Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with all parts of the question! Thank you! 17 Strong Mirrors, Ltd. offers a 3-year warranty on all its products. In Year 1,

Please help with all parts of the question! Thank you!

17

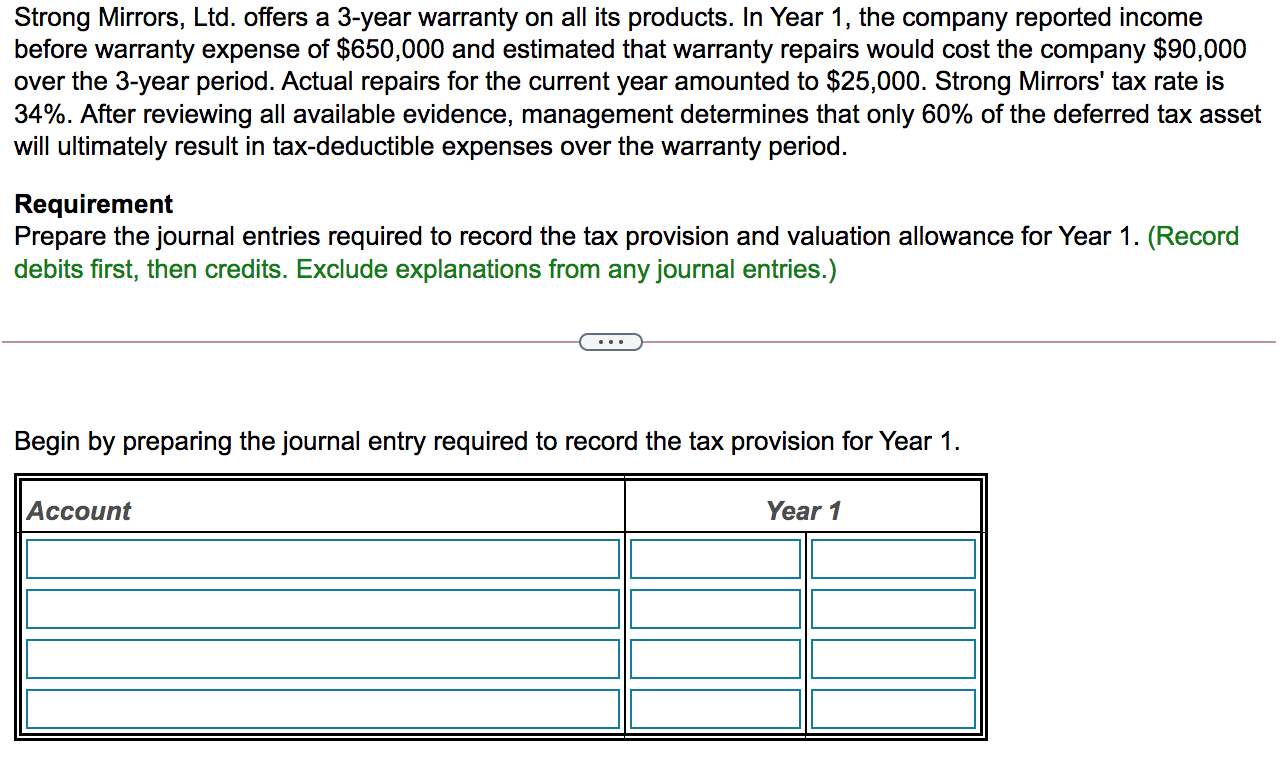

Strong Mirrors, Ltd. offers a 3-year warranty on all its products. In Year 1, the company reported income before warranty expense of $650,000 and estimated that warranty repairs would cost the company $90,000 over the 3-year period. Actual repairs for the current year amounted to $25,000. Strong Mirrors' tax rate is 34%. After reviewing all available evidence, management determines that only 60% of the deferred tax asset will ultimately result in tax-deductible expenses over the warranty period. Requirement Prepare the journal entries required to record the tax provision and valuation allowance for Year 1. (Record debits first, then credits. Exclude explanations from any journal entries.) Begin by preparing the journal entry required to record the tax provision for Year 1. Account Year 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started