Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! will give great review. he table below presents bid-ask quotes for Swiss Franes (SF) from several currency dealers around the world. Please answer

please help! will give great review.

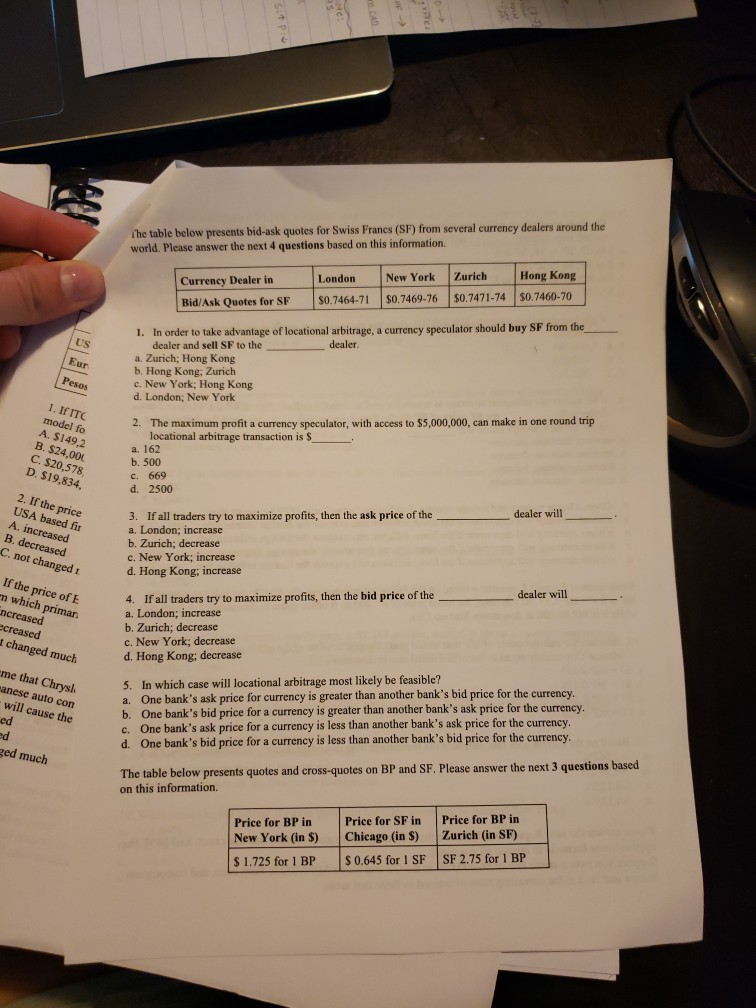

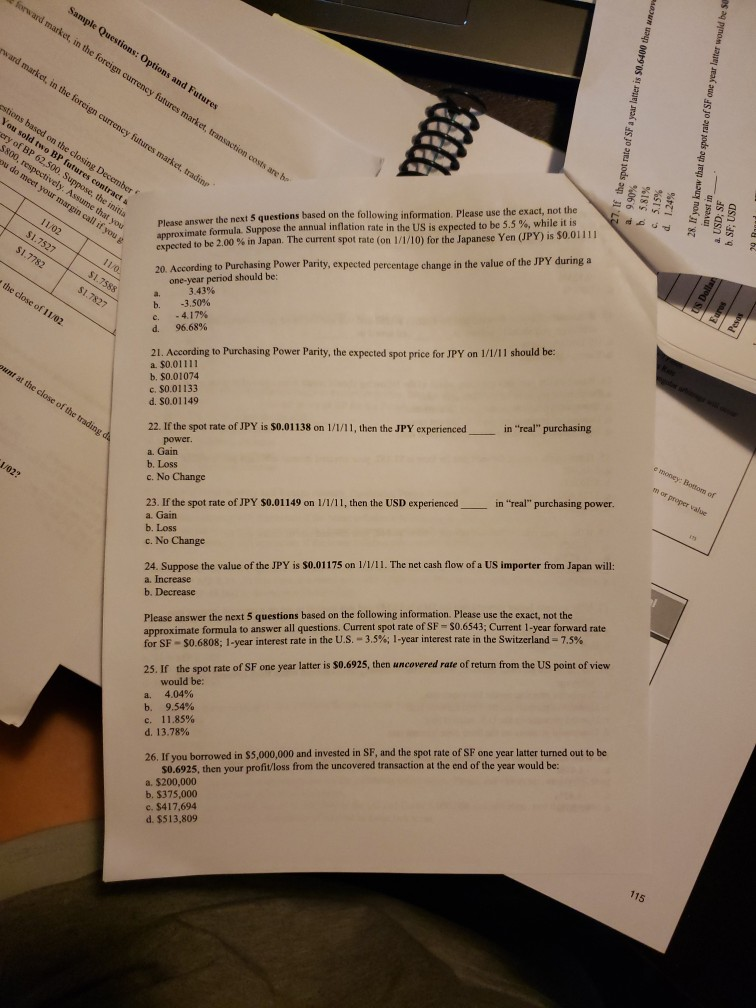

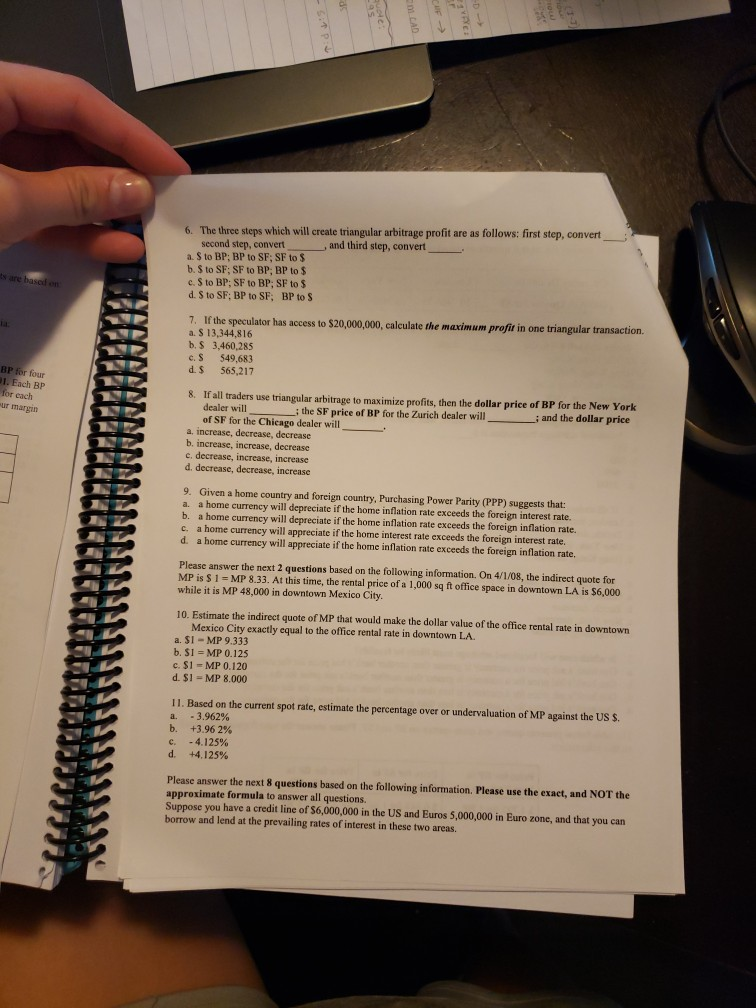

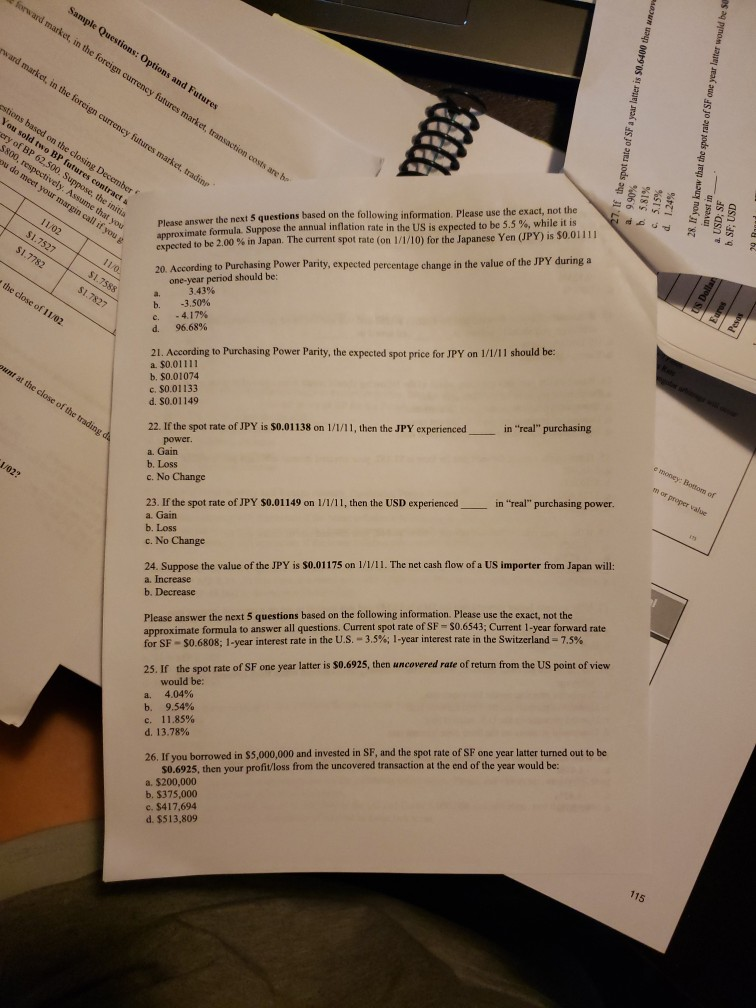

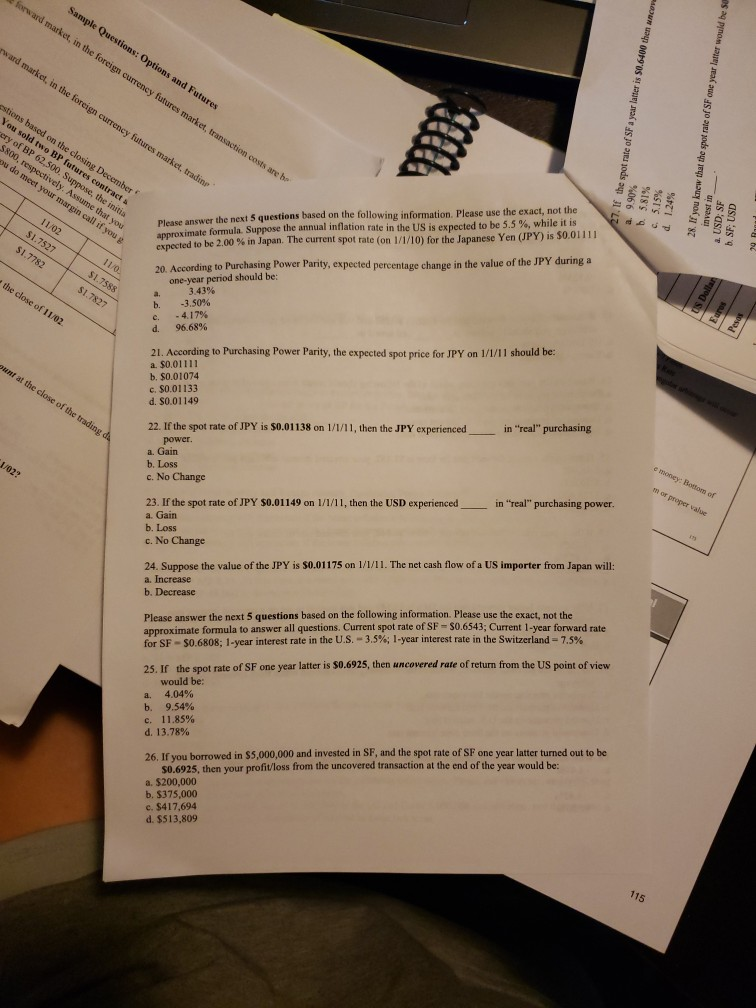

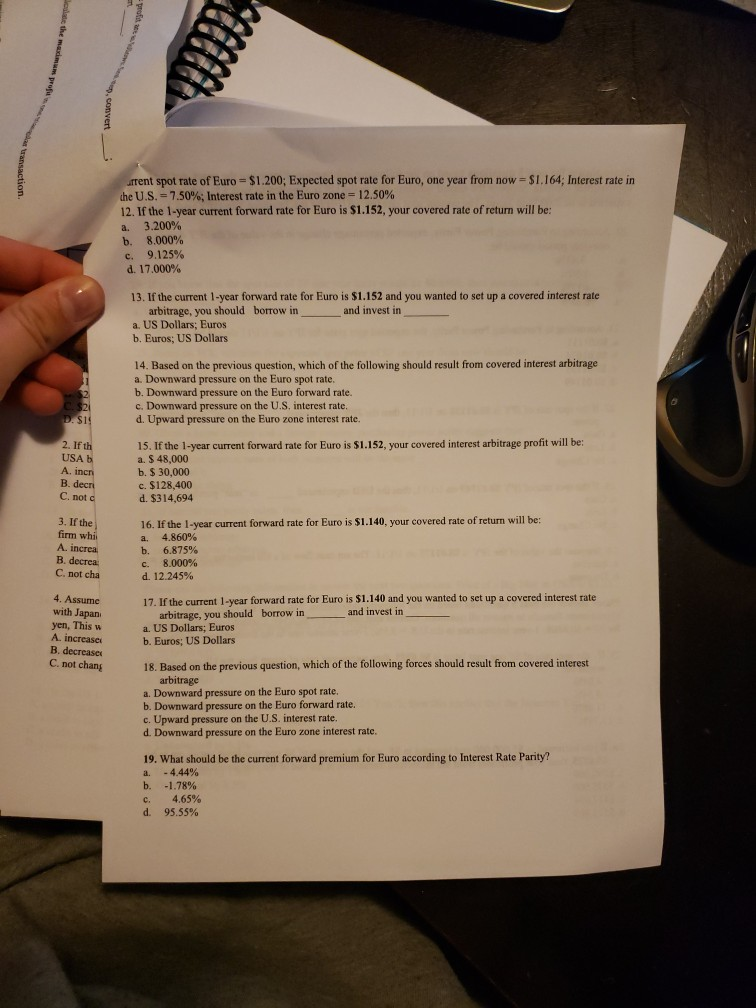

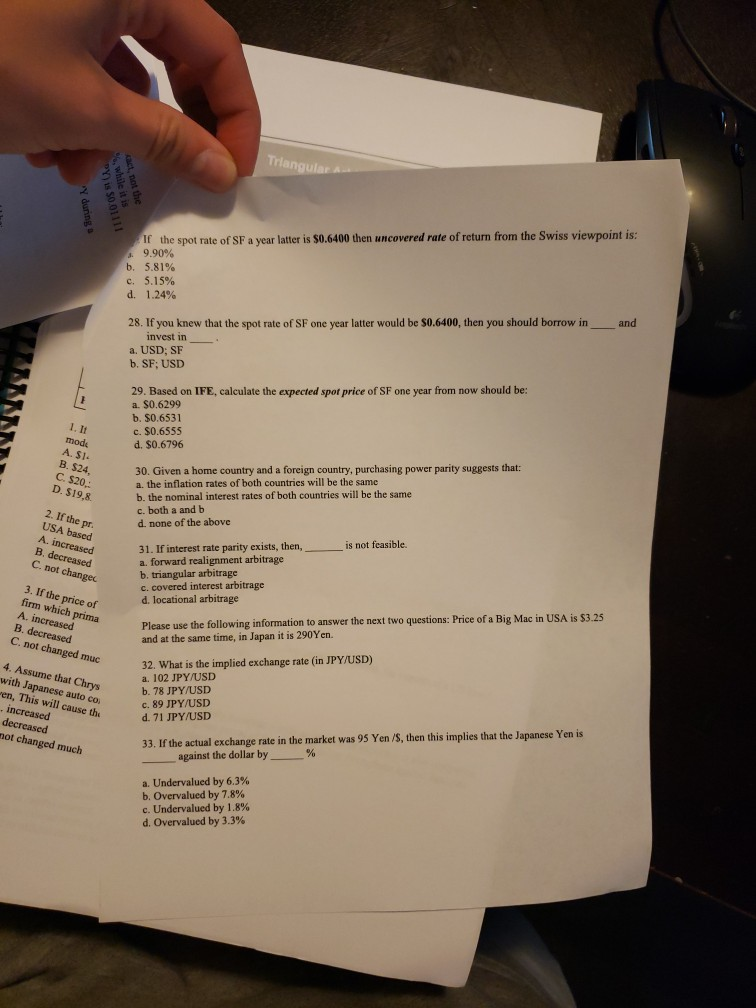

he table below presents bid-ask quotes for Swiss Franes (SF) from several currency dealers around the world. Please answer the next 4 questions based on this information. Hong Kong New York Zurich London Currency Dealer in S0.7469-76 S0.7471-74 S0.7460-70 Bid/Ask Quotes for SFS0.7464-71 . In order to take advantage of locational arbitrage, a currency speculator should buy SF from the U's dealer and sell SF to the a. Zurich; Hong Kong b. Hong Kong; Zurich Pesosc. New York; Hong Kong d. London; New York The maximum profit a currency speculator, with access to $5,000,000, can make in one round trip locational arbitrage transaction is S model 2. A, Co S24,0062 b. 500 D. $19 2. If the c. 669 d. 2500 dealer will 3. If all traders try to maximize profits, then the ask price of tho inereased Lomdons:inereasc b. Zurich; decrease c. New York; increase d. Hong Kong; increase ed nr the price ofE primar dealer will 4. If all traders try to maximize profits, then the bid price of the a. London; increase b. Zurich; decrease c, New York; decrease d. Hong Kong; decrease me that C 5. In which case will locational arbitrage most likely be feasible? a. One bank's ask price for currency is greater than another bank's bid price for the currency b. One bank's bid price for a currency c. One bank's ask price for a currency is less than another bank's ask price for the currency. d. One bank's bid price for a currency is less than another bank's bid price for the currency Il cause the ed is greater than another bank's ask price for the currency ed much The table below presents quotes and cross-quotes on BP and SF. Please answer the next 3 questions b on this information. ased Price for BP in Price for SF in Price for BP in New York (in S) Chicago (in S) Zurich (in SF) $ 1.725 for 1 BP S0.645 for 1 SF SF 2.75 for 1 BP estions based on the following information. Please use the exact, not the approximate formula expected to be 2.00 % Japan. The current spot rate (on 1/1/10) for the Japanese Yen (JPY) is S0.01111 20. According to Purchasing Power Parity, expected percentage change in the value of the JPY during a one-year period should be: 43% -3.50% -4.17% 96.68% b. e. d. 21. According to Purchasing Power Parity, the expected spot price for JPY on 1/1/11 should be: a.$0.01111 b. $0.01074 c. $0.01133 d. $0.01149 22. If the spot rate of JPY is $0.01138 on 1/1/11, then the JPY experienced in "real" purchasing power. a. Gain bLoss c. No Change 23. If the spot rate of JPY $0.01149 on 1/1/11, then the USD experiencedi a. Gain b. Loss c. No Change or in "real" purchasing power 24. Suppose the value of the JPY is $0.01175 on 1/1/11. The net cash flow of a US importer from Japan will: a. Increase b. Decrease Please answer the next 5 questions based on the following information. Please use the exact, not the approximate formula to answer all questions. Current spot rate of SF- $0.6543; Current 1-year forward rate for SF-S06808 1-year interest rate in the U.S. 3.5%; 1-year interest rate in the Switzerland 7.5% the spot rate of SF one year latter is s0.925, then ancovered rate of return from the US point of view 25. Ir would be: 4.04% b. 9,54% c. 11.85% d. 13.78% 26. If you borrowed in $5,000,000 and invested in SF, and the spot rate of SF one year latter turned out to be S0.6925, then your profit/loss from the uncovered transaction at the end of the year would be a. $200,000 b. $375,000 e. $417,694 d. $513,809 75 6. The three steps which will create triangular arbitrage profit are as follows: first step, convert , and third step, convert second step, convert a. S to BP: BP to SF; SF to S b. $ to SF; SF to BP; BP to $ c. S to BP: SF to BP: SF to $ d. S to SF: BP to SF; BP to S ts are 7. If the speculator has access to $20,000,000, calculate the maximum profit in one triangular transaction a. $ 13,344,816 b. S 3,460,285 c.S 549,683 d. $ 565,217 BP fi 1. Each BP for each 8. If all traders use triangular arbitrage to maximize profits, then the dollar price of BP for the New York and the dollar price dealer will _ _, the SF price of BP for the Zurich dealer will ur margin of SF for the Chicago dealer will a, increase, decrease, decrease b. increase, increase, decrease c, decrease, increase, increase d. decrease, decrease, increase Xw9. Given a home country and foreign country, Purchasing Power Parity (PPP) suggests that: a home currency will depreciate if the home inflation rate exceeds the foreign interest rate. a. b. a home currency will depreciate if the home inflation rate exceeds the foreign inflation rate. a home currency will appreciate if the home interest rate exceeds the foreign interest rate. d. c. a home currency will appreciate if the home inflation rate exceeds the foreign inflation rate. Please answer the next 2 questions based on the following information. On 4/1/08, the indirect quote for MP is S 1-MP 8.33. At this time, the rental price of a 1,000 sq ft office space in downtown LA is $6,000 while it is MP 48,000 in downtown Mexico City 10. Estimate the indirect quote of MP that would make the dollar value of the office rental rate in downtown Mexico City exactly equal to the office rental rate in downtown LA. a. SI-MP 9.333 b. S1-MP 0.125 c. S1 MP0.120 d. $1 MP 8.000 11. Based on the current spot rate, estimate the percentage over or undervaluation of MP against the US $. a. -3.962% b. +396 2% c. -4.125% d. +4,125% Please answer the next 8 questions based on the following information. Please use the exact, and NOT the approximate formula to answer all questions. Suppose you have a credit line of $6,000,000 in the US and Euros 5,000,000 in Euro zone, and that you can borrow and lend at the prevailing rates of interest in these two areas. estions based on the following information. Please use the exact, not the approximate formula expected to be 2.00 % Japan. The current spot rate (on 1/1/10) for the Japanese Yen (JPY) is S0.01111 20. According to Purchasing Power Parity, expected percentage change in the value of the JPY during a one-year period should be: 43% -3.50% -4.17% 96.68% b. e. d. 21. According to Purchasing Power Parity, the expected spot price for JPY on 1/1/11 should be: a.$0.01111 b. $0.01074 c. $0.01133 d. $0.01149 22. If the spot rate of JPY is $0.01138 on 1/1/11, then the JPY experienced in "real" purchasing power. a. Gain bLoss c. No Change 23. If the spot rate of JPY $0.01149 on 1/1/11, then the USD experiencedi a. Gain b. Loss c. No Change or in "real" purchasing power 24. Suppose the value of the JPY is $0.01175 on 1/1/11. The net cash flow of a US importer from Japan will: a. Increase b. Decrease Please answer the next 5 questions based on the following information. Please use the exact, not the approximate formula to answer all questions. Current spot rate of SF- $0.6543; Current 1-year forward rate for SF-S06808 1-year interest rate in the U.S. 3.5%; 1-year interest rate in the Switzerland 7.5% the spot rate of SF one year latter is s0.925, then ancovered rate of return from the US point of view 25. Ir would be: 4.04% b. 9,54% c. 11.85% d. 13.78% 26. If you borrowed in $5,000,000 and invested in SF, and the spot rate of SF one year latter turned out to be S0.6925, then your profit/loss from the uncovered transaction at the end of the year would be a. $200,000 b. $375,000 e. $417,694 d. $513,809 75 estions based on the following information. Please use the exact, not the approximate formula expected to be 2.00 % Japan. The current spot rate (on 1/1/10) for the Japanese Yen (JPY) is S0.01111 20. According to Purchasing Power Parity, expected percentage change in the value of the JPY during a one-year period should be: 43% -3.50% -4.17% 96.68% b. e. d. 21. According to Purchasing Power Parity, the expected spot price for JPY on 1/1/11 should be: a.$0.01111 b. $0.01074 c. $0.01133 d. $0.01149 22. If the spot rate of JPY is $0.01138 on 1/1/11, then the JPY experienced in "real" purchasing power. a. Gain bLoss c. No Change 23. If the spot rate of JPY $0.01149 on 1/1/11, then the USD experiencedi a. Gain b. Loss c. No Change or in "real" purchasing power 24. Suppose the value of the JPY is $0.01175 on 1/1/11. The net cash flow of a US importer from Japan will: a. Increase b. Decrease Please answer the next 5 questions based on the following information. Please use the exact, not the approximate formula to answer all questions. Current spot rate of SF- $0.6543; Current 1-year forward rate for SF-S06808 1-year interest rate in the U.S. 3.5%; 1-year interest rate in the Switzerland 7.5% the spot rate of SF one year latter is s0.925, then ancovered rate of return from the US point of view 25. Ir would be: 4.04% b. 9,54% c. 11.85% d. 13.78% 26. If you borrowed in $5,000,000 and invested in SF, and the spot rate of SF one year latter turned out to be S0.6925, then your profit/loss from the uncovered transaction at the end of the year would be a. $200,000 b. $375,000 e. $417,694 d. $513,809 75 /urrent spot rate of Euro-$1.200; Expected spot rate for Euro, one year from now = $1.164; Interest rate in the US.-7.50%; Interest rate in the Euro zone 12.50% 12. If the 1-year current forward rate for Euro is $1.152, your covered rate of return will be: a. 3.200% b. 8.000% C, 9.125% d. 17.000% 13. If the current 1-year forward rate for Euro is $1.152 and you wanted to set up a covered interest rate arbitrage, you should borrow in and invest in a. US Dollars; Euros b. Euros; US Dollars 14. Based on the previous question, which of the following should result from covered interest arbitrage a. Downward pressure on the Euro spot rate. b. Downward pressure on the Euro forward rate. c. Downward pressure on the U.S. interest rate. d. Upward pressure on the Euro zone interest rate. 15. If the 1-year current forward rate for Euro is $1.152, your covered interest arbitrage profit will be: a. $ 48,000 b. $30,000 c. $128,400 d. $314,694 2. I f th A, incr, B. decri C. not c 3. If the 16. If the 1-year current forward rate for Euro is $1.140, your covered rate of return will be: firm w a. 4.860% b. 6.875% c. 8.000% d. 12.245% A. increa B. decrea C, not cha 4. Assume with Japani yen, This w A. increase B. decrease C. not chang 17. If the current 1-year forward rate for Euro is $1.140 and you wanted to set up a covered interest rate arbitrage, you should borrow in a. US Dollars; Euros b. Euros; US Dollars and invest in 18. Based on the previous question, which of the following forces should result from covered interest arbitrage a. Downward pressure on the Euro spot rate. b. Downward pressure on the Euro forward rate. c. Upward pressure on the U.S. interest rate d. Downward pressure on the Euro zone interest rate. 19. What should be the current forward premium for Euro according to Interest Rate Parity? -4.44% -1.78% 4.65% 95.55% b. c. d. If the spot rate of SF a year latter is $0.6400 then uncovered rate of return from the Swiss viewpoint is: 9.90% b. 5.81% c. 5.15% d. 1.24% 28. If you knew that the spot rate of SF one year latter would be $0.6400, then you should borrow in and invest in a. USD; SF b. SF; USD 29. Based on IFE, calculate the expected spot price of SF one year from now should be: a. $0.6299 b. $0.6531 c. $0.6555 d. $0.6796 1. It mode A. $1 B. $24, C. $20,: D. $19,8. 30. Given a home country and a foreign country, purchasing power parity suggests that: b. the nominal interest rates of both countries will be the same c. both a and b d. none of the above 2. If the pr. USA based dcrad31. I interest rate parity exists, then,is not feasible. decreaseda. forward realignment arbitrage not changec c. covered interest arbitrage d. locational arbitrage 3. If the price of firm which prima following information to answer the next two questions: Price of a Big Mac in USA is $3.25 Please use the and at the same time, in Japan it is 290Yen. A. increased C. not changed muc3 10 YSD 32. What is the implied exchange rate (in JPY/USD) 4. Assume that Chrys with Japanese auto co en, This will cause the b. 78 JPY/USD c. 89 JPY/USD d. 71 JPY/USD increased decreased ot changed much 33. If the actual exchange rate in the market was 95 Yen/S, then this implies that the Japanese Yen is against the dollar by a. Undervalued by 6.3% b. Overvalued by 7.8% c. Undervalued by 1.8% d. Overvalued by 3.3%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started