Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help! Which of the following is likely to increase the level of interest rates in the economy? Households start saving a larger percentage of

Please help!

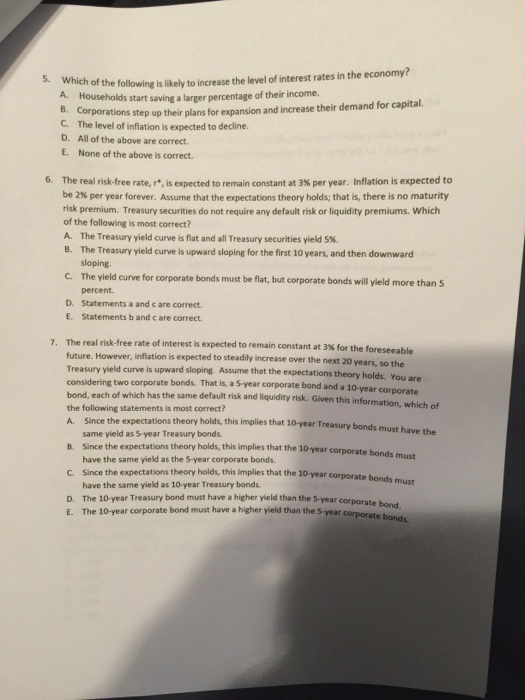

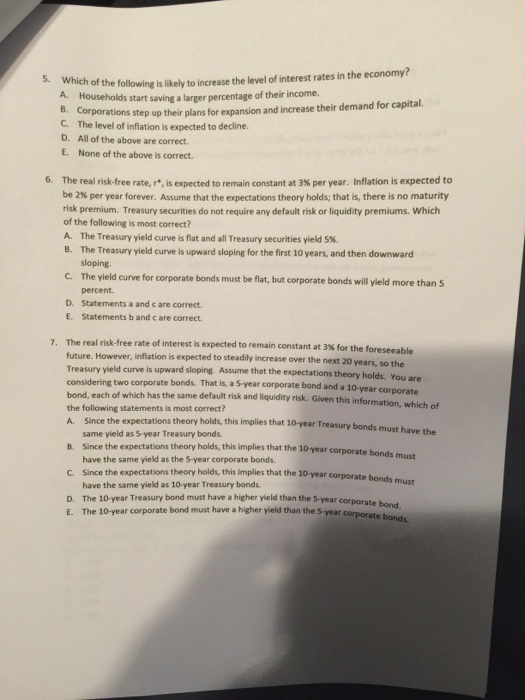

Which of the following is likely to increase the level of interest rates in the economy? Households start saving a larger percentage of their income. Corporations step up their plans for expansion and increase their demand for capital. The level of inflation is expected to decline. All of the above are correct. None of the above is correct. The real risk-free rate, r*. is expected to remain constant at 3percent per year. Inflation is expected to be 2percent per year forever. Assume that the expectations theory holds; that is, there is no maturity risk premium. Treasury securities do not require any default risk or liquidity premiums. Which of the following is most correct? The Treasury yield curve is flat and all Treasury securities yield 5 percent. The Treasury yield curve is upward sloping for the first 10 years, and then downward sloping. The yield curve for corporate bonds must be flat, but corporate bonds will yield more than 5 percent. Statements a and c are correct. Statements b and c are correct. The real risk-free rate of interest is expected to remain constant at 3 percent for the foreseeable future. However, inflation is expected to steadily increase over the next 20 years, so the Treasury yield curve is upward sloping Assume that the expectations theory holds. You are considering two corporate bonds. That is a 5 year corporate bond and a 10-year corporate bond, each of which has the same default risk and liquidity risk. Given this information, which of the following statements is most correct? Since the expectations theory holds, this implies that 10 year Treasury bonds must have the same yield as 5- year Treasury bonds. Since the expectations theory holds, this implies that the 10- year corporate bonds must have the same yield as the 5-year corporate bonds. Since the expectations theory holds, this implies that the 10-year corporate bonds must have the same yield as 10-year Treasury bonds. The 10-year Treasury bond must have a higher yield than the 5-year corporate bond. The 10-year corporate bond must have a higher yield than the 5-year corporate bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started