Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help will give great review- must show all steps Please do and write it in a way that is easy to understand Frieda Falcon

Please help will give great review- must show all steps

Please help will give great review- must show all steps

Please do and write it in a way that is easy to understand

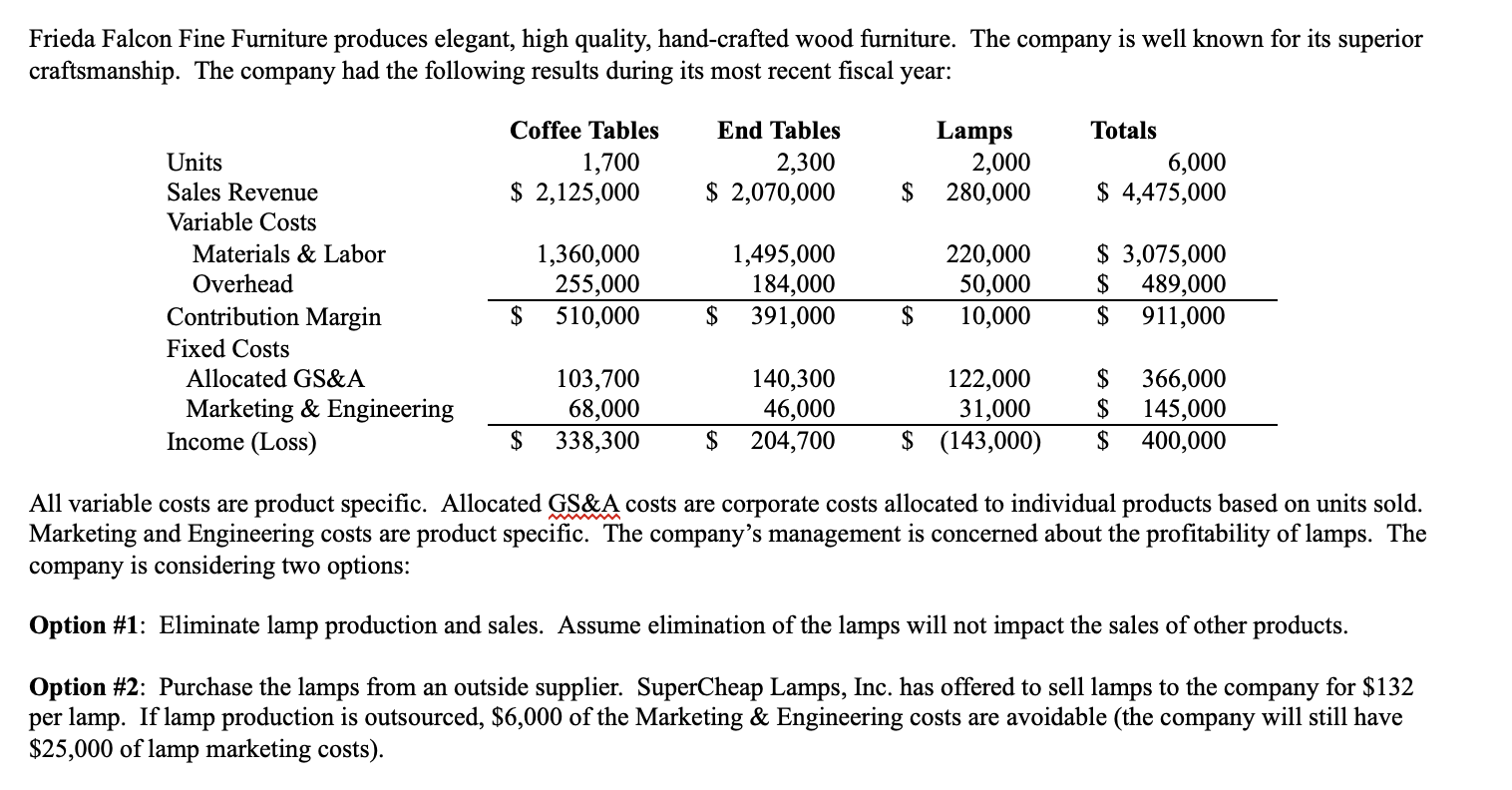

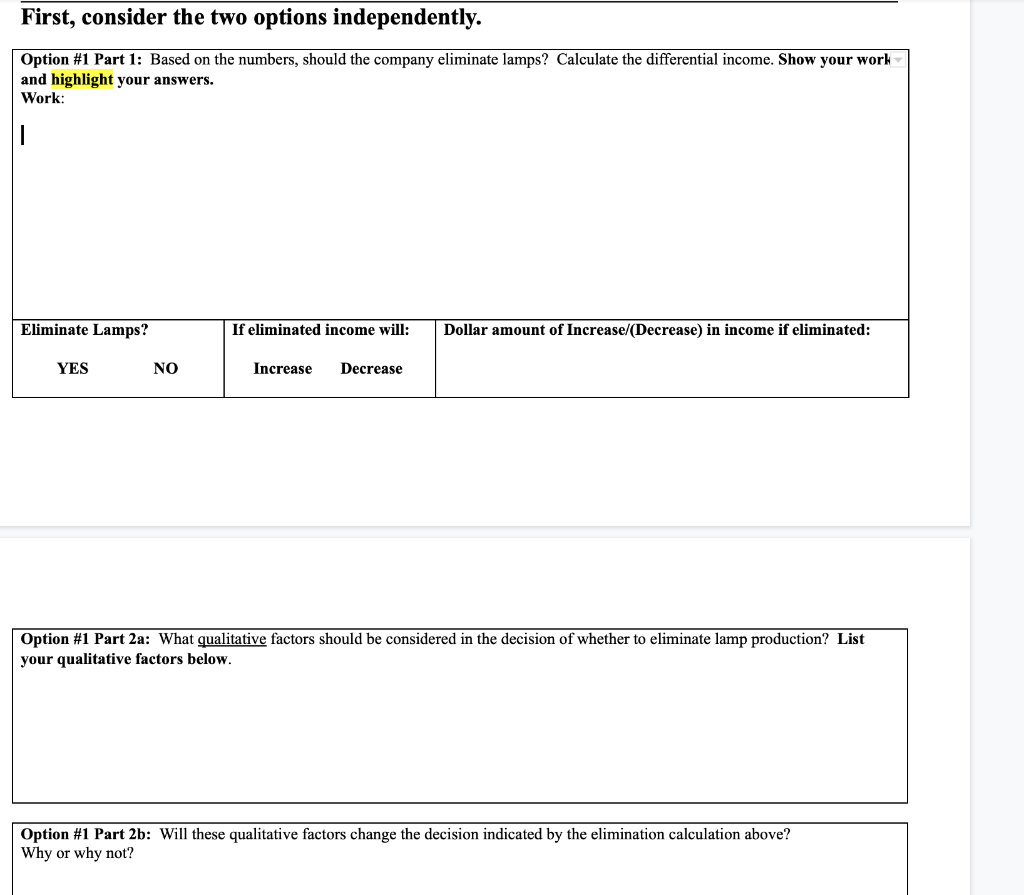

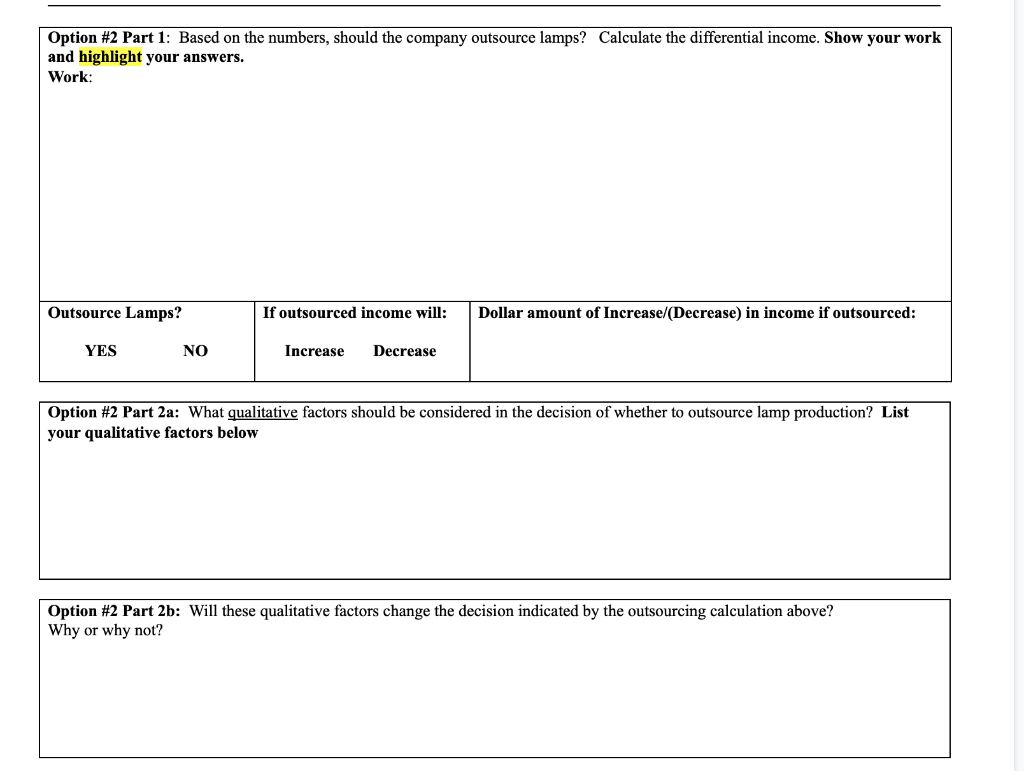

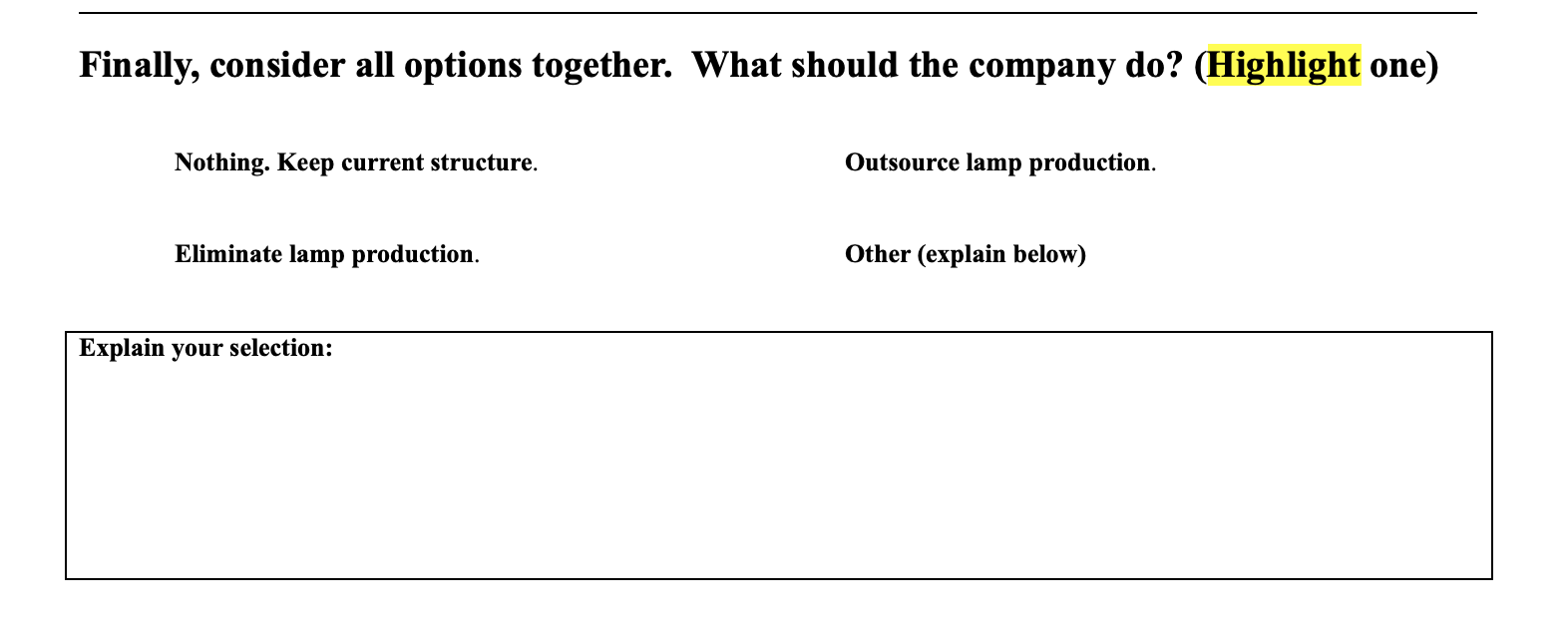

Frieda Falcon Fine Furniture produces elegant, high quality, hand-crafted wood furniture. The company is well known for its superior craftsmanship. The company had the following results during its most recent fiscal year: Coffee Tables 1,700 $ 2,125,000 End Tables 2,300 $ 2,070,000 Lamps 2,000 280,000 Totals 6,000 $ 4,475,000 $ Units Sales Revenue Variable Costs Materials & Labor Overhead Contribution Margin Fixed Costs Allocated GS&A Marketing & Engineering Income (Loss) 1,360,000 255,000 510,000 1,495,000 184,000 391,000 220,000 50,000 10,000 $ 3,075,000 $ 489,000 $ 911,000 $ $ $ 103,700 68,000 338,300 140,300 46,000 204,700 122,000 31,000 $ (143,000) $ $ $ 366,000 145,000 400,000 $ $ All variable costs are product specific. Allocated GS&A costs are corporate costs allocated to individual products based on units sold. Marketing and Engineering costs are product specific. The company's management is concerned about the profitability of lamps. The company is considering two options: Option #1: Eliminate lamp production and sales. Assume elimination of the lamps will not impact the sales of other products. Option #2: Purchase the lamps from an outside supplier. SuperCheap Lamps, Inc. has offered to sell lamps to the company for $132 per lamp. If lamp production is outsourced, $6,000 of the Marketing & Engineering costs are avoidable (the company will still have $25,000 of lamp marketing costs). First, consider the two options independently. Option #1 Part 1: Based on the numbers, should the company eliminate lamps? Calculate the differential income. Show your work and highlight your answers. Work: Eliminate Lamps? If eliminated income will: Dollar amount of Increase/(Decrease) in income if eliminated: YES NO Increase Decrease Option #1 Part 2a: What qualitative factors should be considered in the decision of whether to eliminate lamp production? List your qualitative factors below. Option #1 Part 2b: Will these qualitative factors change the decision indicated by the elimination calculation above? Why or why not? Option #2 Part 1: Based on the numbers, should the company outsource lamps? Calculate the differential income. Show your work and highlight your answers. Work: Outsource Lamps? If outsourced income will: Dollar amount of Increase/(Decrease) in income if outsourced: YES NO Increase Decrease Option #2 Part 2a: What qualitative factors should be considered in the decision of whether to outsource lamp production? List your qualitative factors below Option #2 Part 2b: Will these qualitative factors change the decision indicated by the outsourcing calculation above? Why or why not? Finally, consider all options together. What should the company do? (Highlight one) Nothing. Keep current structure. Outsource lamp production. Eliminate lamp production. Other (explain below) Explain your selectionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started