Answered step by step

Verified Expert Solution

Question

1 Approved Answer

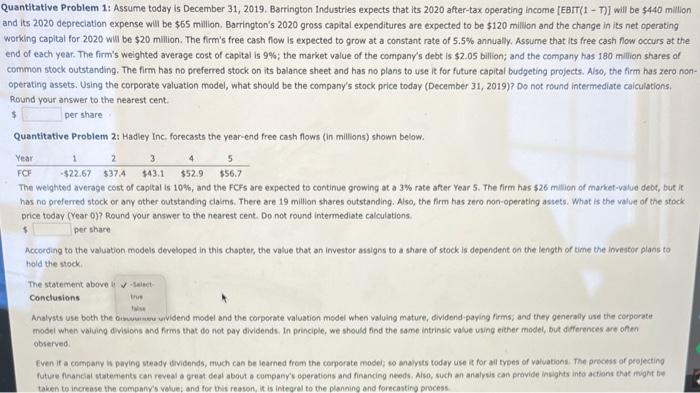

please help will thumbs up Quantitative Problem 1: Assume today is December 31, 2019. Barrington Industries expects that its 2020 after-tax operating income [EBrT(1 -

please help will thumbs up

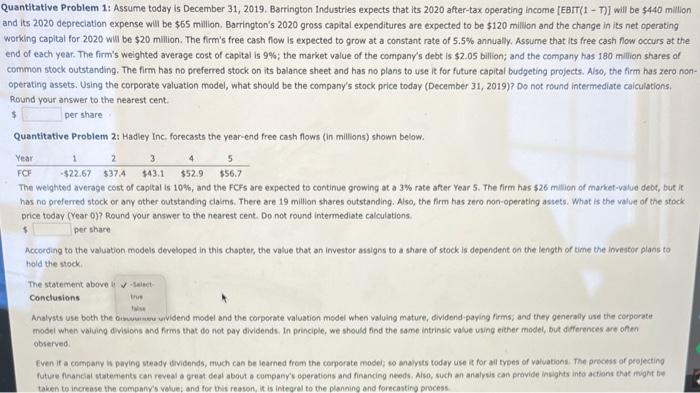

Quantitative Problem 1: Assume today is December 31, 2019. Barrington Industries expects that its 2020 after-tax operating income [EBrT(1 - T)] will be s440 million and its 2020 depreciation expense will be $65 million. Barrington's 2020 gross capital expenditures are expected to be $120million and the change in its net operating working capital for 2020 will be $20 million. The firm's free cash flow is expected to grow at a constant rate of 5.5% annually. Assume that its free cash flow occurs at the end of each year. The firm's weighted average cost of capital is 9%; the market value of the company's debt is $2.05 billion; and the company has 180 million shares of common stock outstanding. The firm has no preferred stock on its balance sheet and has no plans to use it for future capital budgeting projects. Also, the firm has zero nonoperating assets. Using the corporate valuation model, what should be the company's stock price today (December 31, 2019)? Do not round intermediate calculations. Round your answer to the nearest cent. 5 per share Quantitative Problem 2: Hadiey Inc, forecasts the year-end free cash flows (in millions) shown below. The weighted average cost of capltal is 10%, and the FCFs are expected to continue growing at a 3% rate after Year 5 . The firm has $26milion of market-value deot, but it has no preferred stock or any other outstanding daims. There are 19 million shares outstanding. Also, the frm has zero non-operating assets. What is the value of the stock price today ( Year 0)7 Round your answer to the nearest cent. Do not round intermediate calculations. 5. per share According to the valuation models developed in this chupter, the value that an irvestor asigns to a share of stock is dependent on the length of time the investor plans to hold the stock. The statement above if Conclusions Analysts use both the oiswwiswerwidend model and the corporate valuation model when valuing mature, dividend-paying firms; and they generally use the copporte model when valuing devisions and frems that do not pay dividends. In principle, we should find the same intrinsic valve ving eicher model, but differences are often observes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started