Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with 12-14 was not given an answer key to study from and need to knwo if I am doing them right 12. What

please help with 12-14 was not given an answer key to study from and need to knwo if I am doing them right

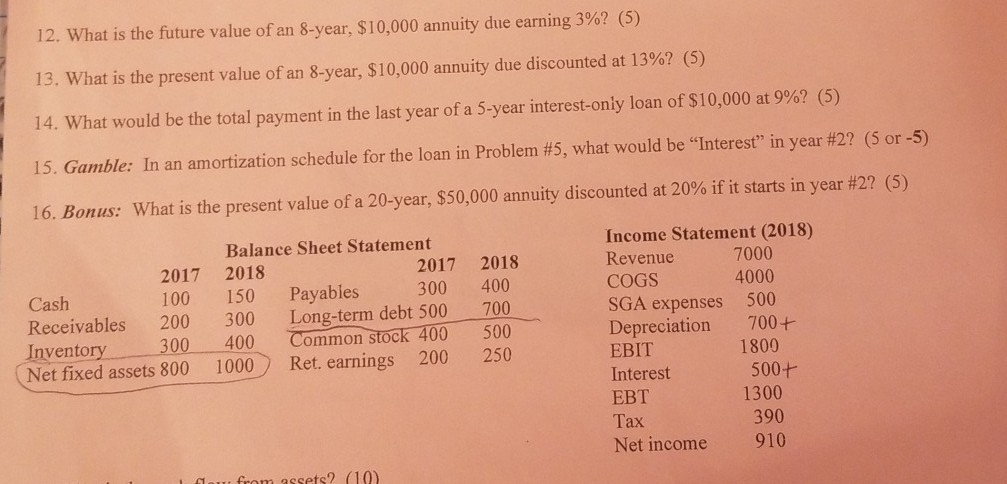

12. What is the future value of an 8-year, $10,000 annuity due earning 3%? (5) 13. What is the present value of an 8-year, $10,000 annuity due discounted at 13%? (5) 14. What would be the total payment in the last year of a 5-year interest-only loan of $10,000 at 9%? (5) 15. Gamble: In an amortization schedule for the loan in Problem #5, what would be "Interest" in year #2? (5 or -5) 16. Bonus: What is the present value of a 20-year, $50,000 annuity discounted at 20% if it starts in year #2? (5) 2017 Cash 100 Receivables 200 Inventory 300 Net fixed assets 800 Balance Sheet Statement 2018 2017 150 Payables 300 300 Long-term debt 500 400 Common stock 400 1000 Ret. earnings 200 2018 400 700 500 250 Income Statement (2018) Revenue 7000 COGS 4000 SGA expenses 500 Depreciation 700+ EBIT 1800 Interest 500+ EBT 1300 390 Net income 910 Tax Cum seseteStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started