Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with 7,8,9 Question 7 Question 8 QUeSTION 9 The partners of Carla Vista Company have decided to liquidate their business. Noncash assets were

Please help with 7,8,9

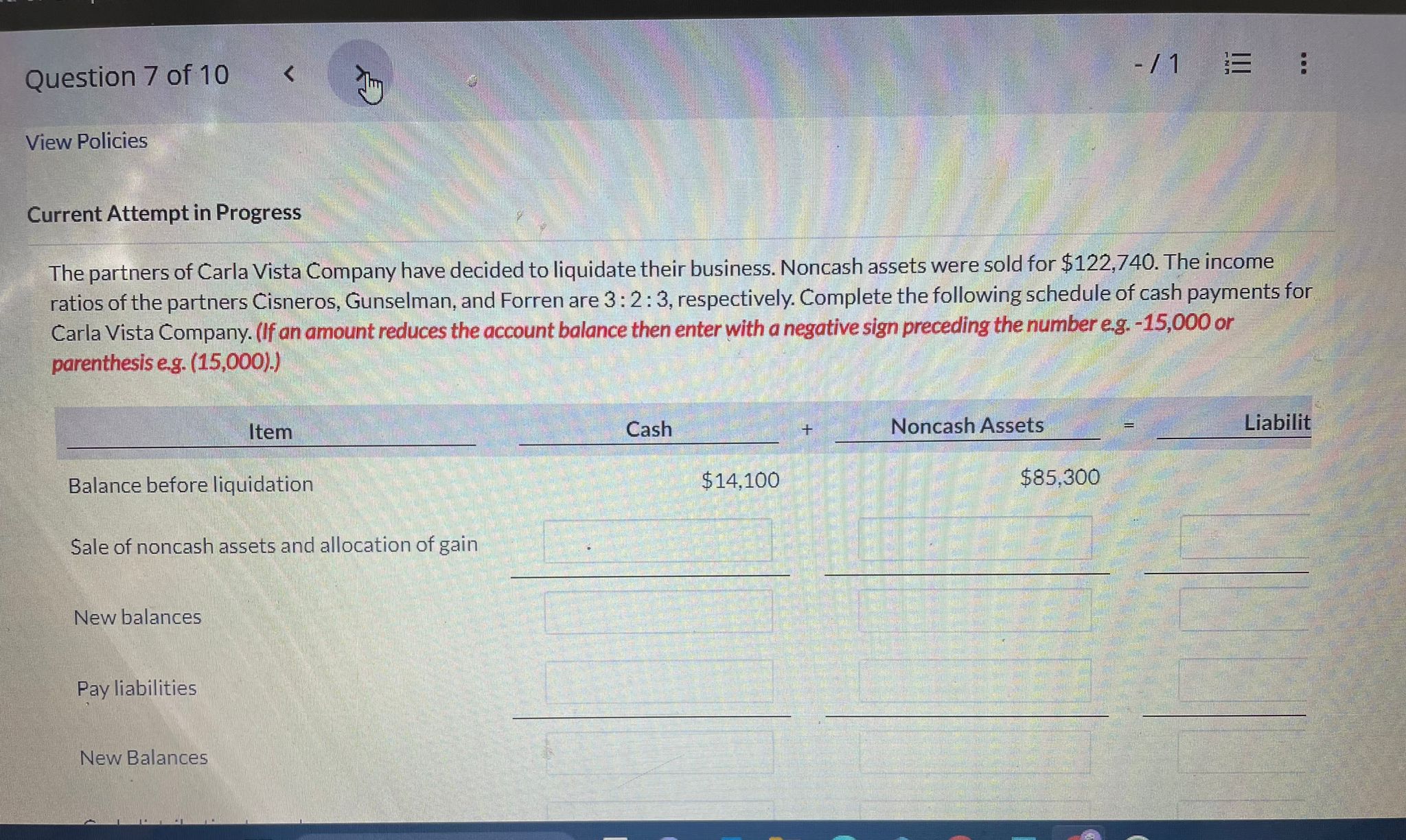

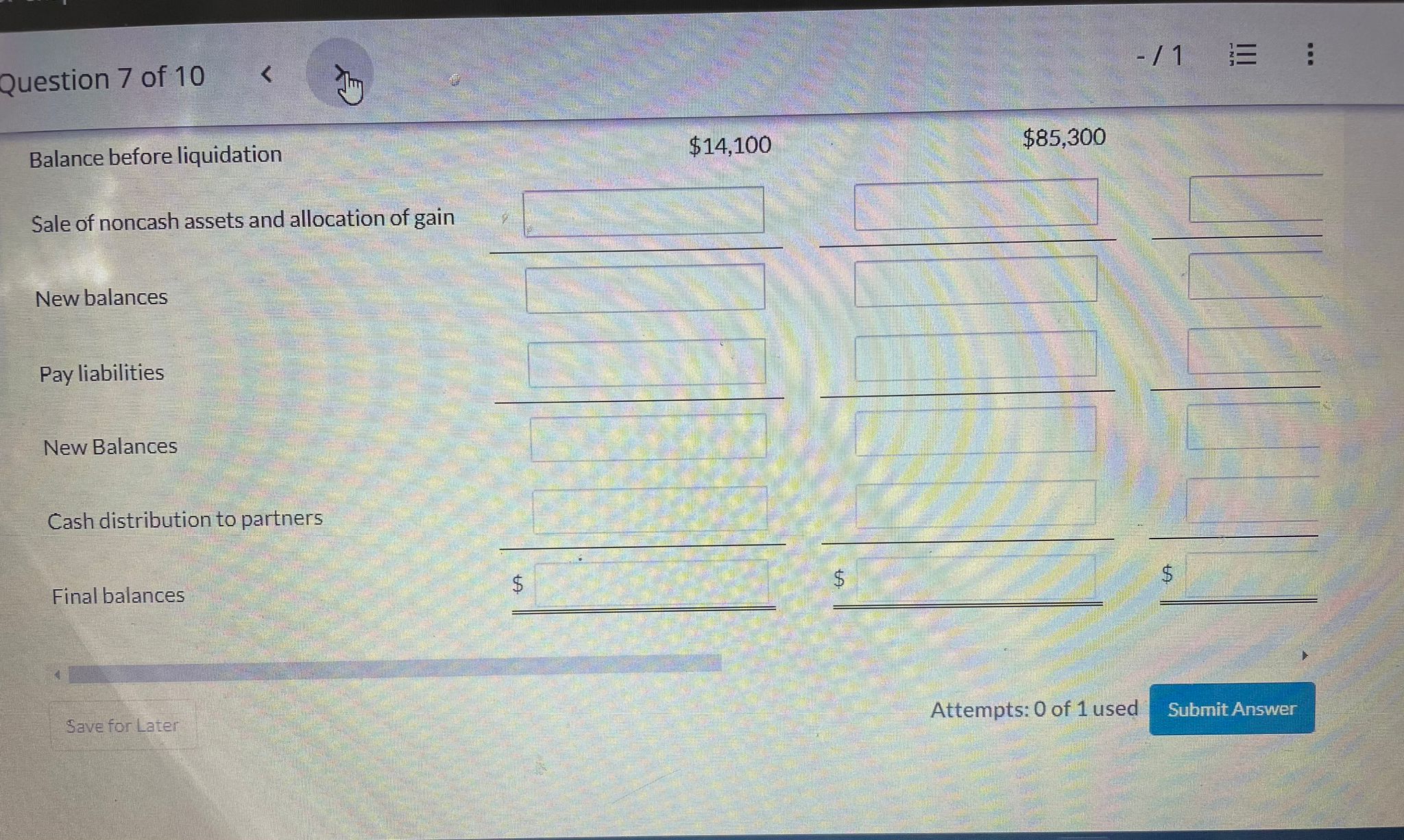

Question 7

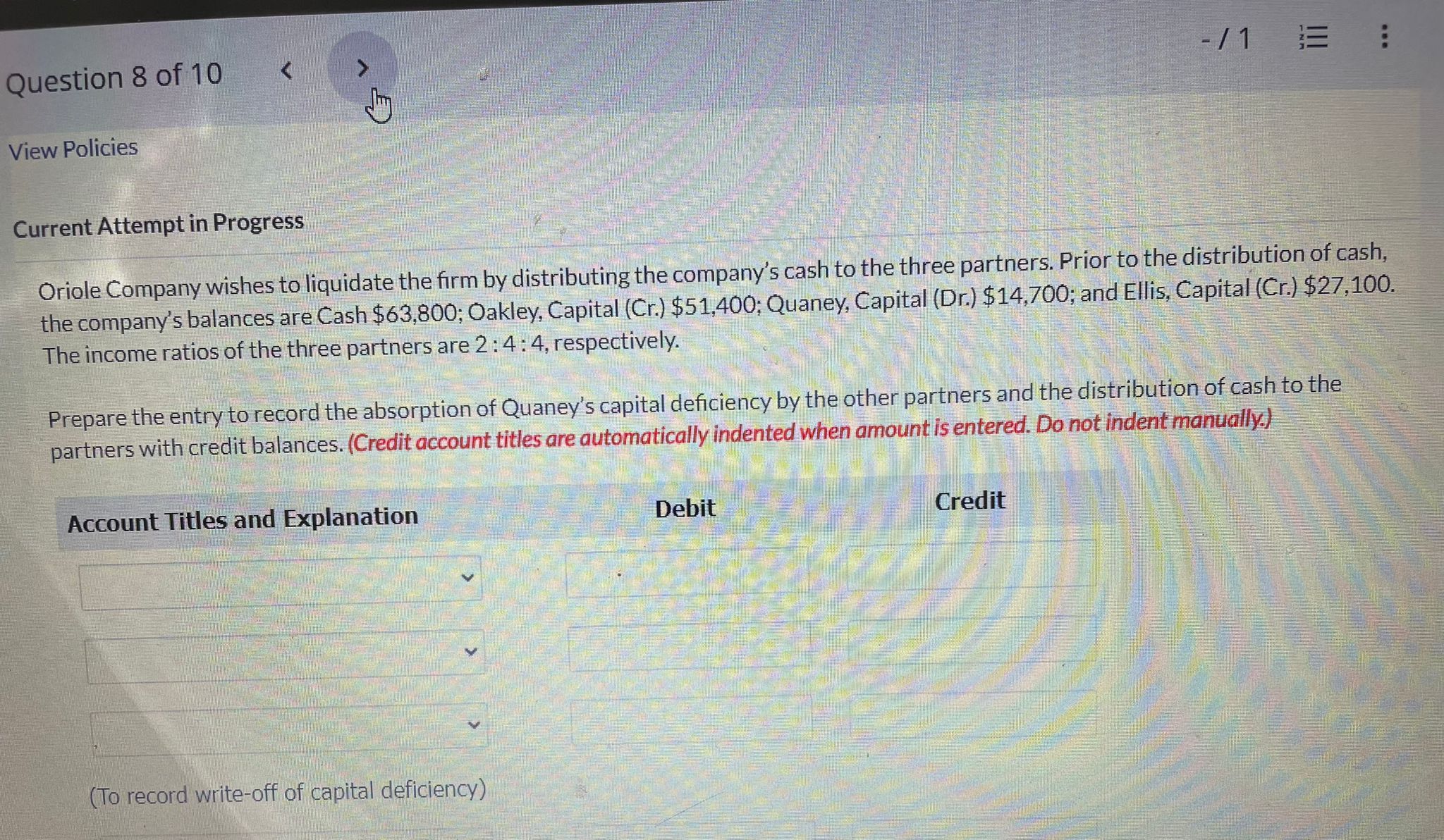

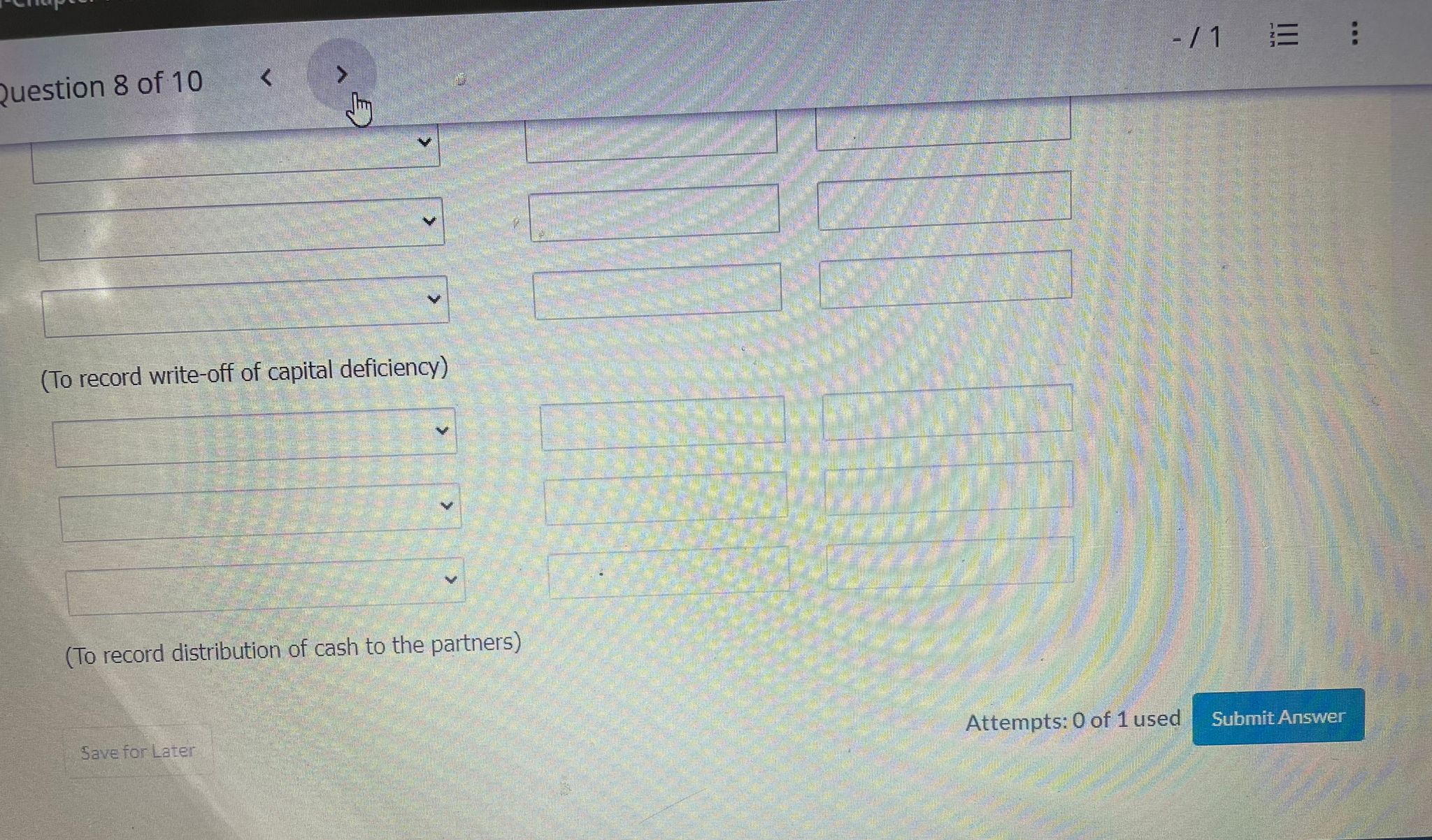

Question 8

QUeSTION 9

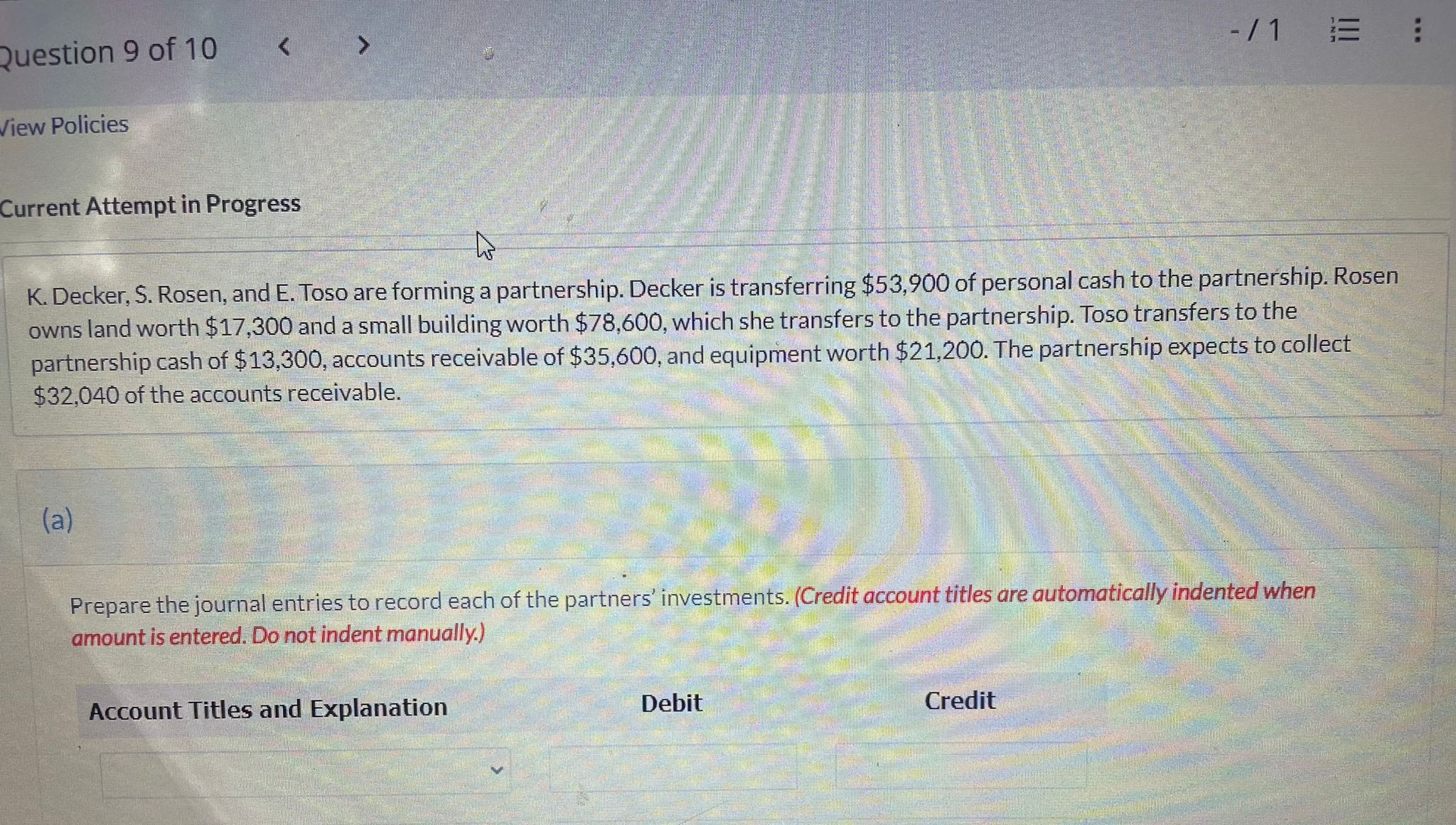

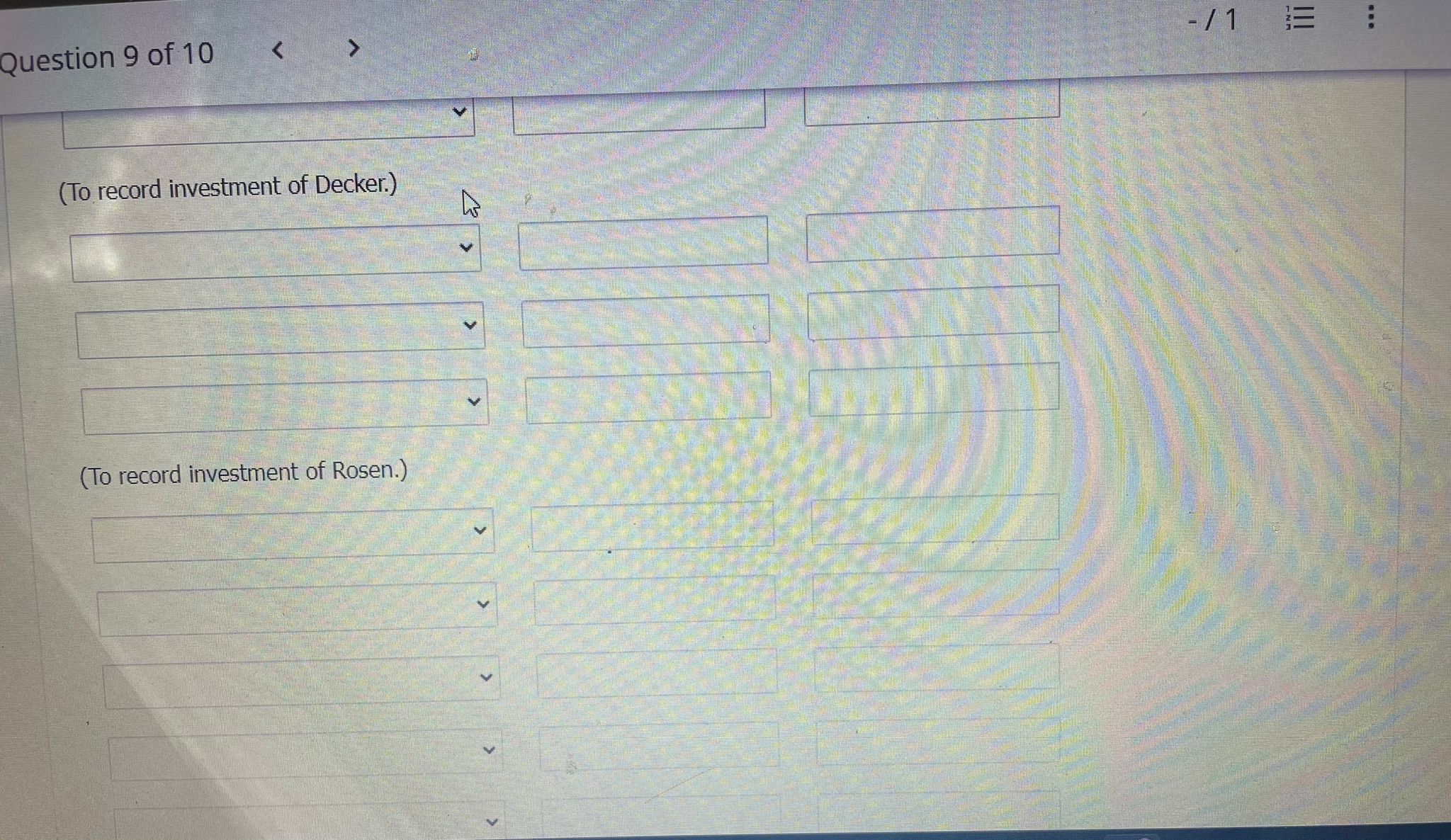

The partners of Carla Vista Company have decided to liquidate their business. Noncash assets were sold for $122,740. The income ratios of the partners Cisneros, Gunselman, and Forren are 3:2:3, respectively. Complete the following schedule of cash payments for Carla Vista Company. (If an amount reduces the account balance then enter with a negative sign preceding the number e.g. 15,000 or parenthesis eg. (15,000). Question 7 of 10 Balance before liquidation $14,100 11 Sale of noncash assets and allocation of gain New balances Pay liabilities New Balances Cash distribution to partners Final balances Attempts: 0 of 1 used Submit Answer Current Attempt in Progress Oriole Company wishes to liquidate the firm by distributing the company's cash to the three partners. Prior to the distribution of cash, the company's balances are Cash $63,800; Oakley, Capital (Cr.) \$51,400; Quaney, Capital (Dr.) \$14,700; and Ellis, Capital (Cr.) \$27,100. The income ratios of the three partners are 2:4:4, respectively. Prepare the entry to record the absorption of Quaney's capital deficiency by the other partners and the distribution of cash to the partners with credit balances. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) (To record write-off of capital deficiency) (To record distribution of cash to the partners) Save for Later Attempts: 0 of 1 used Submit Answer K. Decker, S. Rosen, and E. Toso are forming a partnership. Decker is transferring $53,900 of personal cash to the partnership. Rosen owns land worth $17,300 and a small building worth $78,600, which she transfers to the partnership. Toso transfers to the partnership cash of $13,300, accounts receivable of $35,600, and equipment worth $21,200. The partnership expects to collect $32,040 of the accounts receivable. (a) Prepare the journal entries to record each of the partners' investments. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Question 9 of 10 (To record investment of Decker.) (To record investment of Rosen.) (To record investment of Toso.) Attempts: 0 of 1 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started