Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help!! Waterways Corporation has recently acquired a small manufacturing operation in British Columbia that produces one of its more popular items. This plant will

Please help!!

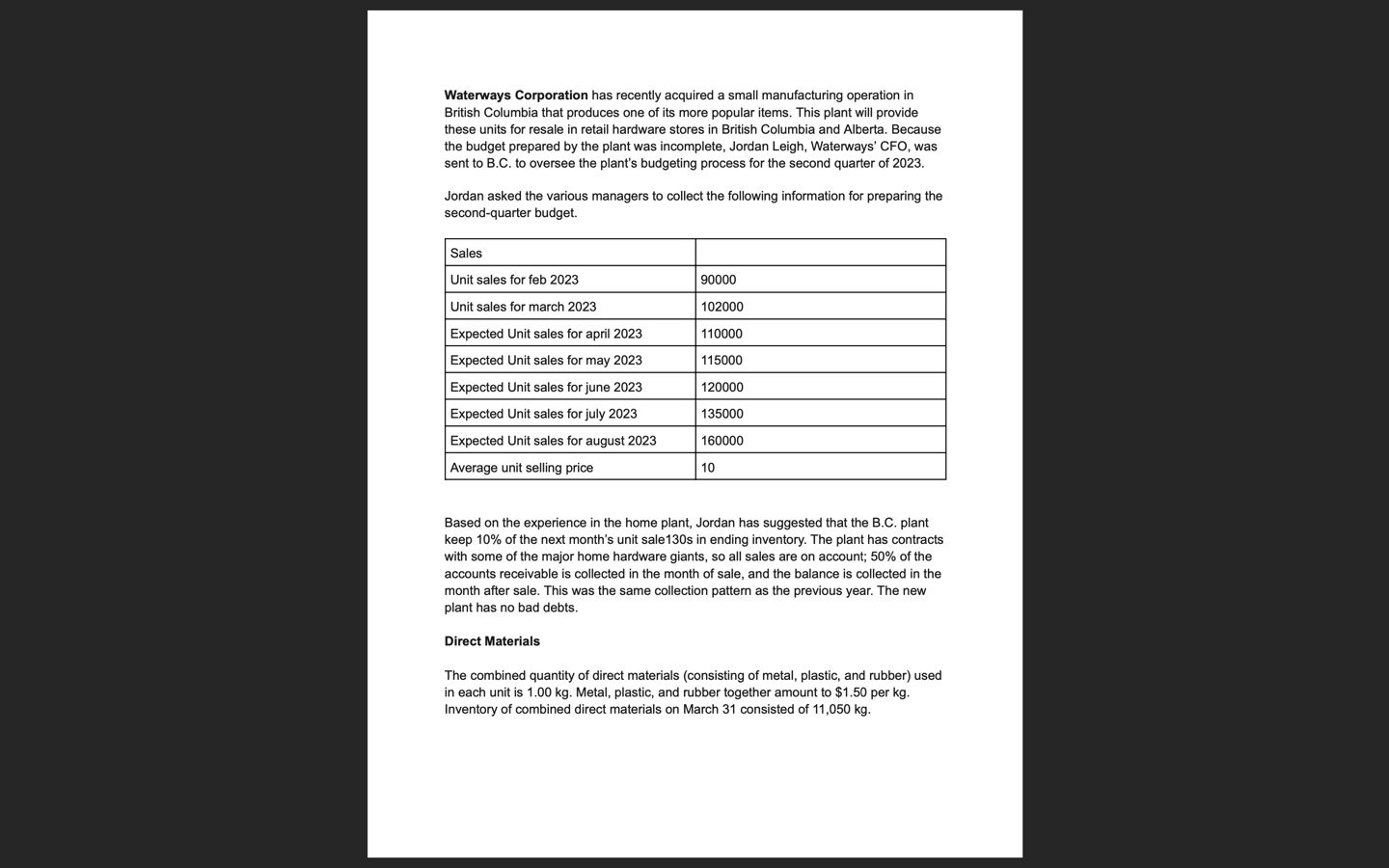

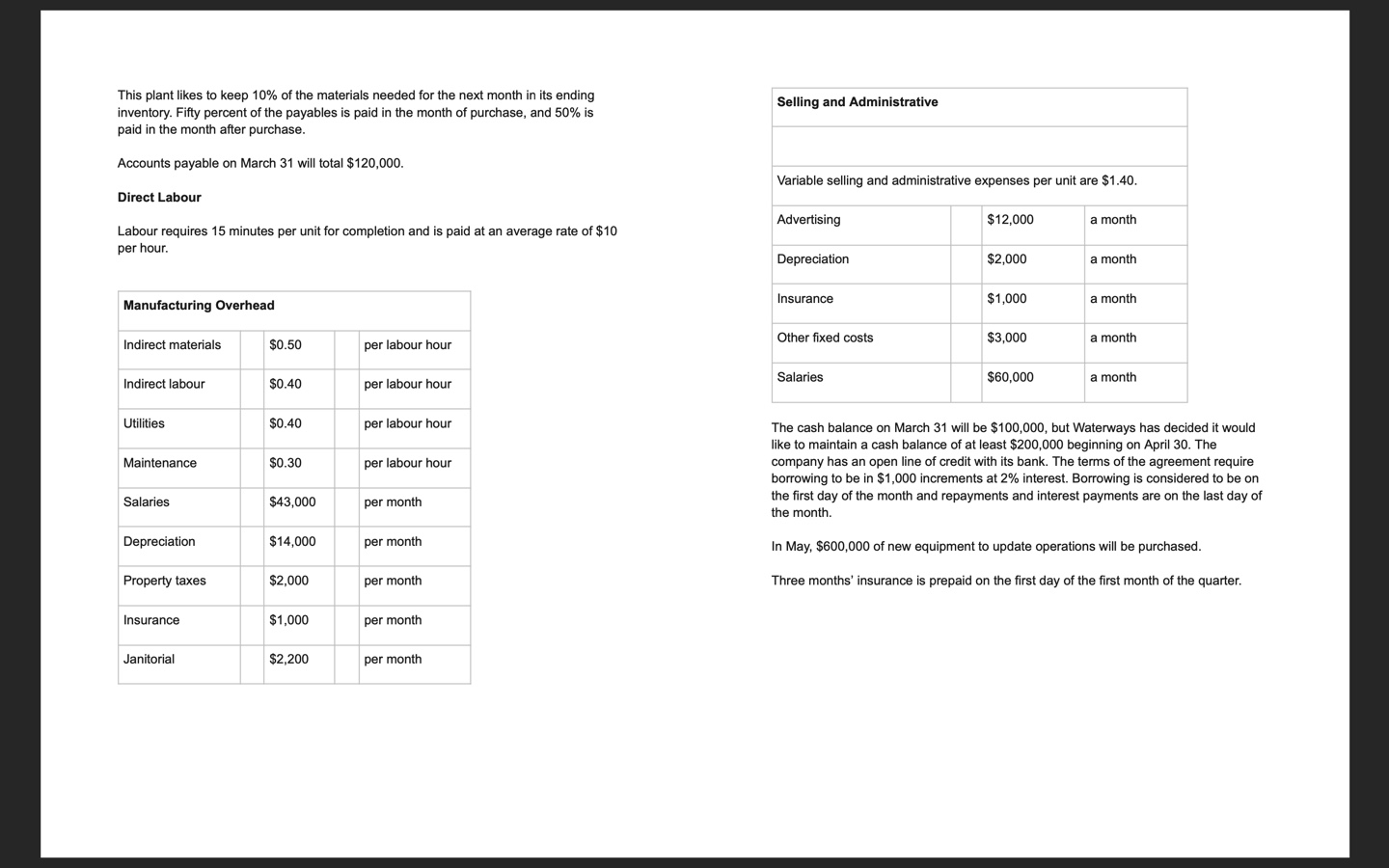

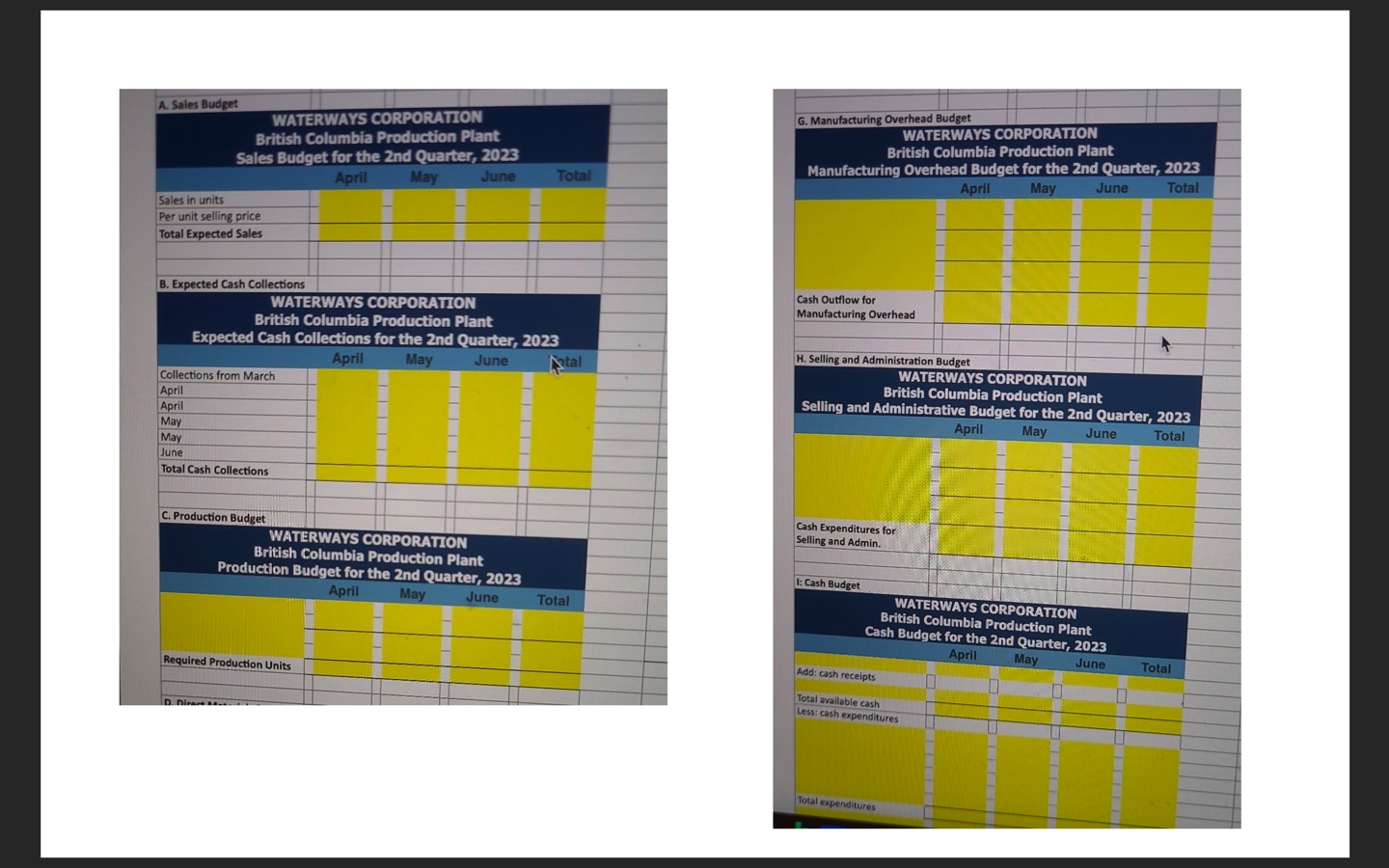

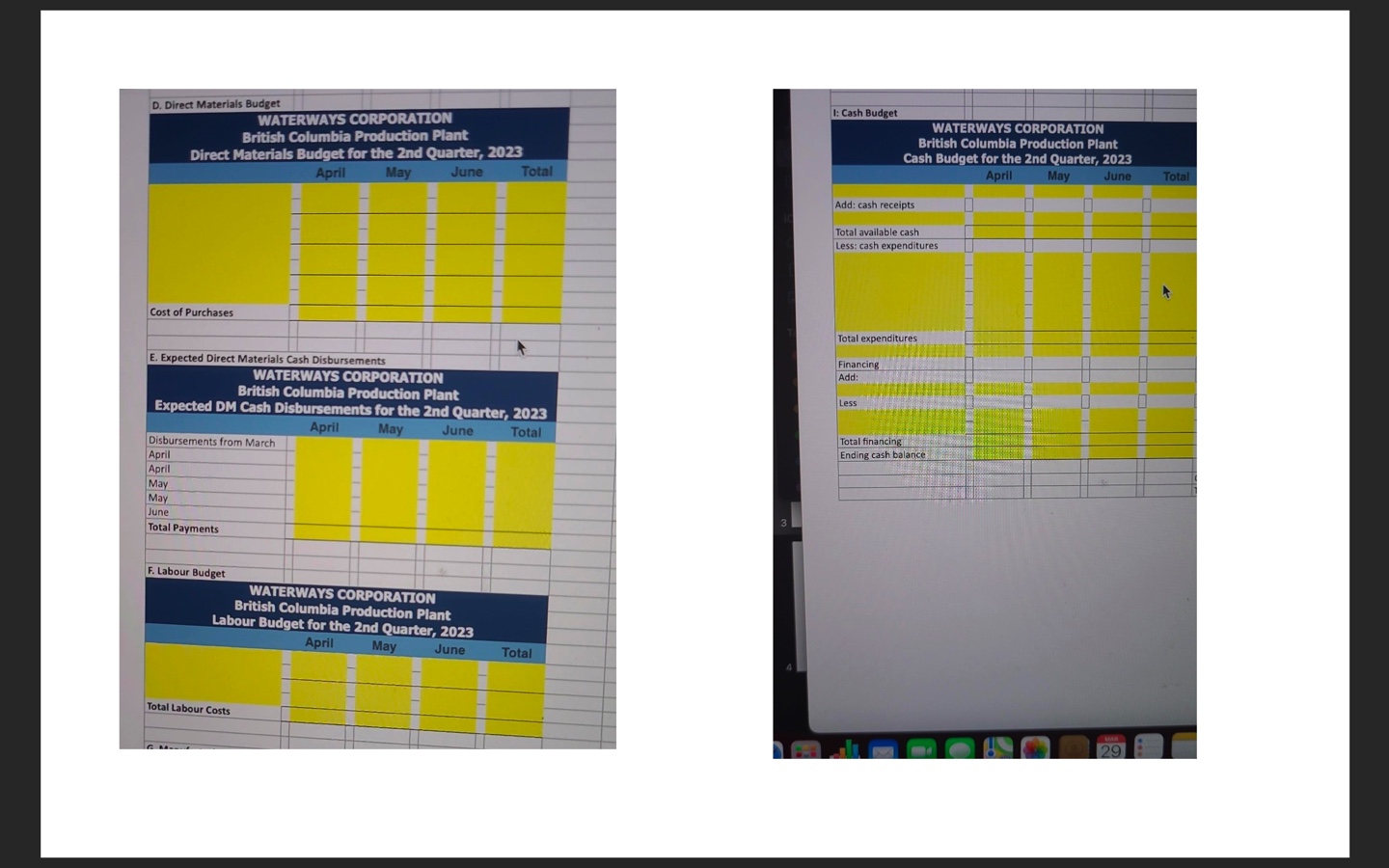

Waterways Corporation has recently acquired a small manufacturing operation in British Columbia that produces one of its more popular items. This plant will provide these units for resale in retail hardware stores in British Columbia and Alberta. Because the budget prepared by the plant was incomplete, Jordan Leigh, Waterways' CFO, was sent to B.C. to oversee the plant's budgeting process for the second quarter of 2023. Jordan asked the various managers to collect the following information for preparing the second-quarter budget. Based on the experience in the home plant, Jordan has suggested that the B.C. plant keep 10% of the next month's unit sale130s in ending inventory. The plant has contracts with some of the major home hardware giants, so all sales are on account; 50% of the accounts receivable is collected in the month of sale, and the balance is collected in the month after sale. This was the same collection pattern as the previous year. The new plant has no bad debts. Direct Materials The combined quantity of direct materials (consisting of metal, plastic, and rubber) used in each unit is 1.00kg. Metal, plastic, and rubber together amount to $1.50 per kg. Inventory of combined direct materials on March 31 consisted of 11,050kg. This plant likes to keep 10% of the materials needed for the next month in its ending inventory. Fifty percent of the payables is paid in the month of purchase, and 50% is paid in the month after purchase. Accounts payable on March 31 will total $120,000. Direct Labour Labour requires 15 minutes per unit for completion and is paid at an average rate of $10 per hour. The cash balance on March 31 will be $100,000, but Waterways has decided it would like to maintain a cash balance of at least $200,000 beginning on April 30 . The company has an open line of credit with its bank. The terms of the agreement require borrowing to be in $1,000 increments at 2% interest. Borrowing is considered to be on the first day of the month and repayments and interest payments are on the last day of the month. In May, $600,000 of new equipment to update operations will be purchased. Three months' insurance is prepaid on the first day of the first month of the quarterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started