please help with a, b, &c!

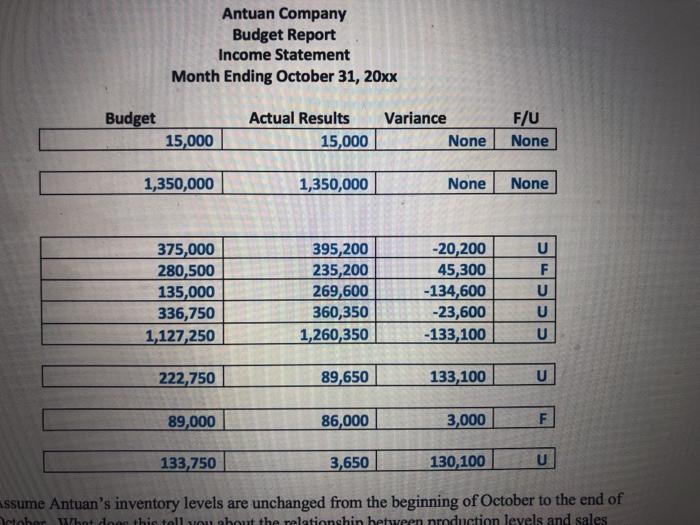

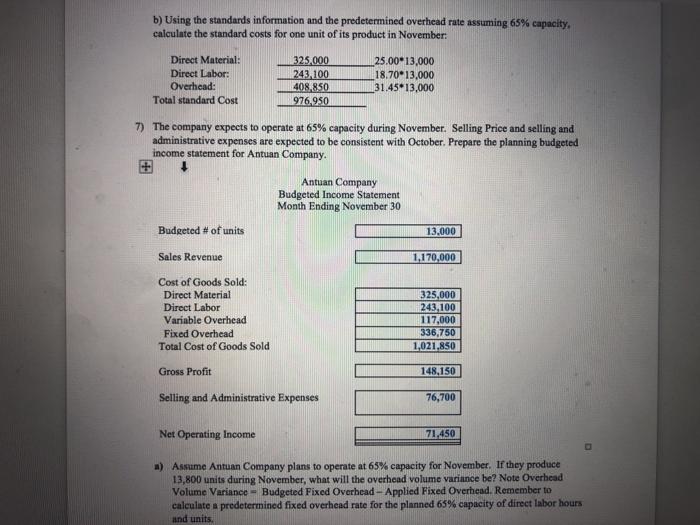

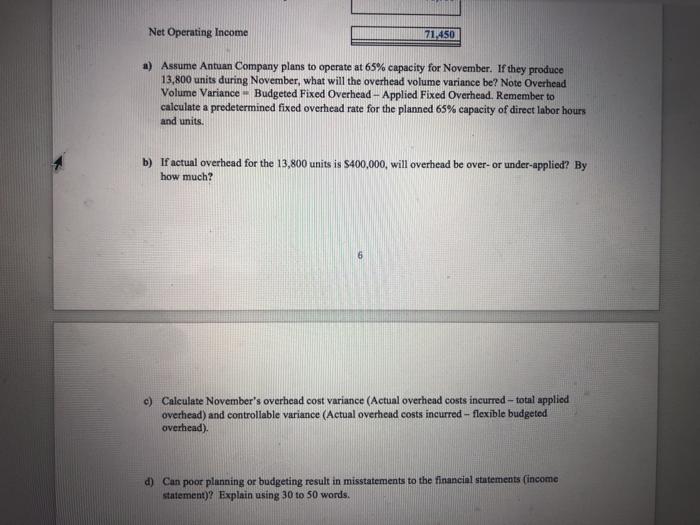

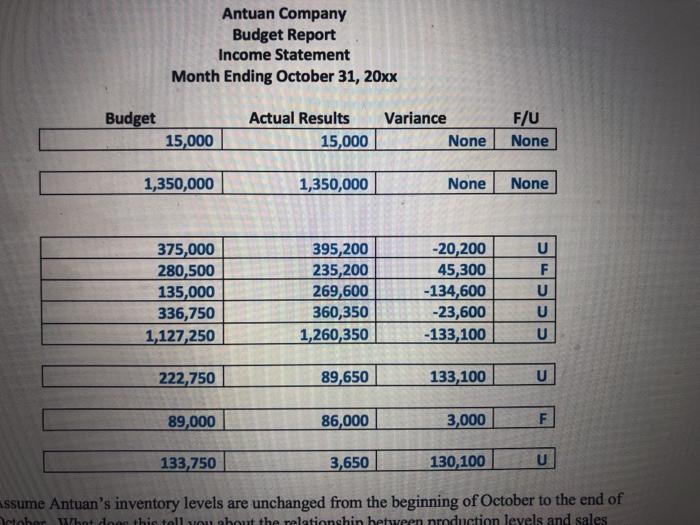

b) Using the standards information and the predetermined overhead rate assuming 65% capacity. calculate the standard costs for one unit of its product in November Direct Material: Direct Labor: Overhead: Total standard Cost 325,000 243,100 408,850 976.950 25.00*13,000 18.70*13,000 31.45* 13,000 7) The company expects to operate at 65% capacity during November. Selling Price and selling and administrative expenses are expected to be consistent with October. Prepare the planning budgeted income statement for Antuan Company Antuan Company Budgeted Income Statement Month Ending November 30 Budgeted # of units 13,000 Sales Revenue 1,170,000 Cost of Goods Sold: Direct Material Direct Labor Variable Overhead Fixed Overhead Total Cost of Goods Sold 325,000 243,100 117,000 336,750 1,021,850 Gross Profit 148,150 Selling and Administrative Expenses 76,700 Net Operating Income 71.450 a) Assume Antuan Company plans to operate at 65% capacity for November. If they produce 13,800 units during November, what will the overhead volume variance be? Note Overhead Volume Variance - Budgeted Fixed Overhead - Applied Fixed Overhead. Remember to calculate a predetermined fixed overhead rate for the planned 65% capacity of direct labor hours and units, Net Operating Income 71 450 a) Assume Antuan Company plans to operate at 65% capacity for November. If they produce 13,800 units during November, what will the overhead volume variance be? Note Overhead Volume Variance - Budgeted Fixed Overhead - Applied Fixed Overhead. Remember to calculate a predetermined fixed overhead rate for the planned 65% capacity of direct labor hours and units. b) If actual overhead for the 13,800 units is $400,000, will overhead be over-or under-applied? By how much? c) Calculate November's overhead cost variance (Actual overhead costs incurred - total applied overhead) and controllable variance (Actual overheud costs incurred - flexible budgeted overhead) d) Can poor planning or budgeting result in misstatements to the financial statements (income statement)? Explain asing 30 to 50 words. Antuan Company Budget Report Income Statement Month Ending October 31, 20xx Budget 15,000 Actual Results 15,000 Variance None F/U None 1,350,000 1,350,000 None None 375,000 280,500 135,000 336,750 1,127,250 395,200 235,200 269,600 360,350 1,260,350 -20,200 45,300 - 134,600 -23,600 -133,100 U F U U U 222,750 89,650 133, 100 U 89,000 86,000 3,000 F 133,750 3,650 130, 100 U assume Antuan's inventory levels are unchanged from the beginning of October to the end of ctober What doeshie toll about the relationshin between production levels and sales

please help with a, b, &c!

please help with a, b, &c!