Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help Will give a thumbs up. There are 6 general journal slides. Each with 40 slots 5 account slides Thank you so much Service

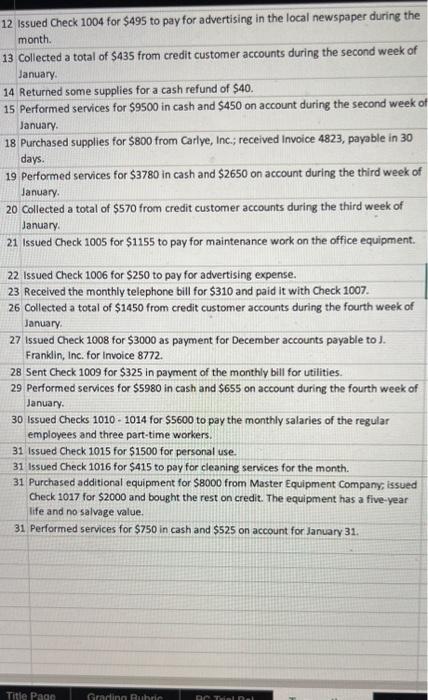

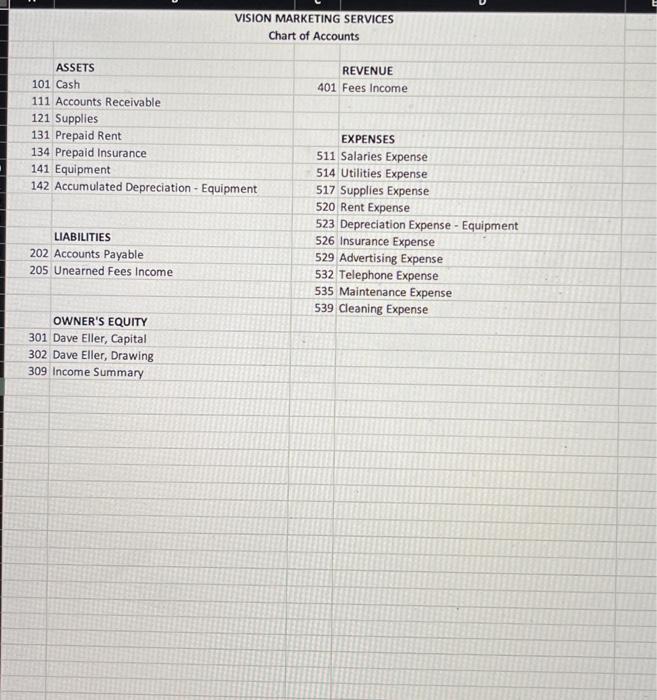

Please help

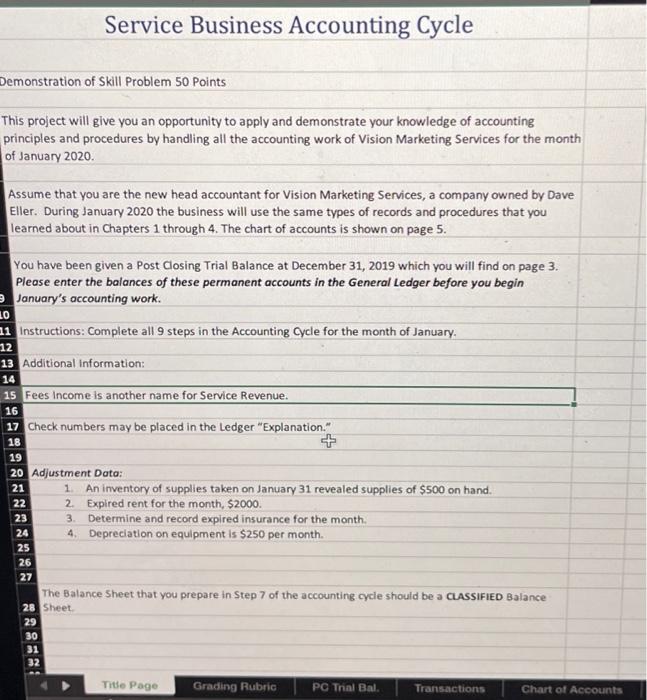

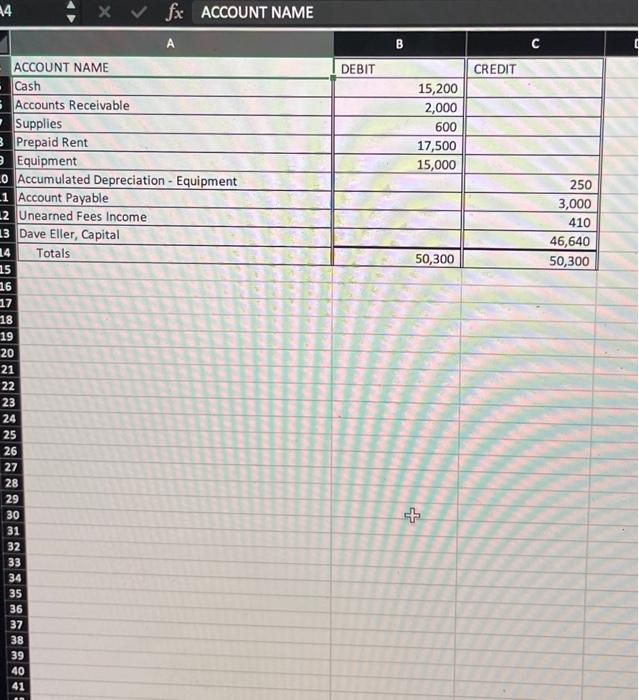

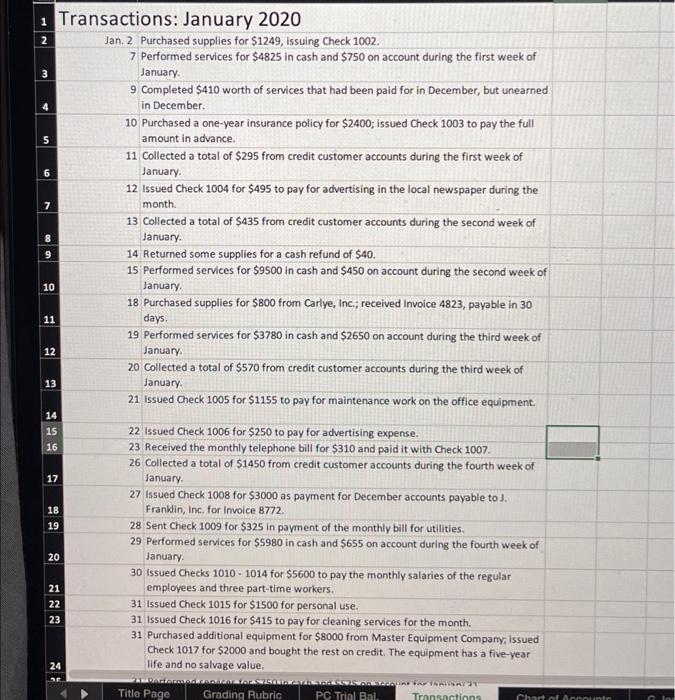

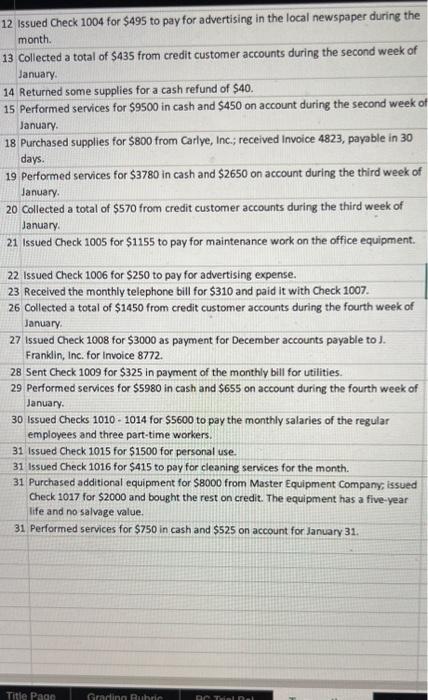

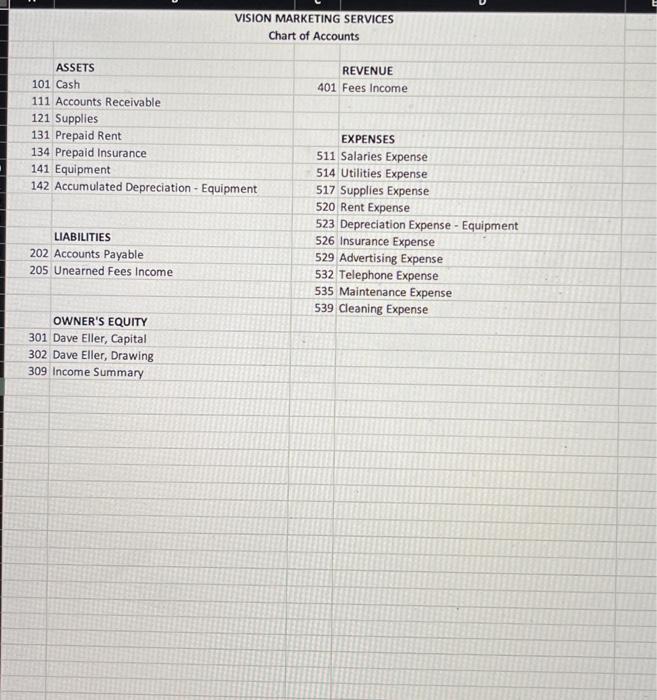

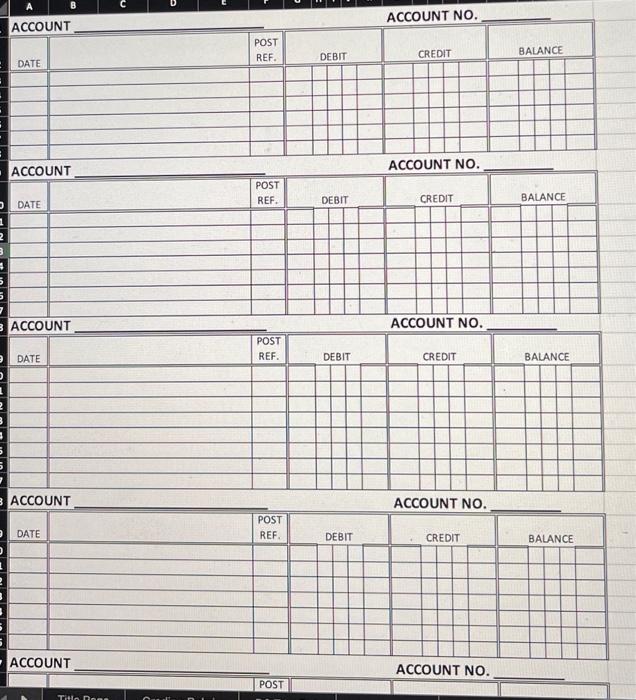

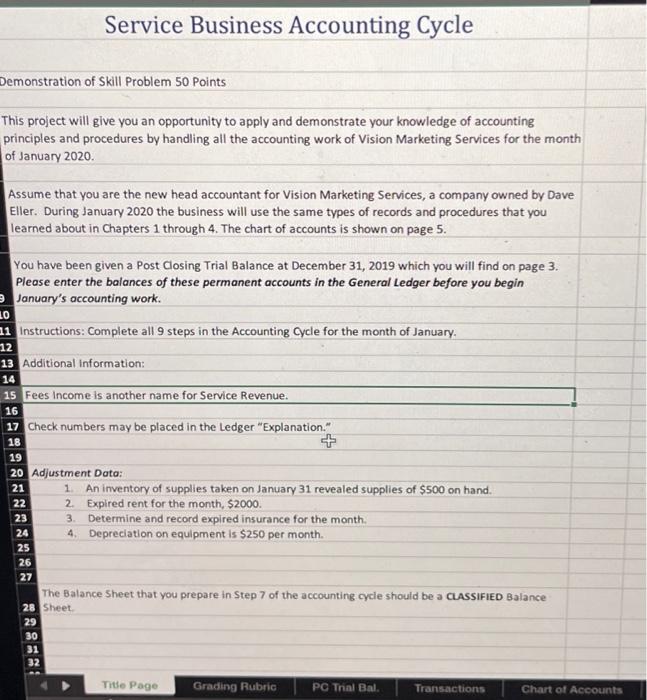

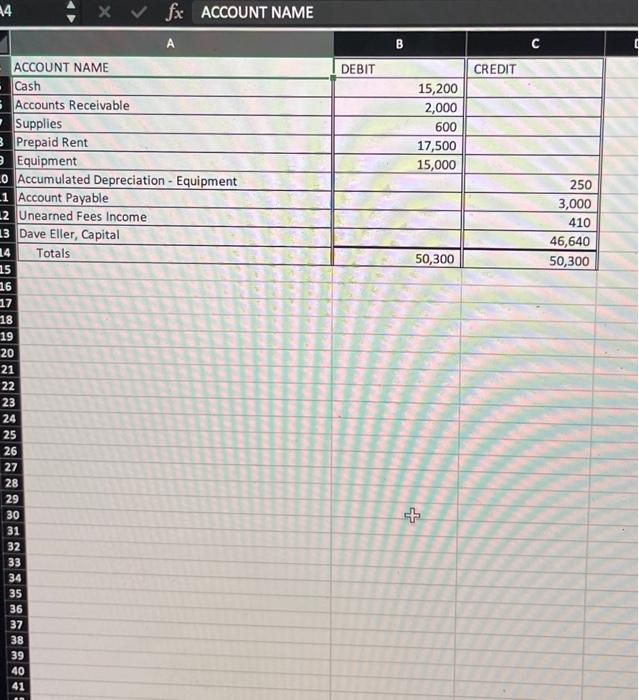

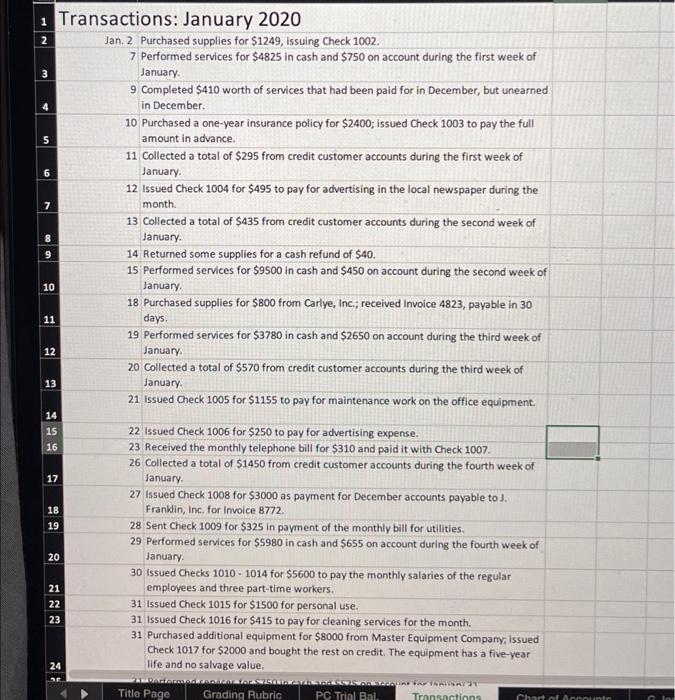

Service Business Accounting Cycle Demonstration of Skill Problem 50 Points This project will give you an opportunity to apply and demonstrate your knowledge of accounting principles and procedures by handling all the accounting work of Vision Marketing Services for the month of January 2020. Assume that you are the new head accountant for Vision Marketing Services, a company owned by Dave Eller. During January 2020 the business will use the same types of records and procedures that you learned about in Chapters 1 through 4 . The chart of accounts is shown on page 5. You have been given a Post Closing Trial Balance at December 31, 2019 which you will find on page 3. Please enter the balances of these permanent accounts in the General Ledger before you begin January's accounting work. Instructions: Complete all 9 steps in the Accounting Cycle for the month of January. Additional information: Fees Income is another name for Service Revenue. Check numbers may be placed in the Ledger "Explanation." 18. 19 20 Adjustment Data: 21. An inventory of supplies taken on January 31 revealed supplies of $500 on hand. 22.2. Expired rent for the month, $2000. 23.3. Determine and record expired insurance for the month. 24.4 . Depreciation on equipment is $250 per month. 25 26 27 The Balance Sheet that you prepare in Step 7 of the accounting cycle should be a CASSIFIED Balance 28 Sheet. 29 30 31 32 fx ACCOUNT NAME ACCOUNT NAME A B C Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation - Equipment Account Payable Unearned Fees Income Dave Eller, Capital Totals DEBIT CREDIT 15,200 2,000 600 17,500 15,000 250 3,000 3,000410 50,300 \begin{tabular}{l} 46,640 \\ \hline 50,300 \end{tabular} 12 Issued Check 1004 for $495 to pay for advertising in the local newspaper during the month. 13 Collected a total of $435 from credit customer accounts during the second week of January. 14 Returned some supplies for a cash refund of $40. 15 Performed services for $9500 in cash and $450 on account during the second week of January. 18 Purchased supplies for $800 from Carlye, Inc.; received Invoice 4823 , payable in 30 days. 19 Performed services for $3780 in cash and $2650 on account during the third week of January. 20 collected a total of $570 from credit customer accounts during the third week of January. 21 Issued Check 1005 for $1155 to pay for maintenance work on the office equipment. 22 issued Check 1006 for $250 to pay for advertising expense. 23 Received the monthly telephone bill for $310 and paid it with Check 1007. 26 Collected a total of $1450 from credit customer accounts during the fourth week of January. 27 issued Check 1008 for $3000 as payment for December accounts payable to J. Franilin, Inc. for invoice 8772 . 28 Sent Check 1009 for $325 in payment of the monthly bill for utilities. 29 Performed services for $5980 in cash and $655 on account during the fourth week of January. 30 Issued Checks 1010 - 1014 for $5600 to pay the monthly salaries of the regular employees and three part-time workers. 31 Issued Check 1015 for $1500 for personal use. 31 issued Check 1016 for $415 to pay for cleaning services for the month. 31 Purchased additional equipment for $8000 from Master Equipment Company issued Check 1017 for $2000 and bought the rest on credit. The equipment has a five-year life and no salvage value. 31 Performed services for $750 in cash and $525 on account for January 31. VISION MARKETING SERVICES Chart of Accounts ASSETS 101 Cash 111 Accounts Receivable 121 Supplies 131 Prepaid Rent 134 Prepaid Insurance 141 Equipment 142 Accumulated Depreciation - Equipment LIABILITIES 202 Accounts Payable 205 Unearned Fees Income OWNER'S EQUITY 301 Dave Eller, Capital 302 Dave Eller, Drawing 309 Income Summary REVENUE 401 Fees Income EXPENSES 511 Salaries Expense 514 Utilities Expense 517 Supplies Expense 520 Rent Expense 523 Depreciation Expense - Equipment 526 Insurance Expense 529 Advertising Expense 532 Telephone Expense 535 Maintenance Expense 539 Cleaning Expense GENERAL JOURNAL PAGE ACCOUNT NO. ACCOUNT ACCOUNT NO. ACCOUNT ACCOUNT NO. ACCOUNT ACCOUNT NO. ACCOUNT ACCOUNT NO. ACCOUNT ACCOUNT NO. POST Service Business Accounting Cycle Demonstration of Skill Problem 50 Points This project will give you an opportunity to apply and demonstrate your knowledge of accounting principles and procedures by handling all the accounting work of Vision Marketing Services for the month of January 2020. Assume that you are the new head accountant for Vision Marketing Services, a company owned by Dave Eller. During January 2020 the business will use the same types of records and procedures that you learned about in Chapters 1 through 4 . The chart of accounts is shown on page 5. You have been given a Post Closing Trial Balance at December 31, 2019 which you will find on page 3. Please enter the balances of these permanent accounts in the General Ledger before you begin January's accounting work. Instructions: Complete all 9 steps in the Accounting Cycle for the month of January. Additional information: Fees Income is another name for Service Revenue. Check numbers may be placed in the Ledger "Explanation." 18. 19 20 Adjustment Data: 21. An inventory of supplies taken on January 31 revealed supplies of $500 on hand. 22.2. Expired rent for the month, $2000. 23.3. Determine and record expired insurance for the month. 24.4 . Depreciation on equipment is $250 per month. 25 26 27 The Balance Sheet that you prepare in Step 7 of the accounting cycle should be a CASSIFIED Balance 28 Sheet. 29 30 31 32 fx ACCOUNT NAME ACCOUNT NAME A B C Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation - Equipment Account Payable Unearned Fees Income Dave Eller, Capital Totals DEBIT CREDIT 15,200 2,000 600 17,500 15,000 250 3,000 3,000410 50,300 \begin{tabular}{l} 46,640 \\ \hline 50,300 \end{tabular} 12 Issued Check 1004 for $495 to pay for advertising in the local newspaper during the month. 13 Collected a total of $435 from credit customer accounts during the second week of January. 14 Returned some supplies for a cash refund of $40. 15 Performed services for $9500 in cash and $450 on account during the second week of January. 18 Purchased supplies for $800 from Carlye, Inc.; received Invoice 4823 , payable in 30 days. 19 Performed services for $3780 in cash and $2650 on account during the third week of January. 20 collected a total of $570 from credit customer accounts during the third week of January. 21 Issued Check 1005 for $1155 to pay for maintenance work on the office equipment. 22 issued Check 1006 for $250 to pay for advertising expense. 23 Received the monthly telephone bill for $310 and paid it with Check 1007. 26 Collected a total of $1450 from credit customer accounts during the fourth week of January. 27 issued Check 1008 for $3000 as payment for December accounts payable to J. Franilin, Inc. for invoice 8772 . 28 Sent Check 1009 for $325 in payment of the monthly bill for utilities. 29 Performed services for $5980 in cash and $655 on account during the fourth week of January. 30 Issued Checks 1010 - 1014 for $5600 to pay the monthly salaries of the regular employees and three part-time workers. 31 Issued Check 1015 for $1500 for personal use. 31 issued Check 1016 for $415 to pay for cleaning services for the month. 31 Purchased additional equipment for $8000 from Master Equipment Company issued Check 1017 for $2000 and bought the rest on credit. The equipment has a five-year life and no salvage value. 31 Performed services for $750 in cash and $525 on account for January 31. VISION MARKETING SERVICES Chart of Accounts ASSETS 101 Cash 111 Accounts Receivable 121 Supplies 131 Prepaid Rent 134 Prepaid Insurance 141 Equipment 142 Accumulated Depreciation - Equipment LIABILITIES 202 Accounts Payable 205 Unearned Fees Income OWNER'S EQUITY 301 Dave Eller, Capital 302 Dave Eller, Drawing 309 Income Summary REVENUE 401 Fees Income EXPENSES 511 Salaries Expense 514 Utilities Expense 517 Supplies Expense 520 Rent Expense 523 Depreciation Expense - Equipment 526 Insurance Expense 529 Advertising Expense 532 Telephone Expense 535 Maintenance Expense 539 Cleaning Expense GENERAL JOURNAL PAGE ACCOUNT NO. ACCOUNT ACCOUNT NO. ACCOUNT ACCOUNT NO. ACCOUNT ACCOUNT NO. ACCOUNT ACCOUNT NO. ACCOUNT ACCOUNT NO. POST Will give a thumbs up.

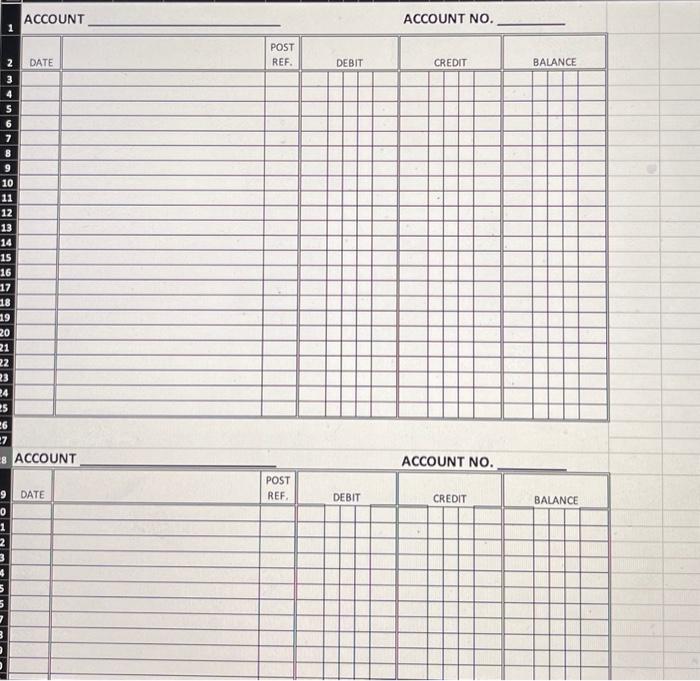

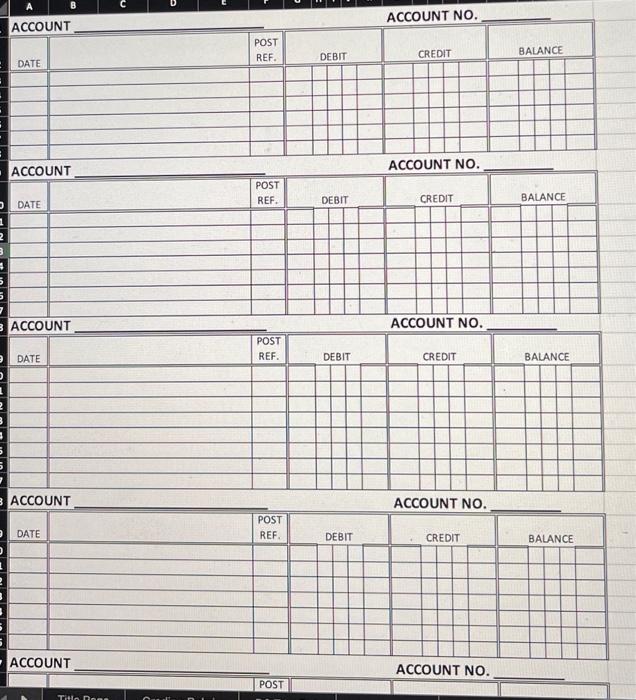

There are 6 general journal slides. Each with 40 slots

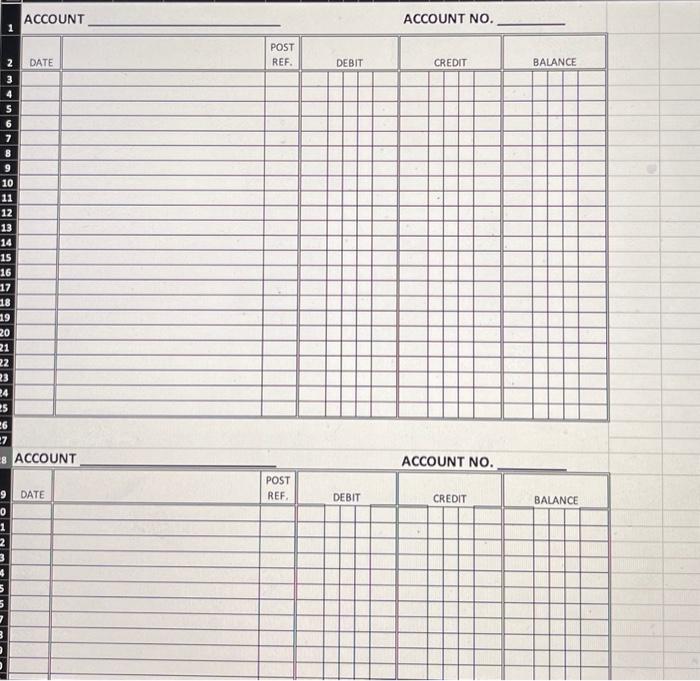

5 account slides

Thank you so much

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started