Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with accounting 1 question with 6 parts When cash is received in advance of services provided, which of the following is true? Service

please help with accounting

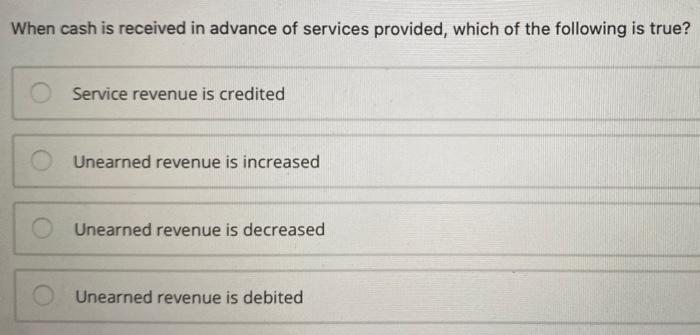

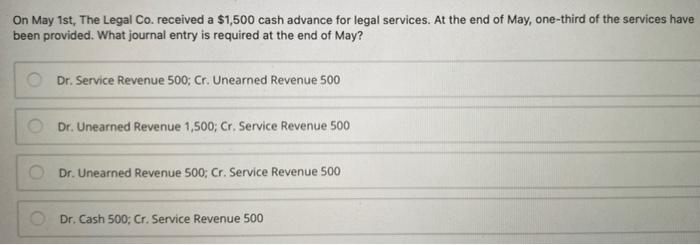

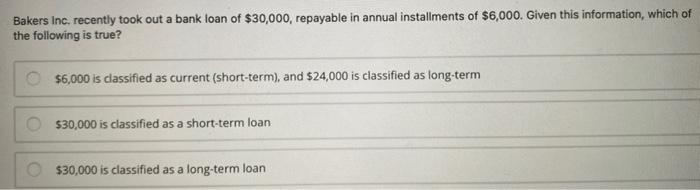

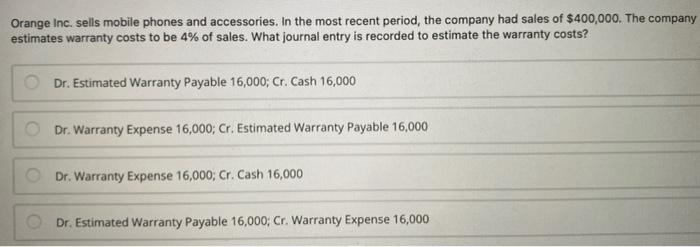

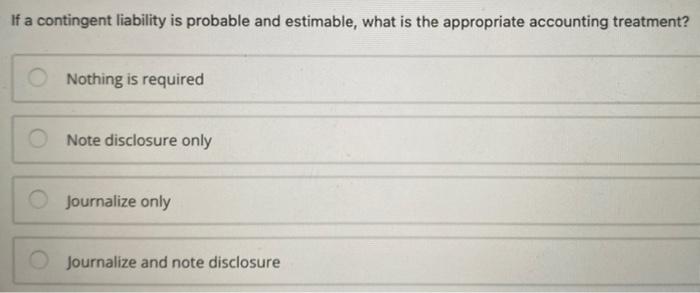

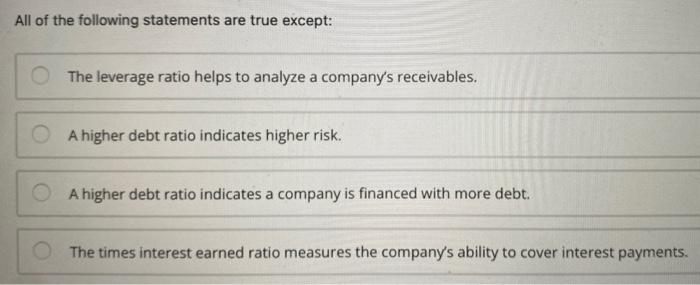

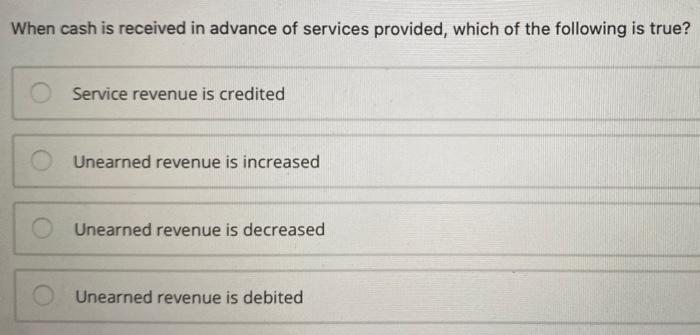

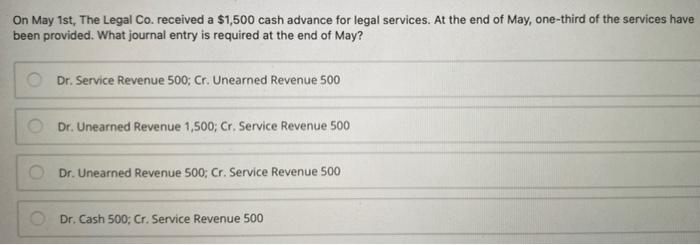

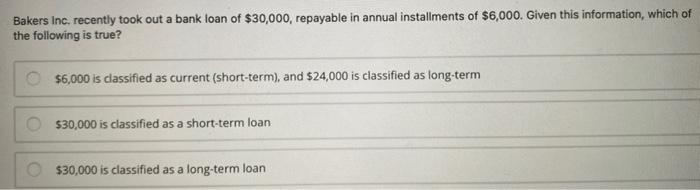

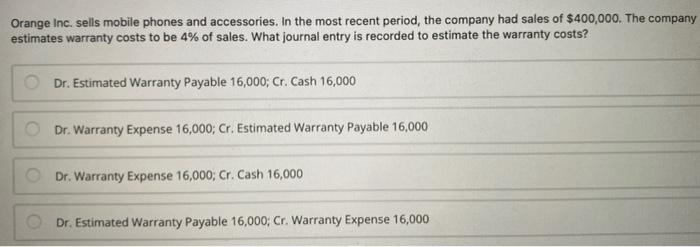

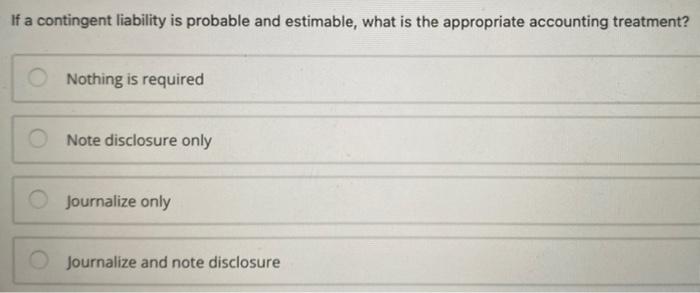

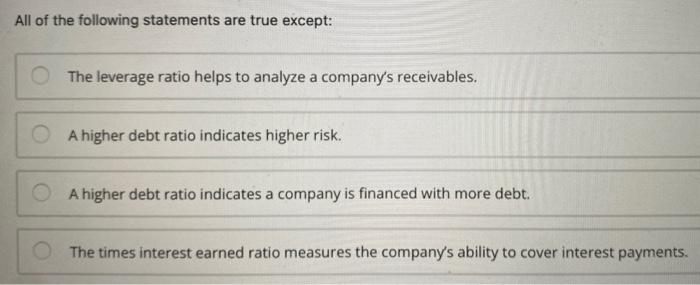

When cash is received in advance of services provided, which of the following is true? Service revenue is credited Unearned revenue is increased Unearned revenue is decreased Unearned revenue is debited On May 1st, The Legal Co. received a $1,500 cash advance for legal services. At the end of May, one-third of the services have been provided. What journal entry is required at the end of May? Dr. Service Revenue 500; Cr. Unearned Revenue 500 Dr. Unearned Revenue 1,500; Cr. Service Revenue 500 Dr. Unearned Revenue 500; Cr. Service Revenue 500 Dr. Cash 500; Cr. Service Revenue 500 Bakers inc, recently took out a bank loan of $30,000, repayable in annual installments of $6,000. Given this information, which of the following is true? $6,000 is classified as current (short-term), and $24,000 is classified as long-term $30,000 is classified as a short-term loan $30,000 is classified as a long-term loan Orange Inc. sells mobile phones and accessories. In the most recent period, the company had sales of $400,000. The company estimates warranty costs to be 4% of sales. What journal entry is recorded to estimate the warranty costs? Dr. Estimated Warranty Payable 16,000; Cr. Cash 16,000 Dr. Warranty Expense 16,000; Cr. Estimated Warranty Payable 16,000 Dr. Warranty Expense 16,000; Cr. Cash 16,000 Dr. Estimated Warranty Payable 16,000; Cr. Warranty Expense 16,000 If a contingent liability is probable and estimable, what is the appropriate accounting treatment? Nothing is required Note disclosure only Journalize only Journalize and note disclosure All of the following statements are true except: The leverage ratio helps to analyze a company's receivables. A higher debt ratio indicates higher risk. A higher debt ratio indicates a company is financed with more debt. The times interest earned ratio measures the company's ability to cover interest payments 1 question with 6 parts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started