please help with all questions

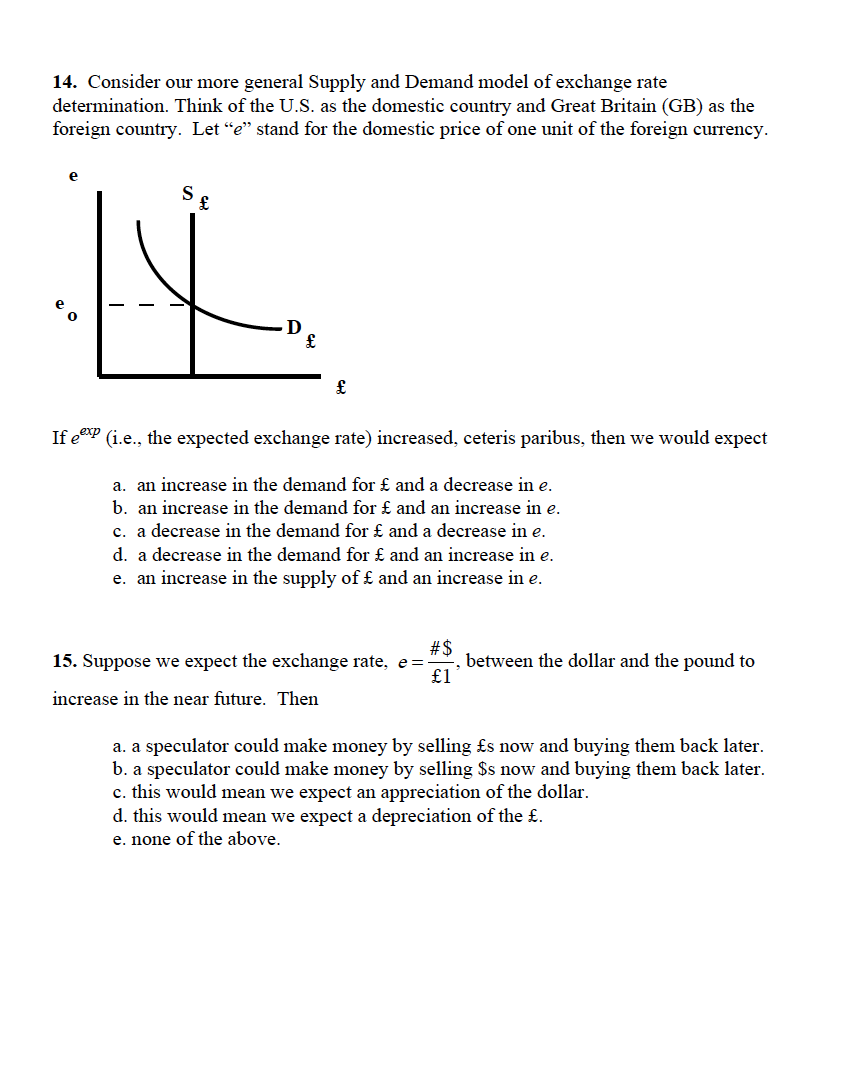

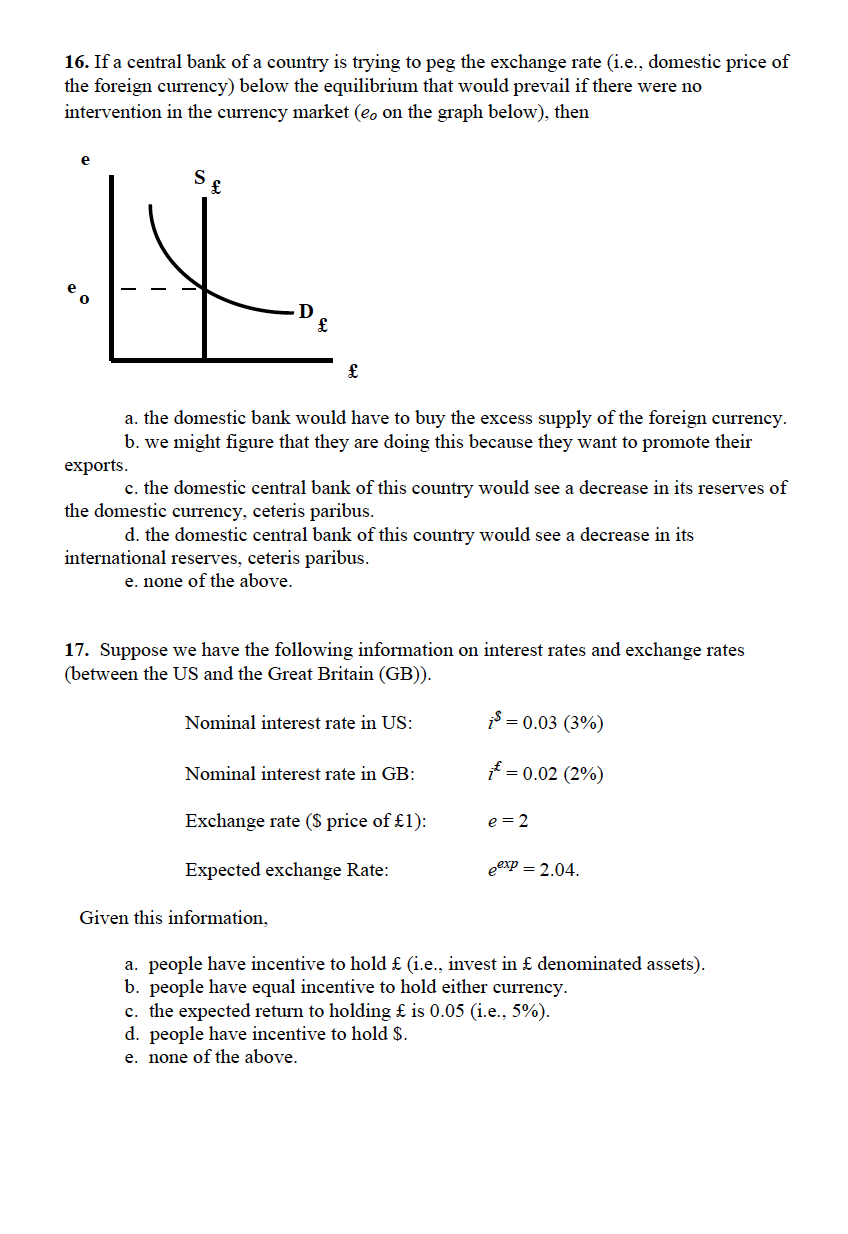

14. Consider our more general Supply and Demand model of exchange rate determination. Think of the U.S. as the domestic country and Great Britain (GB) as the foreign country. Let \"9" stand for the domestic price of one unit of the foreign currency. e If gap (i.e., the expected exchange rate) increased, ceteris paribus, then we would expect a. an increase in the demand for 55 and a decrease in e. b. an increase in the demand for and an increase in e. c. a decrease in the demand for ii and a decrease in e. d. a decrease in the demand for 3 and an increase in e. e. an increase in the supply of :E and an increase in e. 15. Suppose we expect the exchange rate, e = #$, between the dollar and the pound to 1 increase in the near future. Then a. a speculator could make money by selling 135 now and buying them back later. b. a speculator could make money by selling $5 now and buying them back later. c. this would mean we expect an appreciation of the dollar. d. this would mean we expect a depreciation of the :12. e. none of the above. 16. If a central bank of a country is trying to peg the exchange rate (i.e., domestic price of the foreign currency) below the equilibrium that would prevail if there were no intervention in the currency market (9., on the graph below), then e a. the domestic bank would have to buy the excess supply of the foreign currency. b. we might gure that they are doing this because they want to promote their exports. c. the domestic central bank of this country would see a decrease in its reserves of the domestic currency, ceteris paribus. d. the domestic central bank of this country would see a decrease in its international reserves, ceteris paribus. e. none of the above. 17. Suppose we have the following information on interest rates and exchange rates (between the US and the Great Britain (GED. Nominal interest rate in US: I\": = 0.03 (3%) Nominal interest rate in GB: if = 0.02 (2%) Exchange rate ($ price of 1): 3 = 2 Expected exchange Rate: 9'\"? = 2.04. Given this information, people have incentive to hold (i.e., invest in denominated assets). people have equal incentive to hold either currency. the expected retum to holding f. is 0.05 (i.e., 5%). people have incentive to hold $. none of the above. rug-om