Answered step by step

Verified Expert Solution

Question

1 Approved Answer

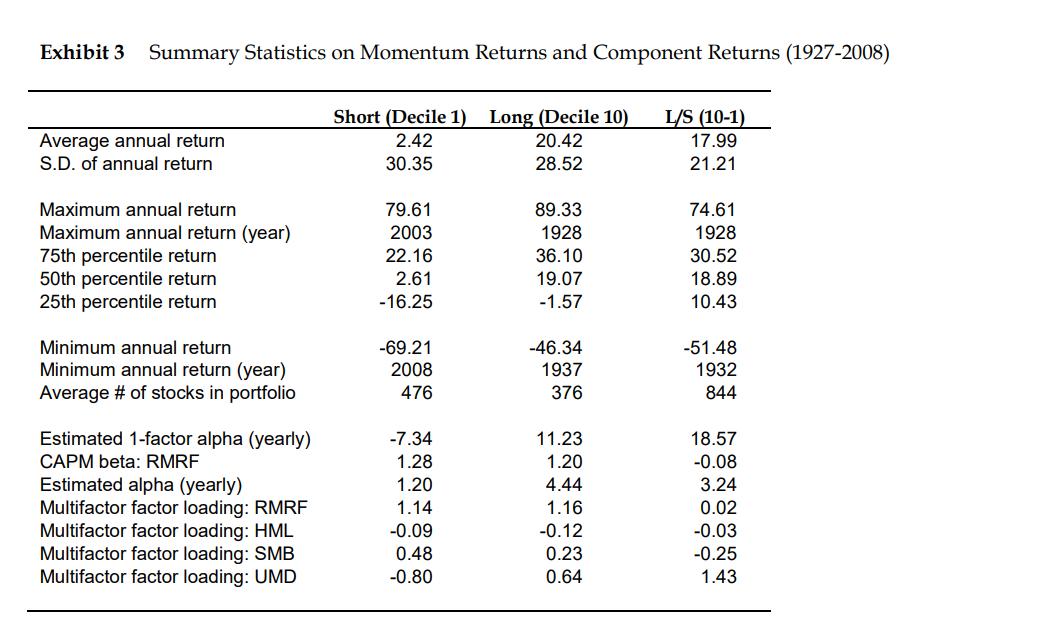

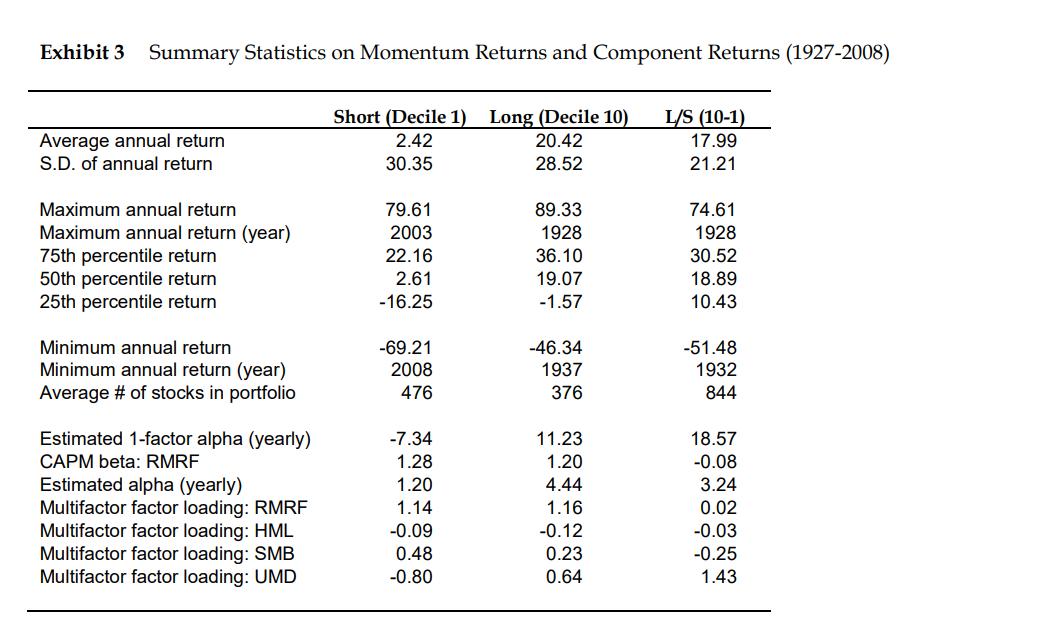

What can be the risk and return tradeoff of the momentum strategy? Exhibit 3 Summary Statistics on Momentum Returns and Component Returns (1927-2008) Average annual

What can be the risk and return tradeoff of the momentum strategy?

Exhibit 3 Summary Statistics on Momentum Returns and Component Returns (1927-2008) Average annual return S.D. of annual return Maximum annual return Maximum annual return (year) 75th percentile return 50th percentile return 25th percentile return Minimum annual return Minimum annual return (year) Average # of stocks in portfolio Estimated 1-factor alpha (yearly) CAPM beta: RMRF Estimated alpha (yearly) Multifactor factor loading: RMRF Multifactor factor loading: HML Multifactor factor loading: SMB Multifactor factor loading: UMD Short (Decile 1) Long (Decile 10) 2.42 20.42 30.35 28.52 79.61 2003 22.16 2.61 -16.25 -69.21 2008 476 -7.34 1.28 1.20 1.14 -0.09 0.48 -0.80 89.33 1928 36.10 19.07 -1.57 -46.34 1937 376 11.23 1.20 4.44 1.16 -0.12 0.23 0.64 L/S (10-1) 17.99 21.21 74.61 1928 30.52 18.89 10.43 -51.48 1932 844 18.57 -0.08 3.24 0.02 -0.03 -0.25 1.43

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The risk and return tradeoff of the momentum strategy can be analyzed based on the summary statistics provided in Exhibit 3 In terms of returns the strategy shows a significant difference between the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started