Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help. Will vote accordingly. Sector Benchmark Benchmark weights (Wsb) ETFs Returns (Rsb) Stocks Holding Weights (Wsh) Holdings Returns (Rsh) XTL 0.52 Telecom Materials Industrials

Please help. Will vote accordingly.

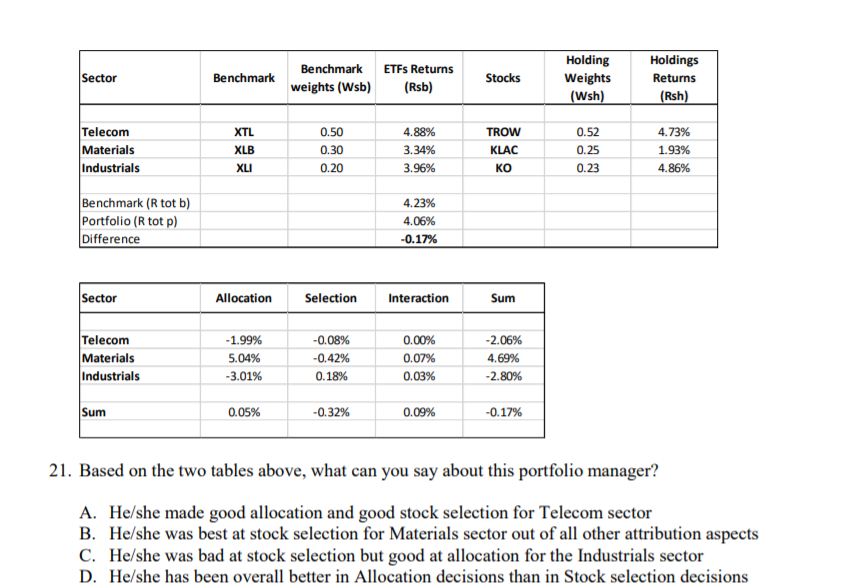

Sector Benchmark Benchmark weights (Wsb) ETFs Returns (Rsb) Stocks Holding Weights (Wsh) Holdings Returns (Rsh) XTL 0.52 Telecom Materials Industrials XLB XLI 0.50 0.30 0.20 4.88% 3.34% 3.96% TROW KLAC KO 0.25 0.23 4.73% 1.93% 4.86% Benchmark (R tot b) Portfolio (R tot p) Difference 4.23% 4.06% -0.17% Sector Allocation Selection Interaction Sum Telecom Materials Industrials -1.99% 5.04% -3.01% -0.08% -0.42% 0.18% 0.00% 0.07% 0.03% -2.06% 4.69% -2.80% Sum 0.05% -0.32% 0.09% -0.17% 21. Based on the two tables above, what can you say about this portfolio manager? A. He/she made good allocation and good stock selection for Telecom sector B. He/she was best at stock selection for Materials sector out of all other attribution aspects C. He/she was bad at stock selection but good at allocation for the Industrials sector D. He/she has been overall better in Allocation decisions than in Stock selection decisionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started