Please help with accounting HW

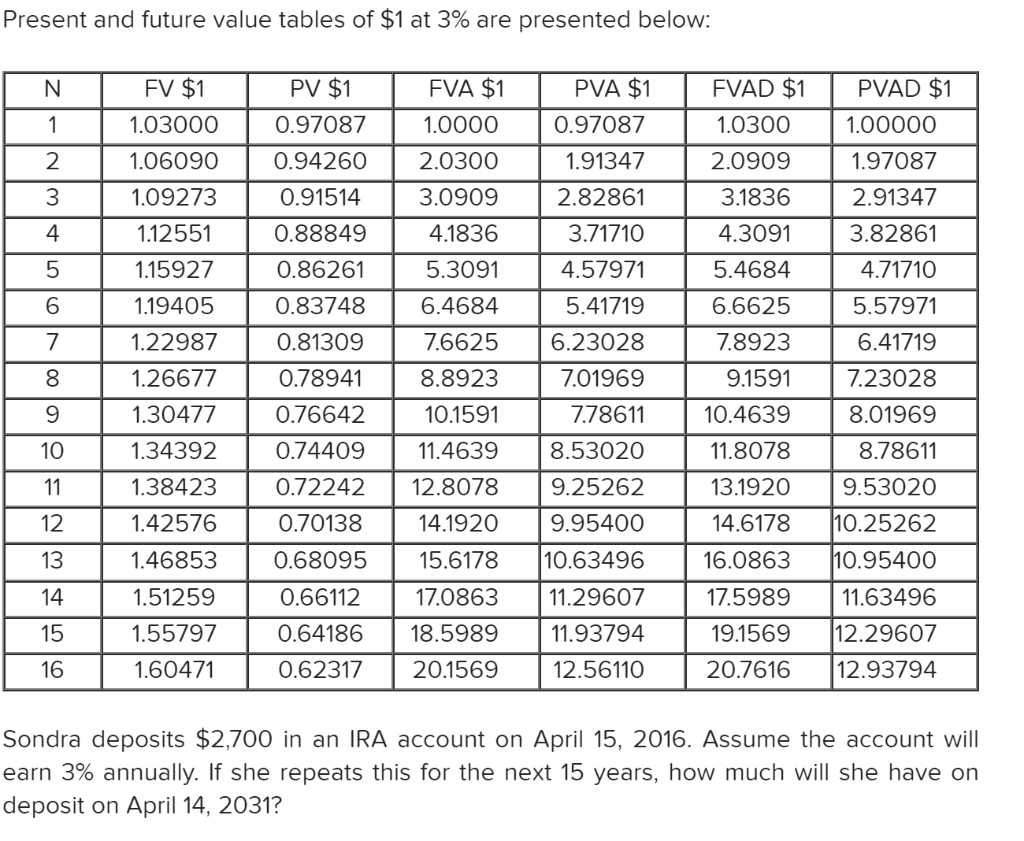

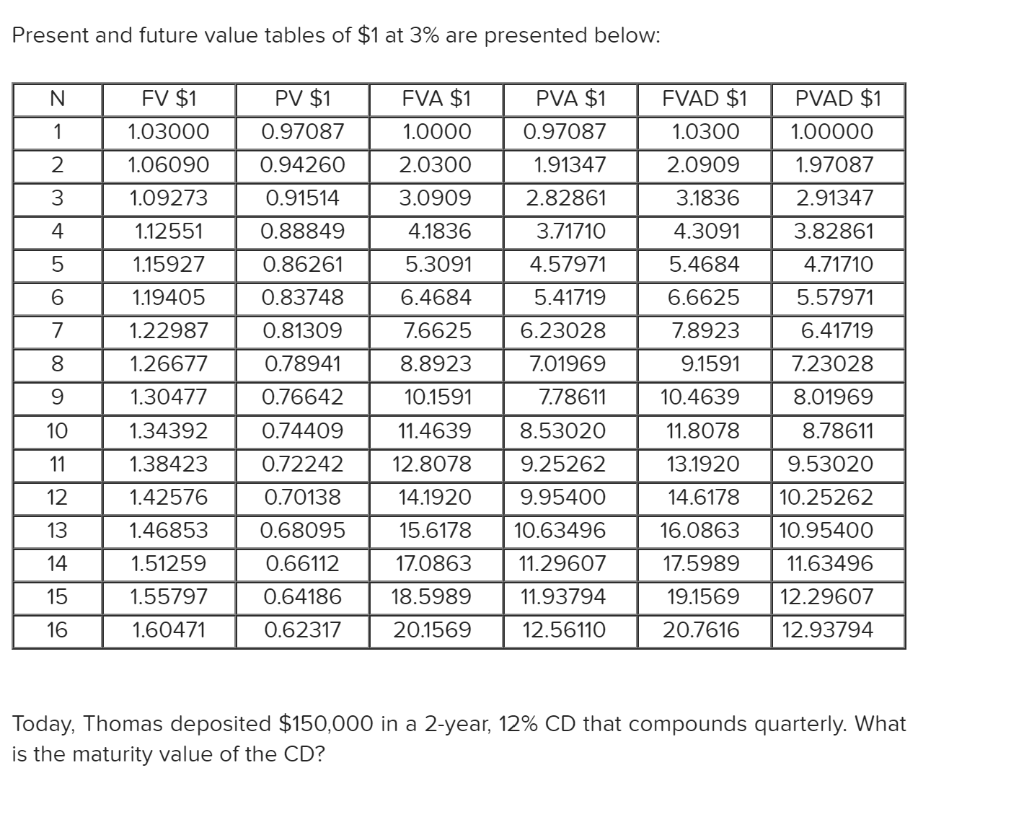

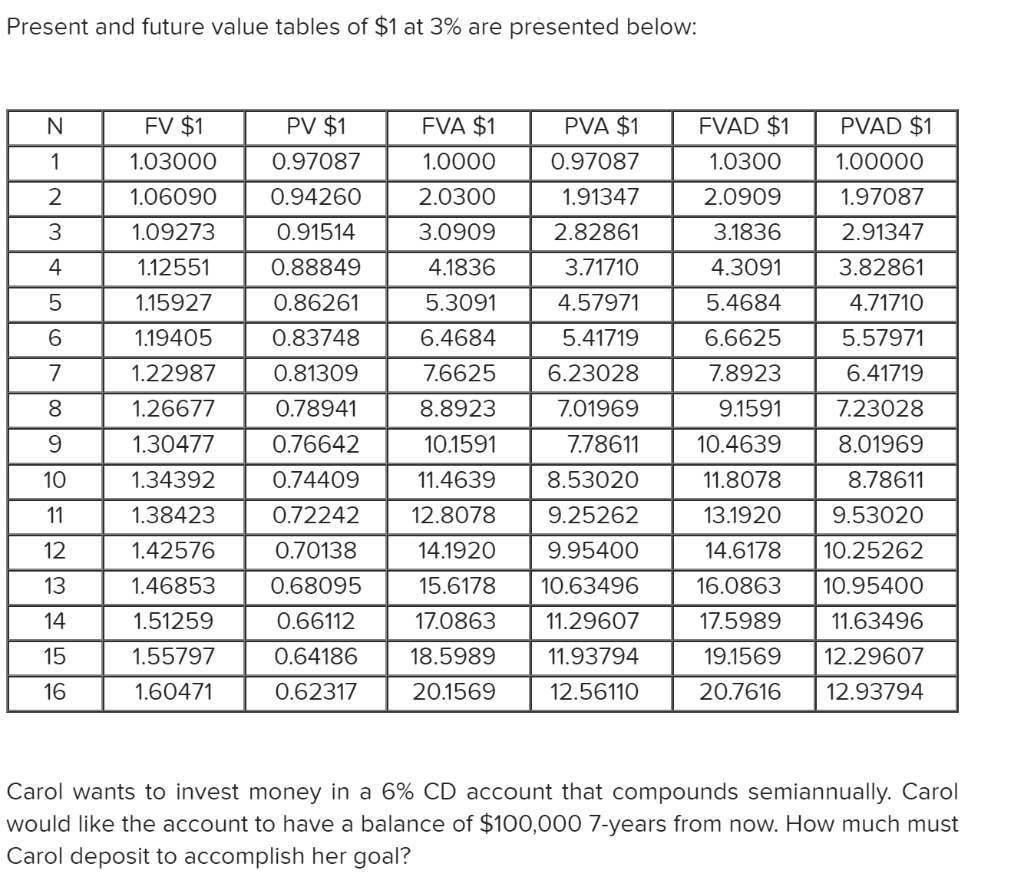

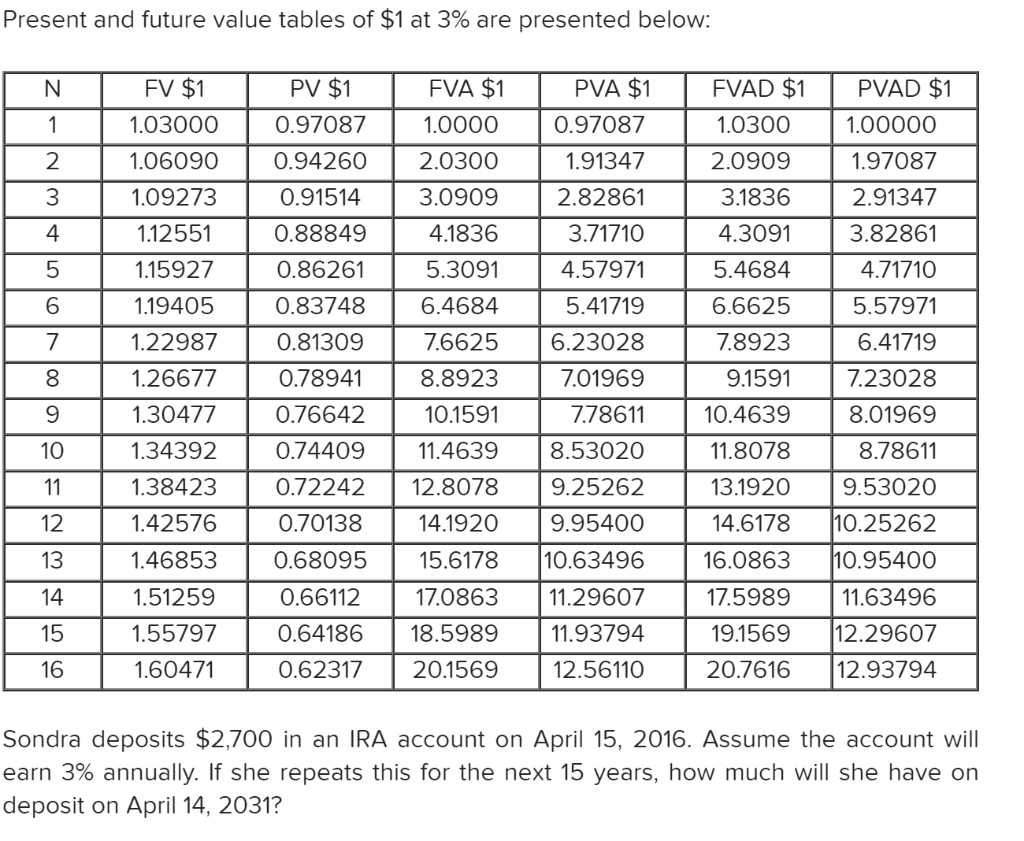

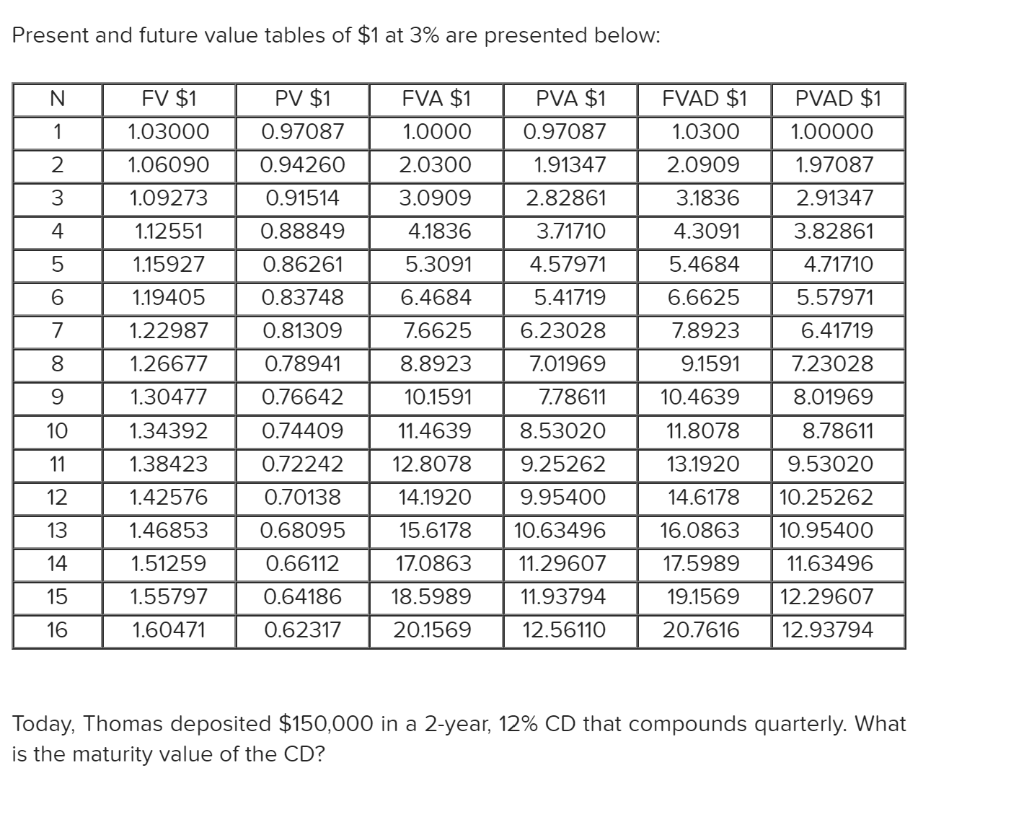

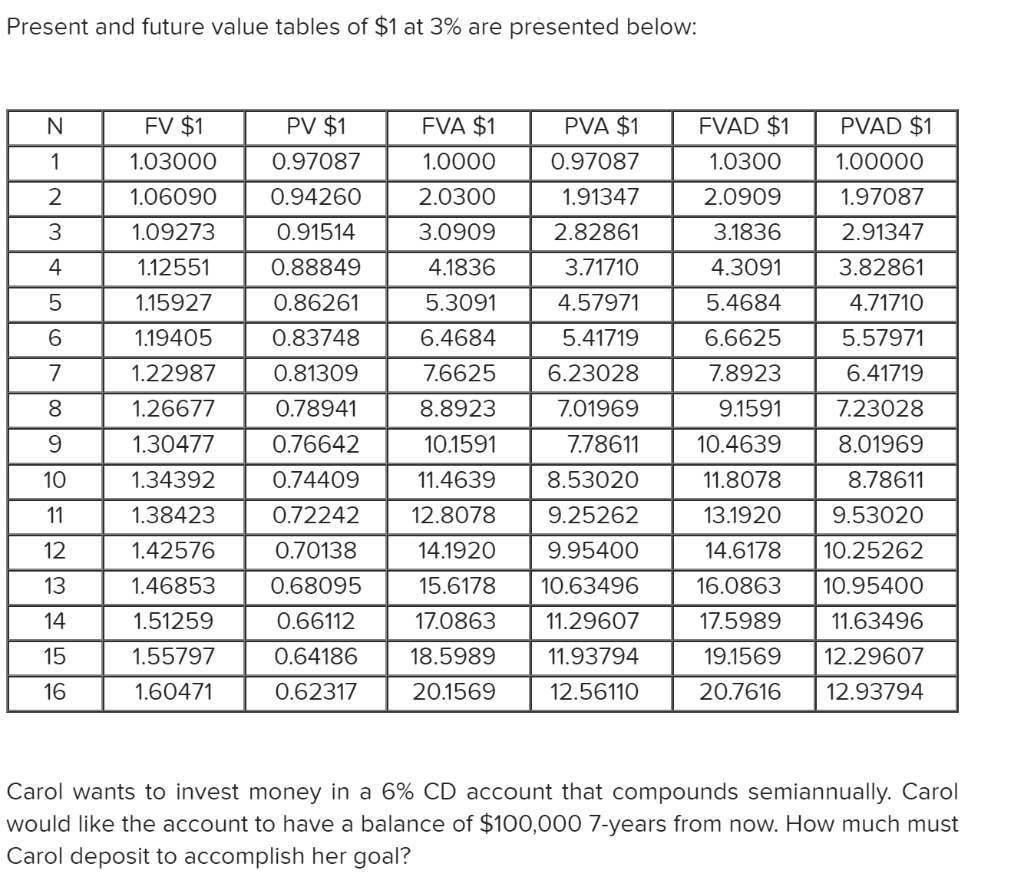

Present and future value tables of $1 at 3% are presented below: N 1 2 PVAD $1 1.00000 1.97087 FV $1 1.03000 1.06090 1.09273 1.12551 1.15927 1.19405 PV $1 0.97087 0.94260 0.91514 0.88849 0.86261 FVA $1 1.0000 2.0300 3.0909 4.1836 FVAD $1 1.0300 2.0909 3.1836 4.3091 3 PVA $1 0.97087 1.91347 2.82861 3.71710 4.57971 5.41719 6.23028 7.01969 4 5 5.3091 6 0.83748 5.4684 6.6625 7.8923 9.1591 7 1.22987 0.81309 0.78941 8 6.4684 7.6625 8.8923 10.1591 11.4639 1.26677 9 0.76642 7.78611 10.4639 2.91347 3.82861 4.71710 5.57971 6.41719 7.23028 8.01969 8.78611 9.53020 10.25262 10.95400 11.63496 12.29607 12.93794 10 11.8078 11 12.8078 13.1920 1.30477 1.34392 1.38423 1.42576 1.46853 1.51259 1.55797 1.60471 12 13 0.74409 0.72242 0.70138 0.68095 0.66112 0.64186 0.62317 8.53020 9.25262 9.95400 10.63496 11.29607 11.93794 12.56110 14.1920 15.6178 17.0863 18.5989 20.1569 14 14.6178 16.0863 17.5989 19.1569 20.7616 15 16 Sondra deposits $2,700 in an IRA account on April 15, 2016. Assume the account will earn 3% annually. If she repeats this for the next 15 years, how much will she have on deposit on April 14, 2031? Present and future value tables of $1 at 3% are presented below: FVA $1 N. 1 FV $1 1.03000 PVA $1 0.97087 1.91347 1.0000 2.0300 3.0909 2 3 4 1.06090 1.09273 1.12551 1.15927 1.19405 1.22987 1.26677 1.30477 5 6 PVAD $1 1.00000 1.97087 2.91347 3.82861 4.71710 5.57971 6.41719 7.23028 8.01969 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 PV $1 0.97087 0.94260 0.91514 0.88849 0.86261 0.83748 0.81309 0.78941 0.76642 0.74409 0.72242 0.70138 0.68095 0.66112 0.64186 0.62317 7 8 FVAD $1 1.0300 2.0909 3.1836 4.3091 5.4684 6.6625 7.8923 9.1591 10.4639 11.8078 13.1920 14.6178 16.0863 17.5989 19.1569 20.7616 2.82861 3.71710 4.57971 5.41719 6.23028 7.01969 7.78611 8.53020 9.25262 9.95400 10.63496 11.29607 11.93794 12.56110 9 10 11 1.34392 1.38423 1.42576 1.46853 12 13 11.4639 12.8078 14.1920 15.6178 17.0863 18.5989 20.1569 8.78611 9.53020 10.25262 10.95400 11.63496 12.29607 12.93794 14 15 16 1.51259 1.55797 1.60471 Today, Thomas deposited $150,000 in a 2-year, 12% CD that compounds quarterly. What is the maturity value of the CD? Present and future value tables of $1 at 3% are presented below: N FVA $1 FV $1 1.03000 1 2 1.0000 2.0300 3.0909 1.06090 1.09273 1.12551 3 4 5 6 7 8 PV $1 0.97087 0.94260 0.91514 0.88849 0.86261 0.83748 0.81309 0.78941 0.76642 0.74409 0.72242 0.70138 0.68095 0.66112 0.64186 0.62317 1.15927 1.19405 1.22987 1.26677 1.30477 1.34392 1.38423 1.42576 1.46853 1.51259 PVA $1 0.97087 1.91347 2.82861 3.71710 4.57971 5.41719 6.23028 7.01969 7.78611 8.53020 9.25262 9.95400 10.63496 11.29607 11.93794 12.56110 FVAD $1 1.0300 2.0909 3.1836 4.3091 5.4684 6.6625 7.8923 9.1591 10.4639 11.8078 13.1920 14.6178 16.0863 17.5989 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 12.8078 14.1920 15.6178 17.0863 18.5989 20.1569 9 PVAD $1 1.00000 1.97087 2.91347 3.82861 4.71710 5.57971 6.41719 7.23028 8.01969 8.78611 9.53020 10.25262 10.95400 11.63496 12.29607 12.93794 10 11 12 13 14 15 1.55797 1.60471 19.1569 20.7616 16 Carol wants to invest money in a 6% CD account that compounds semiannually. Carol would like the account to have a balance of $100,000 7-years from now. How much must Carol deposit to accomplish her goal