Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with all qu 1. An investment bank agreed to underwrite an issue of 33,000,000 shares of stock for Alabaster Corporation on a firm

please help with all qu

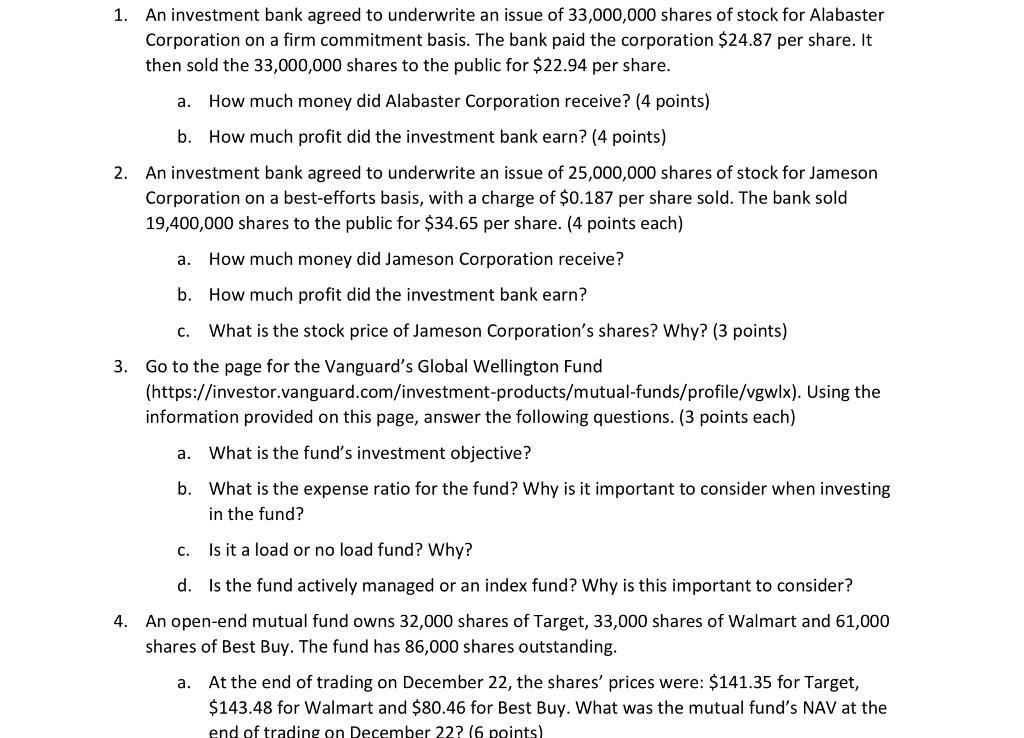

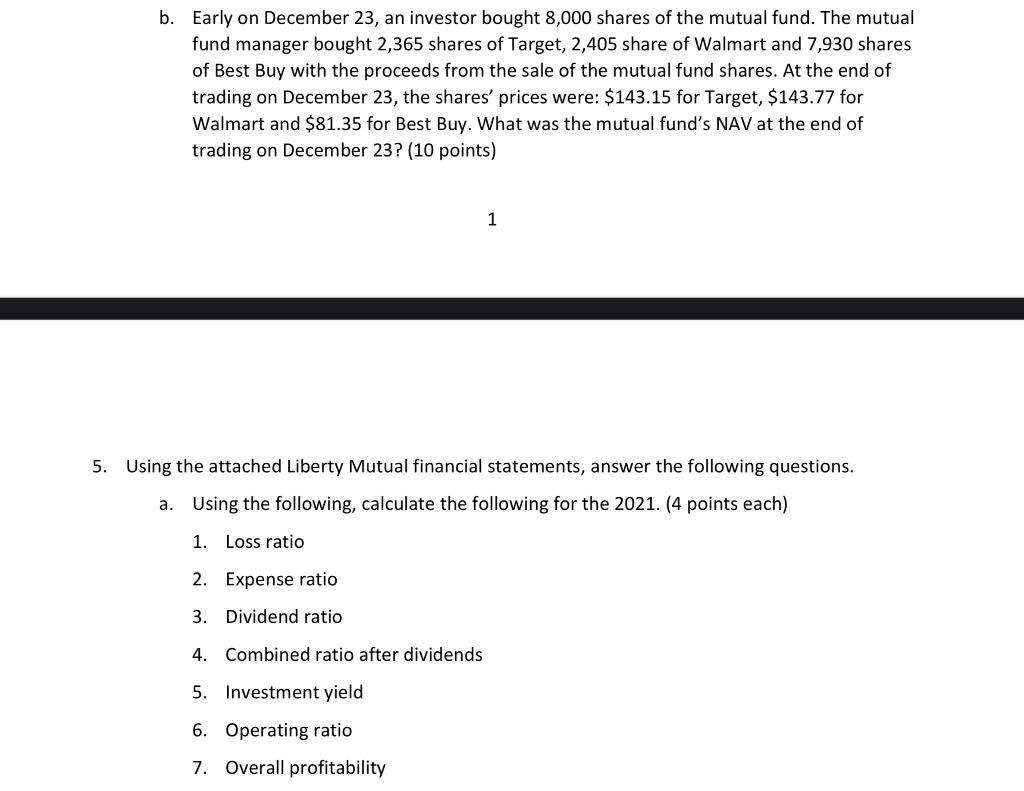

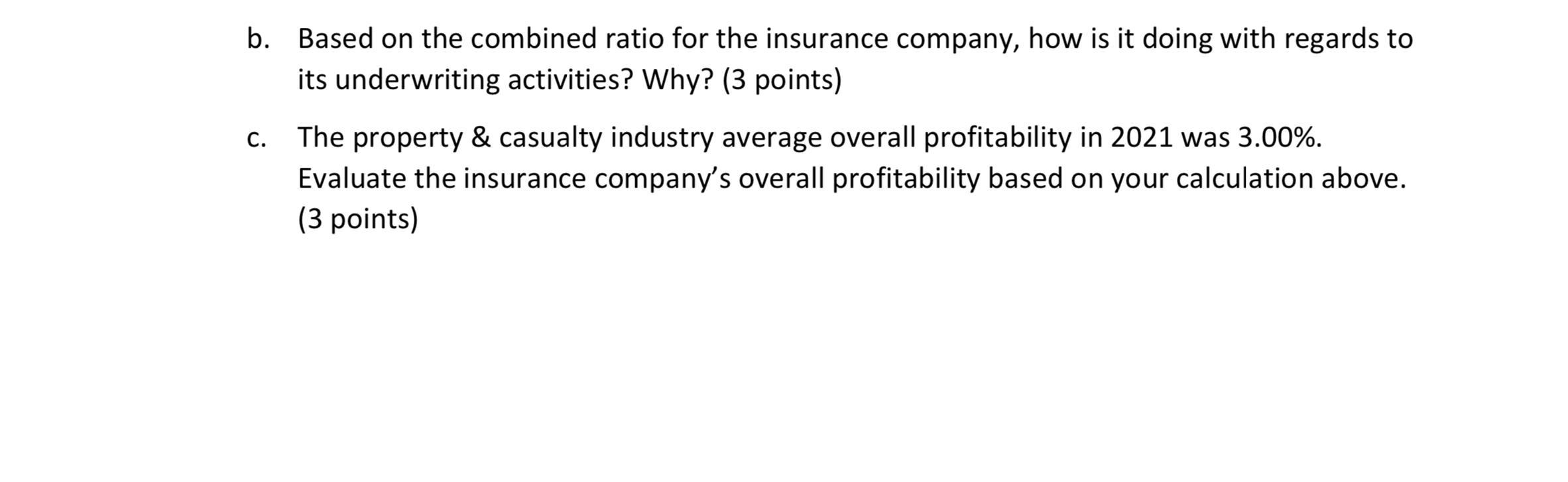

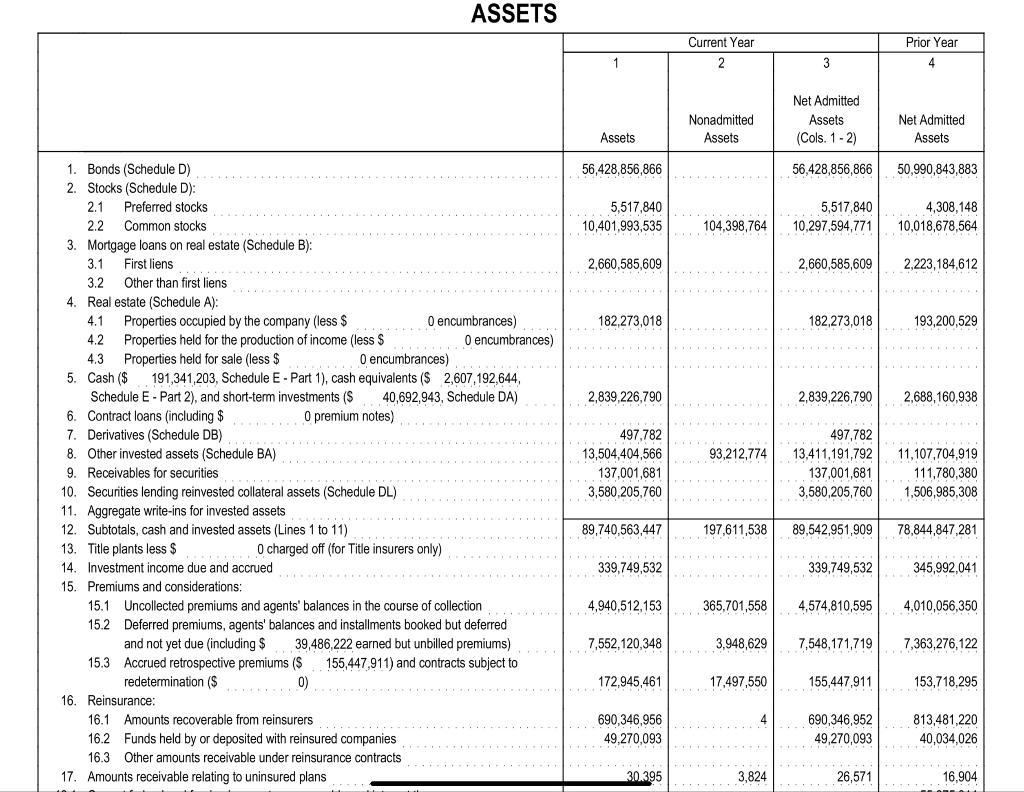

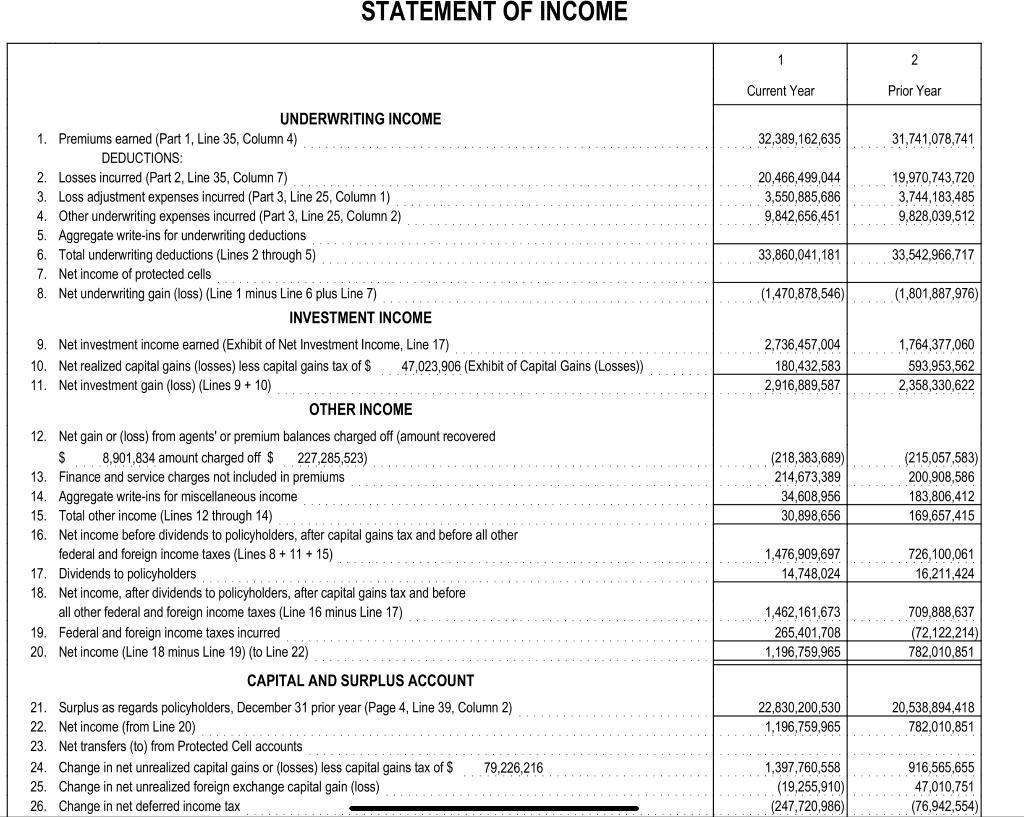

1. An investment bank agreed to underwrite an issue of 33,000,000 shares of stock for Alabaster Corporation on a firm commitment basis. The bank paid the corporation $24.87 per share. It then sold the 33,000,000 shares to the public for $22.94 per share. a. How much money did Alabaster Corporation receive? (4 points) b. How much profit did the investment bank earn? (4 points) 2. An investment bank agreed to underwrite an issue of 25,000,000 shares of stock for Jameson Corporation on a best-efforts basis, with a charge of $0.187 per share sold. The bank sold 19,400,000 shares to the public for $34.65 per share. (4 points each) a. How much money did Jameson Corporation receive? b. How much profit did the investment bank earn? C. What is the stock price of Jameson Corporation's shares? Why? (3 points) 3. Go to the page for the Vanguard's Global Wellington Fund (https://investor.vanguard.com/investment-products/mutual-funds/profile/vgwlx). Using the information provided on this page, answer the following questions. (3 points each) a. What is the fund's investment objective? b. What is the expense ratio for the fund? Why is it important to consider when investing in the fund? c. Is it a load or no load fund? Why? d. Is the fund actively managed or an index fund? Why is this important to consider? 4. An open-end mutual fund owns 32,000 shares of Target, 33,000 shares of Walmart and 61,000 shares of Best Buy. The fund has 86,000 shares outstanding. a. At the end of trading on December 22, the shares' prices were: $141.35 for Target, $143.48 for Walmart and $80.46 for Best Buy. What was the mutual fund's NAV at the end of trading on December 22? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started