Answered step by step

Verified Expert Solution

Question

1 Approved Answer

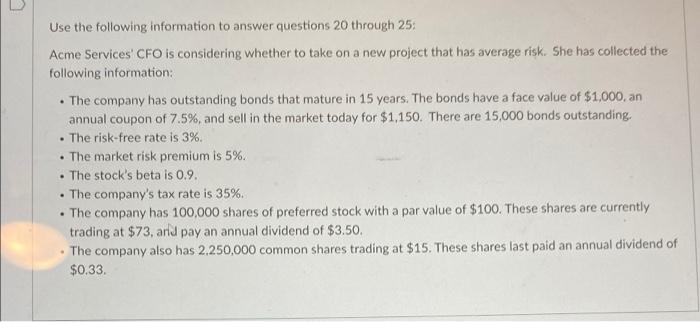

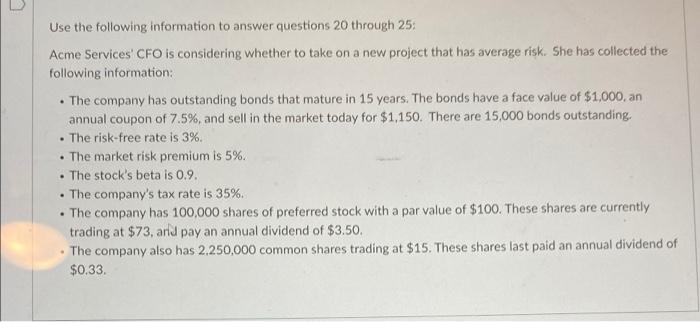

please help w the three qs . Use the following information to answer questions 20 through 25: Acme Services' CFO is considering whether to take

please help w the three qs

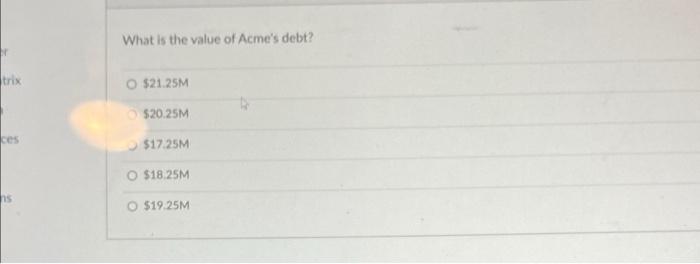

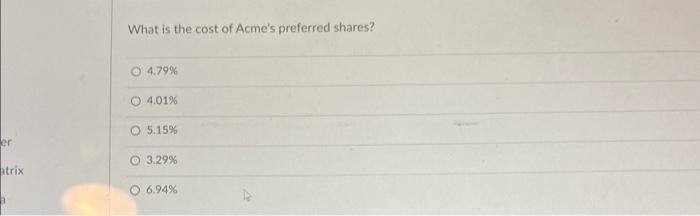

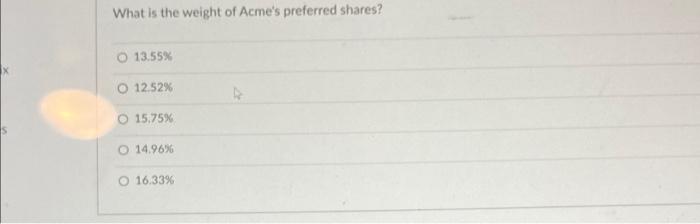

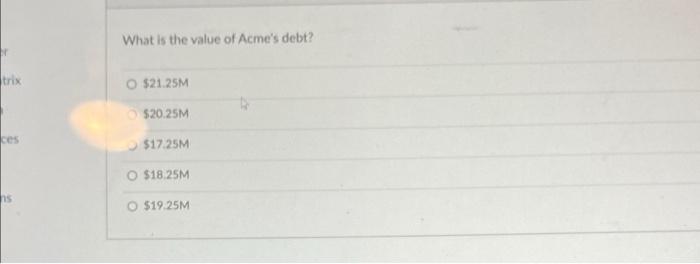

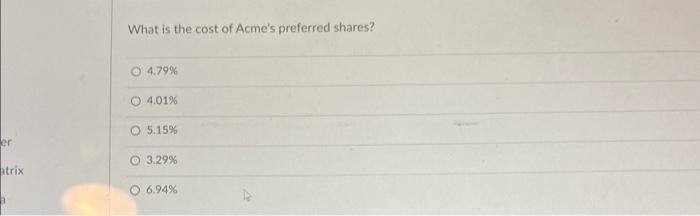

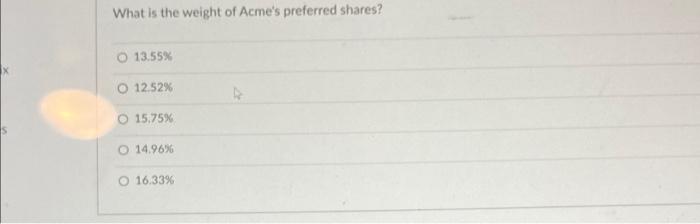

. Use the following information to answer questions 20 through 25: Acme Services' CFO is considering whether to take on a new project that has average risk. She has collected the following information: The company has outstanding bonds that mature in 15 years. The bonds have a face value of $1,000, an annual coupon of 7.5%, and sell in the market today for $1,150. There are 15,000 bonds outstanding. The risk-free rate is 3%. The market risk premium is 5%. The stock's beta is 0.9. The company's tax rate is 35%. The company has 100,000 shares of preferred stock with a par value of $100. These shares are currently trading at $73, and pay an annual dividend of $3.50. The company also has 2.250,000 common shares trading at $15. These shares last paid an annual dividend of $0.33 . . What is the value of Acme's debt? trix O $21.25M $20.25M ces $17.25M O $18.25M s $19.25M What is the cost of Acme's preferred shares? 4.79% 04.01% O 5.15% or 3.29% htrix O 6.94% What is the weight of Acme's preferred shares? 13.55% O 12.52% 15.75% 14.96% 16.33%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started