Answered step by step

Verified Expert Solution

Question

1 Approved Answer

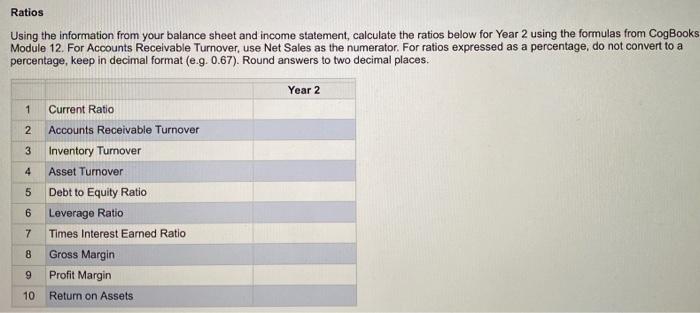

please help with accounting 1 question with 5 parts :) 1. 2. 3. 4. 5. ratios Which ratios help to analyze liquidity? Select all that

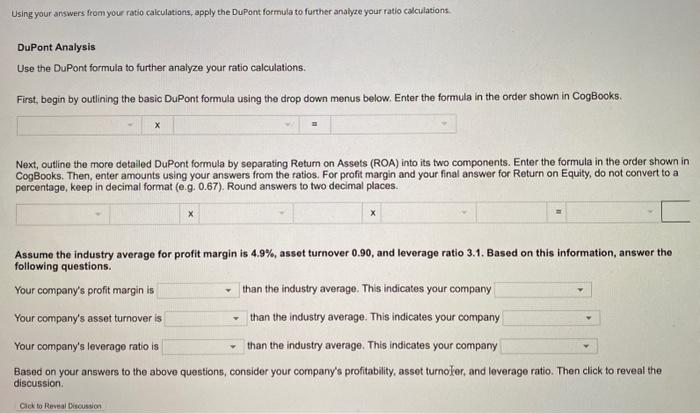

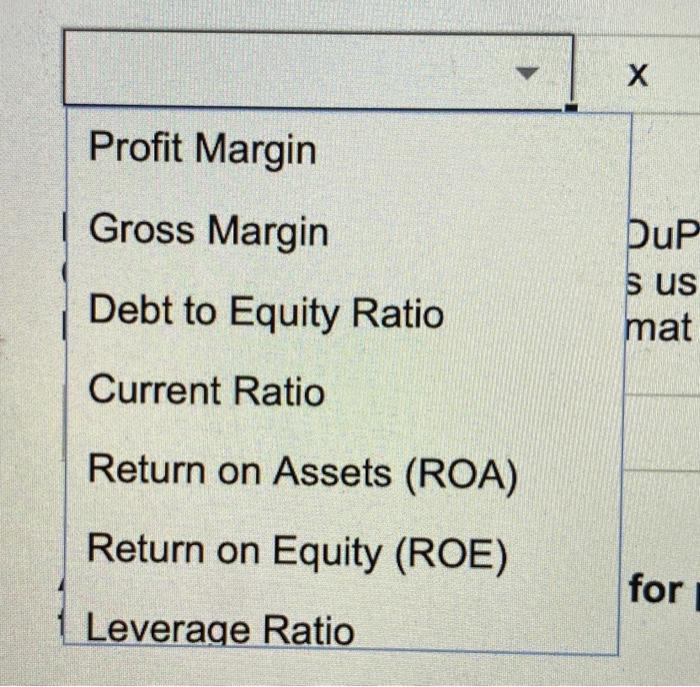

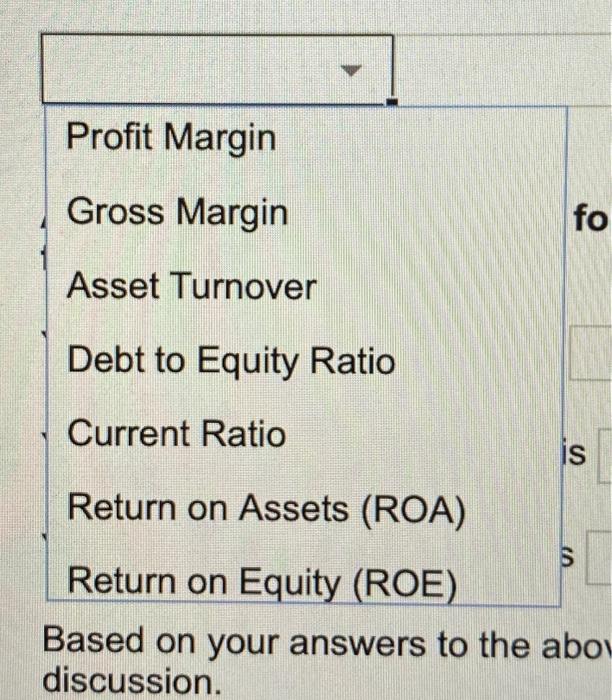

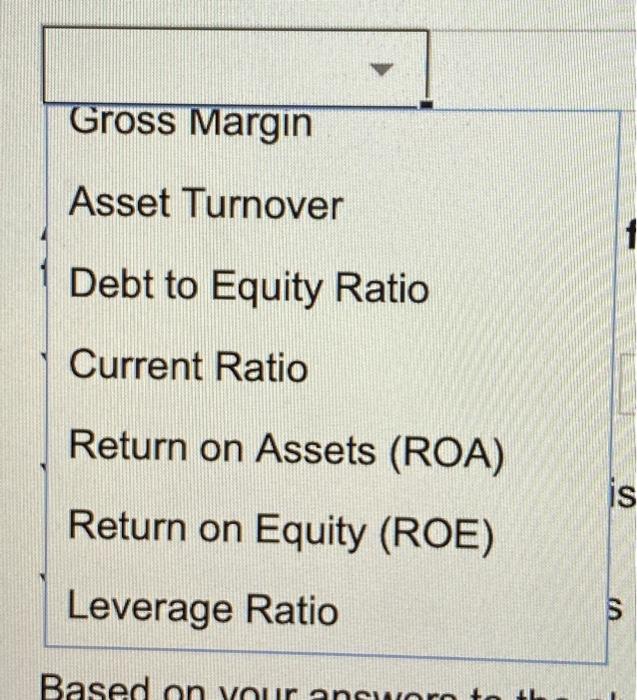

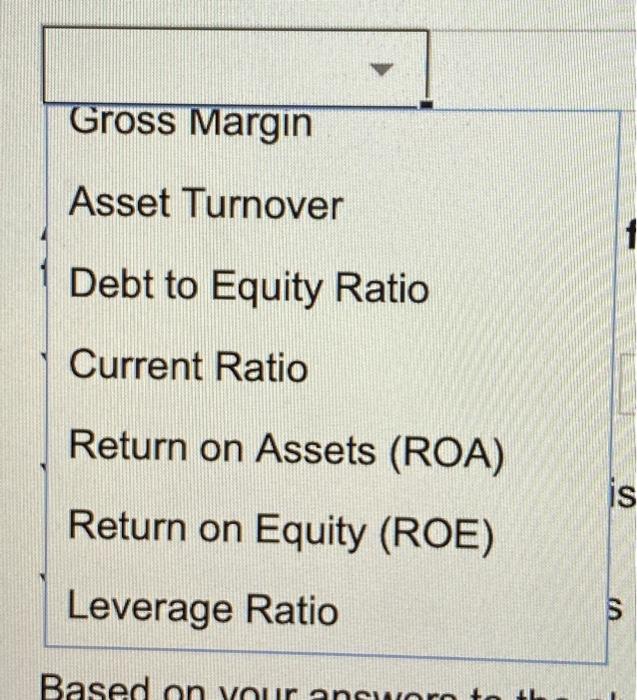

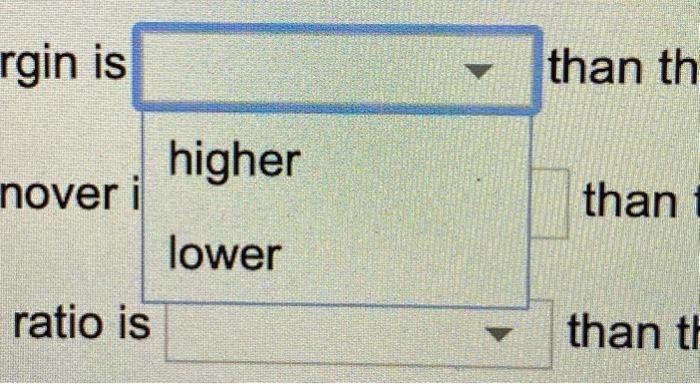

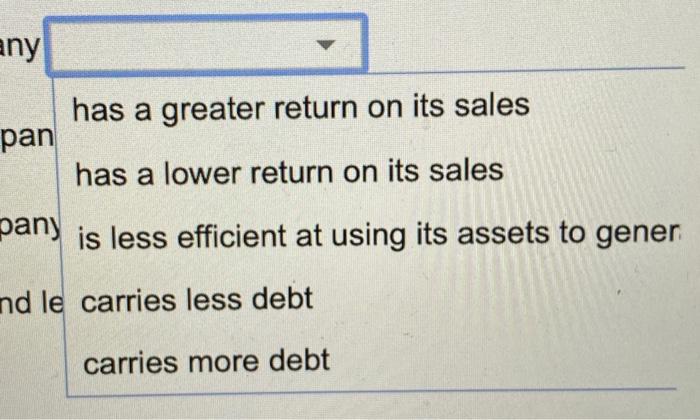

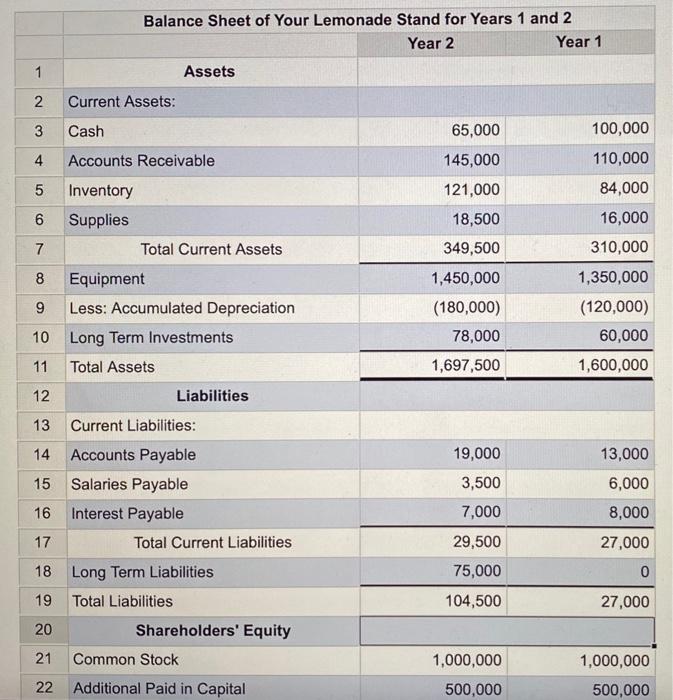

please help with accounting

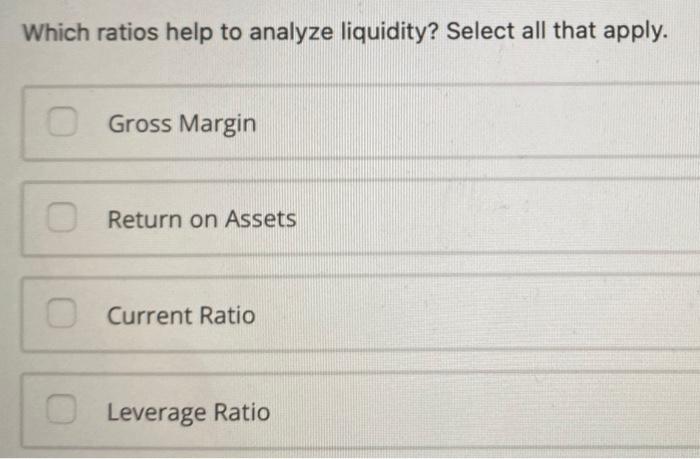

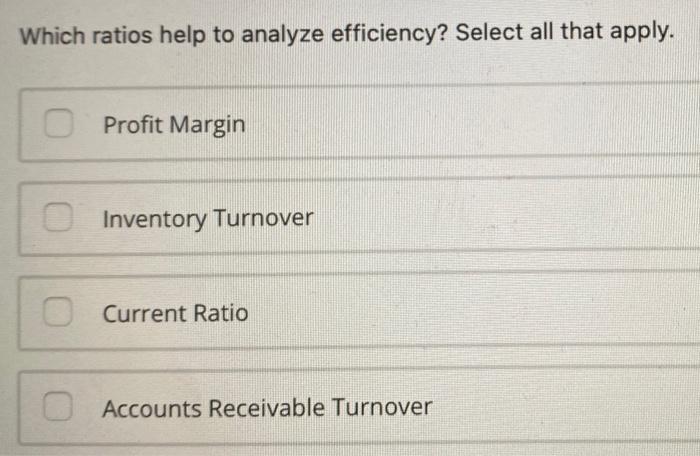

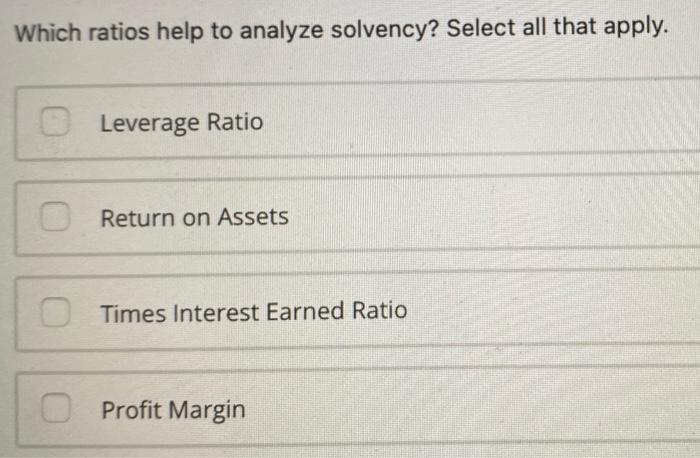

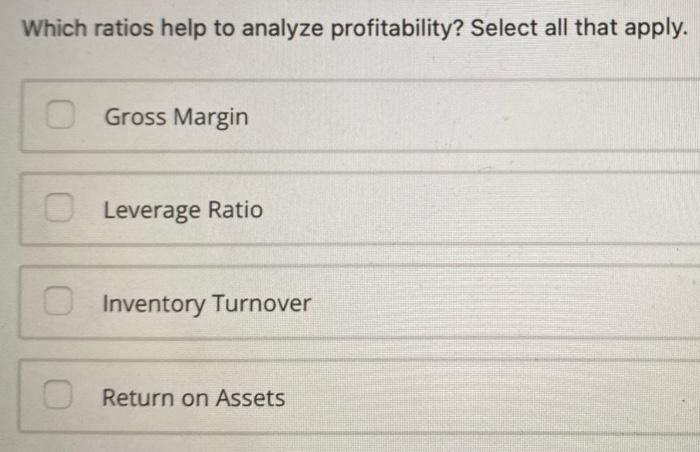

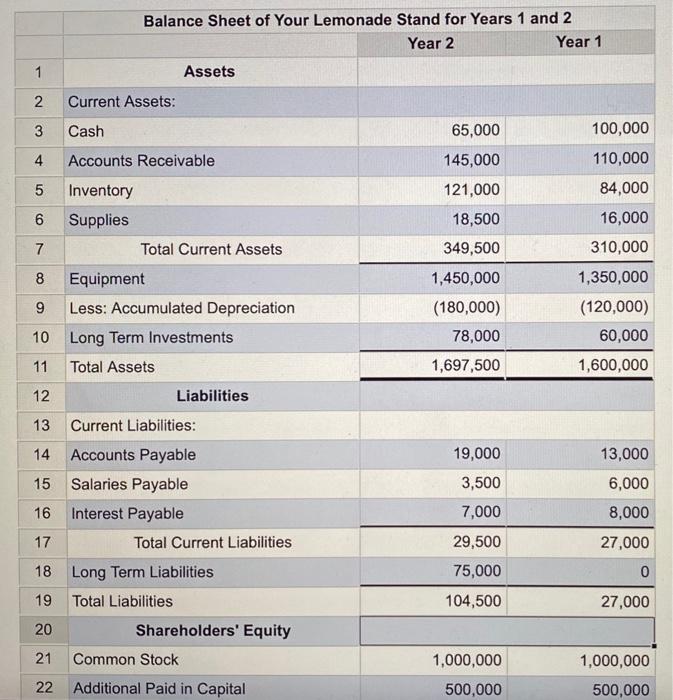

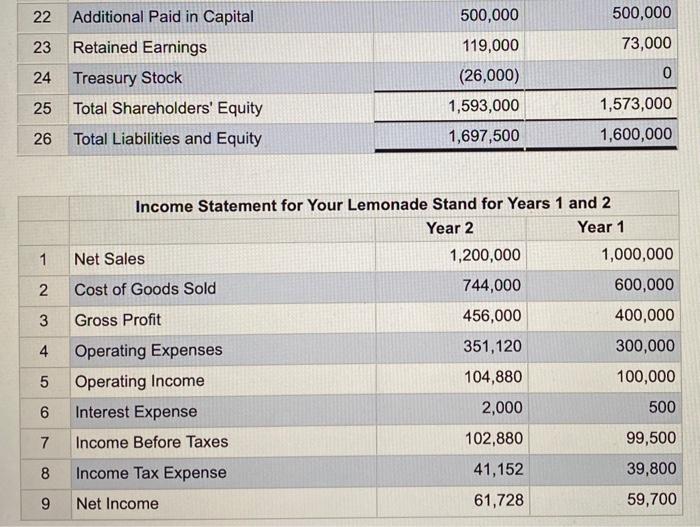

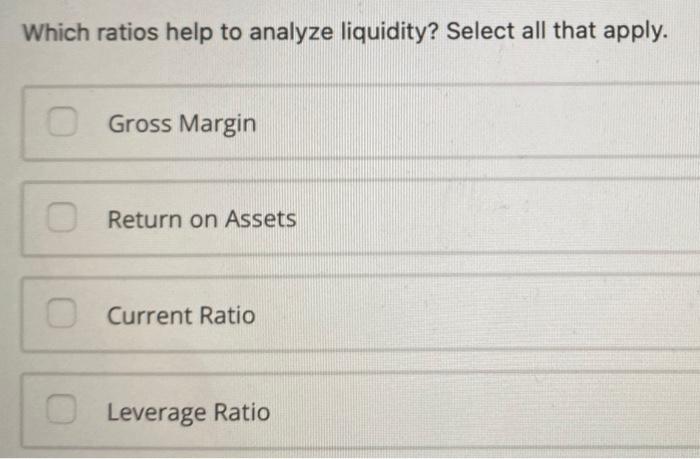

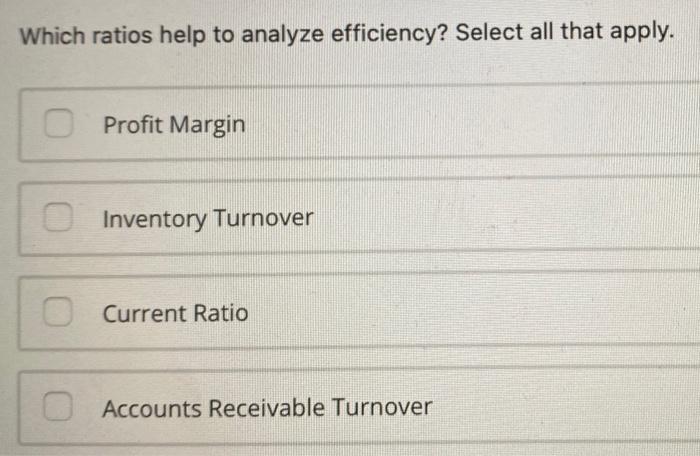

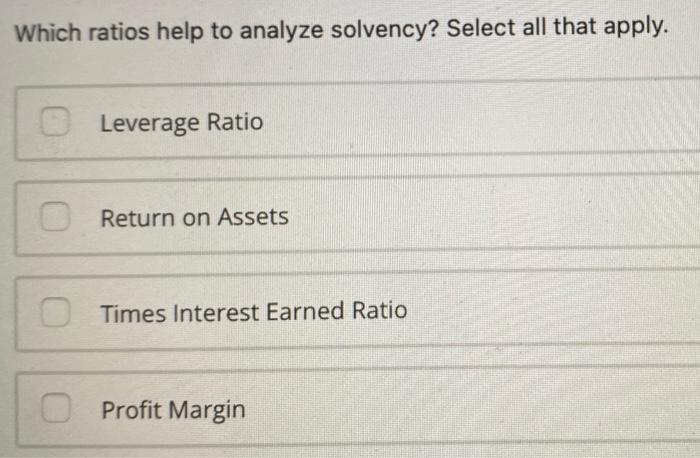

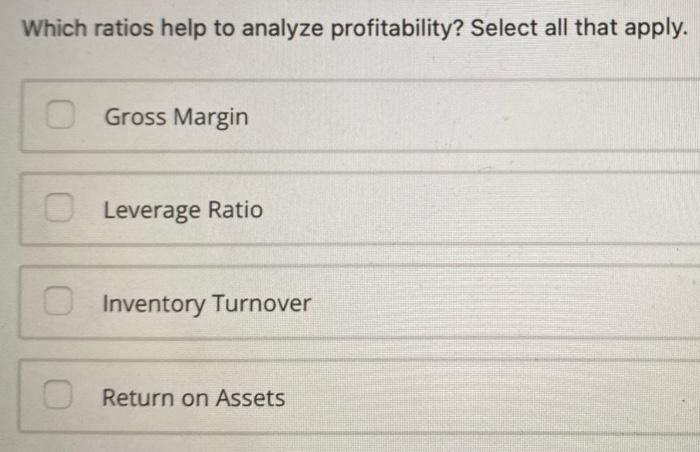

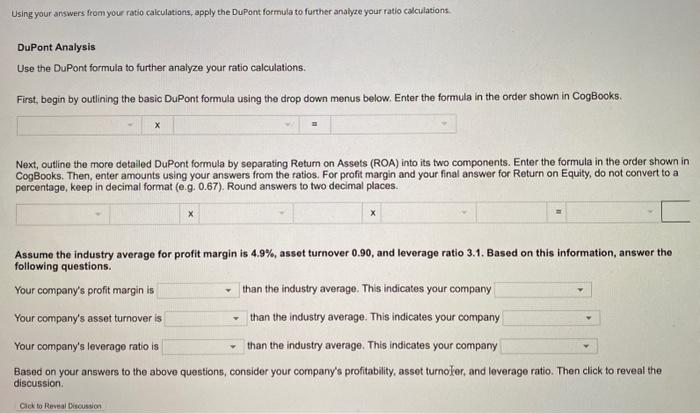

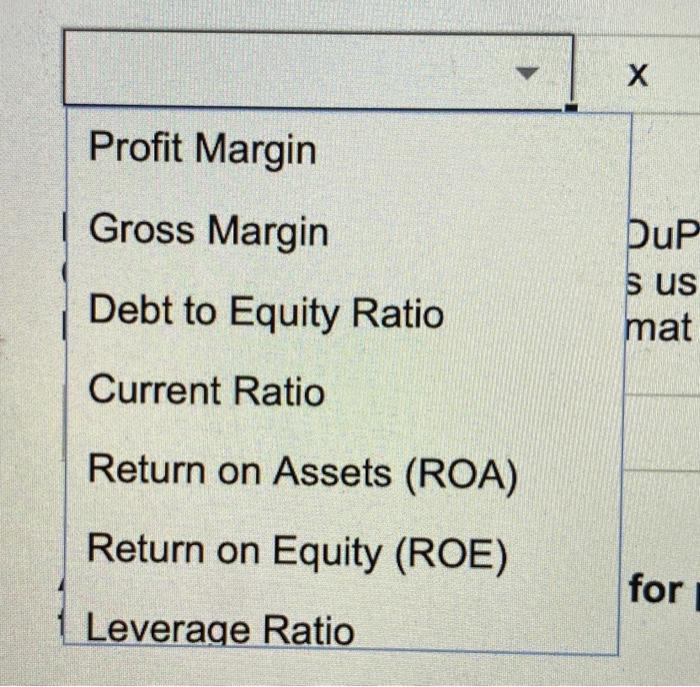

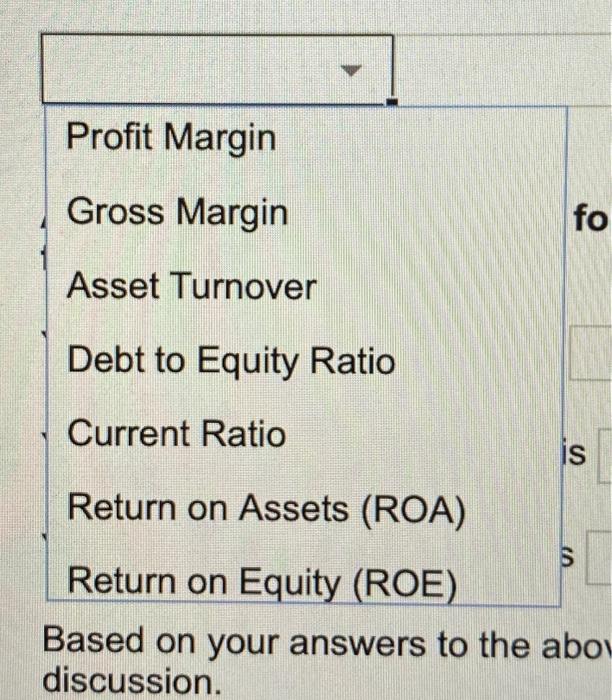

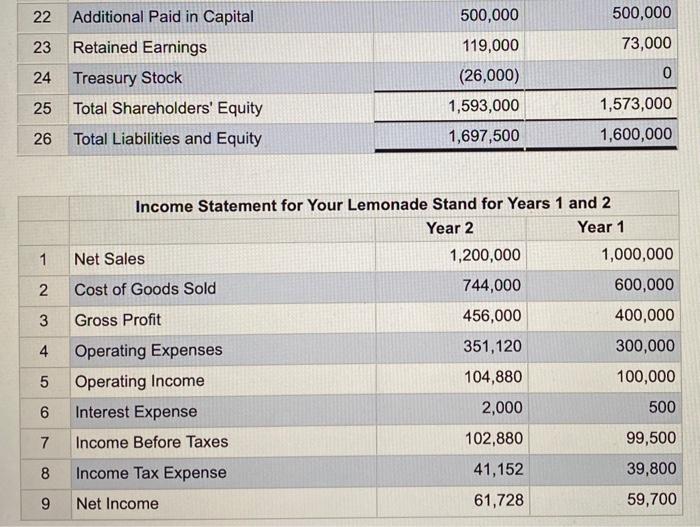

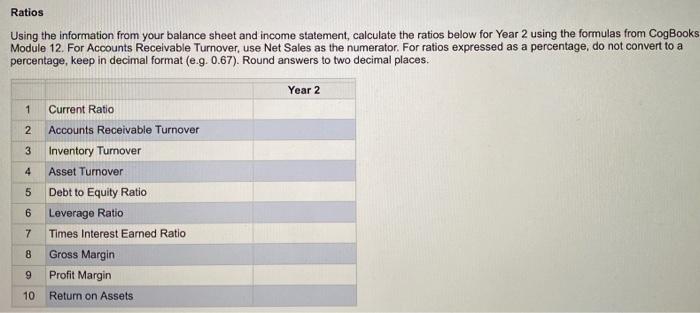

Which ratios help to analyze liquidity? Select all that apply. Gross Margin Return on Assets Current Ratio Leverage Ratio Which ratios help to analyze efficiency? Select all that apply. Profit Margin Inventory Turnover Current Ratio Accounts Receivable Turnover Which ratios help to analyze solvency? Select all that apply. Leverage Ratio Return on Assets Times Interest Earned Ratio Profit Margin Which ratios help to analyze profitability? Select all that apply. Gross Margin Leverage Ratio Inventory Turnover Return on Assets DuPont Analysis Use the DuPont formula to further analyze your ratio calculations. First, begin by outlining the basic DuPont formula using the drop down menus below, Enter the formula in the order shown in CogBooks. Next, outline the more detailed DuPont formula by separating Retum on Assets (ROA) into its two components. Enter the formula in the order shown in CogBooks. Then, enter amounts using your answers from the ratios. For profit margin and your final answer for Return on Equity, do not convert to a percentage, keep in decimal format (e.g. 0.67). Round answers to two decimal places. Assume the industry average for profit margin is 4.9%, asset turnover 0.90, and leverage ratio 3.1, Based on this information, answer the following questions. Your company's profit margin is than the industry average. This indicates your company Your company's asset turnover is than the industry average. This indicates your company Your company's leverage ratio is than the industry average. This indicates your company Based on your answers to the above questions, consider your company's profitability, asset turnoler, and leverage ratio. Then click to reveal the discussion. Cick to Reseal Biscusvon Profit Margin Gross Margin Debt to Equity Ratio Current Ratio Return on Assets (ROA) Return on Equity (ROE) Leverage Ratio Based on your answers to the abo discussion. Gross Margin Asset Turnover Debt to Equity Ratio Current Ratio Return on Assets (ROA) Return on Equity (ROE) Leverage Ratio han th than ratio than has a greater return on its sales has a lower return on its sales is less efficient at using its assets to gener le carries less debt carries more debt Balance Sheet of Your Lemonade Stand for Years 1 and 2 Year 2 Year 1 \begin{tabular}{|r|lrr|} \hline 22 & Additional Paid in Capital & 500,000 & 500,000 \\ \hline 23 & Retained Earnings & 119,000 & 73,000 \\ \hline 24 & Treasury Stock & (26,000) & 0 \\ \hline 25 & Total Shareholders' Equity & 1,593,000 & 1,573,000 \\ \hline 26 & Total Liabilities and Equity & 1,697,500 & 1,600,000 \\ \hline \end{tabular} Income Statement for Your Lemonade Stand for Years 1 and 2 Using the information from your balance sheet and income statement, calculate the ratios below for Year 2 using the formulas from CogBooks Module 12. For Accounts Receivable Turnover, use Net Sales as the numerator. For ratios expressed as a percentage, do not convert to a percentage, keep in decimal format (e.g. 0.67). Round answers to two decimal places 1 question with 5 parts :)

1.

2.

3.

4.

5.

ratios

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started