Answered step by step

Verified Expert Solution

Question

1 Approved Answer

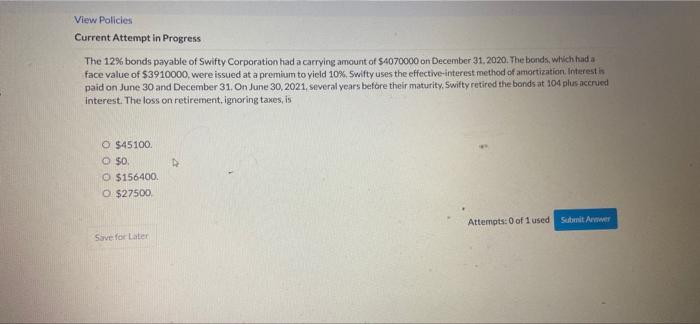

please help View Policies Current Attempt in Progress The 12% bonds payable of Swifty Corporation had a carrying amount of $4070000 on December 31, 2020.

please help

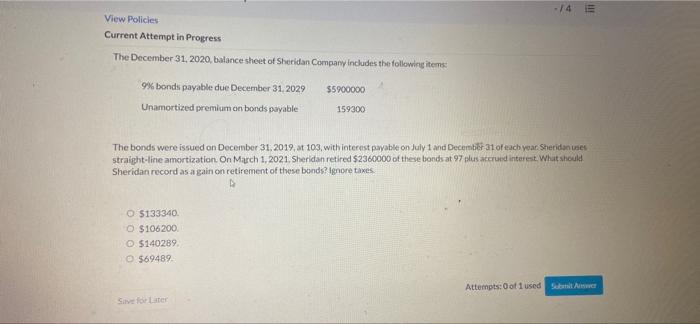

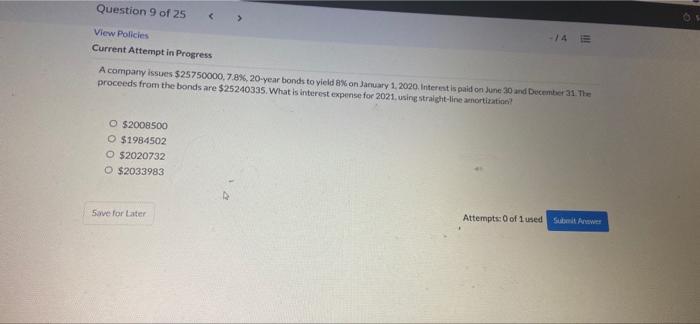

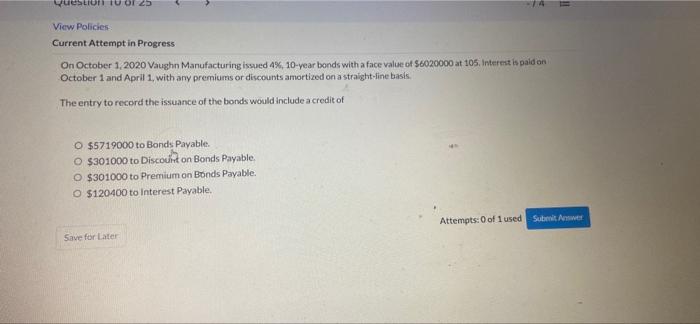

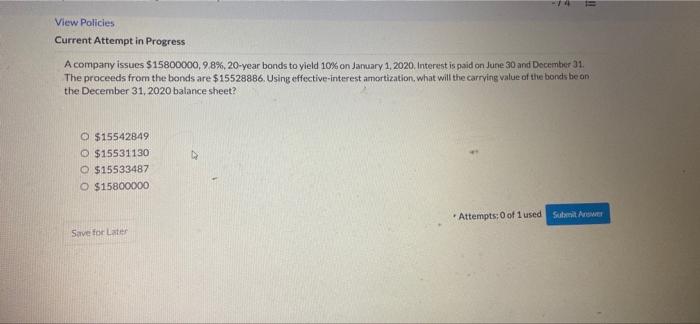

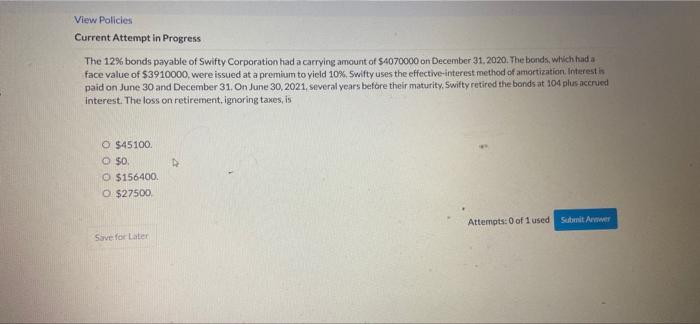

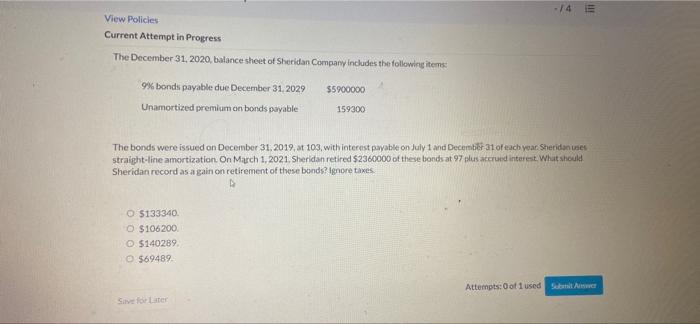

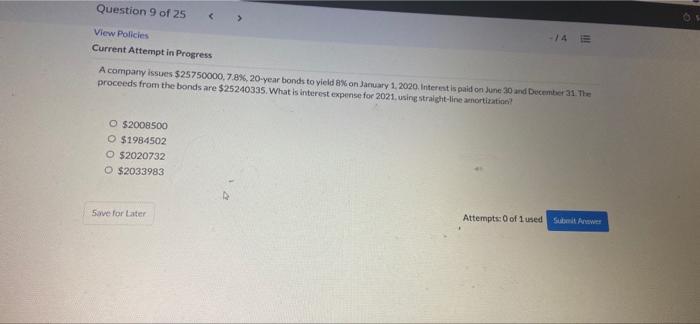

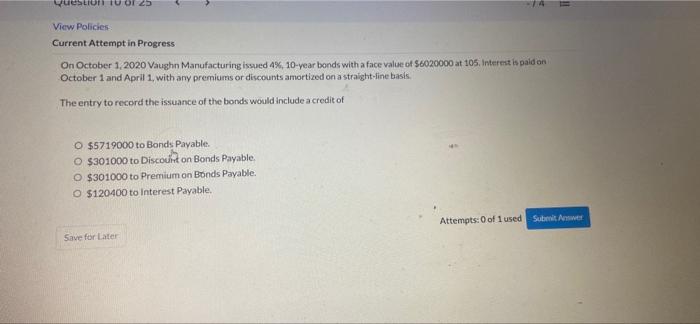

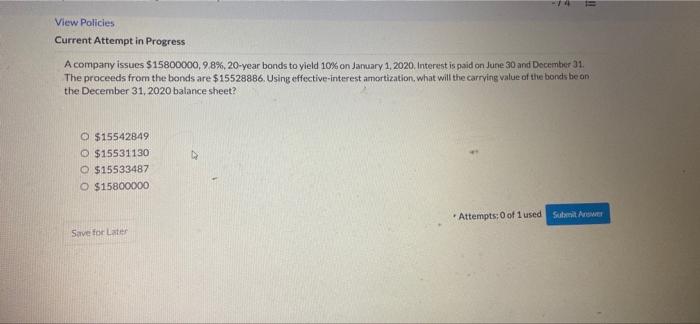

View Policies Current Attempt in Progress The 12% bonds payable of Swifty Corporation had a carrying amount of $4070000 on December 31, 2020. The bonds, which had a face value of $3910000 were issued at a premium to yield 10% Swifty uses the effective interest method of amortization Interestis paid on June 30 and December 31. On June 30, 2021, several years before their maturity, Swifty retired the bonds at 104 plus accrued Interest. The loss on retirement, ignoring taxes, is $45100 $0. $156400 O $27500 Attempts: 0 of 1 used Sun Arne Sove for Later -145 View Policies Current Attempt in Progress The December 31, 2020, balance sheet of Sheridan Company includes the following items $5900000 9% bonds payable due December 31, 2029 Unamortized premium on bonds payable 159300 The bonds were issued on December 31, 2019, at 103, with interest payable on July 1 and December at of each year. Sheridanuses straight-line amortization On March 1, 2021. Sheridan retired S2360000 of these bonds at 97 plus accrued interest. What should Sheridan record as again on retirement of these bonds? Ignore taxes $133340 O $106200 $140289 $69489 Attempts: Oot 1 used SAW Sive for Later Question 9 of 25 View Policies Current Attempt in Progress A company issues $25750000,78% 20-year bonds to yield on January 1, 2020 Interest is paid on June 30 und December 21. The proceeds from the bonds are $25240335. What is interest expense for 2021, using straight-line amortization? O $2008500 $1984502 O $2020732 O $2033983 5ave for Later Attempts: 0 of 1 used uestion to 25 View Policies Current Attempt in Progress On October 1, 2020 Vaughn Manufacturing issued 4%, 10-year bonds with a face value of $6020000 at 105. Interest is paid on October 1 and April 1, with any premiums or discounts amortized on a straight-line basis. The entry to record the issuance of the bonds would include a credit of O $5719000 to Bonds Payable $301000 to Discount on Bonds Payable, O $301000 to Premium on Bonds Payable. O $120400 to interest Payable. Attempts:0 of 1 used Submit Save for Later View Policies Current Attempt in Progress A company issues $15800000, 98%, 20-year bonds to yield 10% on January 1, 2020, Interest is paid on June 30 and December 31. The proceeds from the bonds are $15528886. Using effective-interest amortization, what will the carrying value of the bonds be on the December 31, 2020 balance sheet? O $15542849 O $15531130 O $15533487 O $15800000 Attempts:0 of 1 used Submit Awe Save for Later View Policies Current Attempt in Progress The 12% bonds payable of Swifty Corporation had a carrying amount of $4070000 on December 31, 2020. The bonds, which had a face value of $3910000 were issued at a premium to yield 10% Swifty uses the effective interest method of amortization Interestis paid on June 30 and December 31. On June 30, 2021, several years before their maturity, Swifty retired the bonds at 104 plus accrued Interest. The loss on retirement, ignoring taxes, is $45100 $0. $156400 O $27500 Attempts: 0 of 1 used Sun Arne Sove for Later -145 View Policies Current Attempt in Progress The December 31, 2020, balance sheet of Sheridan Company includes the following items $5900000 9% bonds payable due December 31, 2029 Unamortized premium on bonds payable 159300 The bonds were issued on December 31, 2019, at 103, with interest payable on July 1 and December at of each year. Sheridanuses straight-line amortization On March 1, 2021. Sheridan retired S2360000 of these bonds at 97 plus accrued interest. What should Sheridan record as again on retirement of these bonds? Ignore taxes $133340 O $106200 $140289 $69489 Attempts: Oot 1 used SAW Sive for Later Question 9 of 25 View Policies Current Attempt in Progress A company issues $25750000,78% 20-year bonds to yield on January 1, 2020 Interest is paid on June 30 und December 21. The proceeds from the bonds are $25240335. What is interest expense for 2021, using straight-line amortization? O $2008500 $1984502 O $2020732 O $2033983 5ave for Later Attempts: 0 of 1 used uestion to 25 View Policies Current Attempt in Progress On October 1, 2020 Vaughn Manufacturing issued 4%, 10-year bonds with a face value of $6020000 at 105. Interest is paid on October 1 and April 1, with any premiums or discounts amortized on a straight-line basis. The entry to record the issuance of the bonds would include a credit of O $5719000 to Bonds Payable $301000 to Discount on Bonds Payable, O $301000 to Premium on Bonds Payable. O $120400 to interest Payable. Attempts:0 of 1 used Submit Save for Later View Policies Current Attempt in Progress A company issues $15800000, 98%, 20-year bonds to yield 10% on January 1, 2020, Interest is paid on June 30 and December 31. The proceeds from the bonds are $15528886. Using effective-interest amortization, what will the carrying value of the bonds be on the December 31, 2020 balance sheet? O $15542849 O $15531130 O $15533487 O $15800000 Attempts:0 of 1 used Submit Awe Save for Later

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started