Please help with all of the parts, each picture has a part.

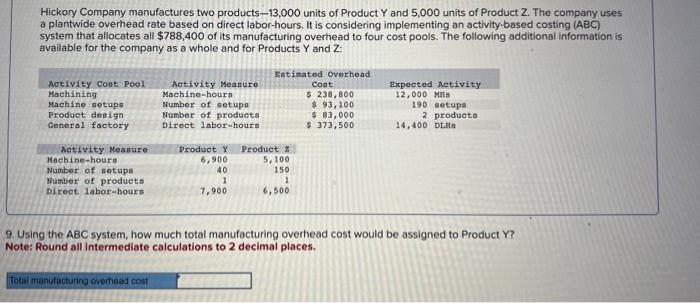

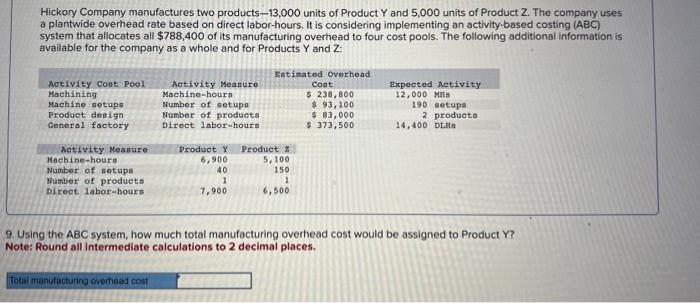

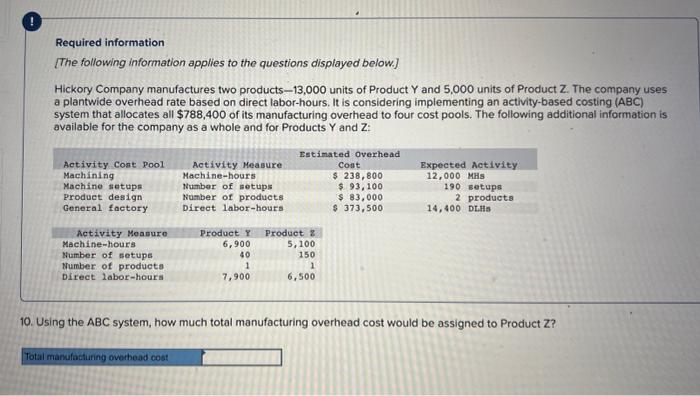

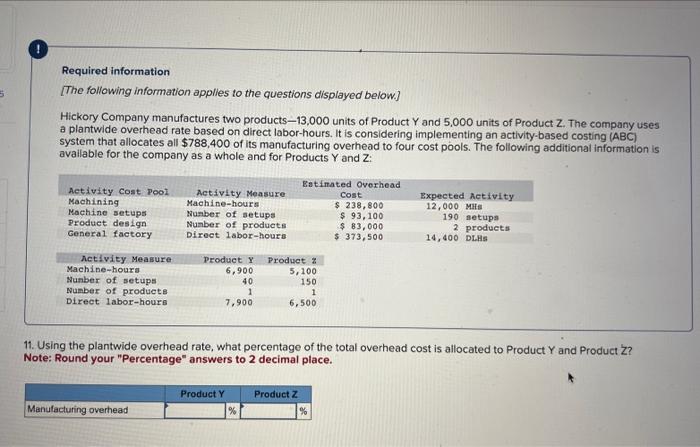

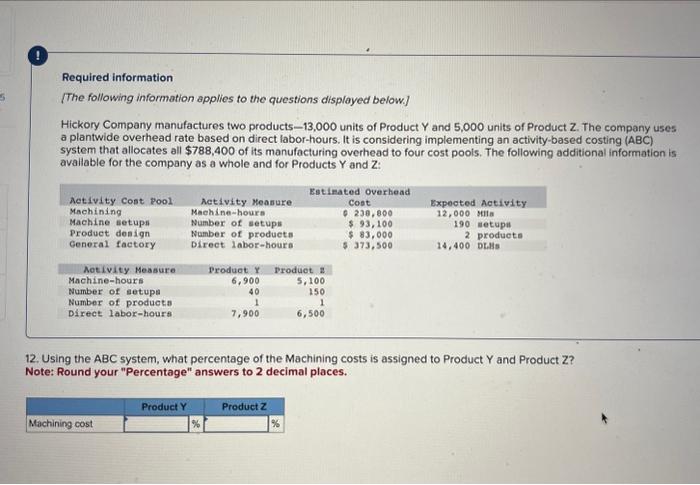

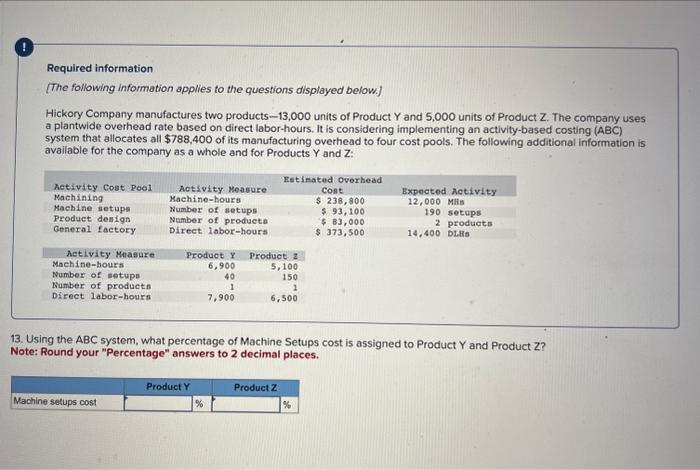

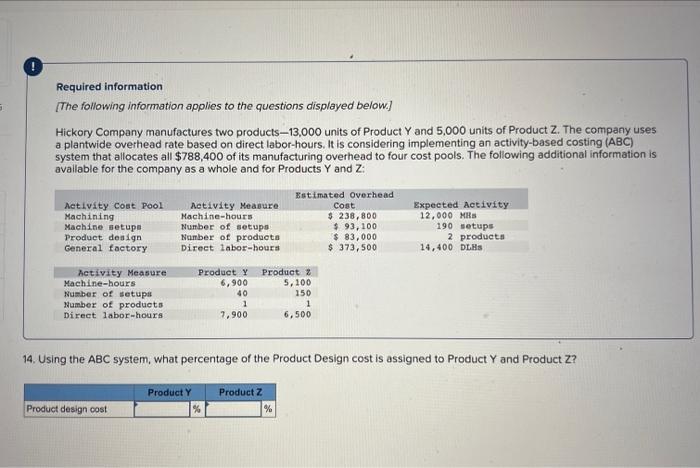

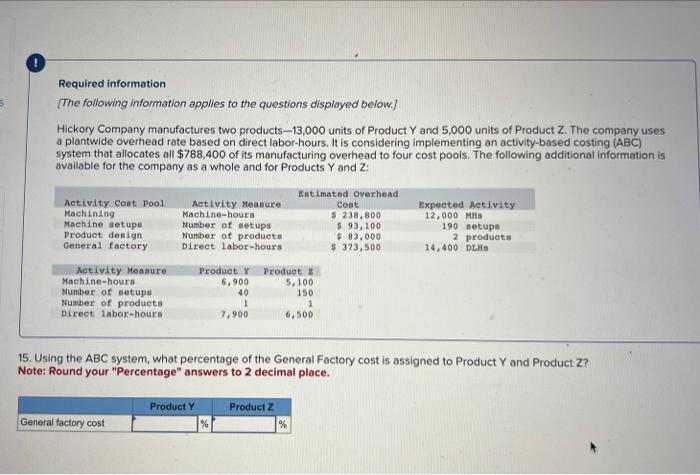

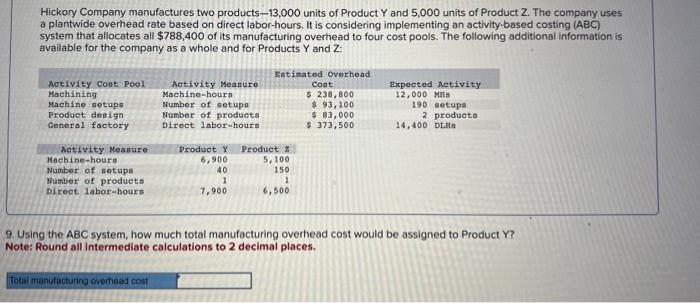

Hickory Company manufactures two products 13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $788,400 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z : 9. Using the ABC system, how much total manufacturing overhead cost would be assigned to Product Y? Note: Round all intermediate calculations to 2 decimal places. Required information [The following information applies to the questions displayed below.] Hickory Company manufactures two products 13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $788,400 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z : 10. Using the ABC system, how much total manufacturing overhead cost would be assigned to Product Z? Required information [The following information applies to the questions displayed below] Hickory Company manufactures two products 13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $788,400 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z : 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y and Product Z? Note: Round your "Percentage" answers to 2 decimal place. Required information [The following information applies to the questions displayed below.] Hickory Company manufactures two products 13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $788,400 of its manufacturing overhead to four cost poois. The following additional information is avaliable for the company as a whole and for Products Y and Z : 12. Using the ABC system, what percentage of the Machining costs is assigned to Product Y and Product Z? Note: Round your "Percentage" answers to 2 decimal places. Required information [The following information applies to the questions displayed below.] Hickory Company manufactures two products 13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $788,400 of its manufacturing overhead to four cost pools. The following additional information is available for the comparty as a whole and for Products Y and Z : 13. Using the ABC system, what percentage of Machine Setups cost is assigned to Product Y and Product Z? Note: Round your "Percentage" answers to 2 decimal places. Required information [The following information applies to the questions displayed below.] Hickory Company manufactures two products 13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $788,400 of its manufacturing overhead to four cost pools. The following additional information is avallable for the company as a whole and for Products Y and Z. 14. Using the ABC system, what percentage of the Product Design cost is assigned to Product Y and Product Z? Required information [The following information applies to the questions displayed below.] Hickory Company manufactures two products 13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all $788,400 of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z : 15. Using the ABC system, what percentage of the General Factory cost is assigned to Product Y and Product Z ? Note: Round your "Percentage" answers to 2 decimal place