Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with all parts of the question! Thank you! 10 Bradley Casinos recently acquired a newly built hotel and casino in Atlantic City. The

Please help with all parts of the question! Thank you!

10

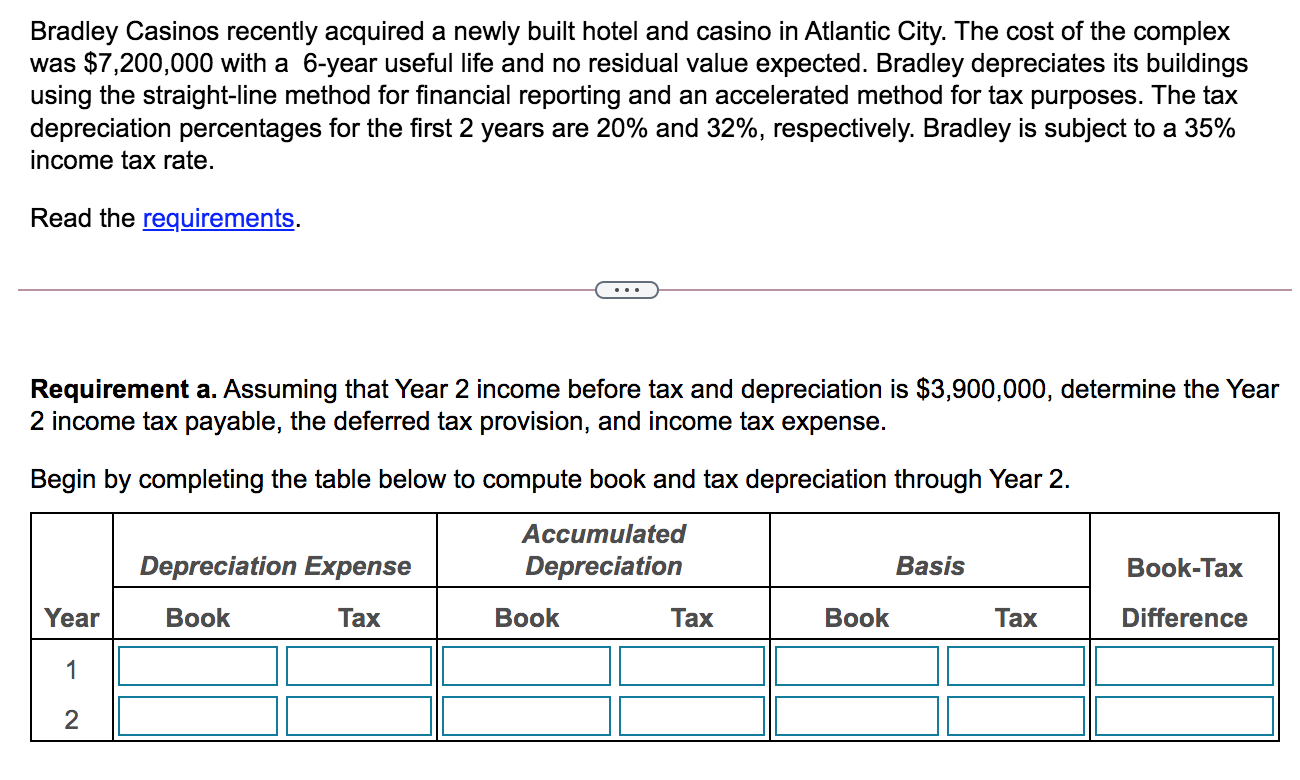

Bradley Casinos recently acquired a newly built hotel and casino in Atlantic City. The cost of the complex was $7,200,000 with a 6-year useful life and no residual value expected. Bradley depreciates its buildings using the straight-line method for financial reporting and an accelerated method for tax purposes. The tax depreciation percentages for the first 2 years are 20% and 32%, respectively. Bradley is subject to a 35% income tax rate. Read the requirements. Requirement a. Assuming that Year 2 income before tax and depreciation is $3,900,000, determine the Year 2 income tax payable, the deferred tax provision, and income tax expense. Begin by completing the table below to compute book and tax depreciation through Year 2. Depreciation Expense Accumulated Depreciation Basis Book-Tax Year Book Tax Book Tax Book Tax Difference 1 2 Requirements a. Assuming that Year 2 income before tax and depreciation is $3,900,000, determine the Year 2 income tax payable, the deferred tax provision, and income tax expense. b. Compute the deferred tax account on the balance sheet at the end of Year 2 and indicate whether the balance represents a deferred tax asset or a deferred tax liabilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started