Answered step by step

Verified Expert Solution

Question

1 Approved Answer

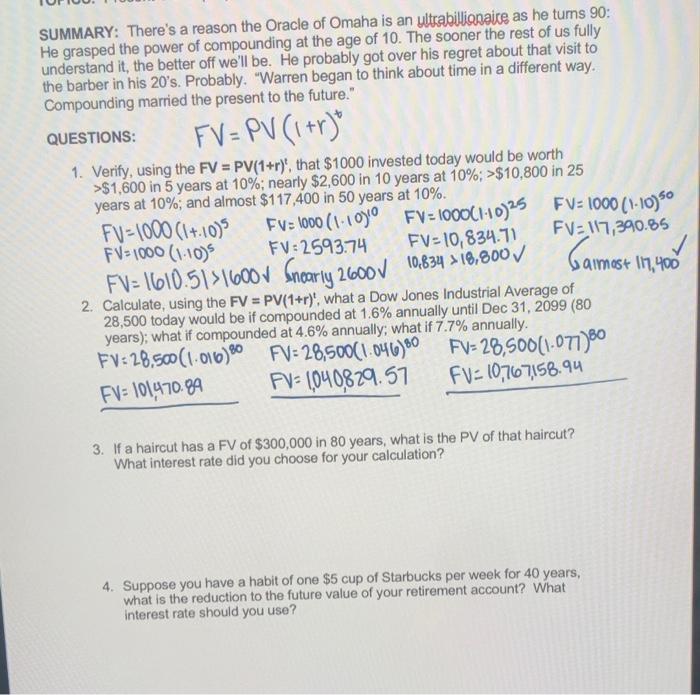

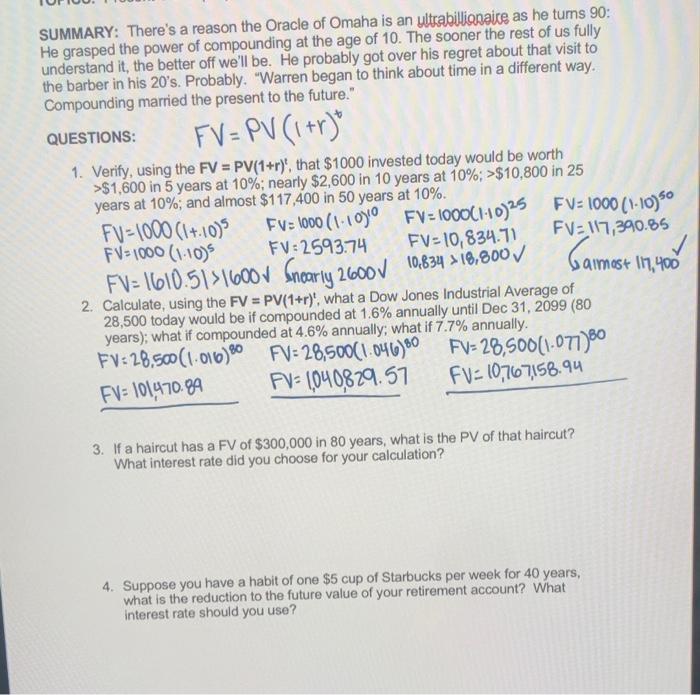

Please help with 3 and 4! SUMMARY: There's a reason the Oracle of Omaha is an ultrabillionaics as he turns 90 : He grasped the

Please help with 3 and 4!

SUMMARY: There's a reason the Oracle of Omaha is an ultrabillionaics as he turns 90 : He grasped the power of compounding at the age of 10 . The sooner the rest of us fully understand it, the better off we'll be. He probably got over his regret about that visit to the barber in his 20's. Probably. "Warren began to think about time in a different way. Compounding married the present to the future." QUESTIONS: FV=PV(1+r)t 1. Verify, using the FV=PV(1+r)t, that $1000 invested today would be worth >$1,600 in 5 years at 10%; nearly $2,600 in 10 years at 10%;>$10,800 in 25 years at 10%; and almost $117,400 in 50 years at 10%. FV=1000(1+.10)5FV=1000(1.10)5FV=1610.51>1600Snearly2600VFV=1000(1.10)10FV=2593.7410.834>18,800/6FV=1000(1.10)25FV=10,834.71GaimostFV=10001FV=117,30 2. Calculate, using the FV =PV(1+r)t, what a Dow Jones Industrial Average of 28,500 today would be if compounded at 1.6% annually until Dec 31,2099(80 years); what if compounded at 4.6% annually; what if 7.7% annually. FV=28,500(1.016)80FV=101,470.89FV=28,500(1.046)80FV=1,040,829.57FV=28,500(1.077)80FV=10,767,158.94 3. If a haircut has a FV of $300,000 in 80 years, what is the PV of that haircut? What interest rate did you choose for your calculation? 4. Suppose you have a habit of one $5 cup of Starbucks per week for 40 years, what is the reduction to the future value of your retirement account? What interest rate should you use

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started