Please help with all parts!

Thank you!!!

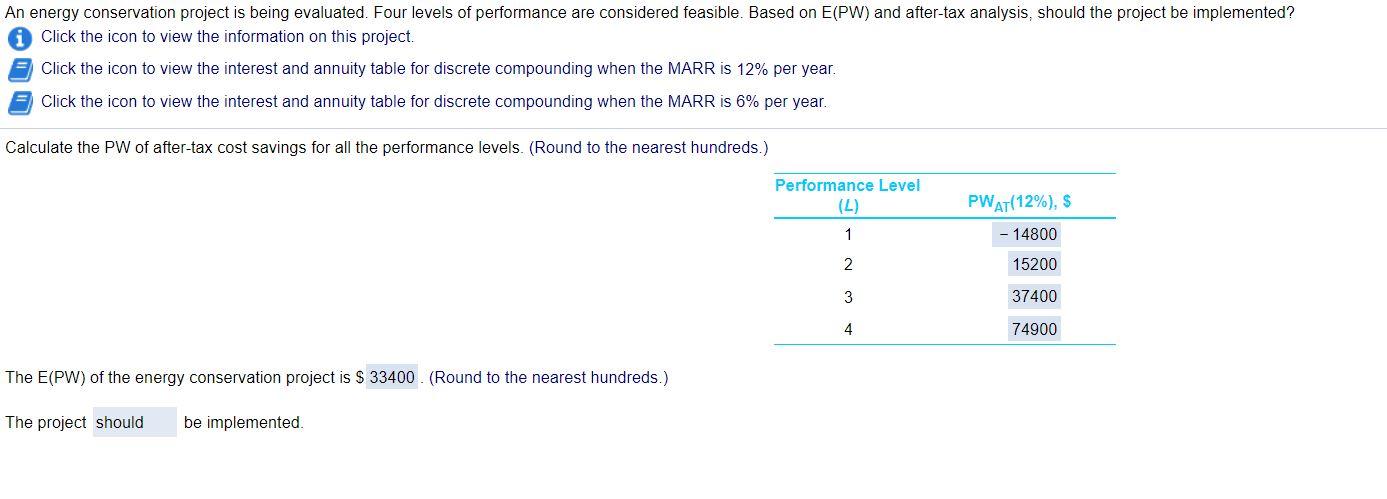

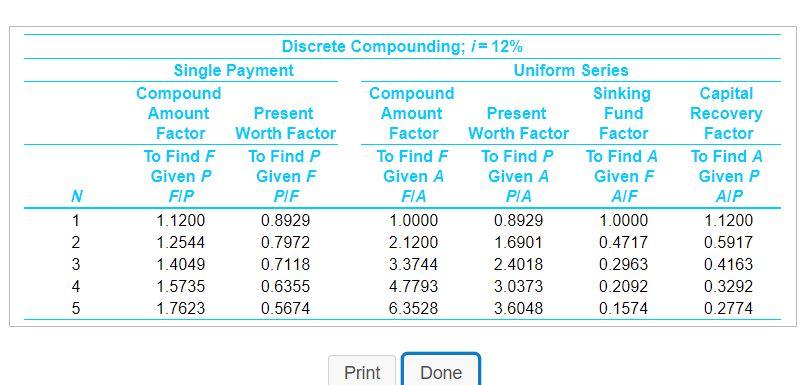

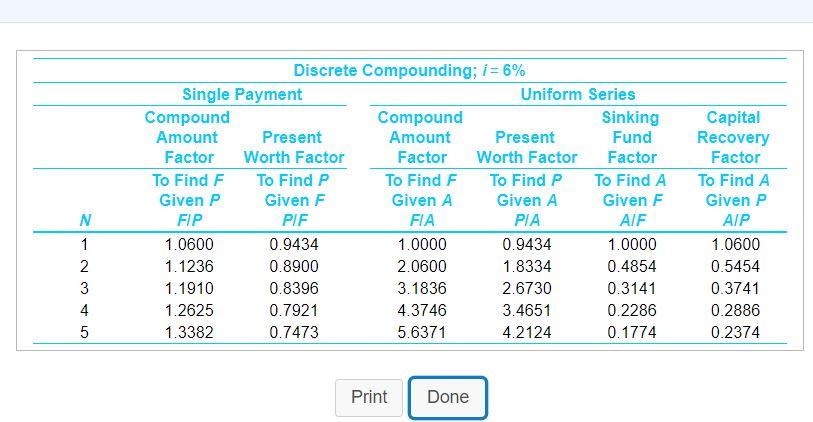

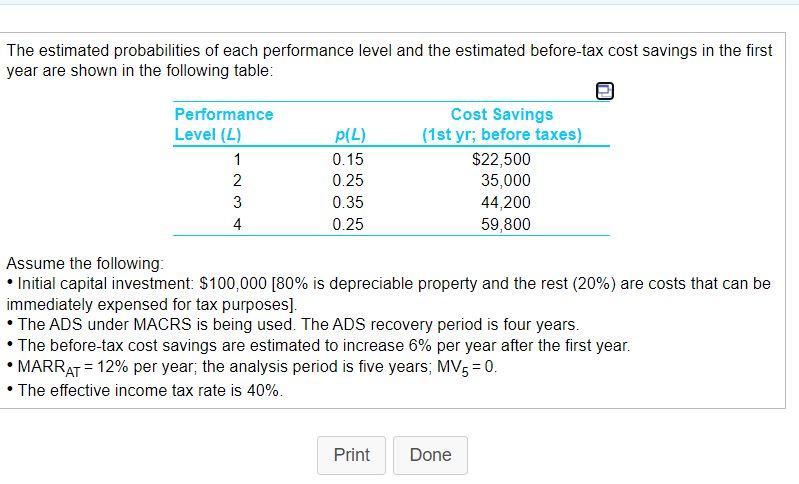

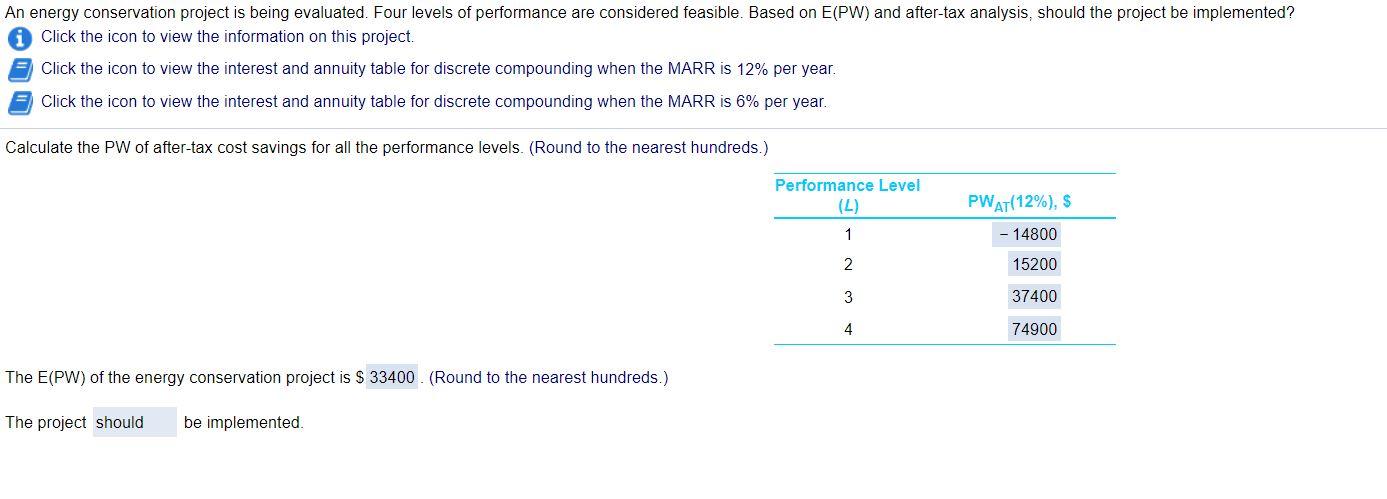

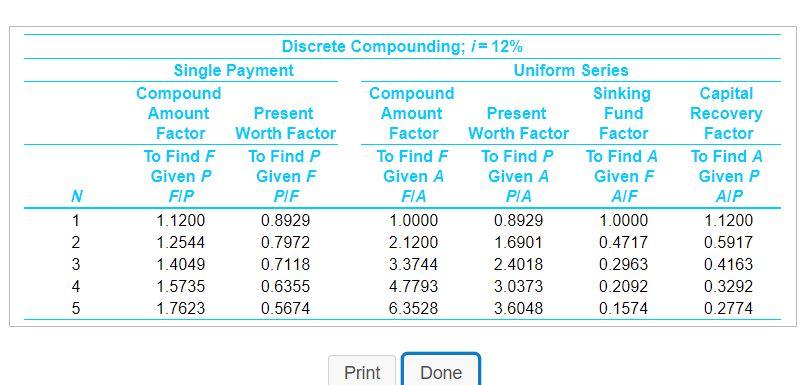

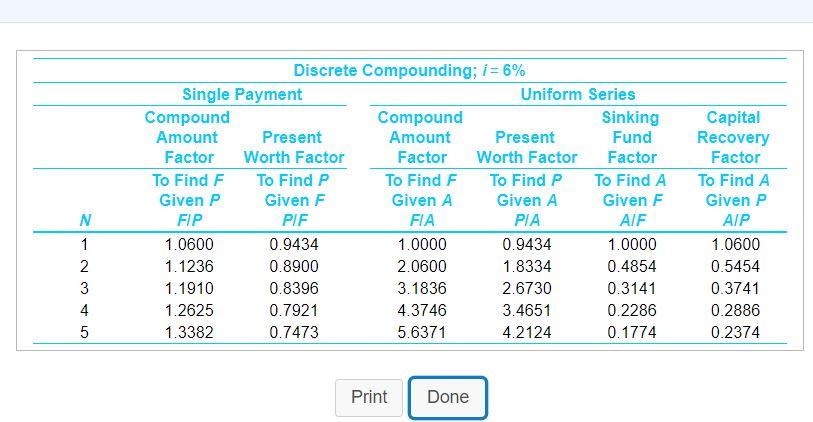

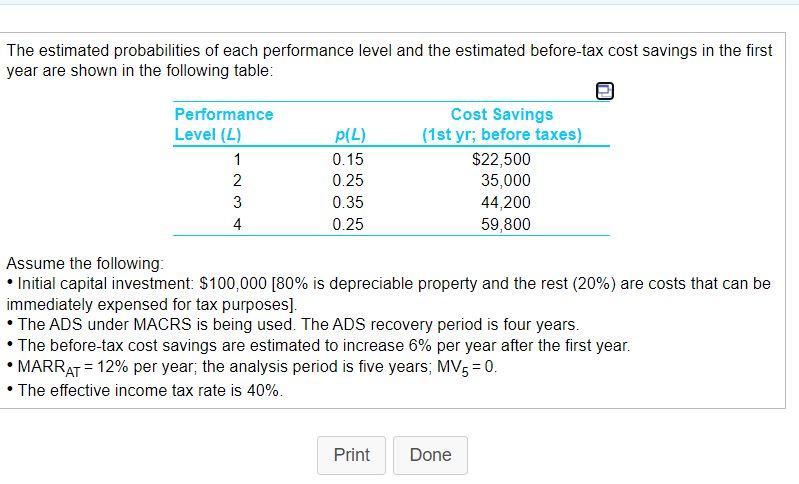

An energy conservation project is being evaluated. Four levels of performance are considered feasible. Based on E(PW) and after-tax analysis, should the project be implemented? Click the icon to view the information on this project Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 6% per year. Calculate the PW of after-tax cost savings for all the performance levels. (Round to the nearest hundreds.) Performance Level (L) PWAT(12%), $ 1 14800 2 15200 3 37400 4 74900 The E(PW) of the energy conservation project is $ 33400. (Round to the nearest hundreds.) The project should be implemented Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.1200 0.8929 1.0000 0.8929 1.0000 1.2544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3.3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 1.7623 0.5674 6.3528 3.6048 0.1574 N 1 2 3 4 5 Capital Recovery Factor To Find A Given P AIP 1.1200 0.5917 0.4163 0.3292 0.2774 Print Done Discrete Compounding; i = 6% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.0600 0.9434 1.0000 0.9434 1.0000 1.1236 0.8900 2.0600 1.8334 0.4854 1.1910 0.8396 3.1836 2.6730 0.3141 1.2625 0.7921 4.3746 3.4651 0.2286 1.3382 0.7473 5.6371 4.2124 0.1774 Capital Recovery Factor To Find A Given P AIP 1.0600 0.5454 0.3741 0.2886 0.2374 Print Done The estimated probabilities of each performance level and the estimated before-tax cost savings in the first year are shown in the following table: Performance Level (L) 1 2 3 4 p(L) 0.15 0.25 0.35 0.25 Cost Savings (1st yr; before taxes) $22,500 35,000 44,200 59,800 Assume the following: Initial capital investment: $100,000 [80% is depreciable property and the rest (20%) are costs that can be immediately expensed for tax purposes]. The ADS under MACRS is being used. The ADS recovery period is four years. The before-tax cost savings are estimated to increase 6% per year after the first year. MARRAT = 12% per year, the analysis period is five years, MV5 = 0. The effective income tax rate is 40%. Print Done An energy conservation project is being evaluated. Four levels of performance are considered feasible. Based on E(PW) and after-tax analysis, should the project be implemented? Click the icon to view the information on this project Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 6% per year. Calculate the PW of after-tax cost savings for all the performance levels. (Round to the nearest hundreds.) Performance Level (L) PWAT(12%), $ 1 14800 2 15200 3 37400 4 74900 The E(PW) of the energy conservation project is $ 33400. (Round to the nearest hundreds.) The project should be implemented Discrete Compounding; i = 12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.1200 0.8929 1.0000 0.8929 1.0000 1.2544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3.3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 1.7623 0.5674 6.3528 3.6048 0.1574 N 1 2 3 4 5 Capital Recovery Factor To Find A Given P AIP 1.1200 0.5917 0.4163 0.3292 0.2774 Print Done Discrete Compounding; i = 6% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.0600 0.9434 1.0000 0.9434 1.0000 1.1236 0.8900 2.0600 1.8334 0.4854 1.1910 0.8396 3.1836 2.6730 0.3141 1.2625 0.7921 4.3746 3.4651 0.2286 1.3382 0.7473 5.6371 4.2124 0.1774 Capital Recovery Factor To Find A Given P AIP 1.0600 0.5454 0.3741 0.2886 0.2374 Print Done The estimated probabilities of each performance level and the estimated before-tax cost savings in the first year are shown in the following table: Performance Level (L) 1 2 3 4 p(L) 0.15 0.25 0.35 0.25 Cost Savings (1st yr; before taxes) $22,500 35,000 44,200 59,800 Assume the following: Initial capital investment: $100,000 [80% is depreciable property and the rest (20%) are costs that can be immediately expensed for tax purposes]. The ADS under MACRS is being used. The ADS recovery period is four years. The before-tax cost savings are estimated to increase 6% per year after the first year. MARRAT = 12% per year, the analysis period is five years, MV5 = 0. The effective income tax rate is 40%. Print Done