Answered step by step

Verified Expert Solution

Question

1 Approved Answer

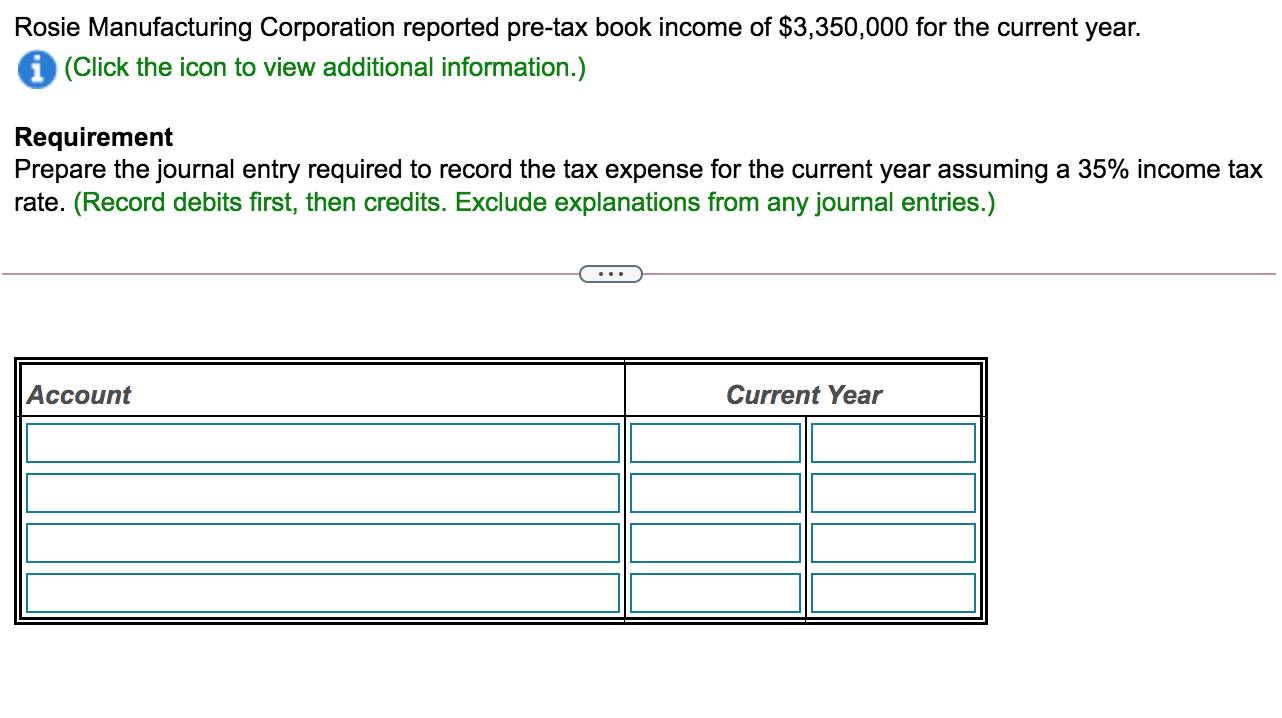

Please help with all parts of the question! Thank you! 12 Rosie Manufacturing Corporation reported pre-tax book income of $3,350,000 for the current year. (Click

Please help with all parts of the question! Thank you!

12

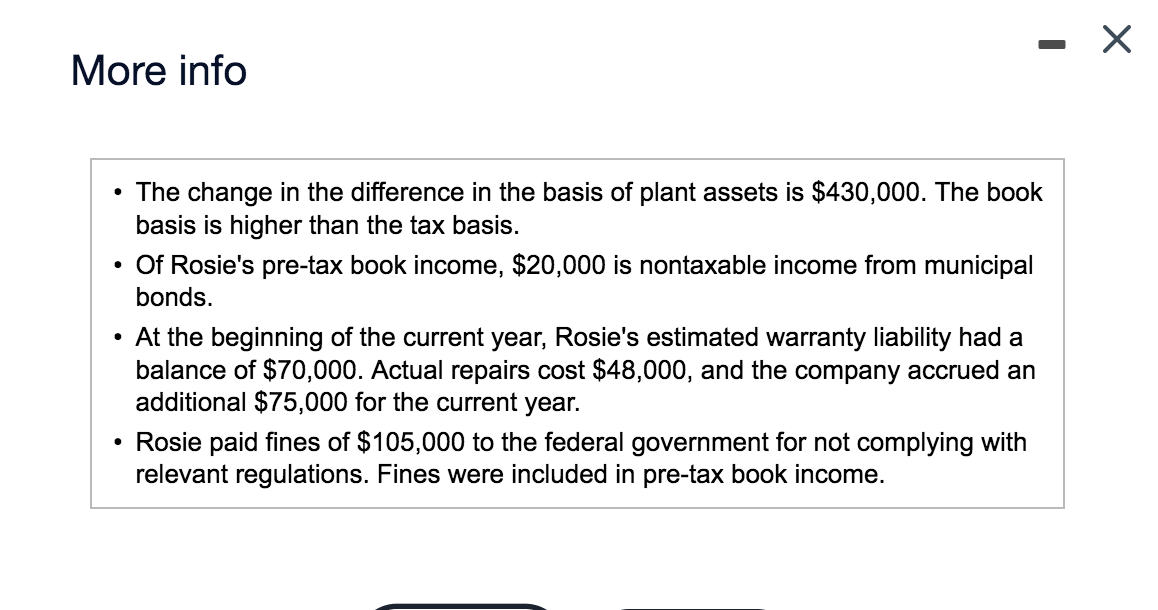

Rosie Manufacturing Corporation reported pre-tax book income of $3,350,000 for the current year. (Click the icon to view additional information.) Requirement Prepare the journal entry required to record the tax expense for the current year assuming a 35% income tax rate. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Current Year More info The change in the difference in the basis of plant assets is $430,000. The book basis is higher than the tax basis. Of Rosie's pre-tax book income, $20,000 is nontaxable income from municipal bonds. At the beginning of the current year, Rosie's estimated warranty liability had a balance of $70,000. Actual repairs cost $48,000, and the company accrued an additional $75,000 for the current year. Rosie paid fines of $105,000 to the federal government for not complying with relevant regulations. Fines were included in pre-tax book incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started