Household income for purpose of the premium tax credit includes all of the following except: Oa. a. Any tax-exempt income Ob. Nontaxable Social Security

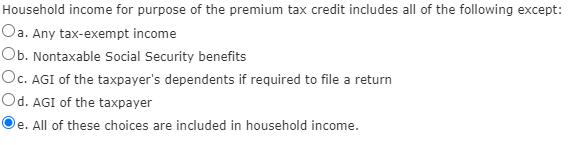

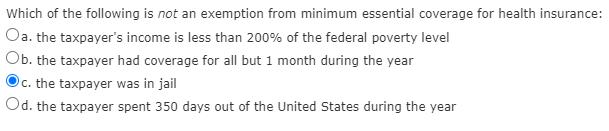

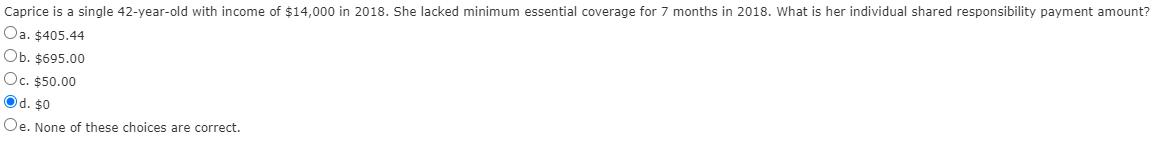

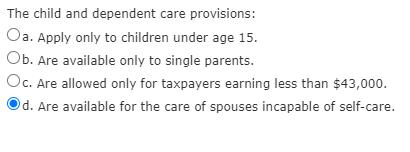

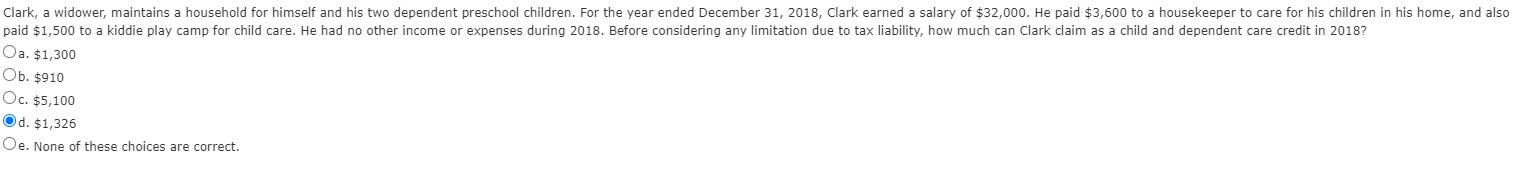

Household income for purpose of the premium tax credit includes all of the following except: Oa. a. Any tax-exempt income Ob. Nontaxable Social Security benefits Oc. AGI of the taxpayer's dependents if required to file a return Od. AGI of the taxpayer Oe. All of these choices are included in household income. Which of the following is not an exemption from minimum essential coverage for health insurance: Oa. the taxpayer's income is less than 200% of the federal poverty level Ob. the taxpayer had coverage for all but 1 month during the year c. the taxpayer was in jail Od. the taxpayer spent 350 days out of the United States during the year Caprice is a single 42-year-old with income of $14,000 in 2018. She lacked minimum essential coverage for 7 months in 2018. What is her individual shared responsibility payment amount? Oa. $405.44 Ob. $695.00 Oc. $50.00 Od. $0 Oe. None of these choices are correct. The child and dependent care provisions: Oa. Apply only to children under age 15. Ob. Are available only to single parents. Oc. Are allowed only for taxpayers earning less than $43,000. d. Are available for the care of spouses incapable of self-care. Clark, a widower, maintains a household for himself and his two dependent preschool children. For the year ended December 31, 2018, Clark earned a salary of $32,000. He paid $3,600 to a housekeeper to care for his children in his home, and also paid $1,500 to a kiddie play camp for child care. He had no other income or expenses during 2018. Before considering any limitation due to tax liability, how much can Clark claim as a child and dependent care credit in 2018? Oa. $1,300 Ob. $910 Oc. $5,100 Od. $1,326 Oe. None of these choices are correct.

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Part1 Q Household income for purpose of the premium tax credit includes all of the following except ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started