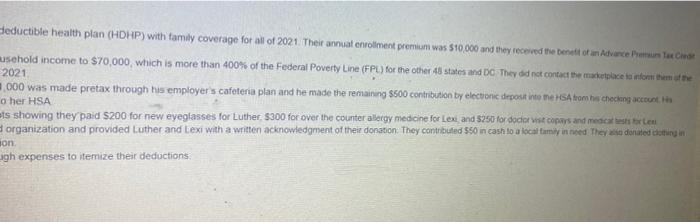

- === POLAR but the end. When they They www. mw000 W The Goddess of the they are the wald They do not crocher HOW TO MED HURT OA 51500 3. $1.000 SC 5500 05 O Stanley 7005 The Formerend wa 2323 HALAS www w CHIA Lets to be SAU SOLO $200 wystawi Lund work The total gain and provided her and when they LIU THU TI, THU 4 4 4 4 4 4 4 HH Seythey do nome do 10 DA SO because they had qualified medical expenses over 5700 O $150 because Lexicante money from her HSA to pay for Luther's medical expenses OC $250 because the over the counter medicine is not a gained medica expense OD. 5700 because all of the contributions were prelax terview condem hehehehehehehe They were in the cover water www.1 W16 www centralne by how the white what they Social Semut They do not com How much den Abend 2013 $ DA 50 OB $1,187 OC $2.700 OD 55,237 VERLIV . . mohd HP) ter we the harata Twenty2001 Hosethemet www in Beweh. Woche La do 1000 Somewoon wees tot werdeturi 450 whether on the food with what they conforme of They have - Lule Gewoonten They were some 2008 . 10 Manductors are not CA O Because they do not have enough expenses to me OB $450 a churable contributo deduction OC $500 as a charitable contribution deduction OD. 5600 as a charitable contribution deduction DE $700 as a che contribution deduction 1 Interview Notes . Luther and Lexi are married and file a joint return Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family covera (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to $70,000, which is more than increase in household income. They were not eligible to claim unemployment at any time in 2021 In 2021, Luther contributed $1,500 to his Health Savings Account (HSA) Of that amount, $1,000 was made pretax through his employer's employer sent Form W-2 reporting $1,000 in Box 12a with code W. Lexi did not contbute to her HSA Lex received a Form 1099 SA showing a distribution from her HSA of $700. Lexi has receipts showing they paid $200 for new eyeglasses . Luther and Lexi donated $450 by check to their local food bank. The food bank is a qualified organization and provided Luther and Lexi with good condition with fair market value of $200 to Goodwill. They have a receipt for the donation Luther and Lexi are US citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions 7 What amount can Luther take as an HSA deduction? OA. $1,500 OB $1,000 OC. $500 OD SO eductible health plan (HDHP) with family coverage for all of 2021 Their annual enrollment premium was $10,000 and they received the benefit olan van Preta usehold income to $70,000, which is more than 400% of the Federal Poverty Line (EPL) for the other 48 states and DG They did not contact the marketece em to the 2021 000 was made pretax through his employer's cafeteria plan and he made the remaining $500 contribution by electronic depost into the HSA from his cocong accom her HSA s showing they paid $200 for new eyeglasses for Luther, $300 for over the counter allergy medicine for Lexi, and $250 for doctor is copays and medical tests fortes organization and provided Luther and Lexi with a written acknowledgment of their donation They contributed $50 in cash to a local family in need. They dong on gh expenses to itemize their deductions 8. How much of Lexi's Form 1099-SA amount is taxable? OA. $0 because they had qualified medical expenses over $700 OB. $150 because Lexi can't use money from her HSA to pay for Luther's medical expenses OC. $250 because the over the counter medicine is not a qualified medical expense OD. $700 because all of the contributions were pretax 9. How much of Luther and Lexi's APTC must be repaid for tax year 2021? OA. $0 OB. $1,187 OC. $2,700 OD. $5,237 10. How much can Luther and Lexi deduct for their charitable donations? OA. $0 because they do not have enough expenses to itemize OB. $450 as a charitable contribution deduction OC. $500 as a charitable contribution deduction OD. $600 as a charitable contribution deduction OE. $700 as a charitable contribution deduction Interview Notes Luther and Lexi are married and file a joint return Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family coverage for all of 20 (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to S70,000 which is more than 400% of the Fed increase in household income. They were not eligible to claim unemployment at any time in 2021 . In 2021. Luther contributed $1,500 to his Health Savings Account (HSA) of that amount, $1,000 was made pretax through his employer's cateterna plan ang employer sent Form W-2 reporting $1.000 in Box 12a, with code W. Lexi did not cont>ute to her HSA Lexi received a Form 1099-SA showing a distribution from her HSA of $700 Lexi has receipts showing they paid $200 for new eyeglasses for Luther, 8300 Luther and Lexi donated S450 by check to their local food bank. The food bank is a qualified organization and provided Luther and Lee with a written acknow good condition with fair market value of $200 to Goodwill. They have a receipt for the donation Luther and Lexi are U.S. citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions a 7 What amount can Luther take as an HSA deduction? OA. $1,500 OB. $1,000 OC. $500 OD. $0 Luther and Lexi are married and file a joint retum. Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family coverage for all of 2021 Their (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to $70,000, which is more than 400% of the Federal Povert increase in household income. They were not eligible to claim unemployment at any time in 2021 In 2021, Luther contributed $1,500 to his Health Savings Account (HSA) of that amount, $1,000 was made pretax through his employee's cafeteria plan and he made employer sent Form W-2 reporting $1,000 in Box 12a, with code W Lexi did not contribute to her HSA Lexi received a Form 1099.SA showing a distribution from her HSA of S700 Lexi has receipts showing they paid $200 for new eyeglasses for Luther $300 for over the Luther and Lexi donated $450 by check to their local food bank. The food bank is a qualified organization and provided Luther and Leo with a written acknowledge good condition with fair market value of $200 to Goodwill. They have a receipt for the donation Luther and Lexiar US citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions 8. How much of Lexis Form 1099-SA amount is taxable? OA. SO because they had qualified medical expenses over $700 OB. $150 because Lexi can't use money from her HSA to pay for Luther's medical expenses OC. $250 because the over the counter medicine is not a qualified medical expense OD. $700 because all of the contributions were pretax ductible health plan (HDHP) with family coverage for all of 2021. Their annual enrolment premium was $10,000 and they received the benetean Advance Permed ehold income to $70,000, which is more than 400% of the Federal Poverty Line (FPL) for the other 48 states and DC They did not contact the place to tomme 21 0 was made pretax through his employer's cafeteria plan and he made the remaining $500 contibution by electronic depost into the FSA com la decat er HSA Showing they paid $200 for new eyeglasses for Luther, 300 for over the counter allergy medicine for Lexi, and $250 for doctor vist copays and medical teatre ganization and provided-Luther and Lex with a written acknowledgement of their danabon They contributed $50 in case to a local tarmly in need. They alsa demand cutture expenses to itemize their deductions a enses Luther and Lexe are married and file a joint return Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family coverage for all of 2021. Their an (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to $70,000, which is more than 400% of the Federal Povert increase in household income. They were not eligible to claim unemployment at any time in 2021 In 2021 Luther contributed $1,500 to his Health Savings Account (HSA) Of that amount $1,000 was made prelax through his employer's cafetera plan and he made in employer sent Form W-2 reporting $1,000 in Box 12a, with code W Lex did not contribute to her HSA Lexi received a Form 1099-SA showing a distribution from her HSA of S700. Lexi has receipts showing they paid $200 for new eyeglasses for Luther, $300 for over the Luther and Lexi donated $450 by check to their local food bank. The food bank is a qualified organization and provided Luther and Lex with a written acknowledgment good condition with fair market value of $200 to Goodwill. They have a receipt for the donation Luther and Lexi are US citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions 9. How much of Luther and Lexi's APTC must be repaid for tax year 2021? A SO B. 51,187 20. $2.700 ODS5 237 3 of 4. able health plan (HDHP) with family coverage for all of 2021 Their annual enrollment premium was $10,000 and they recerved the benefit of an Adence Prem Tax Card income to $70,000, which is more than 400% of the Federal Poverty Line (FPL) for the other 48 states and DC They did not contact the marketplace to form them of the as made pretax through his employer's cafeteria plan and he made the remaining $500 contribution by electronic deposit into the HSA from his checking accounts SA ing they paid $200 for new eyeglasses for Luther, 5300 for over the counter allergy medicine for Lex and $250 for doctor visit copays and medical units for en Eation and provided Luther and Lexi with a written acknowledgment of their donation They contributed $50 in cash to a local tamty in need They also donated clothing in nses to itemize their deductions Interview Notes Luther and Lexi are mamed and file a joint retum Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family coverage for all of 2021 (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to $70,000, which is more than 400% of the Fede increase in household income They were not eligible to claim unemployment at any time in 2021 . In 2021, Luther contributed $1,500 to his Health Savings Account (HSA) of that amount $1000 was made pretax through his employer's cafeteria plan and employer sent Form W-2 reporting $1.000 in Box 12a with code W Lexi did not contribute to her HSA Lexi received a Form 1099 SA showing a distribution from her HSA of $700 Lexi has receipts showing they paid $200 for new eyeglasses for Luther $300 for Luther and Lexi donated $450 by check to their local food bank The food bank is a qualified organization and provided Luther and Lex with a written acknowl good condition with fair market value of $200 to Goodwill. They have a receipt for the donation . Luther and Lext are US citizens with vald Social Secunty numbers They do not have enough expenses to itemize their dechrictions 10 How much can Luther and Lee deduct for their charitable donations ? OA. SO because they do not have enough expenses to itemize OB. $450 as a charitable contribution deduction DC. $500 as a charitable contribution deduction OD $600 as a charitable contribution deduction DE $700 as a charitable contribution deduction = health plan (HDHP) with family coverage for all of 2021. Their annual enrollment premium was $10,000 and they received the benefit of an Advance PT Credit come to $70,000, which is more than 400% of the Federal Poverty Line (FPL) for the other 48 states and DC They did not contact the marketplace to inform theme - made pretax through his employer's cafeteria plan and he made the remaining 5500 contribution by electronc deposit into the HSA from his checking accounts g they paid $200 for new eyeglasses for Luther, $300 for over the counter allergy medicine for Lexi and $2.50 for doctor wise cominys and medical tests tot mtion and provided Luther and Lexi with a written acknowledgment of their donation. They contributed 550 in cash to a local family on need They also donated coming ases to itemize their deductions - === POLAR but the end. When they They www. mw000 W The Goddess of the they are the wald They do not crocher HOW TO MED HURT OA 51500 3. $1.000 SC 5500 05 O Stanley 7005 The Formerend wa 2323 HALAS www w CHIA Lets to be SAU SOLO $200 wystawi Lund work The total gain and provided her and when they LIU THU TI, THU 4 4 4 4 4 4 4 HH Seythey do nome do 10 DA SO because they had qualified medical expenses over 5700 O $150 because Lexicante money from her HSA to pay for Luther's medical expenses OC $250 because the over the counter medicine is not a gained medica expense OD. 5700 because all of the contributions were prelax terview condem hehehehehehehe They were in the cover water www.1 W16 www centralne by how the white what they Social Semut They do not com How much den Abend 2013 $ DA 50 OB $1,187 OC $2.700 OD 55,237 VERLIV . . mohd HP) ter we the harata Twenty2001 Hosethemet www in Beweh. Woche La do 1000 Somewoon wees tot werdeturi 450 whether on the food with what they conforme of They have - Lule Gewoonten They were some 2008 . 10 Manductors are not CA O Because they do not have enough expenses to me OB $450 a churable contributo deduction OC $500 as a charitable contribution deduction OD. 5600 as a charitable contribution deduction DE $700 as a che contribution deduction 1 Interview Notes . Luther and Lexi are married and file a joint return Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family covera (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to $70,000, which is more than increase in household income. They were not eligible to claim unemployment at any time in 2021 In 2021, Luther contributed $1,500 to his Health Savings Account (HSA) Of that amount, $1,000 was made pretax through his employer's employer sent Form W-2 reporting $1,000 in Box 12a with code W. Lexi did not contbute to her HSA Lex received a Form 1099 SA showing a distribution from her HSA of $700. Lexi has receipts showing they paid $200 for new eyeglasses . Luther and Lexi donated $450 by check to their local food bank. The food bank is a qualified organization and provided Luther and Lexi with good condition with fair market value of $200 to Goodwill. They have a receipt for the donation Luther and Lexi are US citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions 7 What amount can Luther take as an HSA deduction? OA. $1,500 OB $1,000 OC. $500 OD SO eductible health plan (HDHP) with family coverage for all of 2021 Their annual enrollment premium was $10,000 and they received the benefit olan van Preta usehold income to $70,000, which is more than 400% of the Federal Poverty Line (EPL) for the other 48 states and DG They did not contact the marketece em to the 2021 000 was made pretax through his employer's cafeteria plan and he made the remaining $500 contribution by electronic depost into the HSA from his cocong accom her HSA s showing they paid $200 for new eyeglasses for Luther, $300 for over the counter allergy medicine for Lexi, and $250 for doctor is copays and medical tests fortes organization and provided Luther and Lexi with a written acknowledgment of their donation They contributed $50 in cash to a local family in need. They dong on gh expenses to itemize their deductions 8. How much of Lexi's Form 1099-SA amount is taxable? OA. $0 because they had qualified medical expenses over $700 OB. $150 because Lexi can't use money from her HSA to pay for Luther's medical expenses OC. $250 because the over the counter medicine is not a qualified medical expense OD. $700 because all of the contributions were pretax 9. How much of Luther and Lexi's APTC must be repaid for tax year 2021? OA. $0 OB. $1,187 OC. $2,700 OD. $5,237 10. How much can Luther and Lexi deduct for their charitable donations? OA. $0 because they do not have enough expenses to itemize OB. $450 as a charitable contribution deduction OC. $500 as a charitable contribution deduction OD. $600 as a charitable contribution deduction OE. $700 as a charitable contribution deduction Interview Notes Luther and Lexi are married and file a joint return Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family coverage for all of 20 (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to S70,000 which is more than 400% of the Fed increase in household income. They were not eligible to claim unemployment at any time in 2021 . In 2021. Luther contributed $1,500 to his Health Savings Account (HSA) of that amount, $1,000 was made pretax through his employer's cateterna plan ang employer sent Form W-2 reporting $1.000 in Box 12a, with code W. Lexi did not cont>ute to her HSA Lexi received a Form 1099-SA showing a distribution from her HSA of $700 Lexi has receipts showing they paid $200 for new eyeglasses for Luther, 8300 Luther and Lexi donated S450 by check to their local food bank. The food bank is a qualified organization and provided Luther and Lee with a written acknow good condition with fair market value of $200 to Goodwill. They have a receipt for the donation Luther and Lexi are U.S. citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions a 7 What amount can Luther take as an HSA deduction? OA. $1,500 OB. $1,000 OC. $500 OD. $0 Luther and Lexi are married and file a joint retum. Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family coverage for all of 2021 Their (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to $70,000, which is more than 400% of the Federal Povert increase in household income. They were not eligible to claim unemployment at any time in 2021 In 2021, Luther contributed $1,500 to his Health Savings Account (HSA) of that amount, $1,000 was made pretax through his employee's cafeteria plan and he made employer sent Form W-2 reporting $1,000 in Box 12a, with code W Lexi did not contribute to her HSA Lexi received a Form 1099.SA showing a distribution from her HSA of S700 Lexi has receipts showing they paid $200 for new eyeglasses for Luther $300 for over the Luther and Lexi donated $450 by check to their local food bank. The food bank is a qualified organization and provided Luther and Leo with a written acknowledge good condition with fair market value of $200 to Goodwill. They have a receipt for the donation Luther and Lexiar US citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions 8. How much of Lexis Form 1099-SA amount is taxable? OA. SO because they had qualified medical expenses over $700 OB. $150 because Lexi can't use money from her HSA to pay for Luther's medical expenses OC. $250 because the over the counter medicine is not a qualified medical expense OD. $700 because all of the contributions were pretax ductible health plan (HDHP) with family coverage for all of 2021. Their annual enrolment premium was $10,000 and they received the benetean Advance Permed ehold income to $70,000, which is more than 400% of the Federal Poverty Line (FPL) for the other 48 states and DC They did not contact the place to tomme 21 0 was made pretax through his employer's cafeteria plan and he made the remaining $500 contibution by electronic depost into the FSA com la decat er HSA Showing they paid $200 for new eyeglasses for Luther, 300 for over the counter allergy medicine for Lexi, and $250 for doctor vist copays and medical teatre ganization and provided-Luther and Lex with a written acknowledgement of their danabon They contributed $50 in case to a local tarmly in need. They alsa demand cutture expenses to itemize their deductions a enses Luther and Lexe are married and file a joint return Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family coverage for all of 2021. Their an (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to $70,000, which is more than 400% of the Federal Povert increase in household income. They were not eligible to claim unemployment at any time in 2021 In 2021 Luther contributed $1,500 to his Health Savings Account (HSA) Of that amount $1,000 was made prelax through his employer's cafetera plan and he made in employer sent Form W-2 reporting $1,000 in Box 12a, with code W Lex did not contribute to her HSA Lexi received a Form 1099-SA showing a distribution from her HSA of S700. Lexi has receipts showing they paid $200 for new eyeglasses for Luther, $300 for over the Luther and Lexi donated $450 by check to their local food bank. The food bank is a qualified organization and provided Luther and Lex with a written acknowledgment good condition with fair market value of $200 to Goodwill. They have a receipt for the donation Luther and Lexi are US citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions 9. How much of Luther and Lexi's APTC must be repaid for tax year 2021? A SO B. 51,187 20. $2.700 ODS5 237 3 of 4. able health plan (HDHP) with family coverage for all of 2021 Their annual enrollment premium was $10,000 and they recerved the benefit of an Adence Prem Tax Card income to $70,000, which is more than 400% of the Federal Poverty Line (FPL) for the other 48 states and DC They did not contact the marketplace to form them of the as made pretax through his employer's cafeteria plan and he made the remaining $500 contribution by electronic deposit into the HSA from his checking accounts SA ing they paid $200 for new eyeglasses for Luther, 5300 for over the counter allergy medicine for Lex and $250 for doctor visit copays and medical units for en Eation and provided Luther and Lexi with a written acknowledgment of their donation They contributed $50 in cash to a local tamty in need They also donated clothing in nses to itemize their deductions Interview Notes Luther and Lexi are mamed and file a joint retum Luther and Lexi were enrolled in their Marketplace second lowest cost silver (SLCSP) high deductible health plan (HDHP) with family coverage for all of 2021 (APTC) of $5,237 Lexi received a large bonus from her employer at the end of 2021, which increased their household income to $70,000, which is more than 400% of the Fede increase in household income They were not eligible to claim unemployment at any time in 2021 . In 2021, Luther contributed $1,500 to his Health Savings Account (HSA) of that amount $1000 was made pretax through his employer's cafeteria plan and employer sent Form W-2 reporting $1.000 in Box 12a with code W Lexi did not contribute to her HSA Lexi received a Form 1099 SA showing a distribution from her HSA of $700 Lexi has receipts showing they paid $200 for new eyeglasses for Luther $300 for Luther and Lexi donated $450 by check to their local food bank The food bank is a qualified organization and provided Luther and Lex with a written acknowl good condition with fair market value of $200 to Goodwill. They have a receipt for the donation . Luther and Lext are US citizens with vald Social Secunty numbers They do not have enough expenses to itemize their dechrictions 10 How much can Luther and Lee deduct for their charitable donations ? OA. SO because they do not have enough expenses to itemize OB. $450 as a charitable contribution deduction DC. $500 as a charitable contribution deduction OD $600 as a charitable contribution deduction DE $700 as a charitable contribution deduction = health plan (HDHP) with family coverage for all of 2021. Their annual enrollment premium was $10,000 and they received the benefit of an Advance PT Credit come to $70,000, which is more than 400% of the Federal Poverty Line (FPL) for the other 48 states and DC They did not contact the marketplace to inform theme - made pretax through his employer's cafeteria plan and he made the remaining 5500 contribution by electronc deposit into the HSA from his checking accounts g they paid $200 for new eyeglasses for Luther, $300 for over the counter allergy medicine for Lexi and $2.50 for doctor wise cominys and medical tests tot mtion and provided Luther and Lexi with a written acknowledgment of their donation. They contributed 550 in cash to a local family on need They also donated coming ases to itemize their deductions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started