Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with all parts of the problem The data needed to determine year-end adjustments are as follows: i. Supplies on hand at March 31

please help with all parts of the problem

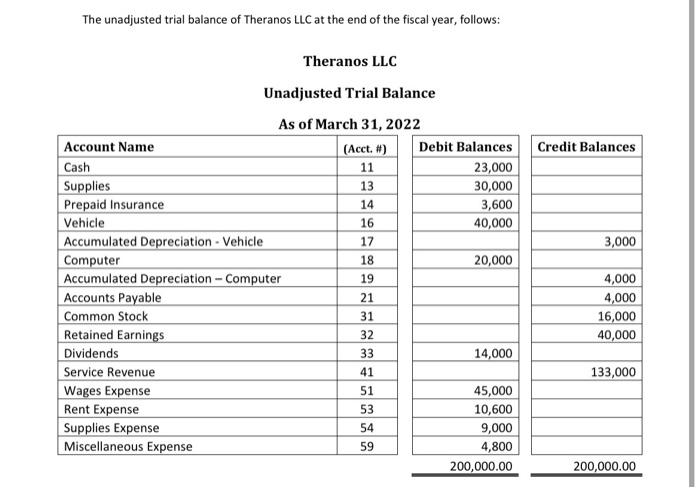

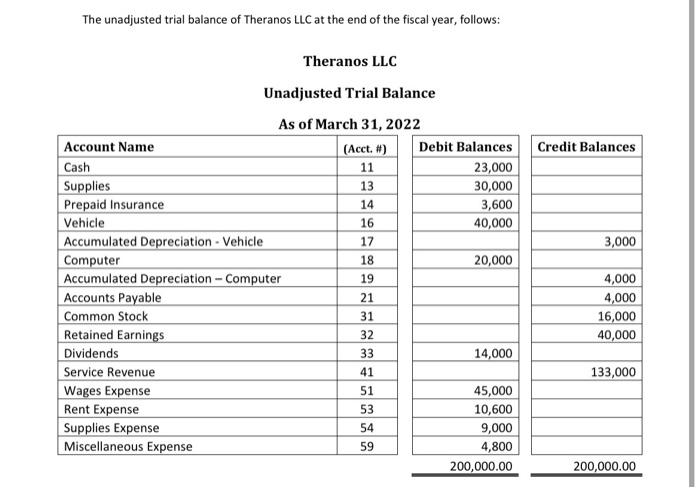

The unadjusted trial balance of Theranos LLC at the end of the fiscal year, follows: Theranos LLC Unadjusted Trial Balance As of March 31, 2022

The data needed to determine year-end adjustments are as follows:

i. Supplies on hand at March 31 are $10,000.

ii. Insurance premiums expired during year are $1,800.

iii. Depreciation of the computer during year is $400.

iv. Depreciation of the vehicle during year is $1,000.

v. Revenue earned but not billed at March 31 is $1,500.

Instructions:

a. For each account listed on the trial balance, enter the balance in the appropriate Balance

column of a T account.

b. Journalize the adjusting entries. The following additional accounts should be used:

i. Accounts Receivable, 12;

ii. Depreciation ExpenseVehicle, 55;

iii. Depreciation ExpenseComputer, 56;

iv. Insurance Expense, 57.

c. Post the adjusting entries to the T accounts created in part a.

d. Prepare an adjusted trial balance.

e. Prepare an income statement, a retained earnings statement, and a balance sheet.

f. Journalize and post the closing entries to the T accounts created in part a. (Income Summary is

account #34 in the chart of accounts.) Indicate closed accounts by inserting a line in both the

debit and credit side of the relevant T accounts.

g. Prepare a post-closing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started